Asian stock markets are having a hard time swallowing the volatility around the overnight moves on Wall Street due to the Deepseek AI problems, while equally swallowing the Deep Suck coming out of the White House around more tariffs. The USD was pushed significantly higher after several sessions of weakness with the Australian dollar breaking down below the 63 cent level again.

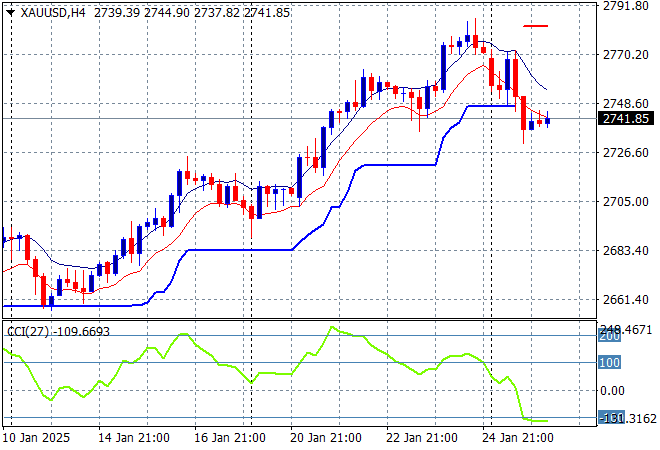

Oil futures are pulling back slightly again with Brent crude now just above the $76USD per barrel level while gold is failing to advance back above the $2750USD per ounce level:

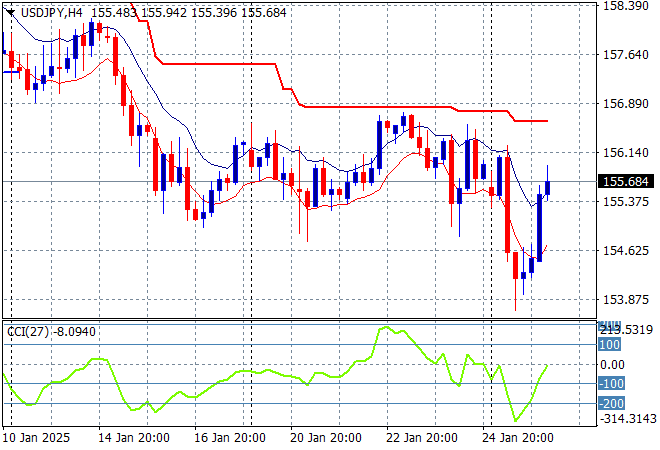

Mainland Chinese share markets are closed for New Year holidays with the Hang Seng Index also closed. Japanese stock markets are the weakest in the region by far with the Nikkei 225 closing more than 1.5% lower at 38926 points while the USDPY pair has bounced back sharply in a near 200 pip turnaround to get back above the 155 handle:

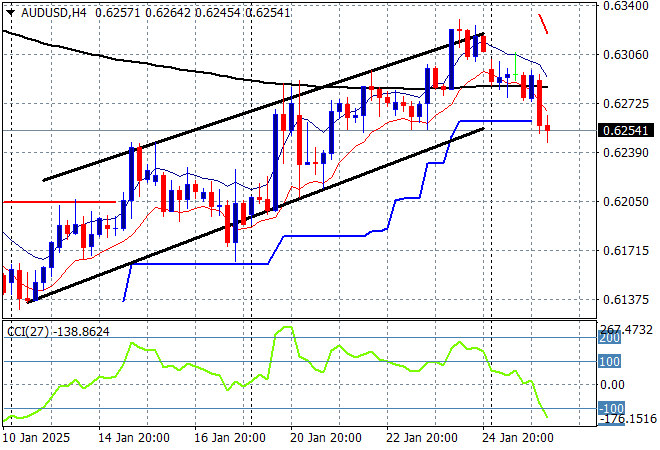

Australian stocks were able to escape mass carnage with the ASX200 closing just 0.1% lower at 8399 points while the Australian dollar has broken down below the 63 cent level on the continued tariff volatility, ceasing the strong rebound channel off its new monthly low:

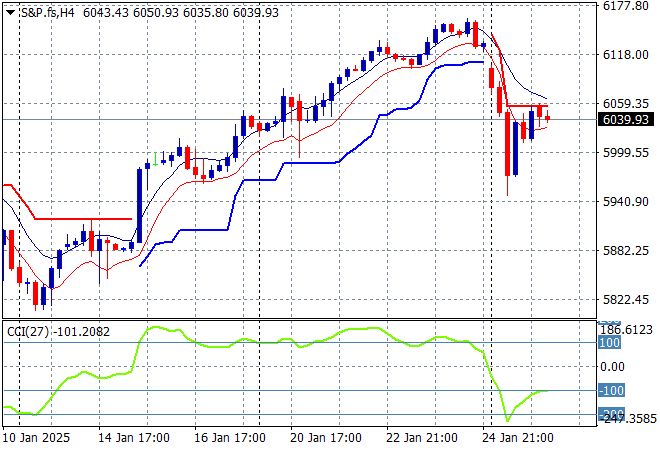

S&P and Eurostoxx futures are pushing slightly higher as we head into the London session with the S&P500 four hourly chart showing momentum remaining well into oversold territory as price action is forming a classic dead cat bounce following last night’s AI led selloff:

The economic calendar includes the latest US durable goods orders and house price indicies.