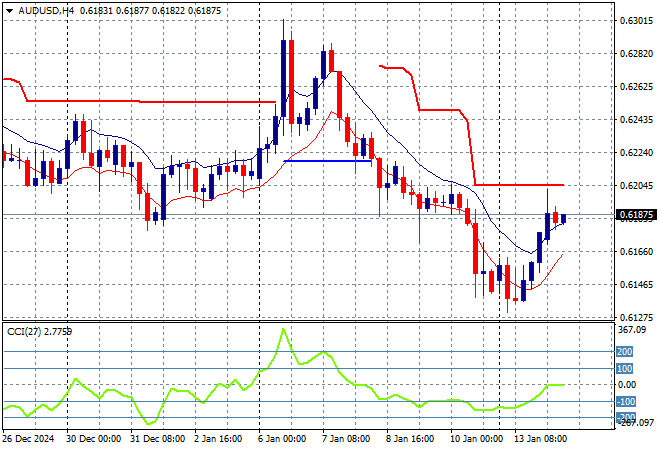

Asian stock markets are in the main doing a lot better in reaction to a somewhat mixed first session overnight on Wall Street as concerns over the incoming Trump tariffs waned. The USD is pulling back slightly against the undollars following an overreaction to Friday night’s NFP print with Euro heading back above the 1.02 handle going into the London session while the Australian dollar is trying in vain to get back above the 62 cent level in what looks like a dead cat bounce.

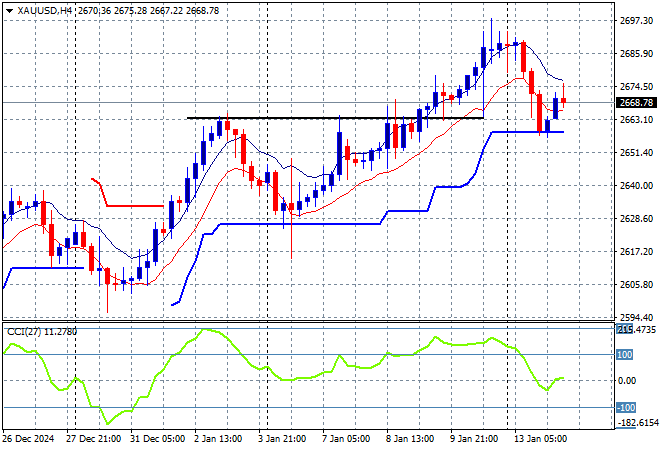

Oil futures are pulling back very slightly with Brent crude still above the $80USD per barrel level while gold is trying to find its feet again after pulling back from a failed breakout above the $2700USD per ounce level:

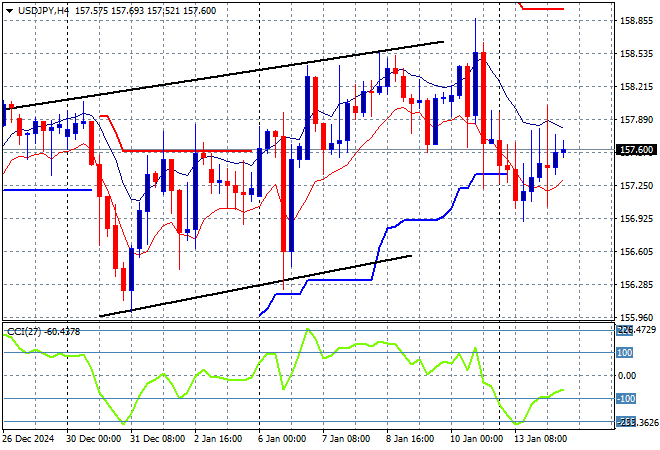

Mainland Chinese share markets are making substantial gains with the Shanghai Composite up more than 2% as it pushed back above the 3200 point level while the Hang Seng Index is also in a similar mood, lifting more than 2% to get back above the 19000 point level. Japanese stock markets reopened and are playing catchup with a mild selloff on a lot of BOJ machinations with the Nikkei 225 closing some 1.8% lower at 38467 points while the USDPY pair has tried to recover some of its short term reversal as it sits just above the mid 157 level as Yen still remains the strongest undollar:

Australian stocks were able to lift slightly as the ASX200 closed nearly 0.5% higher at 8231 points while the Australian dollar has stalled out just below the 62 cent level after rebounding off its new monthly low:

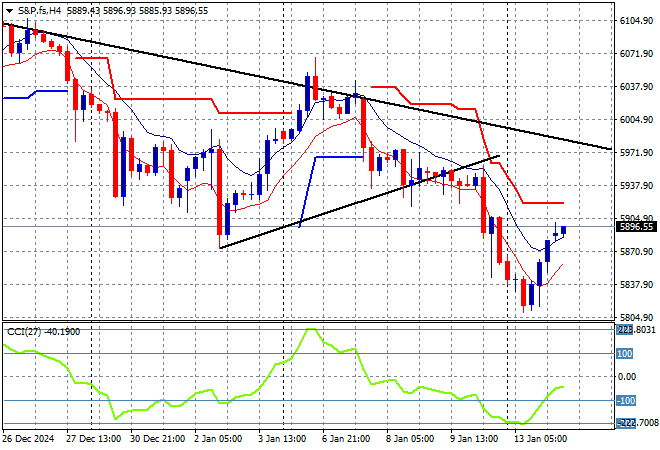

S&P and Eurostoxx futures are in rebound mode as we head into the London session with the S&P500 four hourly chart showing momentum getting out of oversold territory but price action is still breaking down from last week’s pennant formation as it rejected the medium term resistance at the 6000 point zone. Dead cats beware:

The economic calendar will include the closely watched US PPI print then quite a few Fed speeches.