Asian stock markets are barely positive in reaction to the slightly hawkish tone the Fed took last night at the latest FOMC Meeting, with volatility still looking through the increasingly isolationist and tariff based US trade policies. The USD was pushed slightly higher overnight and has held on to most of those gains going into the London session with the Australian dollar still hovering around the 62 cent level as traders weigh up the February RBA rate meeting.

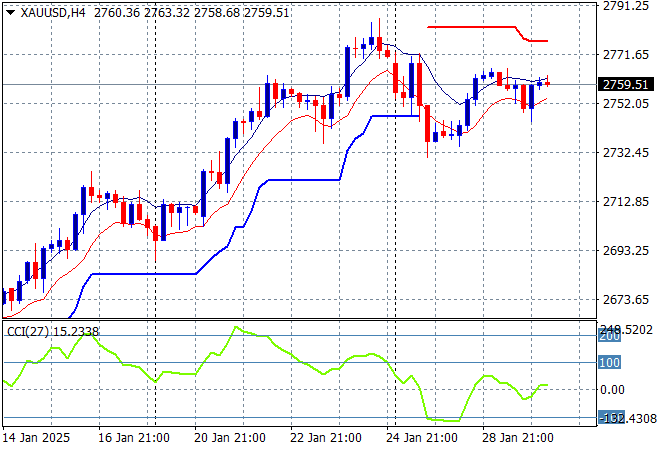

Oil futures are pulling back slightly again with Brent crude now below the $76USD per barrel level while gold is trying but not really moving back above the $2750USD per ounce level:

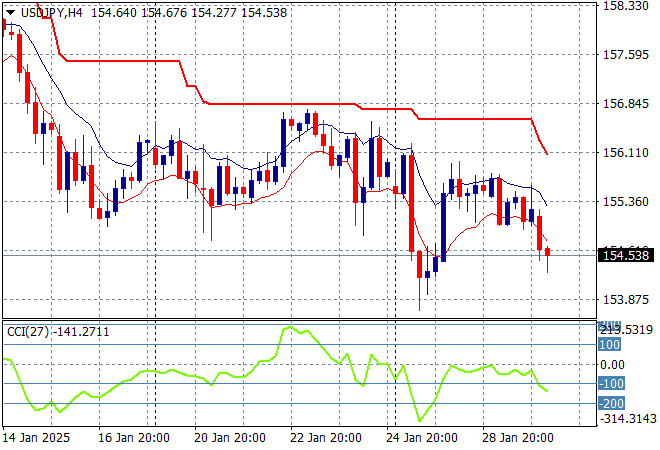

Mainland Chinese share markets are closed for New Year holidays with the Hang Seng Index also closed. Japanese stock markets were the weakest in the region again with the Nikkei 225 closing just 0.1% higher at 39480 points while the USDPY pair has rolled over again to be well below the 155 handle:

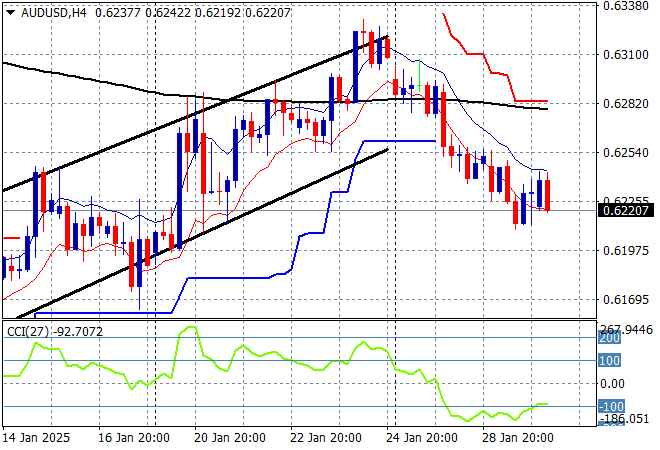

Australian stocks had a much better bid the ASX200 closing 0.5% higher at 8493 points while the Australian dollar has failed to take back the overnight losses as it falls in afternoon trade to almost cross below the 62 cent level:

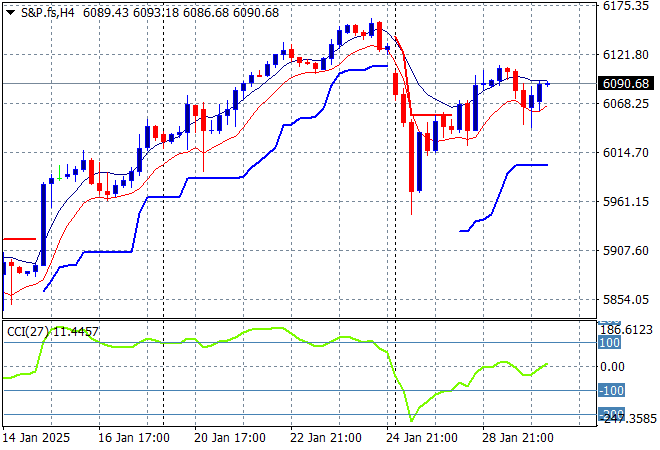

S&P and Eurostoxx futures are pushing slightly higher as we head into the London session with the S&P500 four hourly chart showing momentum trying to get out of oversold territory as price action is no longer a classic dead cat bounce:

The economic calendar tonight will now focus on the latest ECB meeting followed by US GDP numbers.