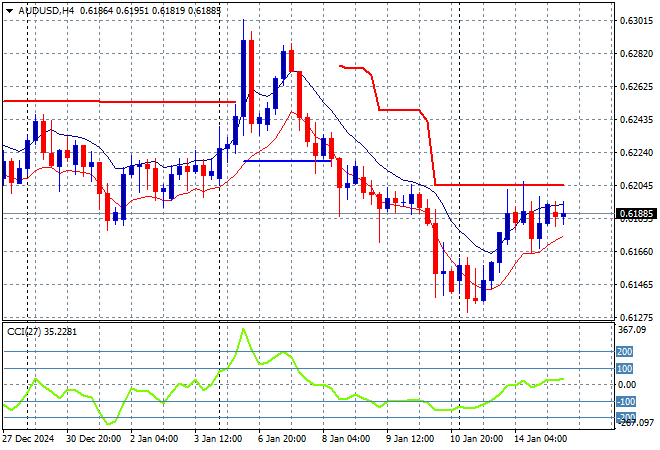

Asian stock markets are mixed alongside FX markets as we all await tonight’s US CPI print with Wall Street still in hesitation mode amid the LA firs and concerns over the incoming Trump tariffs and other shenanigans. The USD is pulling back slightly against the undollars following an overreaction to Friday night’s NFP print with Euro hovering around the 1.03 handle going into the London session while the Australian dollar has been unable to get back above the 62 cent level in what looks like a dead cat bounce.

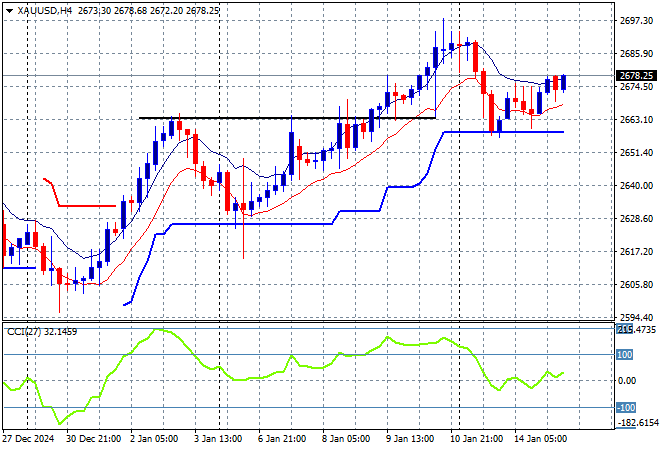

Oil futures are pulling back very slightly with Brent crude just above the $80USD per barrel level while gold is trying to find its feet again after pulling back from a failed breakout above the $2700USD per ounce level:

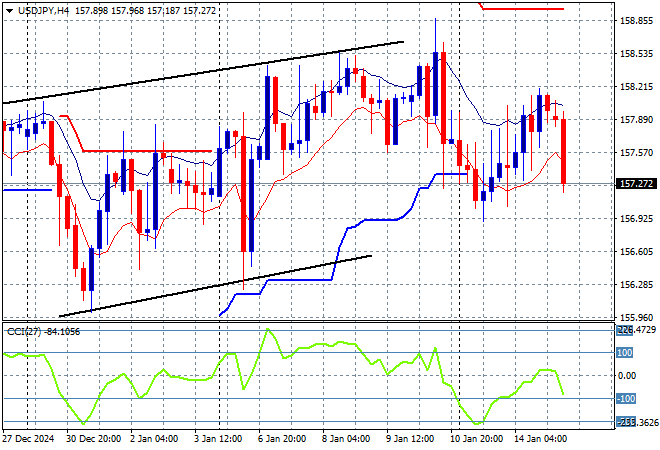

Mainland Chinese share markets are moving slightly lower with the Shanghai Composite down 0.3% or so as it remains slightly above the 3200 point level while the Hang Seng Index is dead flat at just above the 19200 point level. Japanese stock markets reopened are still mixed with the Nikkei 225 closing 0.3% lower at 38367 points while the USDPY pair has flopped back down to the 157 handle as Yen still remains the strongest undollar:

Australian stocks weren’t able to lift at all with as the ASX200 closing some 0.2% lower at 8213 points while the Australian dollar has stalled out again just below the 62 cent level after rebounding off its new monthly low earlier in the week:

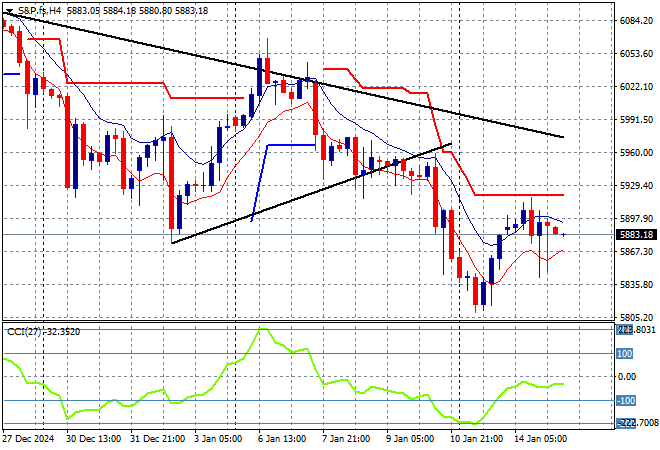

S&P and Eurostoxx futures are no longer in rebound mode as we head into the London session with the S&P500 four hourly chart showing momentum now out of oversold territory but still negative as price action is still breaking down from last week’s pennant formation as it rejected the medium term resistance at the 6000 point zone. Dead cats beware:

The economic calendar includes two important inflation prints tonight, first the UK then the US.