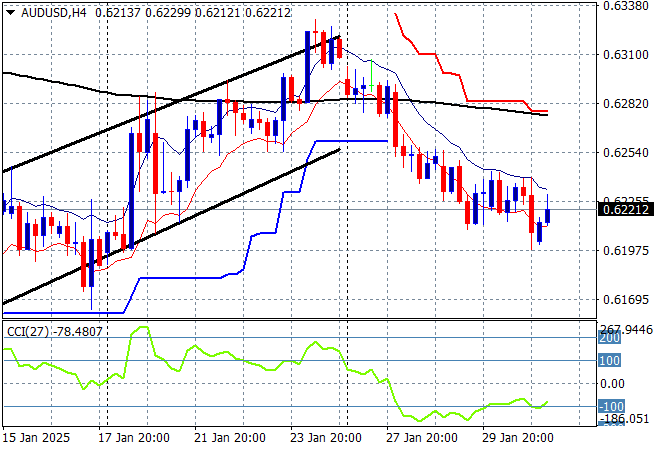

Asian stock markets are doing well to absorb the latest Fed and ECB meetings with the added volatility of a Japanese inflation print and subsequent BOJ comments giving Yen a reprieve after the USD fell all week. Indeed, the USD is strengthening against most of the majors again as the Clown in the Oval Office again pushed for more and immediate tariffs against Canada and Mexico and Taiwan and…well anyone to take the spotlight off basically. The Australian dollar is still hovering around the 62 cent level as traders weigh up the February RBA rate meeting.

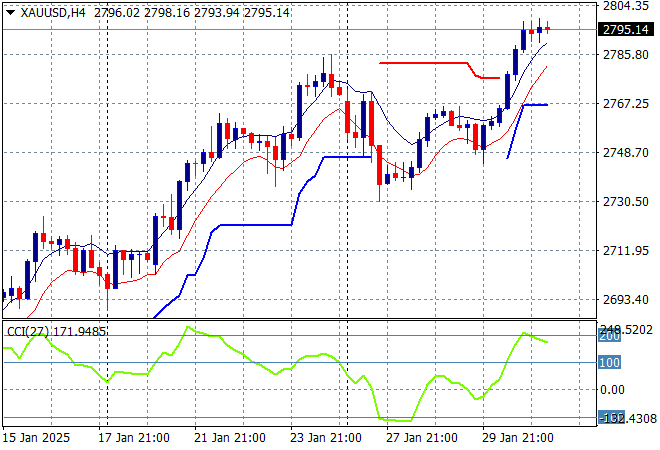

Oil futures are trying to steady after a week of poor results with Brent crude now slightly above the $76USD per barrel level while gold really wants to extend its new historic high and get above the $2800USD per ounce level but is finding strong resistance:

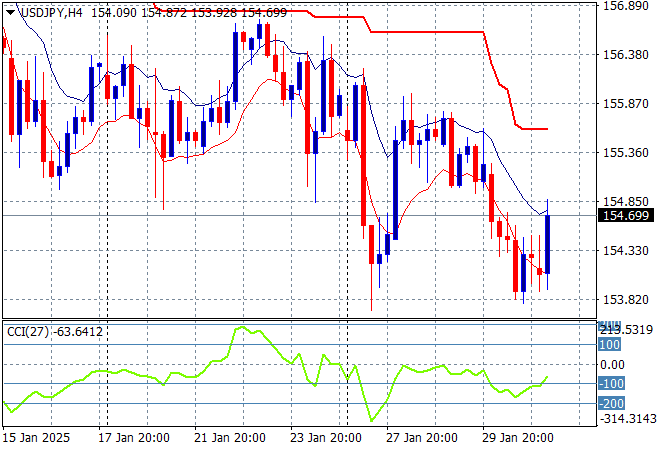

Mainland Chinese share markets are closed for New Year holidays with the Hang Seng Index also closed. Japanese stock markets did okay through the inflation and Yen volatility with a modest lift across the board as the Nikkei 225 finished 0.3% higher at 39636 points while the USDPY pair has jumped up towards but not above the 155 handle on the BOJ comments around the inflation print itself:

Australian stocks had another strong bid to finish the week as the ASX200 closed 0.5% higher at 8532 points while the Australian dollar has failed to take back the overnight losses as it falls in afternoon trade to almost cross below the 62 cent level:

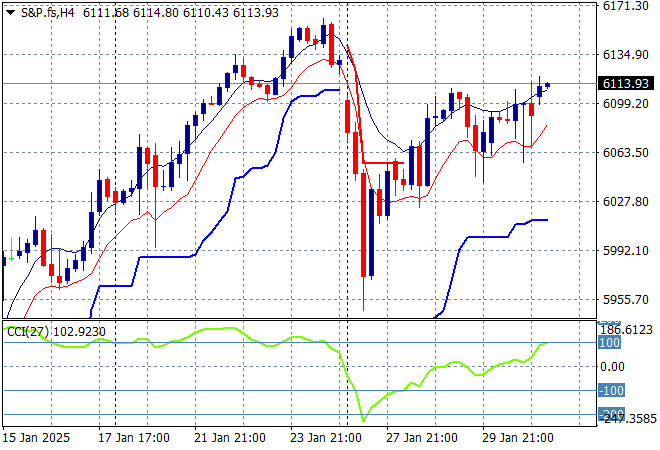

S&P and Eurostoxx futures are pushing slightly higher as we head into the London session with the S&P500 four hourly chart showing momentum building territory as price action gets out of its dead cat bounce to turn into something more sustainable:

The economic calendar finishes the week with the dual German unemployment and inflation prints, followed by the latest US CPE print.

Vale Marianne Fathfull