Wall Street advanced once more this time the broader S&P500 officially made a new high with tech stocks pulling back as European bourses also performed well. The USD is failing to get out of its weak short term cycle against the major currency pairs with Euro lifting back above the 1.04 handle while Yen has reversed its own short term selloff. Meanwhile the Australian dollar is slowly advancing above the 62 cent level despite the increased Trump Spittle around tariffs.

10 year Treasury yields were little changed remaining at the 4.6% level while trading in oil was again weak with Brent crude retracing back below the $78USD per barrel level in a minor corrective phase. Gold also took a breather as it rests strongly above the $2750USD per ounce level.

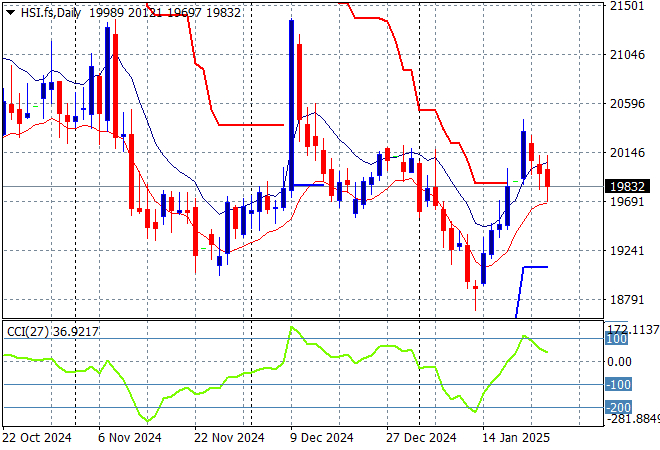

Looking at stock markets from Asia in yesterday’s session, where mainland share markets moved higher in afternoon trade with the Shanghai Composite up 1.4% or so as it breaks above the 3200 point level while the Hang Seng Index was off slightly, down 0.4% as it continues its retracement below the 20000 point level.

The Hang Seng Index daily chart shows how resistance formed around the 21000 point level with only one false breakout in late November squashed back to the 20000 point level where price action has stayed since. This was setting up for another potential breakdown here as price oscillated downward but has turned into an impressive bounce – can it be maintained?

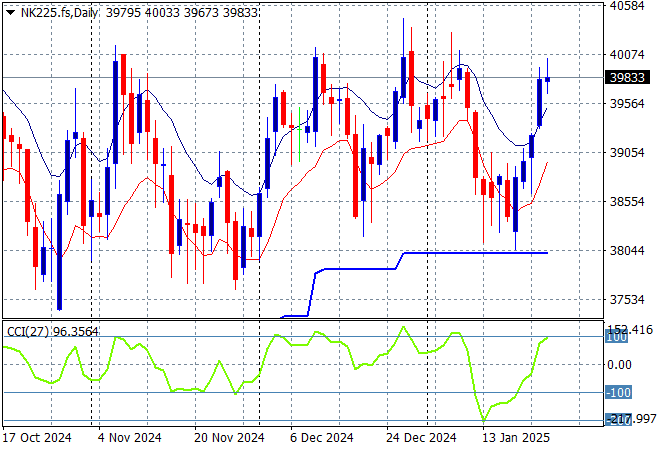

Japanese stock markets are the standouts again with the Nikkei 225 closing more than 0.8% higher at 38585 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Yen volatility remains a problem here, with a sustained return above the 38000 point level from May/June possibly on the cards but resistance is firming:

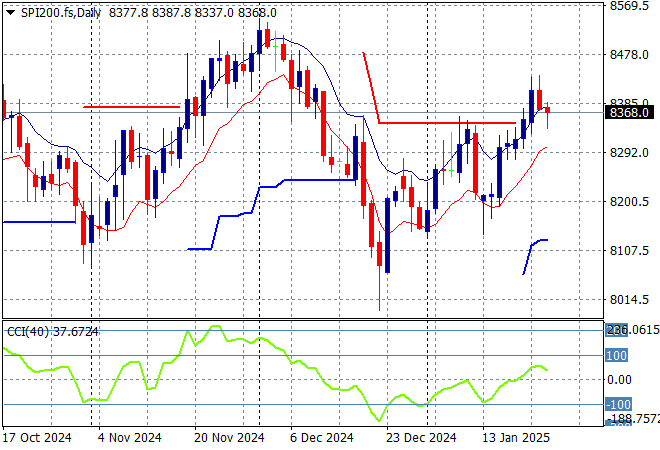

Australian stocks are down across the board with the ASX200 closing some 0.6% lower at 8378 points

SPI futures however are up 0.3% due to the solid lead from Wall Street overnight so we could see a filling pattern here today. The daily chart pattern and short price action suggests continued moves above resistance overhead at the 8300 point level:

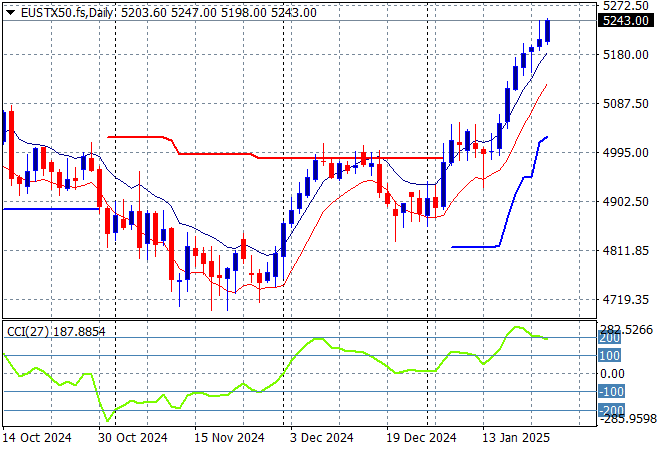

European markets were able to make some minor gains across most of the continent as the Eurostoxx 50 Index lifted 0.2% higher to remain above the 5200 point level, finishing at 5212 points.

This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance unable to breach the 5000 point barrier in recent months. Price had previously cleared the 4700 local resistance level as it seeks to return to the previous highs as momentum tries to pick up strongly here with the 4900 point level turning into strong support:

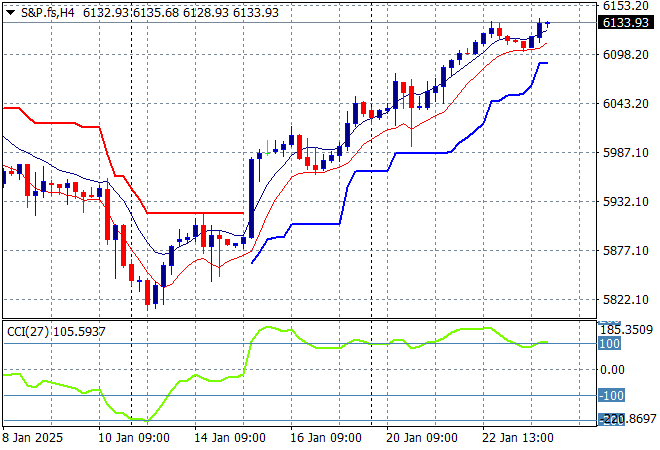

Wall Street was also able to continue its uptrend overnight although the NASDAQ stumbled at the close for a minor loss while the S&P500 advanced some 0.3% higher to finish at 6102 points, a new record high.

Short term price action was looking somewhat ominous before Friday night with a triangle pattern and support at the 5900 point collapsing as the bottom pickers stood aside to make a new low but short term resistance has now been cleared with this one off move. The New Year high looks to be turning into the new support level:

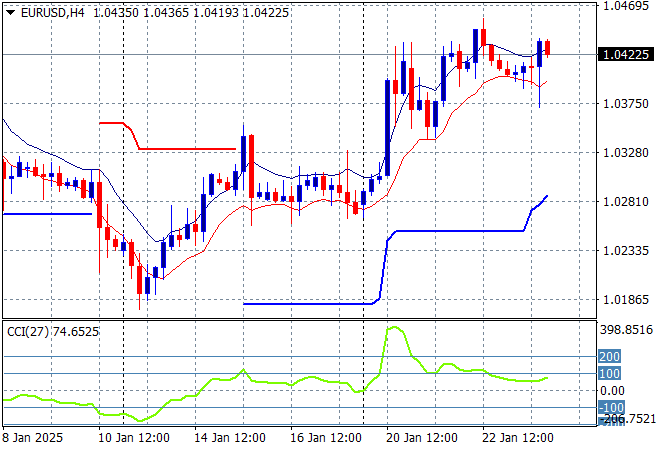

Currency markets had been wavering the strong USD mood before the end of last week with King Dollar still dominating since the most recent NFP print but weakness has again due to more Trump Tariff madness. Almost all the undollars advanced again with Euro getting back above the 1.04 level and staying there in morning trade, not quite matching the intraweek high.

The union currency is just holding on to this uptrend but is finding some staunch overhead resistance at the 1.04 handle proper with overbought momentum now in retracement mode. Watch for a potential reversal here:

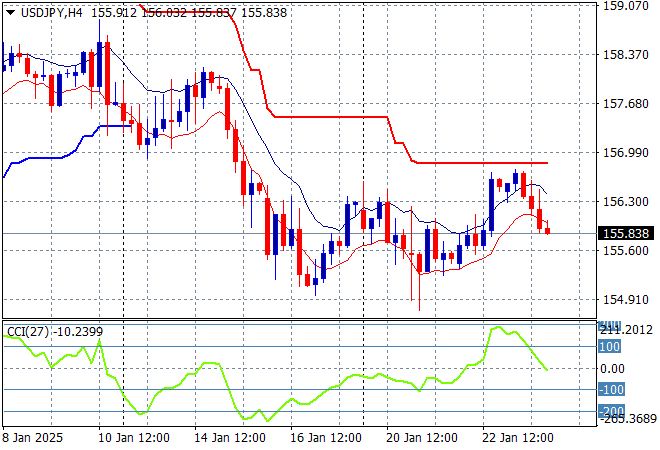

The USDJPY pair was unable to sustain its recent small breakout overnight above the 156 handle on temporary USD strength as it retraces this move and then some in every session overnight.

Short term momentum has reverted out of extremely overbought settings but is now fully entrenched in negative settings as price seeks the to break below the 155 level but as I warned last week, the potential for a rebound was building here, although it looks to be a dead cat bounce at best:

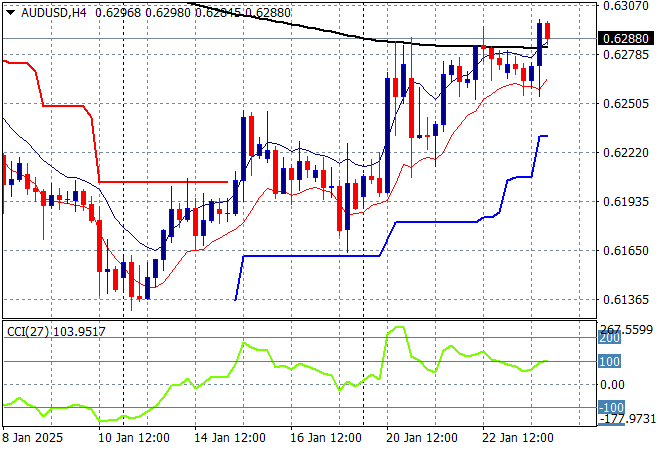

The Australian dollar is still depressed in the medium term but is looking better in the short term albeit on USD weakness as it held well above the 62 cent zone overnight with a proper go at the 63 cent level as well.

The potential follow through to the high 62’s as it almost hits the 200 day moving average (upper black sloping line) indicates some chance of a medium term reversal, but this is high risk going into the live February RBA rate meeting – watch for a rejection at just below the 63 cent level instead:

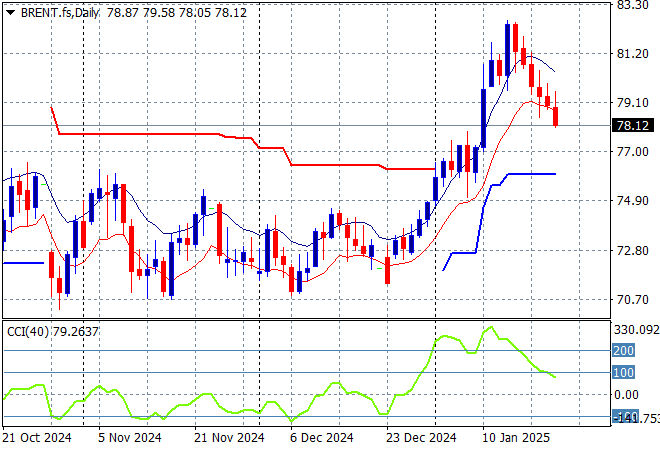

Oil markets are now in a proper retracement after failing to continue their breakout from Friday night with Brent crude retracing back below the $79USD per barrel level in a continued pullback after being so overbought in recent weeks.

The daily chart pattern has broken out of its spring formation with short term momentum bursting into overbought territory with a run up to the $80 level now complete, but needs another breather first as this looks considerably overdone and likely to slip in the coming sessions:

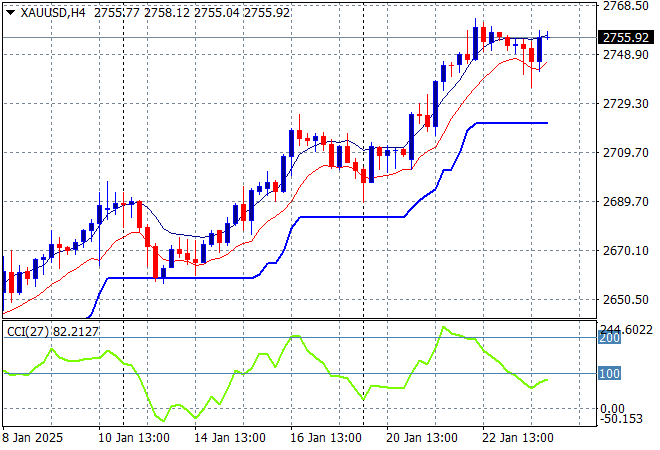

Gold is now well back on track after recently running out of steam as it made further inroads above the $2700USD per ounce level recently but had a mild pause overnight after closing above the $2750 level.

Price action had been accelerating in confidence in early December as new levels of support were being created regardless of USD strength but this pullback and rebound both had been fighting too much under the $2700 zone so I have been skeptical of any upside potential. However this is looking more interesting:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!