Steel prices are continuing to show some life. Not so iron ore.

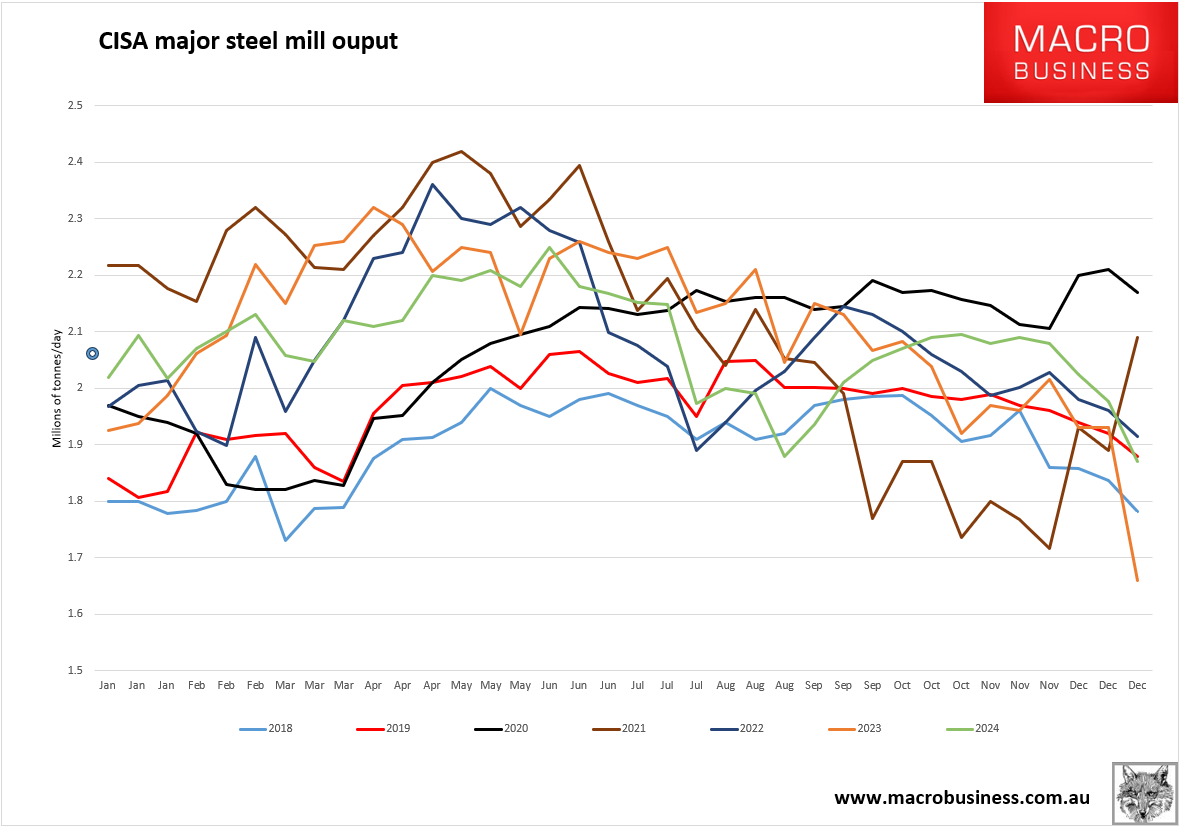

CISA steel mill output for the first 10 days of January was strong.

However, that is unlikely to last beyond the seasonal rebuild.

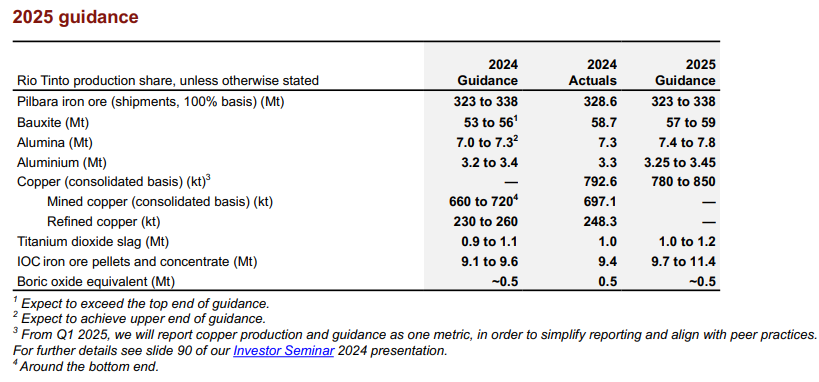

RIO confirmed strong guidance (though its recent record has been shit).

More to the point, RIO confirmed the Pilbara killer is on track.

Simandou iron ore project

• The SimFer mine is on track to deliver first production at the mine gate in 2025, ramping up over 30 months to an annualised capacity of 60 million tonnes per year 2 (27 million tonnes per year Rio Tinto share).

• For the SimFer mine, bulk earthworks are progressing to plan, despite productivity being impacted by wet weather during the quarter. All mine construction contracts are complete, and the two initial crushers are now commissioned, with first ore crushed on 1 January 2025.

• During the fourth quarter, all construction milestones for the period stipulated by the Government of Guinea were achieved for the SimFer infrastructure scope. In connection with SimFer’s scope of the 620 kilometre long multi-use TransGuinean railway line, which will connect Simandou’s mine operations to the port facilities, with the arrival of track laying locomotives, 8.5 kilometres of rail was installed and in October construction of the 275 metre Milo River bridge was completed. Tunnel excavation activity on the SimFer scope is now more than 75% complete, with construction at the port continuing to advance on the transhipment vessel (TSV) wharf and rail car dumper infrastructure. Expectations for delivery of the first trans shipping vessels remain on plan.

Macquarie is bearish.

Iron ore prices, which have been trending down, are expected to keep falling. Macquarie’s Garvey expects iron ore to fall to an average of $US80 per tonne next year, from around $US140 per tonne at the start of 2024.

It will be lower than that as Chinese demand falls 2-3% this and next as well.

This is roughly a 100mt swing in market balance to surplus every year for three years.

$50-60 is inevitable.