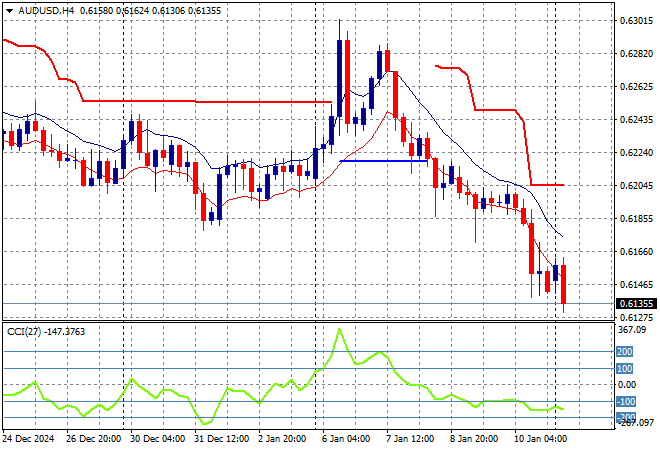

The response to the US unemployment print on Friday and subsequent tightening of oil sanctions on Russia has seen Asian stocks gapped broadly lower on the weekend gap and stay there in afternoon trade. The USD continues to push to new highs as the stronger than expected NFP print keeps the undollars in there place as Euro has almost broken below the 1.02 handle going into the London session while the Australian dollar is cratering as interest rate cut predictions continue to be brought forward, as it makes a new low again this afternoon.

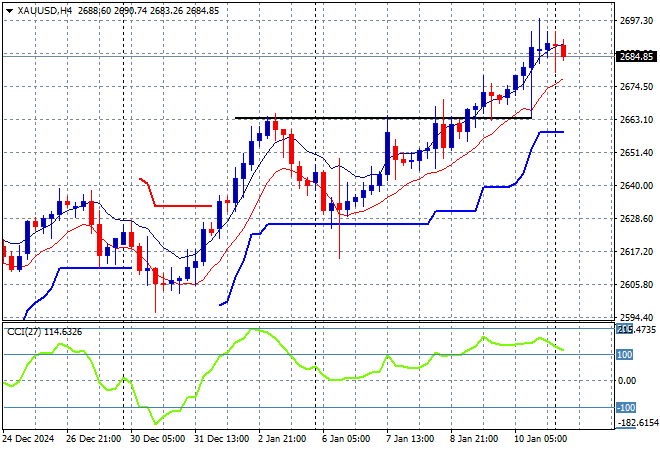

Oil futures are pushing higher with Brent crude lifting above the $81USD per barrel level while gold is easing off after its strong trend of late, holding steady just below the $2700USD per ounce level:

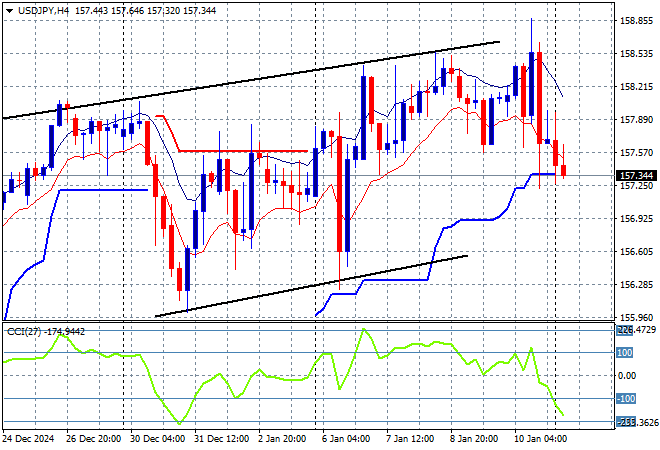

Mainland Chinese share markets are not making any gains with the Shanghai Composite down 0.3% as it remains well below the 3200 point level while the Hang Seng Index is also in retreat, down more than 1% to crack the 19000 point level. Japanese stock markets are closed – again – while the USDPY pair has continued its short term reversal as it sits just above the 157 level as Yen remains the strongest undollar:

Australian stocks were the worst performing in the region as the ASX200 closed more than 1.2% lower at 8191 points while the Australian dollar has gapped lower, falling down to the 61.30 level for a new monthly low:

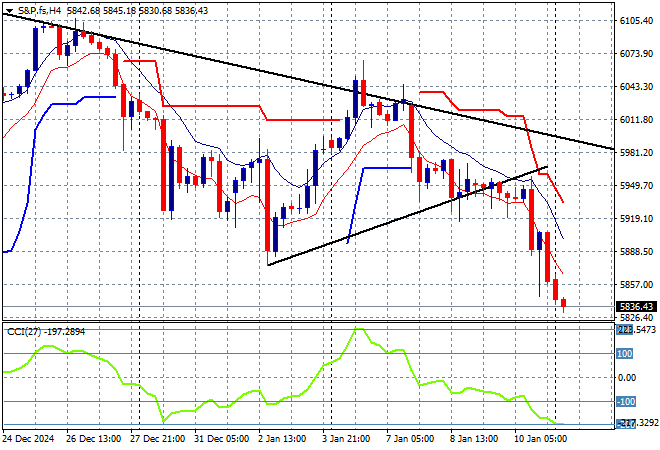

S&P and Eurostoxx futures are in retreat as we head into the London session with the S&P500 four hourly chart showing momentum remaining in oversold territory with price action still breaking down from last week’s pennant formation as it rejected the medium term resistance at the 6000 point zone:

The economic calendar is very quiet tonight following Friday’s NFP print with a few ECB speeches to look out for.