The latest US CPI print overnight sent stocks, commodities and undollars higher with Wall Street having its best one day performance in months while European shares also rebounded strongly. The USD fell back against most of the undollars despite the higher CPI print with Euro almost making a new weekly high as Yen advanced while the plucky Australian dollar finally broke through the 62 cent level.

US Treasuries saw big rallies with the 10 year yield dropping more than 13 points back to the 4.6% level while oil markets surged after their very minor pullback recently as Brent crude pushed through the $82USD per barrel level. Gold also re-engaged after its recent slow recovery, almost heading back above the $2700USD per ounce level.

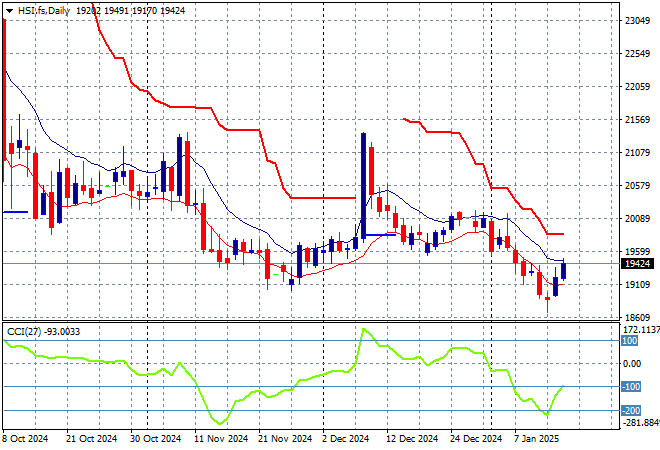

Looking at stock markets from Asia in yesterday’s session, where mainland Chinese share markets moved slightly lower at first before selling off at the close with the Shanghai Composite down 0.4% to just above the 3200 point level while the Hang Seng Index went the other way, beginning dead flat before rallying to close 0.4% higher at just below the 19300 point level.

The Hang Seng Index daily chart shows how resistance formed around the 21000 point level with only one false breakout in late November squashed back to the 20000 point level where price action has stayed since. This is still setting up for another potential breakdown here:

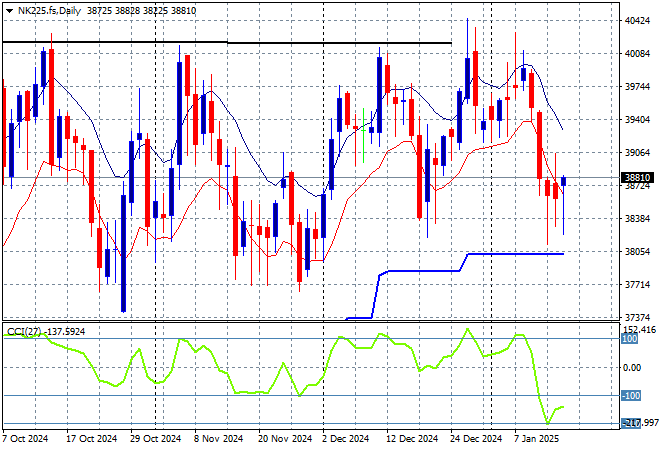

Japanese stock markets reopened and were still mixed with the Nikkei 225 closing 0.1% lower at 38444 points

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Yen volatility remains a problem here, with a sustained return above the 38000 point level from May/June possibly on the cards but resistance is firming:

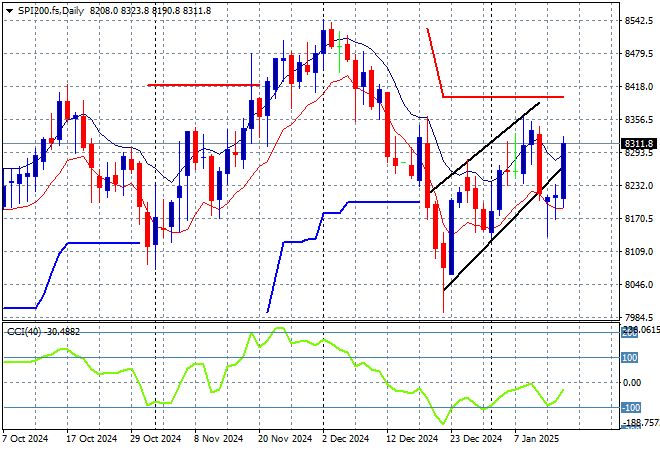

Australian stocks weren’t able to lift at all with as the ASX200 closing some 0.2% lower at 8213 points.

SPI futures however are indicating a massive surge at the open with at least a 1.2% or more jump higher due to the rally on Wall Street overnight. The daily chart pattern and short price action suggests this rollover has built a little too much momentum to the downside even if support at the 8400 point level was illusory indeed with a bearish flag suggesting a break below the 8200 point level next:

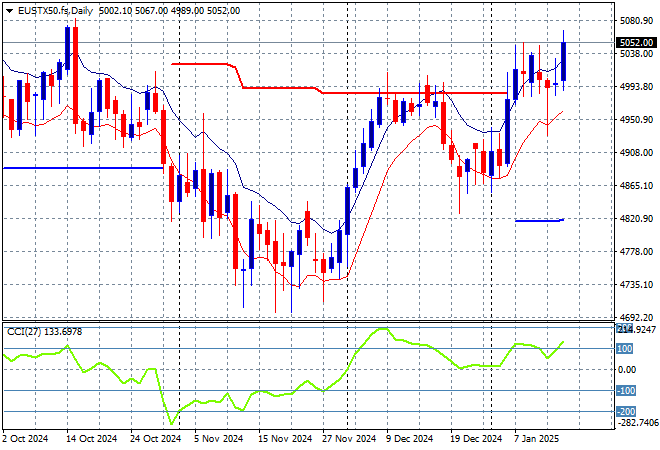

European markets were stable before the US CPI print and were able to get back on track overnight with the Eurostoxx 50 Index closing 1% higher to get back above the 5000 point level, finishing at 5032 points.

This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance unable to breach the 5000 point barrier in recent months. Price had previously cleared the 4700 local resistance level as it seeks to return to the previous highs as momentum tries to pick up strongly here with the 4900 point level turning into strong support:

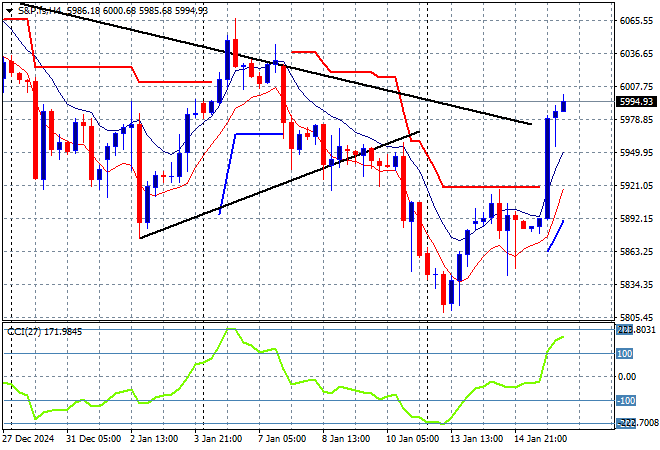

Wall Street pushed aside all the macro risk factors and latched onto the CPI print with a big rally across the board with the NASDAQ surging some 2% higher while the S&P500 also moved up 1.8% to close at 5949 points.

Short term price action was looking somewhat ominous before Friday night with a triangle pattern and support at the 5900 point collapsing as the bottom pickers stood aside to make a new low but short term resistance has now been cleared with this one off move. The next target to beat is the New Year high before the Trump Circus begins:

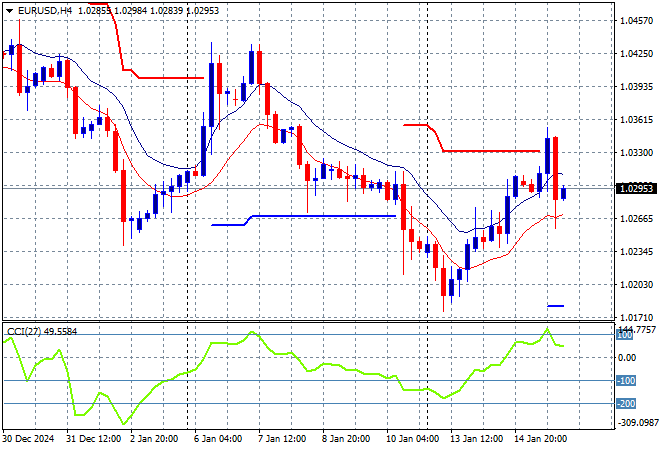

Currency markets had been in a strong USD mood overall with King Dollar dominating well before the NFP print last Friday night but the weekend gap has set up some weakness before last nights CPI print which has seen further pushback that continued overnight as Euro launched above the 1.03 level.

The union currency was ready to make new lows in a very oversold condition so this isn’t that surprising as markets re-align as I still think it will likely slide further back towards the new year low and head towards parity soon as medium term momentum remains quite negative. Note how it wasn’t able to hold on to last nights gains:

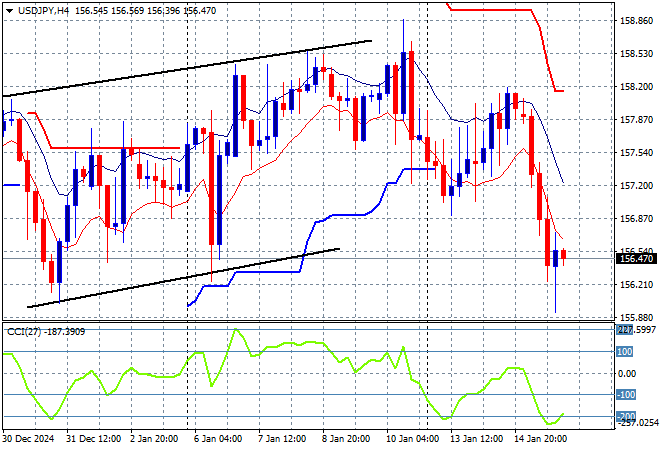

The USDJPY pair continues to move around quite a bit after gapping lower in the previous sessions with a solid selloff overnight to almost finish below the 156 handle this morning on the CPI print, having had hall the hallmarks of a dead cat bounce.

Short term momentum has reverted out of extremely overbought settings but is still very positive indeed as price action settles down but there is still potential for more upside here dependent on trading activity as the new year begins, but watch for a potential rollover here:

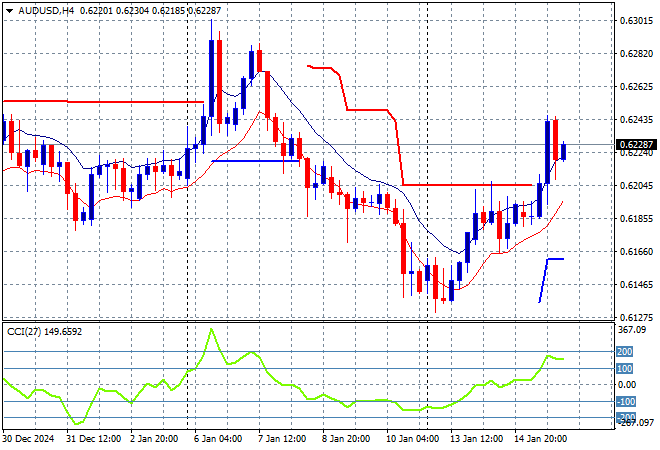

The Australian dollar remains one of the most depressed undollars but it finally found some traction on the USD weakness following last night’s CPI print as it finally zoomed above the 62 handle.

The prior breakdown had been on the cards for weeks and will reverberate into the new year as the currency finally reweights according to its position in the global economy, but short term overhead ATR resistance on the four hourly chart was not longer rejected in last night’s move. Wait for a potential follow through to the high 62’s before another retracement as rate cut bets locally accelerate again:

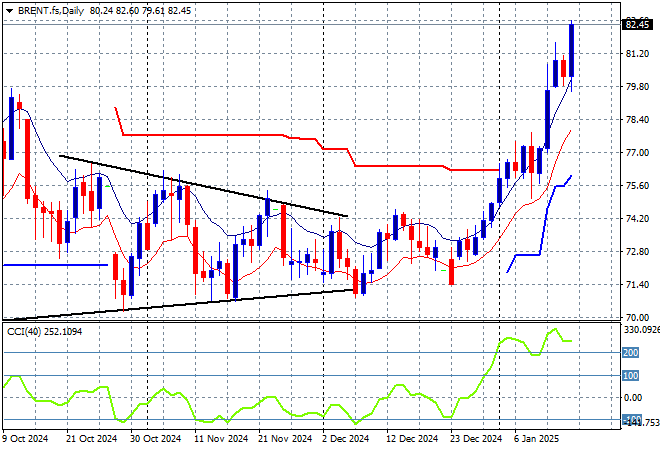

Oil markets continued their breakout overnight with Brent crude pushing well above the $83USD per barrel level on energy price speculation around the US CPI print.

The daily chart pattern has broken out of its spring formation with short term momentum bursting into overbought territory with a run up to the $80 level now complete, but needs another breather first as this looks considerably overdone and likely to slip in the coming sessions:

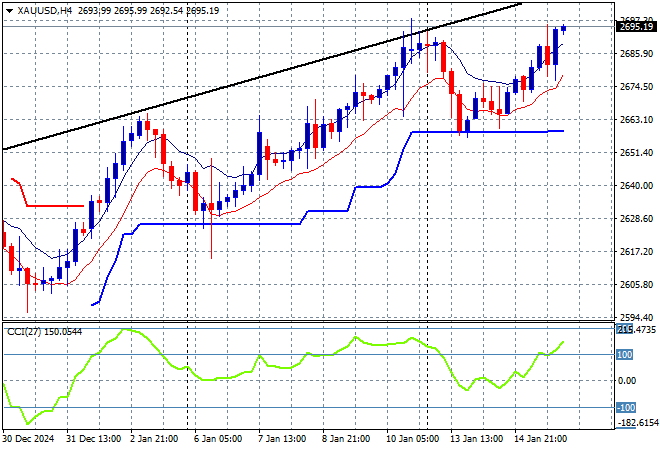

Gold is trying to get back on track and was able to advance further overnight after recently running out of steam as it nearly broke through the $2700USD per ounce level.

Price action had been accelerating in confidence in early December as new levels of support were being created regardless of USD strength but this pullback and rebound both had been fighting too much under the $2700 zone so I have been skeptical of any upside potential. However this does look interesting if it can break through:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!