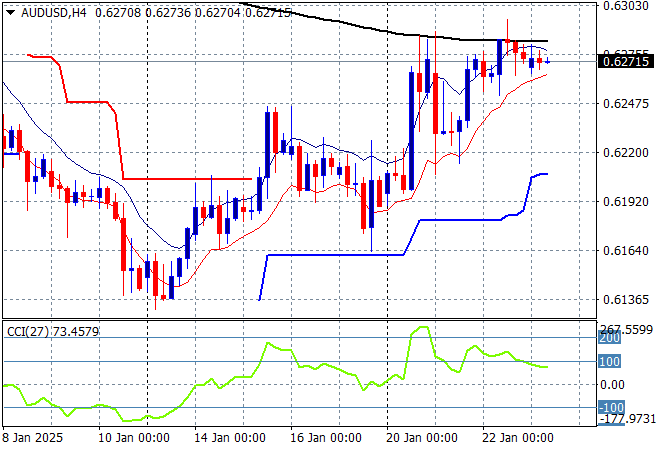

Asian stock markets again moved due to internal concerns with Chinese shares moving higher on state instituted rules on investment while Japanese exports for December helped lift the Nikkei. Local stocks fared poorly however as the USD is still suffering from post-Trumpian volatility which had been centered around Yen. Meanwhile Australian dollar holds fast above mid 62 cent level.

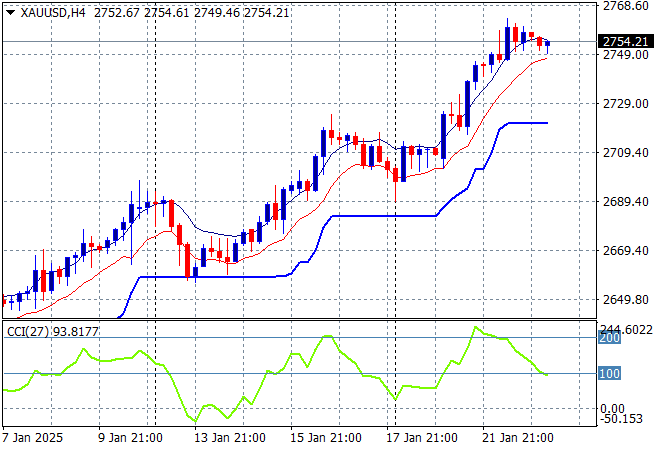

Oil futures are pulling back slightly again with Brent crude now just below the $79USD per barrel level while gold is slowing its recent advance after finding its feet again with its new breakout above the $2750USD per ounce level taking a pause:

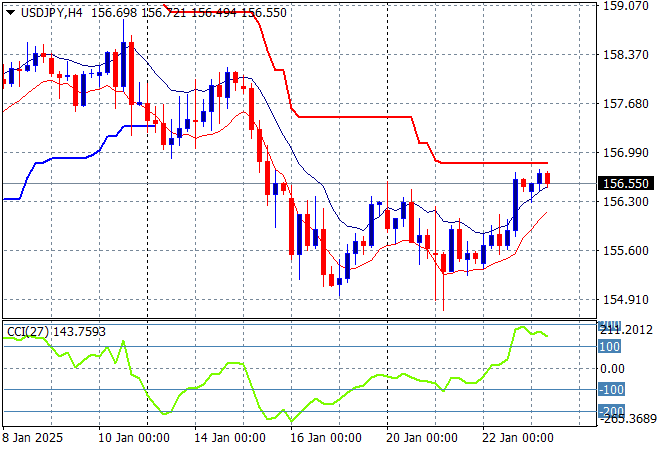

Mainland Chinese share markets are moving higher in afternoon trade with the Shanghai Composite up 1.4% or so as it breaks above the 3200 point level while the Hang Seng Index was off slightly, down 0.6% as it continues its retracement below the 20000 point level. Japanese stock markets are the standouts again with the Nikkei 225 closing more than 0.8% higher at 38585 points while the USDPY pair has firmed slightly above the 156 handle in welcoming weakness:

Australian stocks are down across the board with the ASX200 closing some 0.6% lower at 8378 points while the Australian dollar is stalling out again to remain just above the mid 62 cent level after rebounding off its new monthly low:

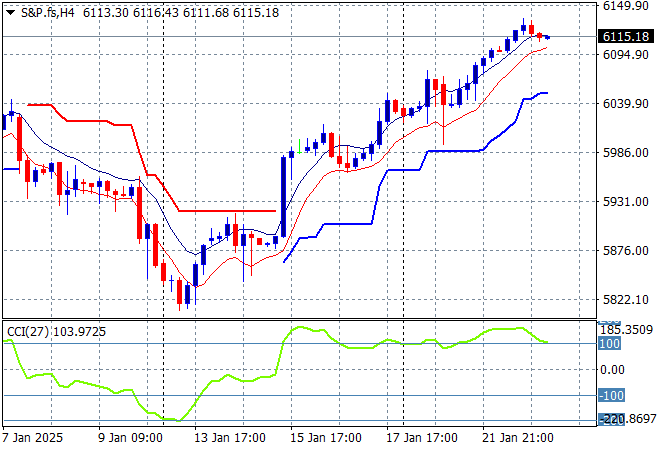

S&P and Eurostoxx futures are pushing slightly lower as we head into the London session with the S&P500 four hourly chart showing momentum remaining well into overbought territory as price action accelerates above former medium term resistance at the 6000 point zone:

The economic calendar is relatively quiet again with the latest weekly initial jobless claims in the US.