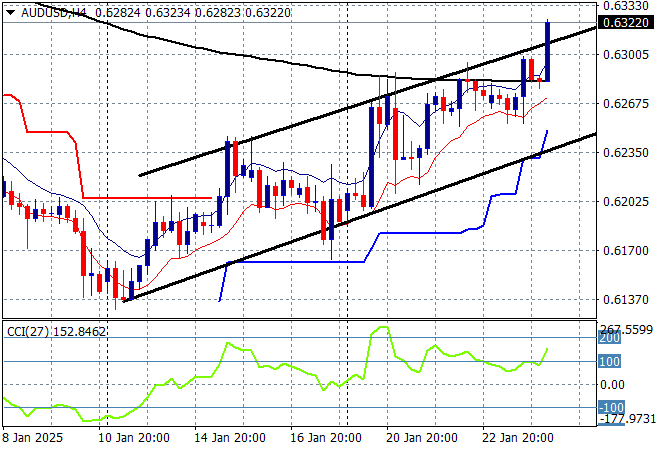

The big news to end the trading week here in Asia is a possible turnaround on the Trump Tariffs on Chyna with Asian stock markets lifting in general across the region while the USD was pushed significantly lower, particularly against Yen. This was helped by the expected rate rise by the BOJ in its meeting this afternoon, with the Australian dollar breaking out above the 63 cent level for a new monthly high.

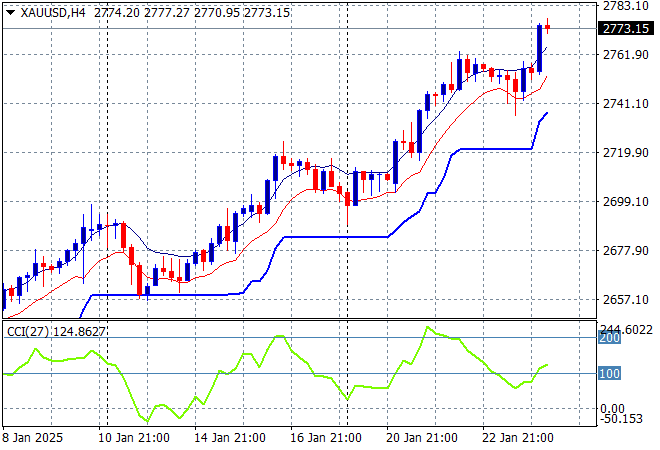

Oil futures are pulling back slightly again with Brent crude now just above the $78USD per barrel level while gold is advancing again with a new breakout above the $2770USD per ounce level on the USD weakness:

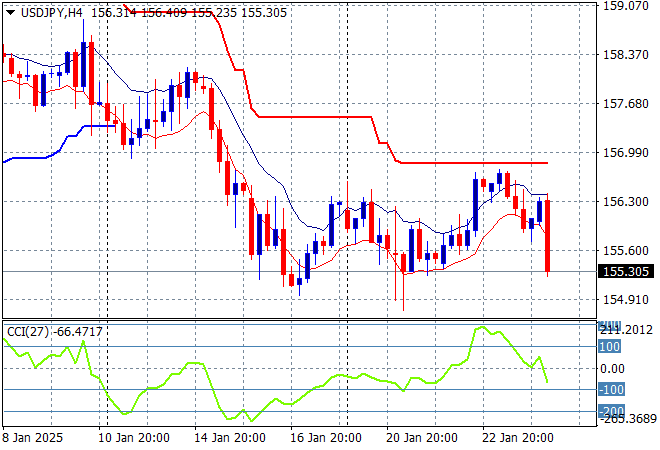

Mainland Chinese share markets are moving higher in afternoon trade with the Shanghai Composite up 0.7% or so as it continues to move above the 3200 point level while the Hang Seng Index is soaring even higher, currently up 1.8% to just get above the 20000 point level. Japanese stock markets are the weakest in the region on the BOJ rate rise with the Nikkei 225 about to close just 0.2% higher at 40082 points while the USDPY pair has dropped back to the start of week position just above the 155 handle as Yen firms:

Australian stocks are up slightly with the ASX200 about to close some 0.3% higher at 8402 points while the Australian dollar has broken out above the 63 cent level on the China tariff turnaround, continuing its strong rebound channel off its new monthly low:

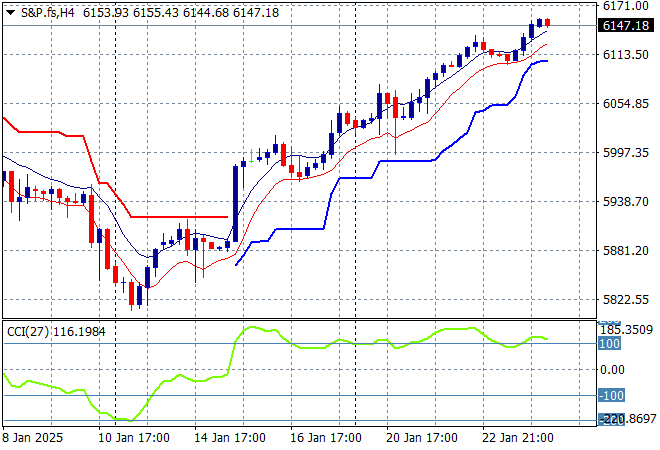

S&P and Eurostoxx futures are pushing slightly higher on the weaker USD as we head into the London session with the S&P500 four hourly chart showing momentum remaining well into overbought territory as price action accelerates above former medium term resistance at the 6000 point zone:

The economic calendar finishes the trading week with flash manufacturing and services PMIs across both sides of the Atlantic (with more from China on Saturday) with US existing home sales as well.