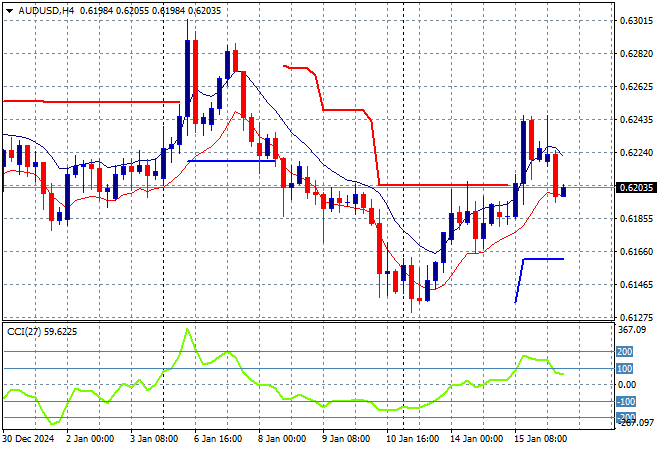

Asian stock markets are somewhat mixed although local shares got a boost on a surprise uptick in the unemployment print that energised more RBA rate cut speculation. Meanwhile other FX volatility was centered around Yen that continues to firm against USD while the Australian dollar retraced back to the 62 cent level in what looks like a dead cat bounce.

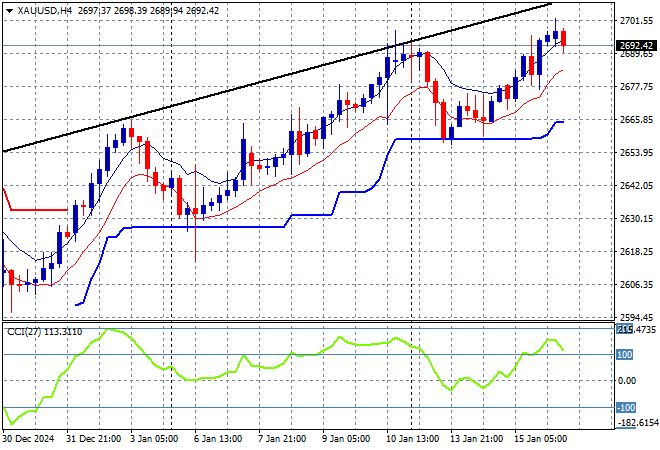

Oil futures are pulling back ever so slightly but Brent crude is still above the $82USD per barrel level while gold is trying to find its feet again after pulling back from a failed breakout above the $2700USD per ounce level:

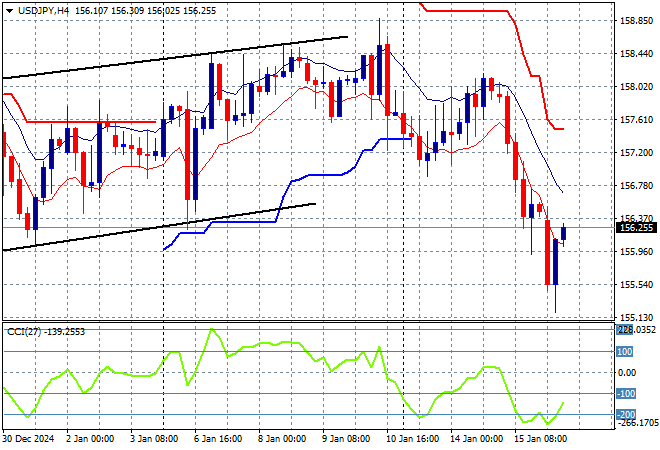

Mainland Chinese share markets are moving slightly higher with the Shanghai Composite up 0.3% or so as it remains slightly above the 3200 point level while the Hang Seng Index is up more than 1% at just above the 19500 point level. Japanese stock markets are doing slightly better but still mixed with the Nikkei 225 closing 0.3% higher at 38572 points while the USDPY pair has flopped back down to the 155 handle as Yen still remains the strongest undollar:

Australian stocks were the best performing in the region with the ASX200 closing some 1.4% higher at 8326 points while the Australian dollar has stalled out again to get back to the 62 cent level after rebounding off its new monthly low earlier in the week:

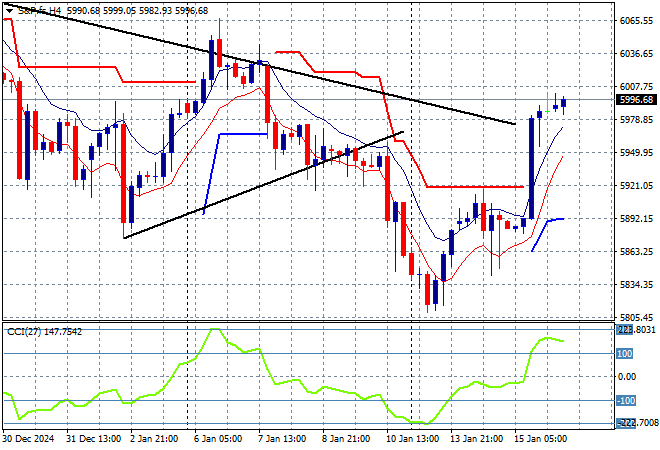

S&P and Eurostoxx futures are pushing slightly higher as we head into the London session with the S&P500 four hourly chart showing momentum now well into overbought territory as price action tries to get back above medium term resistance at the 6000 point zone. Dead cats beware:

The economic calendar includes the latest UK GDP figures then US retail sales and other tertiary prints tonight.