Wall Street advanced once more although the broader S&P500 just missed out on making a new high with tech stocks again leading the way. European bourses were somewhat mixed on the periphery but also performed well. The USD is now trying to get out of its weak short term cycle against the major currency pairs with Euro stumbling a little while Yen unexpectedly sold off in the middle of the session. Meanwhile the Australian dollar is just holding on above the 62 cent level as the rate differential dynamic starts to make a play.

10 year Treasury yields lifted nearly 3 points to almost return above the 4.6% level while trading in oil was again somewhat subdued with Brent crude retracing back below the $79USD per barrel level. Gold also took a breather as it rests strongly above the $2700USD per ounce level.

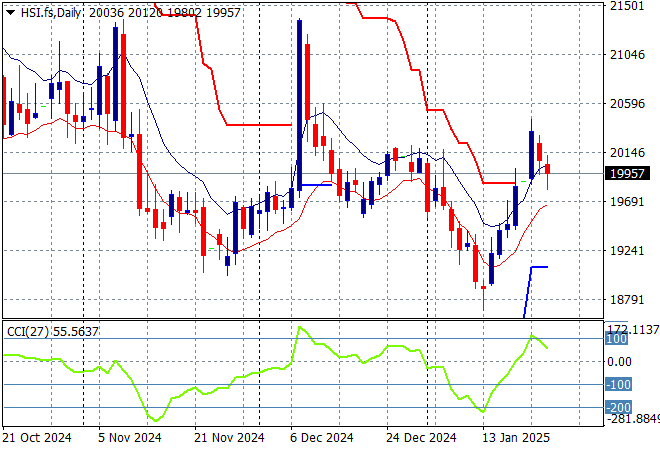

Looking at stock markets from Asia in yesterday’s session, where mainland Chinese share markets are moving sharply lower in afternoon trade with the Shanghai Composite down 0.8% or so as it almost breaks below the 3200 point level while the Hang Seng Index is also off, down more than 1.6% as it retraces well below the 20000 point level.

The Hang Seng Index daily chart shows how resistance formed around the 21000 point level with only one false breakout in late November squashed back to the 20000 point level where price action has stayed since. This was setting up for another potential breakdown here as price oscillated downward but has turned into an impressive bounce – can it be maintained?

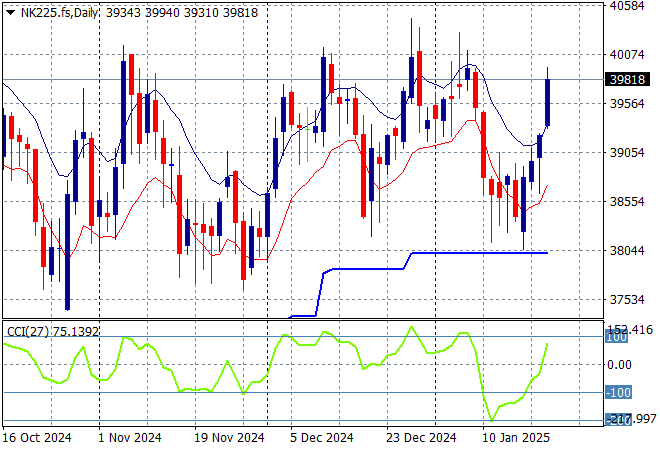

Japanese stock markets are the standouts however despite the higher Yen with the Nikkei 225 closing 1.5% higher at 38585 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Yen volatility remains a problem here, with a sustained return above the 38000 point level from May/June possibly on the cards but resistance is firming:

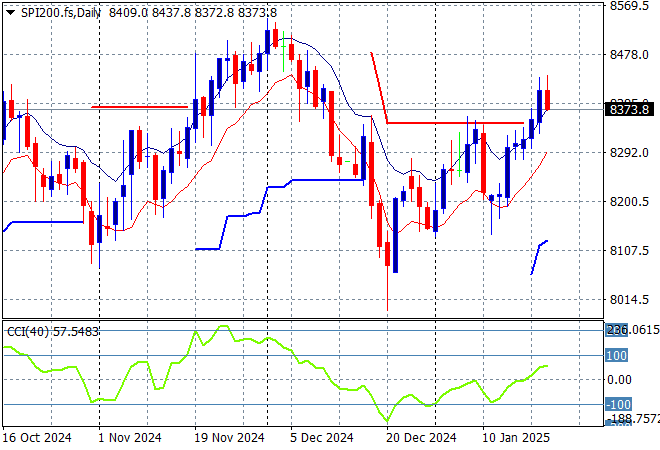

Australian stocks are lifting slightly across the board with the ASX200 closing some 0.3% higher at 8429 points.

SPI futures however are down some 0.4% despite the solid lead from Wall Street overnight so we could see a continuation breakout pattern here today. The daily chart pattern and short price action suggests continued moves above resistance overhead at the 8300 point level:

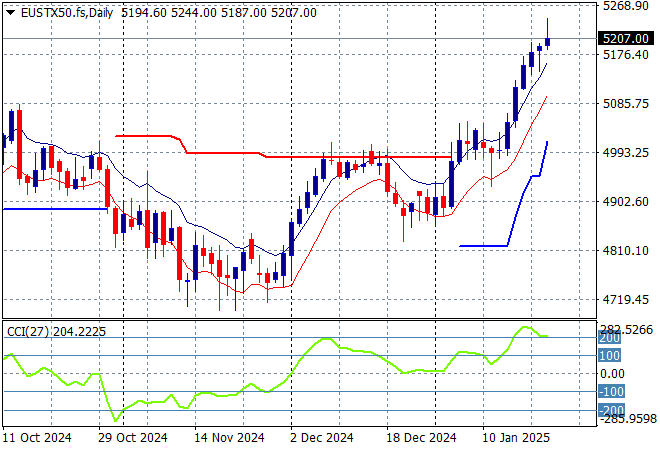

European markets were able to make some serious gains across most of the continent as the Eurostoxx 50 Index lifted nearly 0.8% higher to get back above the 5200 point level, finishing at 5204 points.

This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance unable to breach the 5000 point barrier in recent months. Price had previously cleared the 4700 local resistance level as it seeks to return to the previous highs as momentum tries to pick up strongly here with the 4900 point level turning into strong support:

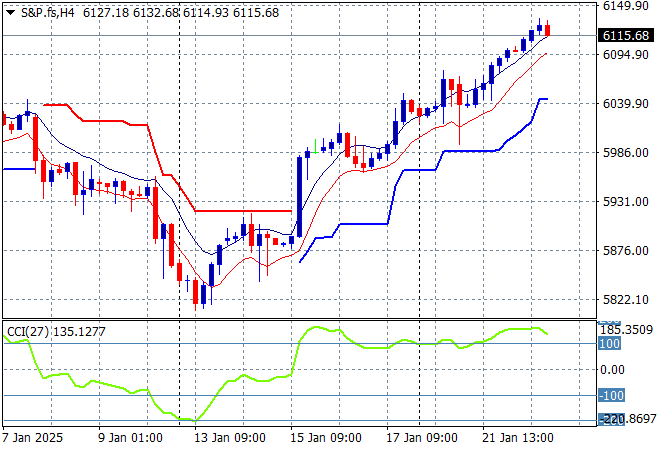

Wall Street was able to continue its uptrend overnight with the NASDAQ up nearly 1.3% while the S&P500 advanced some 0.8% higher to finish at 6086 points.

Short term price action was looking somewhat ominous before Friday night with a triangle pattern and support at the 5900 point collapsing as the bottom pickers stood aside to make a new low but short term resistance has now been cleared with this one off move. The New Year high looks to be the new support level potentially?

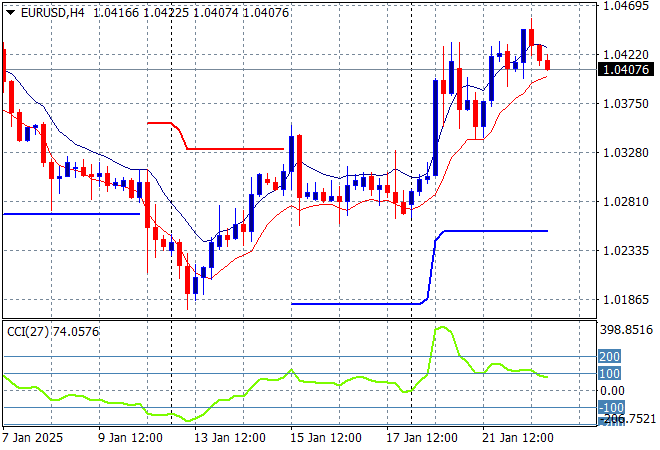

Currency markets had been wavering the strong USD mood before the end of last week with King Dollar still dominating since the most recent NFP print but weakness has again returned despite walking back of tariff talk. Almost all the undollars advanced again with Euro jumping smartly above the 1.04 level and staying there in morning trade.

The union currency is just holding on to this uptrend but is finding some staunch overhead resistance at the 1.04 handle proper with overbought momentum now in retracement mode. Watch for a potential reversal here:

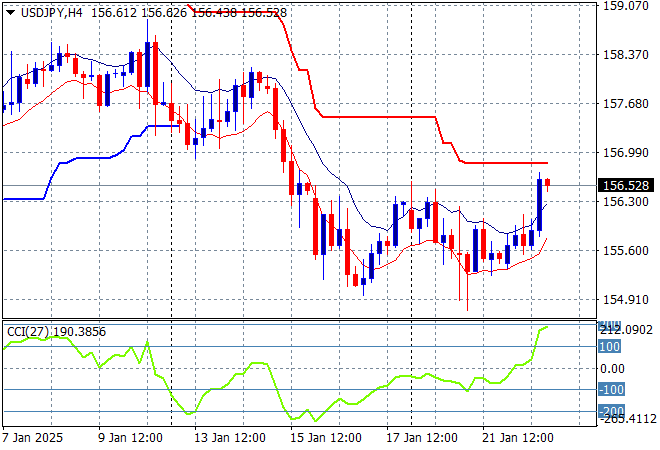

The USDJPY pair was able to break a small breakout overnight above the 156 handle on temporary USD strength but it will be interesting to see if this holds on the Asian open this morning with short term resistance looming overhead.

Short term momentum has reverted out of extremely overbought settings but is now fully entrenched in negative settings as price seeks the to break below the 155 level but as I warned last week, the potential for a rebound was building here, although it looks to be a dead cat bounce at best:

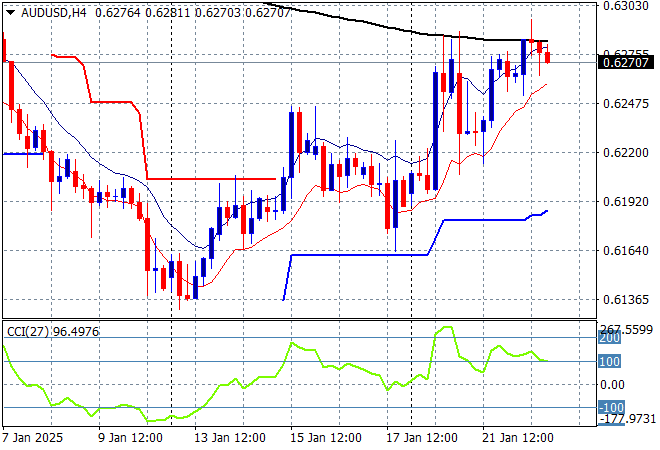

The Australian dollar is still depressed in the medium term but is looking better in the short term albeit on USD weakness as it held well above the 62 cent zone overnight with some slippage in the early hours this morning.

The potential follow through to the high 62’s as it almost hits the 200 day moving average (upper black sloping line) indicates some chance of a medium term reversal, but this is high risk going into the live February RBA rate meeting – watch for a rejection at just below the 63 cent level instead:

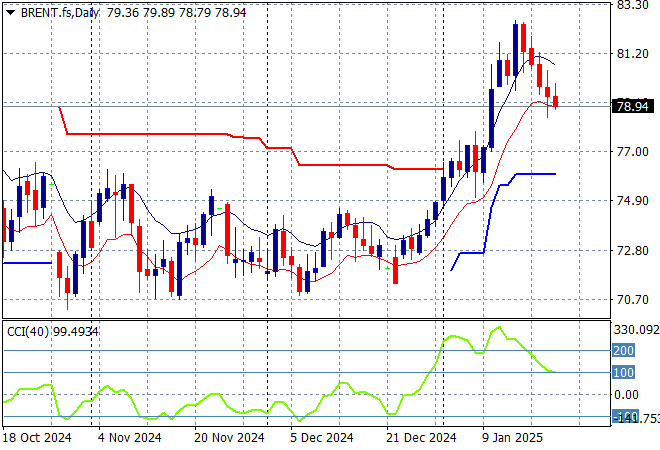

Oil markets couldn’t continue their breakout from Friday night with Brent crude retracing back below the $79USD per barrel level in a continued welcome pullback after being so overbought in recent weeks.

The daily chart pattern has broken out of its spring formation with short term momentum bursting into overbought territory with a run up to the $80 level now complete, but needs another breather first as this looks considerably overdone and likely to slip in the coming sessions:

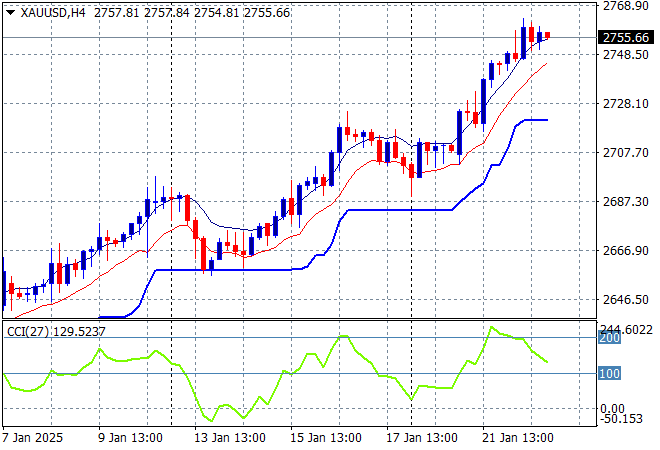

Gold is now well back on track after recently running out of steam as it made further inroads above the $2700USD per ounce level recently but had a mild pause overnight after closing above the $2750 level.

Price action had been accelerating in confidence in early December as new levels of support were being created regardless of USD strength but this pullback and rebound both had been fighting too much under the $2700 zone so I have been skeptical of any upside potential. However this is looking more interesting:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!