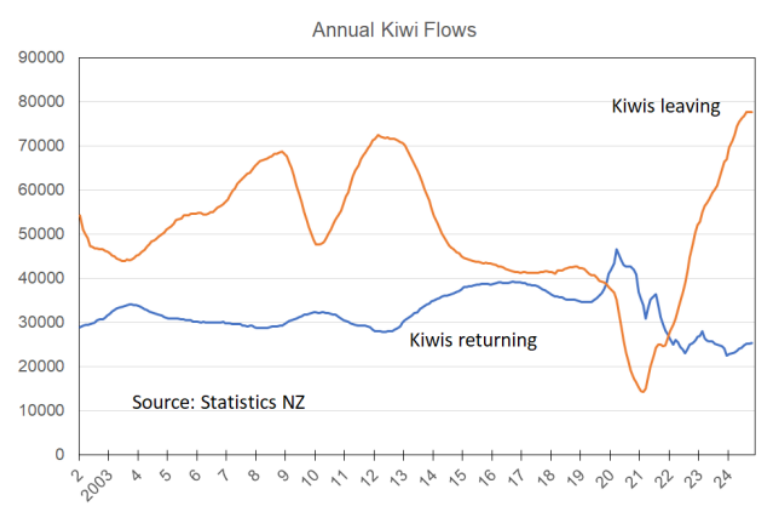

Immigration into New Zealand has fallen sharply, driven by increasing numbers of Kiwis fleeing to other countries (including Australia).

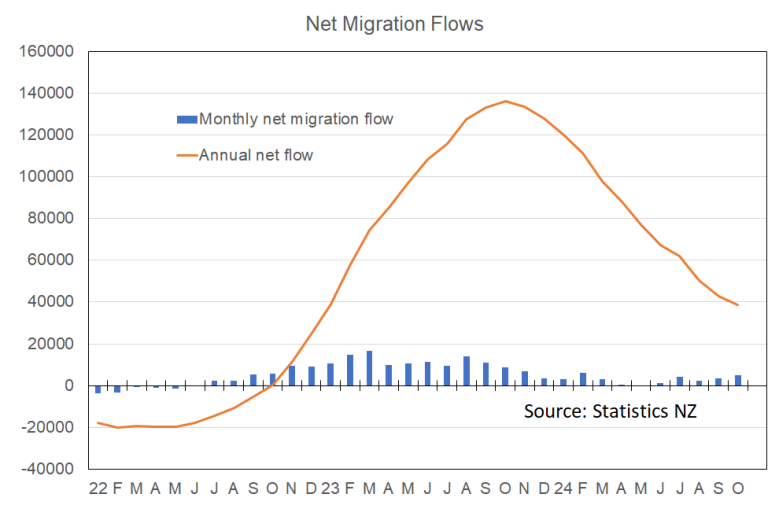

As illustrated below by independent economist Tony Alexander, annual net migration fell to 38,800 in October from 42,700 in September and a record 136,000 a year ago.

The large change in the past year reflects gross inflows falling by 65,000 while outflows have risen 32,000.

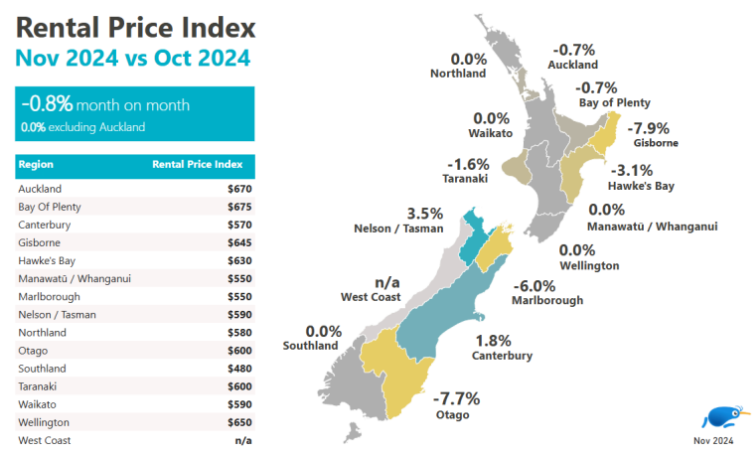

The sharp slowing in net migration has meant that New Zealand landlords are having a more difficult time letting their properties.

Trade Me Property’s latest Rental Price Index reported an excess supply of rental properties and falling asking rents.

The number of properties posted for rent online increased 36% in November 2024 compared to the same month last year, and by 4% compared to October 2024.

That brought the number of rental postings on the platform to its highest level since 2019.

The median advertised rent in November was $630 per week, down $5 from October.

Commenting on the result, Trade Me Property Customer Director Gavin Lloyd suggested that landlords should lower their asking rents.

“As a result of the oversupply, landlords may need to soften [rent] price expectations to meet the current market, which continues to favour tenants”, he said.

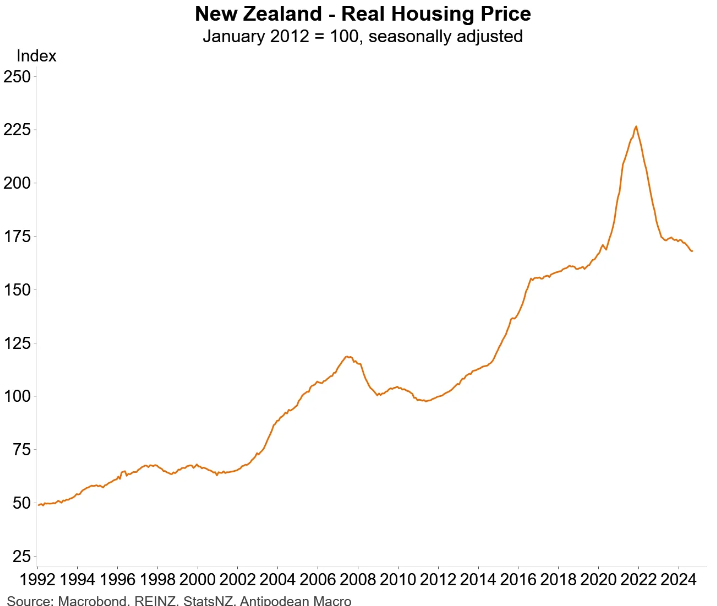

New Zealand home prices have also fallen sharply, with real values back at pre-pandemic levels.

Therefore, prospective first home buyers in New Zealand are facing vastly improving conditions:

- Rents are falling, making it easier to save a deposit.

- Mortgage rates are falling.

- House prices are falling.