Macro Afternoon

A lot of regional internal news are moving Asian stock markets instead of the usual macro newsfront with mainland Chinese shares off sharply while traders await the latest BOJ decision as wage and labour concerns mount. The USD is still suffering from post-Trumpian volatility which had been centered around Yen although as other undollars continue to probe the weaker USD as the Australian dollar holds fast above mid 62 cent level.

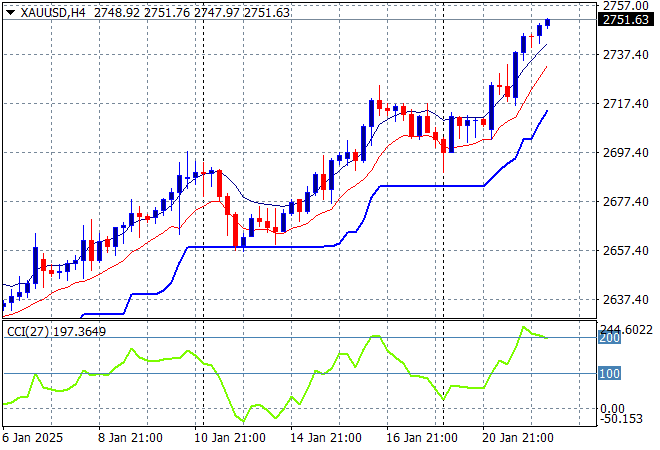

Oil futures are pulling back slightly again with Brent crude now just above the $79USD per barrel level while gold is advancing after finding its feet again with its new breakout above the $2700USD per ounce level:

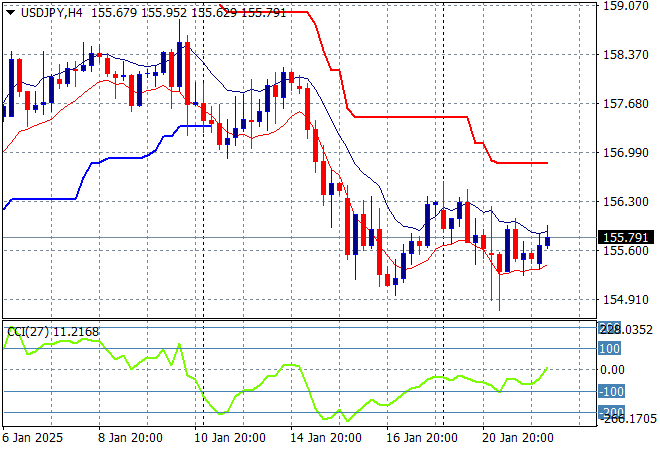

Mainland Chinese share markets are moving sharply lower in afternoon trade with the Shanghai Composite down 0.8% or so as it almost breaks below the 3200 point level while the Hang Seng Index is also off, down more than 1.3% as it retraces well below the 20000 point level. Japanese stock markets are the standouts however despite the higher Yen with the Nikkei 225 about to close 1.4% higher at 38585 points while the USDPY pair has firmed slightly above the 155 handle as Yen still remains the strongest undollar:

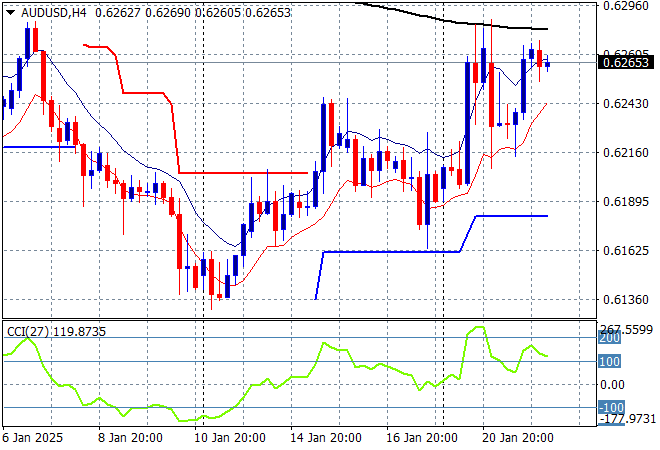

Australian stocks are lifting slightly across the board with the ASX200 closing some 0.2% higher at 8421 points while the Australian dollar is nearly stalling out again to remain just above the mid 62 cent level after rebounding off its new monthly low:

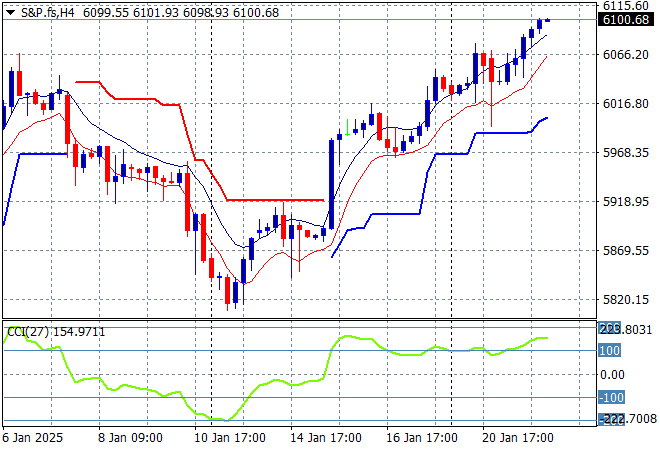

S&P and Eurostoxx futures are pushing slightly higher as we head into the London session with the S&P500 four hourly chart showing momentum remaining well into overbought territory as price action accelerates above former medium term resistance at the 6000 point zone:

The economic calendar is relatively quiet with the latest US Redbook followed by a speech by ECB President LaGarde.