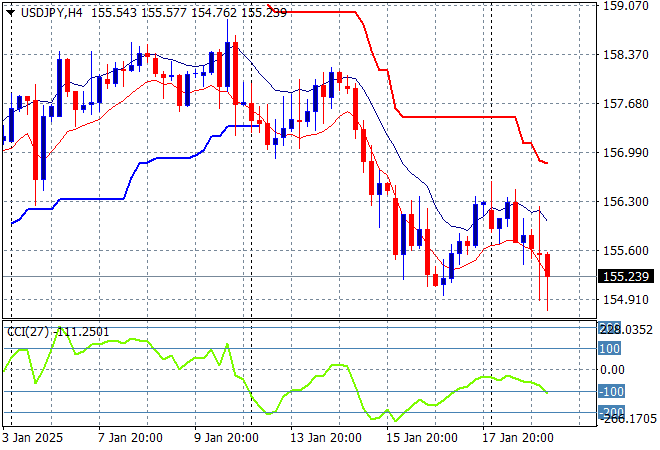

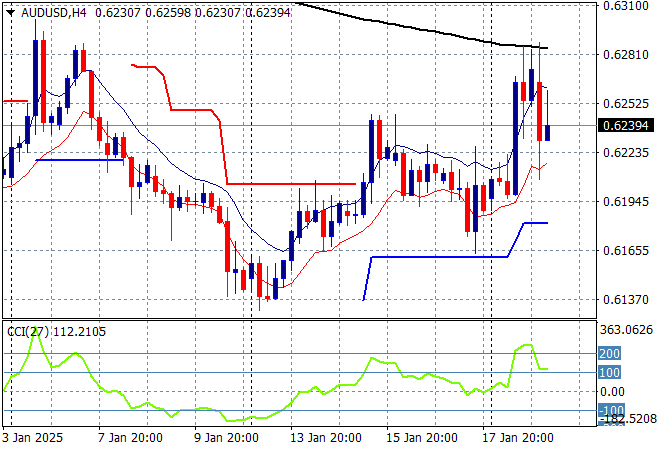

Asian stock markets are generally in a positive mood although mainland Chinese shares can’t find a bid as they worry about the incoming Washington Circus as tariff threats still linger like a full Depends pullup. Meanwhile FX volatility was centered around Yen again as other undollars continue to probe the USD while the Australian dollar retraced back to the mid 62 cent level.

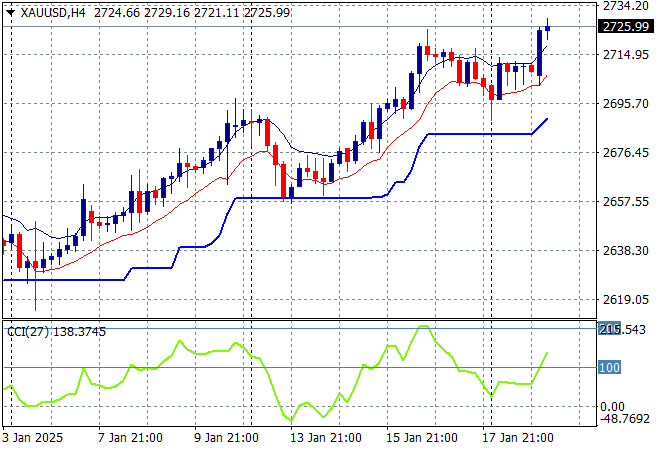

Oil futures are pulling back ever so slightly but Brent crude is still above the $80USD per barrel level while gold is advancing after finding its feet again with a new breakout above the $2700USD per ounce level:

Mainland Chinese share markets are moving slightly lower in afternoon trade with the Shanghai Composite down 0.3% or so as it remains slightly above the 3200 point level while the Hang Seng Index is up 0.8% to stay just above the 20000 point level. Japanese stock markets are still uneasy due to the higher Yen with the Nikkei 225 closing just 0.1% higher at 38945 points while the USDPY pair has flopped back down to the 155 handle as Yen still remains the strongest undollar:

Australian stocks had another solid day across the board with the ASX200 closing some 0.6% higher at 8402 points while the Australian dollar has stalled out again to remain just above the 62 cent level after rebounding off its new monthly low earlier in the week:

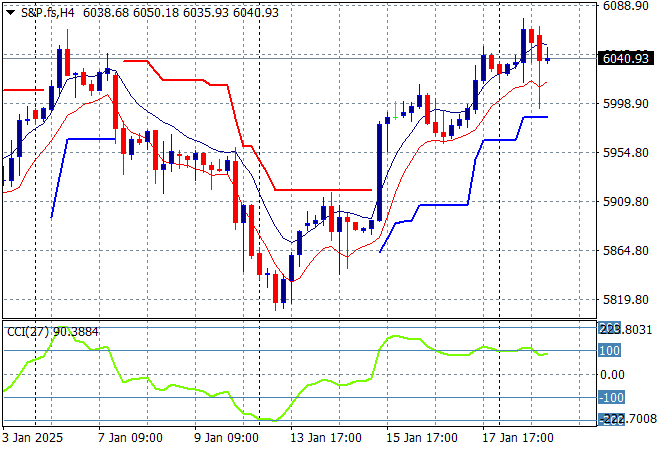

S&P and Eurostoxx futures are pushing slightly higher as we head into the London session with the S&P500 four hourly chart showing momentum remaining well into overbought territory as price action tries to get back above medium term resistance at the 6000 point zone:

The economic calendar includes UK unemployment, the closely watched German ZEW Survey, then the latest Canadian inflation.

He nails it……