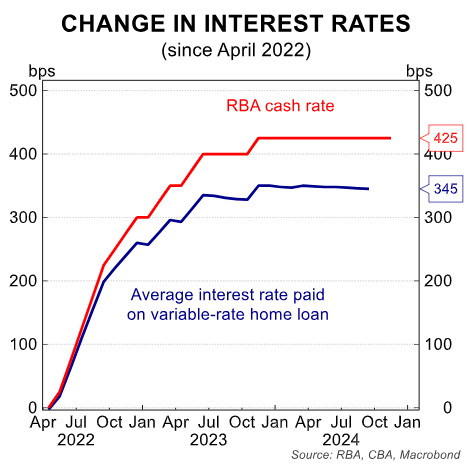

The Reserve Bank of Australia’s (RBA) aggressive interest rate hikes have done precisely what they were designed to: smash demand.

The impact has been keenly felt across Australia’s private (market) sector, where activity has stalled.

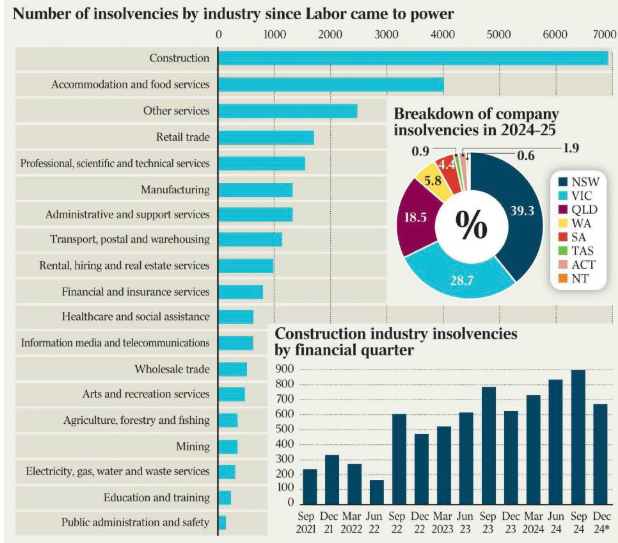

Vast numbers of firms have gone into insolvency over the past two years, with the construction and hospitality industries most badly impacted.

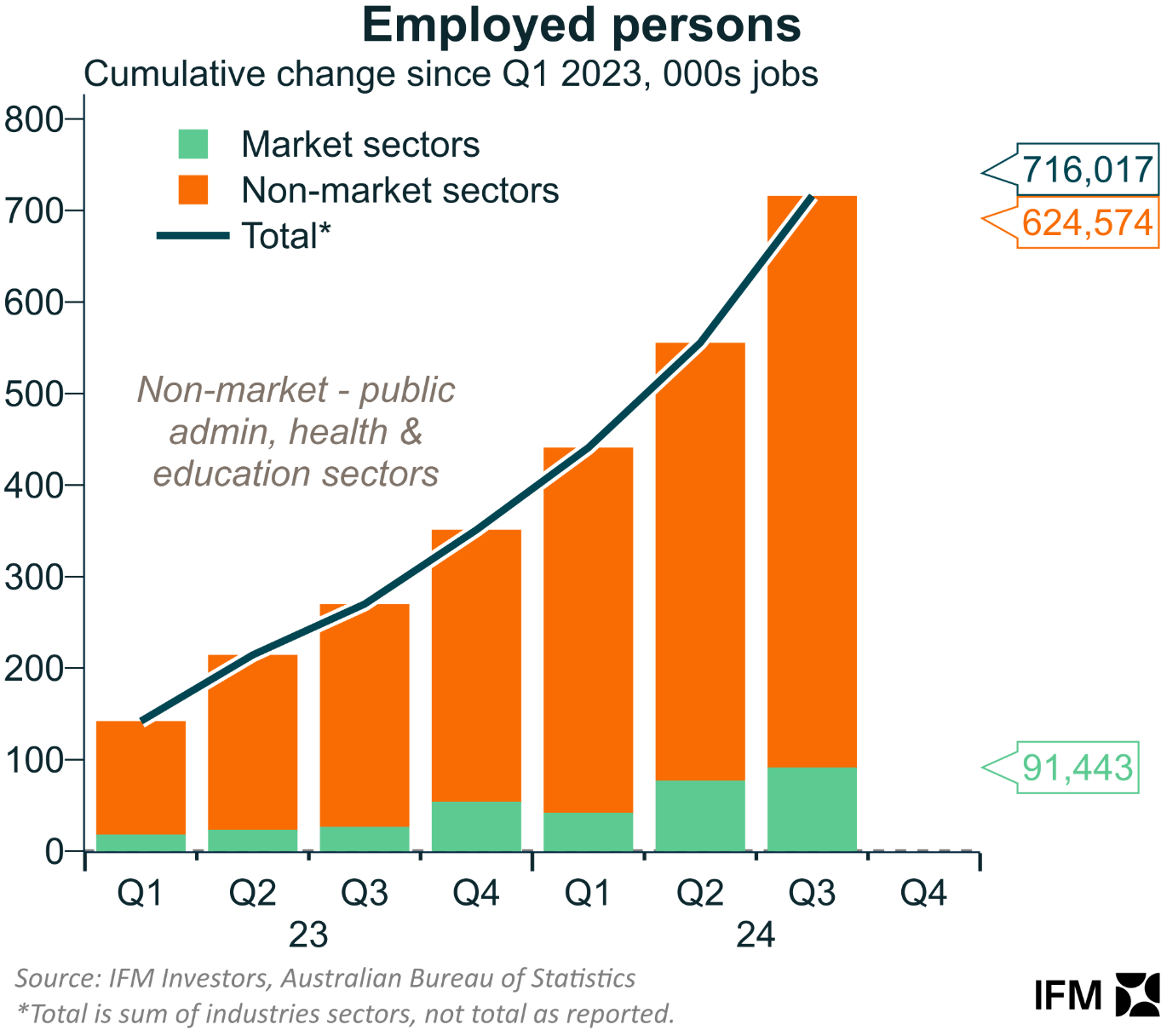

Employment across the market sector has also stalled, with only 91,433 jobs created since Q1 2023, against a civilian population increase of 956,000 over the same period.

The problem for the RBA is that while the private sector is in recession, overall demand across the economy remains solid thanks to the boom in the non-market (government-aligned) sector, alongside historically high net overseas migration.

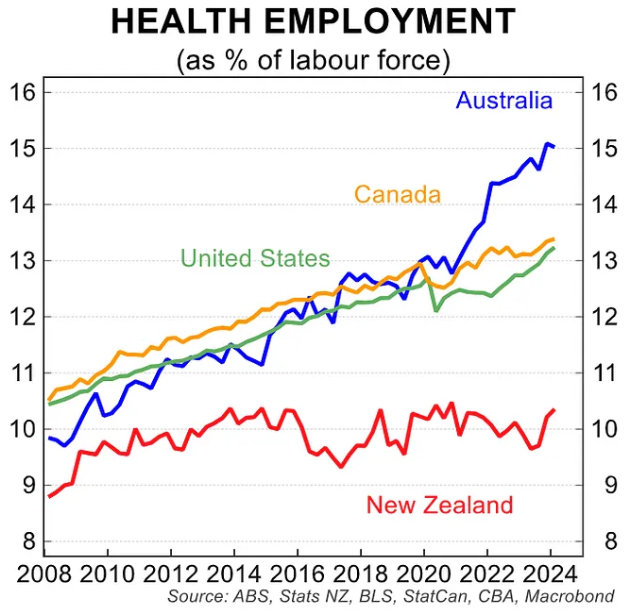

The above chart from Alex Joiner from IFM Investors shows that the non-market sector has created 624,574 jobs since Q1 2023, accounting for 87% of Australia’s total job growth.

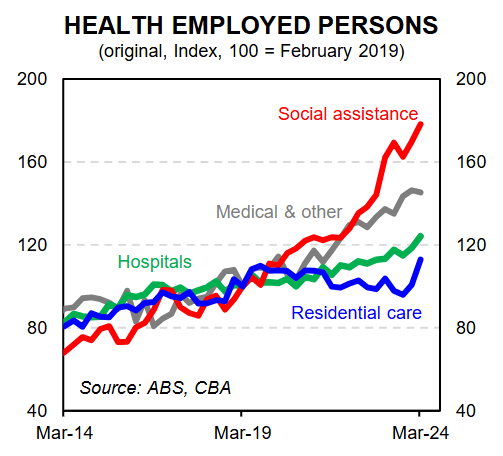

Much of this non-market job growth has been generated by the ever-expanding National Disability Insurance Scheme (NDIS).

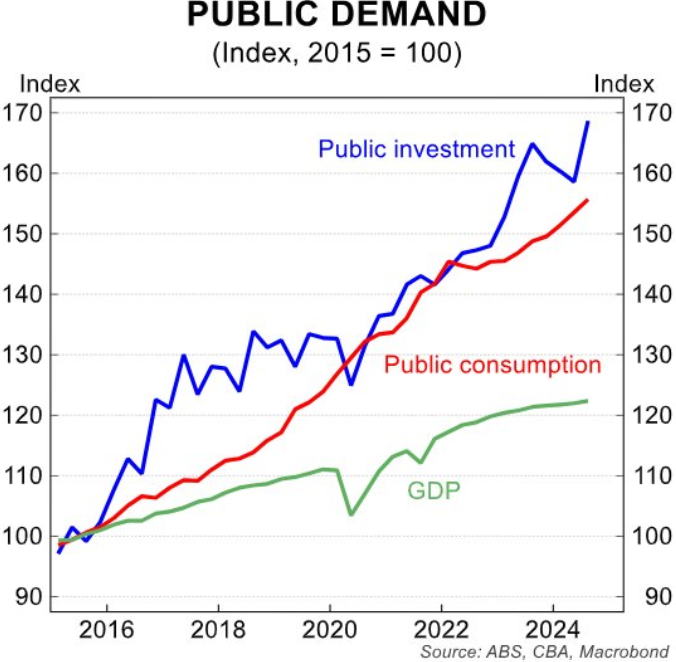

The same can be said for Australia’s GDP growth, which has been overwhelmingly driven by public spending while the private sector has languished.

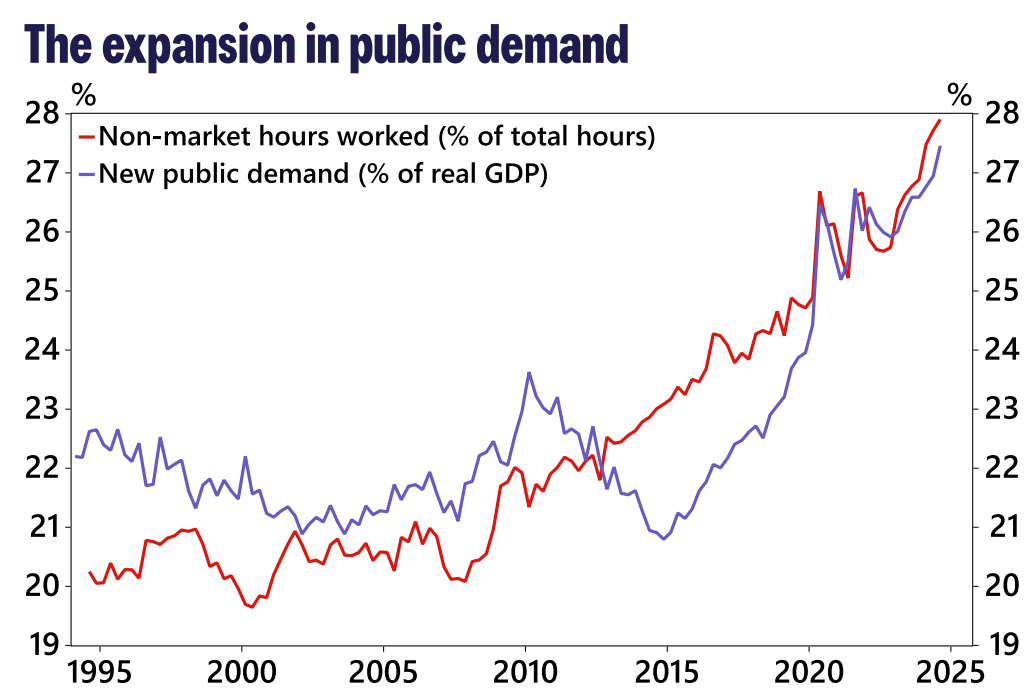

Australia is experiencing what independent economist Tarric Brooker coined “burnout economics”.

The RBA is actively attempting to slow down the economy by imposing high interest rates. Meanwhile, Australia’s governments are actively driving economic growth and creating many non-market jobs through unprecedented public spending.

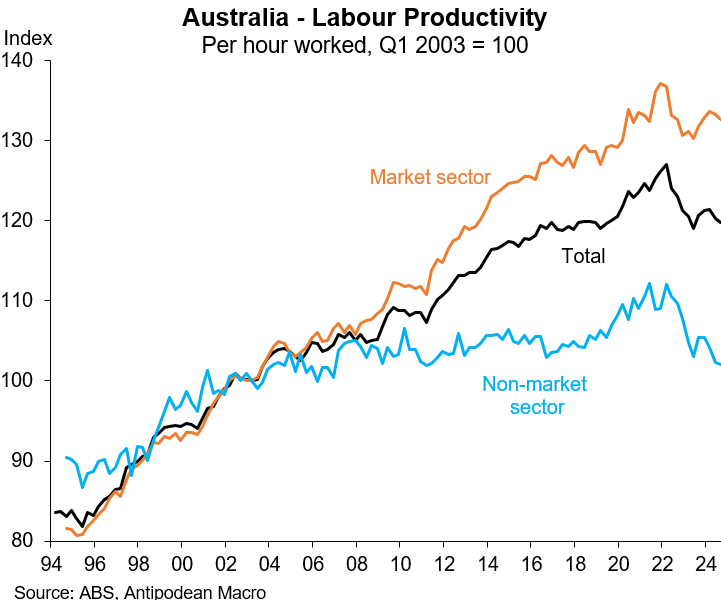

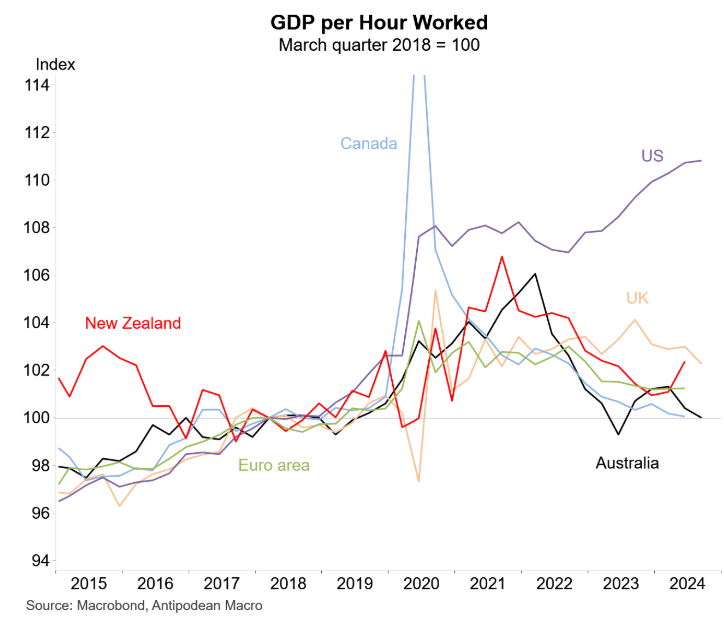

This record expansion in the non-market economy is contributing to Australia’s productivity decline.

Indeed, Australia’s recent labour productivity growth ranks among the bottom of advanced nations.

If the RBA was looking at the private (market) sector in isolation, it would have cut interest rates long ago.

However, the RBA must look at the aggregate economy, which is being artificially stimulated by the record expansion of the non-market sector via public spending.

In other words, Australia’s governments have frustrated the RBA’s efforts to slow demand and lower inflation, which has kept the private sector in recession.