The ANZ is doved up.

RBA to cut cash rate by 25bp in Feb and Aug 2025

We now expect the RBA to cut the cash rate by 25bp at its February meeting.

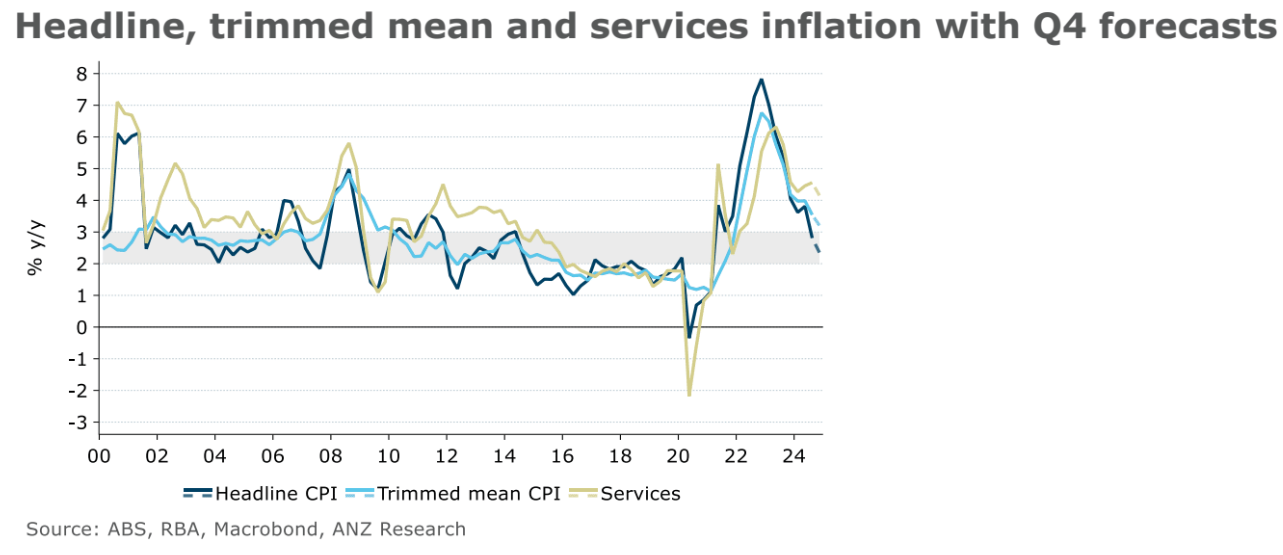

The weaker-than-expected monthly CPI indicator for November has prompted us to downgrade our Q4 trimmed mean inflation forecast by 0.2ppt to 0.5%q/q, which would be the lowest quarterly result since Q2 2021.

This would see annual trimmed mean inflation decline 0.3ppt to 3.2% y/y, below the RBA’s forecast of 3.4% y/y.

The six-month annualised rate is forecast to fall to 2.6%, around the middle of the target band.

Services inflation is estimated to drop to 4.1% y/y‒the lowest since Q3 2022.

We think this will be enough for the RBA to cut the cash rate by 25bp at its February meeting, rather than waiting until May.

The RBA Board noted in the December minutes that “if the future flow of data continued to evolve in line with, or weaker than, their expectations, it would further increase their confidence that inflation was declining sustainably towards target.”

As of Friday morning, markets had priced in a 75% chance of a February cut.

A hold in February is not off the table if the RBA puts more weight on its concerns that the persistent tightness in the labour market still poses upside risks to inflation.

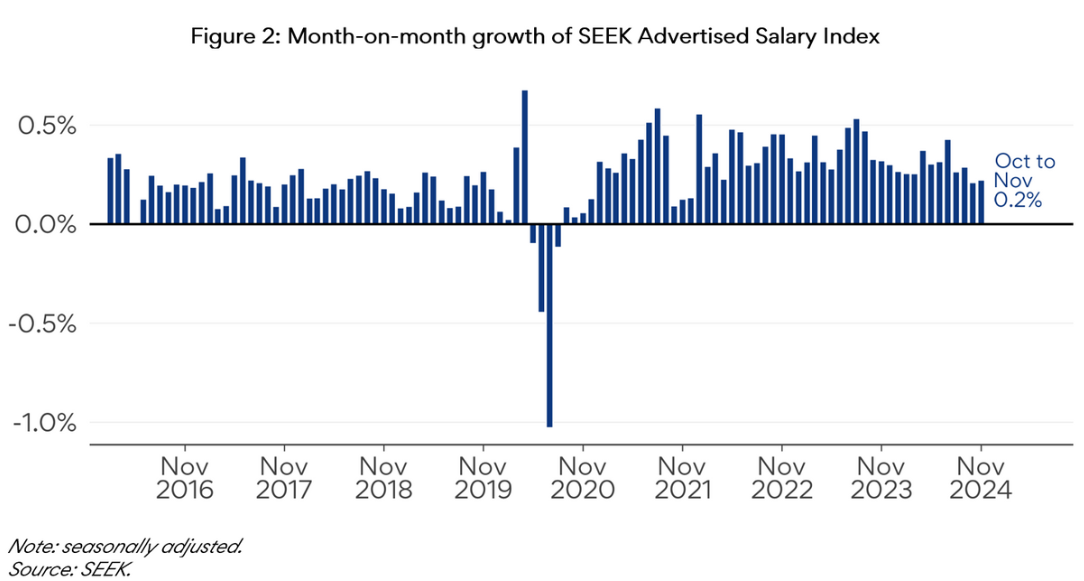

But the sharper-than-expected slowdown in wage growth in 2024 and weaker inflation forecast for Q4 suggest an unemployment rate at or just below 4% may be consistent with underlying inflation in the band.

The change to our Q4 CPI forecasts does not affect our view on the likely extent of the easing cycle.

We still expect only two 25bp rate cuts in this cycle (February and August 2025).

The resilience in the labour market reinforces the likely shallowness of this cycle.

The Australian Bureau of Statistics (ABS) job vacancies figure rose 4.2% q/q in Q4, the first rise in over two years; and we expect December’s unemployment rate to print at 4.0% on Thursday.

We think the RBA will be cautious in dialling down the restrictiveness of current policy settings, rather than February being the start of an aggressive easing cycle, especially given the uncertainty over the level of current restrictiveness.

The quarterly annualised SEEK salary index is running at 1.8% in a clear downward trend.

As wages tumble under pressure from the cheap Indian worker stampede, services inflation will keep coming down.

The neutral interest rate is much lower than anybody reckons in the immigration-led economy.

My bet is four rate cuts starting in February and continuing into 2026 as the iron ore crash joins the great Aussie disinflation.

Even more if Albo is voted out and fiscal is reined in.