Wednesday’s Q4 CPI release from the Australian Bureau of Statistics (ABS) has increased pressure on the Reserve Bank of Australia (RBA) to cut the official cash rate.

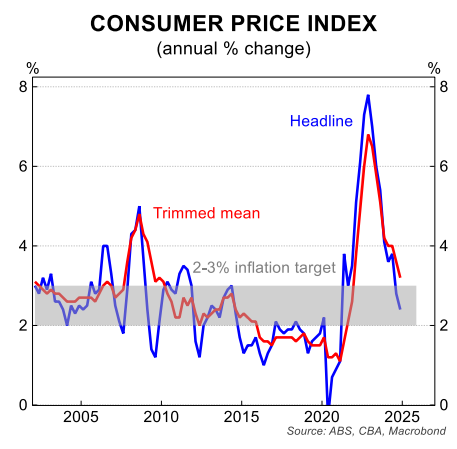

The headline CPI rose by 0.2% in Q4 2024 and the annual rate fell to 2.4% (i.e., around the middle of the RBA’s target band).

The policy-relevant trimmed mean CPI increased by 0.5% in Q4 2024, and the annual rate eased to 3.2%. However, the six-month annualised underlying inflation rate fell to 2.65%, comfortably within the RBA’s target band.

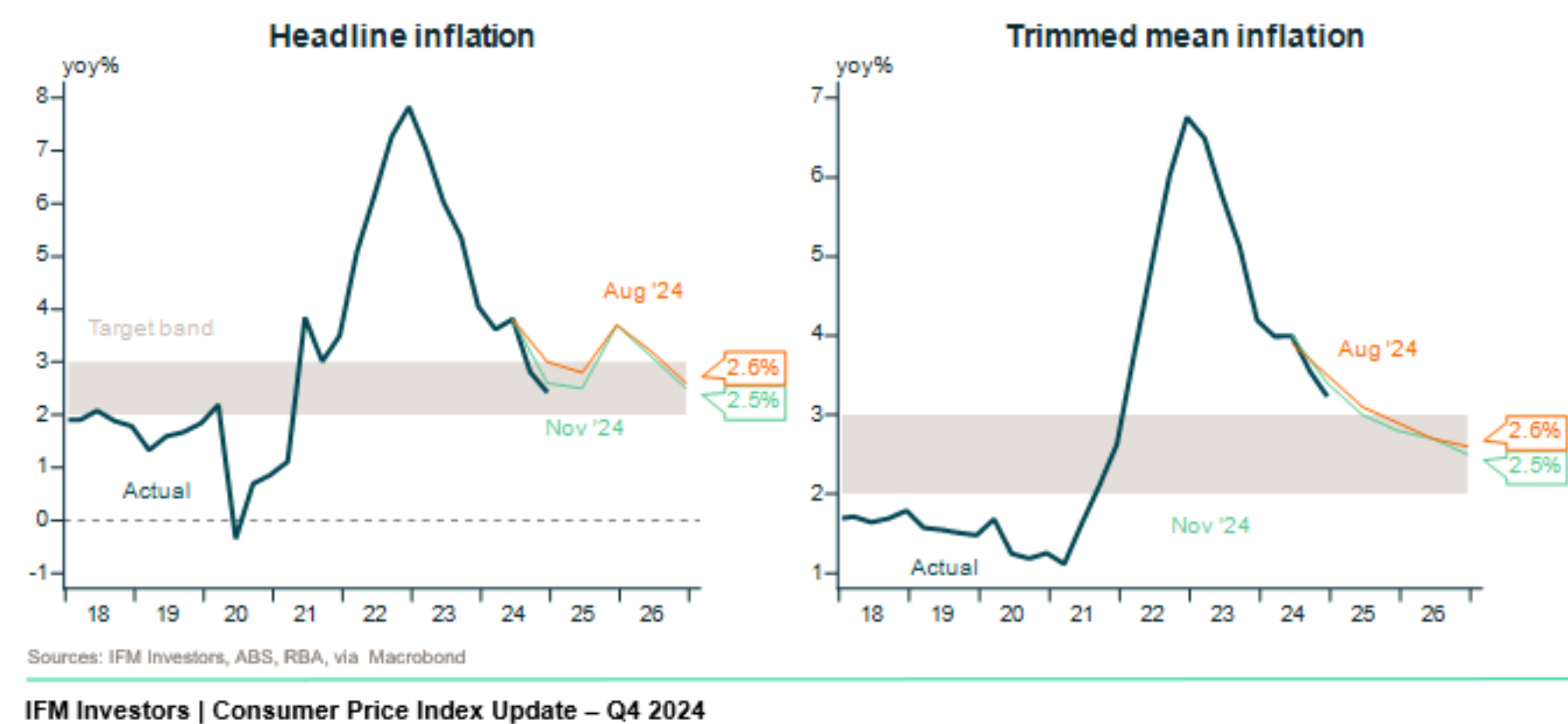

The following chart from Alex Joiner from IFM Investors shows that underlying and headline inflation are tracking well below the RBA’s projections in its November Statement of Monetary Policy.

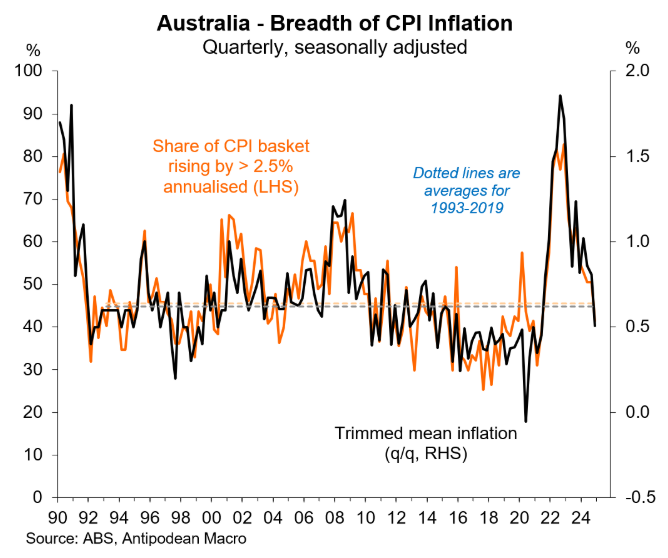

Justin Fabo from Antipodean Macro also showed that the slowing in trimmed mean inflation in Q4 occurred alongside a moderation in measures of the breadth of inflation which were below average in the quarter.

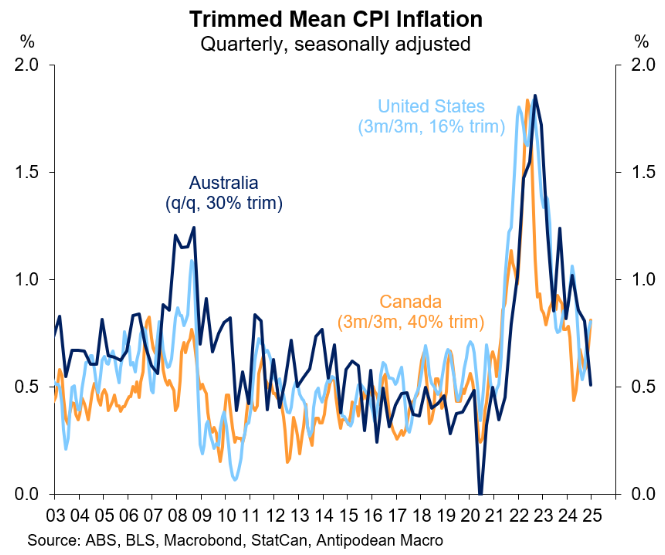

Quarterly trimmed mean inflation in Australia also dipped below that in the United States and Canada in Q4 as underlying inflation in those economies rose through the quarter.

“The December quarter 2024 CPI indicated that the disinflation process has gathered momentum, in line with our expectation”, noted CBA head of Australian economics Gareth Aird.

“The inflation report is overwhelmingly positive and will be welcomed by policymakers in both Government and at the RBA”.

“We believe today’s data has given the green light for the RBA to commence normalising the cash rate at the February Board meeting with a 25bp rate cut (in line with our base case, which we have held since late October 2024)”.

“The pace of easing is likely to be gradual and we continue to expect one 25bp rate decrease each quarter in 2025 for an end year cash rate of 3.35% (broadly in line with the RBA’s assessment of the neutral cash rate)”, Aird noted.

Westpac chief economist Luci Ellis agreed, tipping a rate cut in February.

“With trimmed mean inflation at 0.5% in the quarter (3.2%yr), we have just enough evidence to conclude that disinflation has proceeded faster than the RBA expected, so the Board will have the required confidence to start the rate-cutting phase in February”, Ellis wrote.

“In addition to the trimmed mean outcome, we see encouraging signs in housing-related inflation suggesting that the momentum in domestic price pressures is fading a bit faster than the RBA feared”.

“Both rents and home-building costs have decelerated noticeably in recent months, and not just because of government cost-of-living support”.

Treasurer Jim Chalmers hailed the inflation result, noting that underlying inflation “is now at a three-year low” and “headline inflation is around the middle of the RBA’s target band”.

It will be hard for the RBA to resist cutting rates at its next monetary policy meeting on 18 February.

Expect Treasurer Jim Chalmers and Prime Minister Anthony Albanese to dial up the pressure on the RBA, knowing full well that a pre-election rate cut is vital to Labor holding office.