Recent research from the Property Investment Professionals of Australia (PIPA) and the Property Investors Council of Australia (PICA) claimed that deleterious government policies have driven investors out of the property market, fuelling the rental crisis.

The research claimed that Australia has fallen short by 35,000 investors required to meet tenant demand, “leaving renters grappling with limited options in an already stretched market”.

PIPA Chair Nicola McDougall said that “from 2003 to 2017, the number of individual property investors grew steadily, with annual increases ranging from 56,000 to 60,000”.

“However, this upward trend disappeared in recent years due to factors such as increased market interference, restrictive lending policies, and tax hikes, all of which have deterred investors”.

She argued that “instead of penalising investors with increased regulations and taxes, governments should focus on policies that encourage investment in the private rental market”.

Separately, ABC claimed that investors sold out heavily in Victoria, with rental bond statistics indicating that the state lost 24,726 rentals (3.6% of its stock) in the year ending 30 September 2024.

This was the sharpest decrease in rental bonds on record.

The investor sell-off was more severe in Melbourne, which lost 23,108 rentals (4.2% of its stock) in the year ended 30 September 2024.

PIPA chair Ben Kingsley claimed that the sell-off in Victoria was driven by four main factors: investors selling due to high interest rates, increased land taxes imposed by the state government to help fund the COVID recovery, tenancy reforms that ended no-fault evictions, and investors who had been in the market for a long time but were now cashing out.

Kingsley claimed the decline in rental bonds was “further evidence that the Labor government has made the lives of tenants in Victoria a lot harder” by driving an “exodus of investors providing private rental accommodation in Victoria”.

“I would be very, very worried as a tenant that I’m going to be paying higher rent in Victoria over the near term,” he said.

New data from PropTrack, reported in The Australian, suggests a ‘statistically significant’ escalation of investors quitting Melbourne amid new property taxes imposed by the state government.

Following the Victorian government’s transition to a higher tax structure, investment property sales in the state have increased by almost one-third compared to other states.

PropTrack’s research, conducted before the state imposed two more new property taxes on January 1, discovered that property investors in Victoria were pulling money out of the market as new levies altered the returns for property investment.

On average, roughly 6% of property investors in Australia will sell in any given year, but PropTrack found that the proportion of investors selling in Victoria is now 9%.

“We see that pattern extending into 2025“, said Paul Ryan, senior economist at REA’s PropTrack.

Ryan estimates that approximately 5000 extra investors have sold out of Victoria since the state imposed the first of a series of new taxes 18 months ago.

“There is clearly a set of investors who are doing their numbers across Victoria and making the assumption that there is very little more upside to be gained from their property holdings”, Ryan said.

Rental and price data demonstrate that the investor exodus has been favourable for Victorian tenants and first-home buyers.

“Melbourne rents were down 0.4% through the second half of 2024, mostly due to a 1.1% fall in unit rents, while house rents are unchanged over the past six months”, noted CoreLogic Research Director Tim Lawless earlier this month.

“At the same time, we are seeing a rise in rental vacancy rates and an easing in rental growth, suggesting less rental supply is being accompanied by less rental demand”.

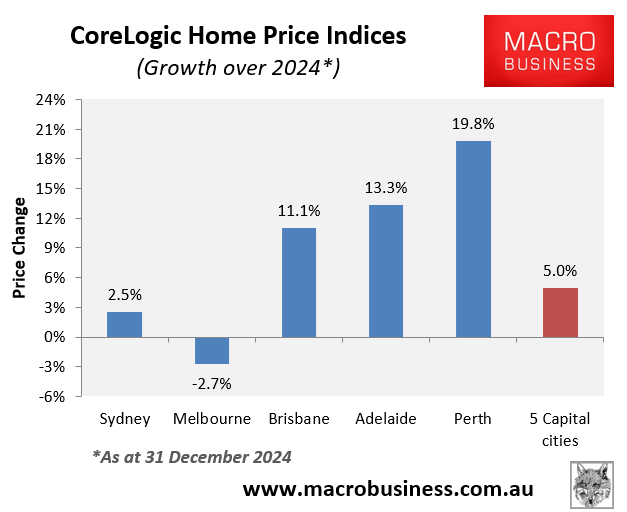

Meanwhile, CoreLogic reported that Melbourne property values fell by 2.7% in 2024, making homes more affordable for first-time purchasers.

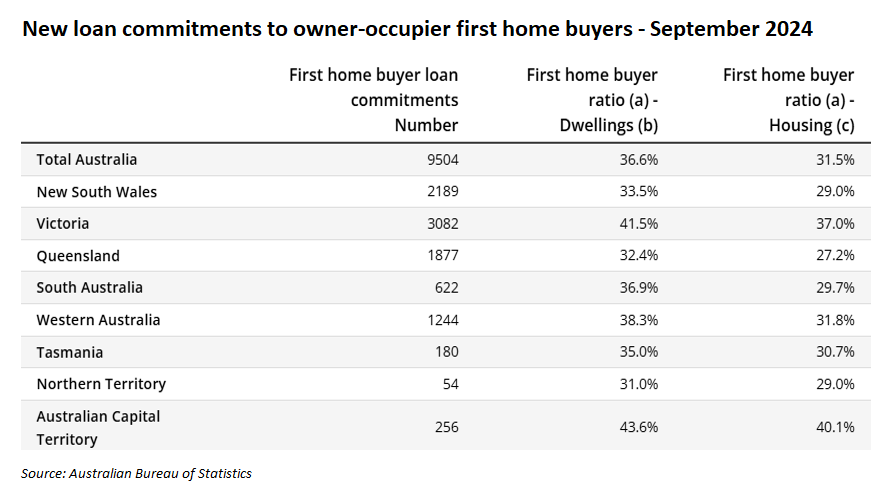

Accordingly, Victoria has by far the greatest proportion of first-time home buyers of any state in Australia.

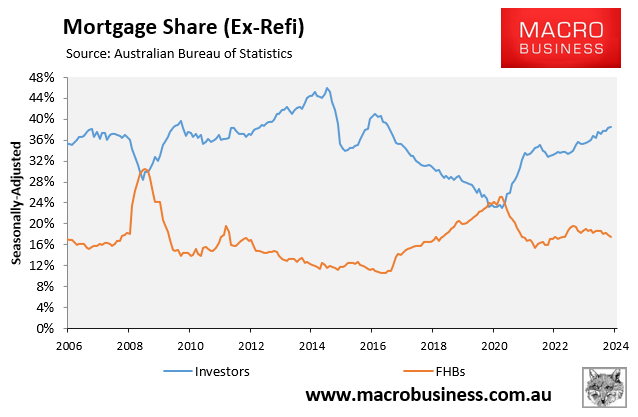

This should come as no surprise, given that there has historically been an inverse relationship between investor mortgage demand and first-home buyer mortgage demand.

As a result, when investors sell their properties, they invariably end up in the hands of first-time purchasers.

Furthermore, while a rental property is removed from the market when an investor sells to a first-time homebuyer, it also takes a rental household off the market.

Therefore, rental supply and demand are lowered in unison, leaving the rental market in equilibrium.

If we want to increase home ownership, we should limit the number of investors in the market. We should also encourage investors to sell to first-time homebuyers, as is happening in Victoria.