The migrants are still pouring in, and the housing shortage is getting worse, but, as they say, “you can’t leverage rents” so affordability is a real constraint.

Thus the rent shock has run into a brick wall. Goldman has more.

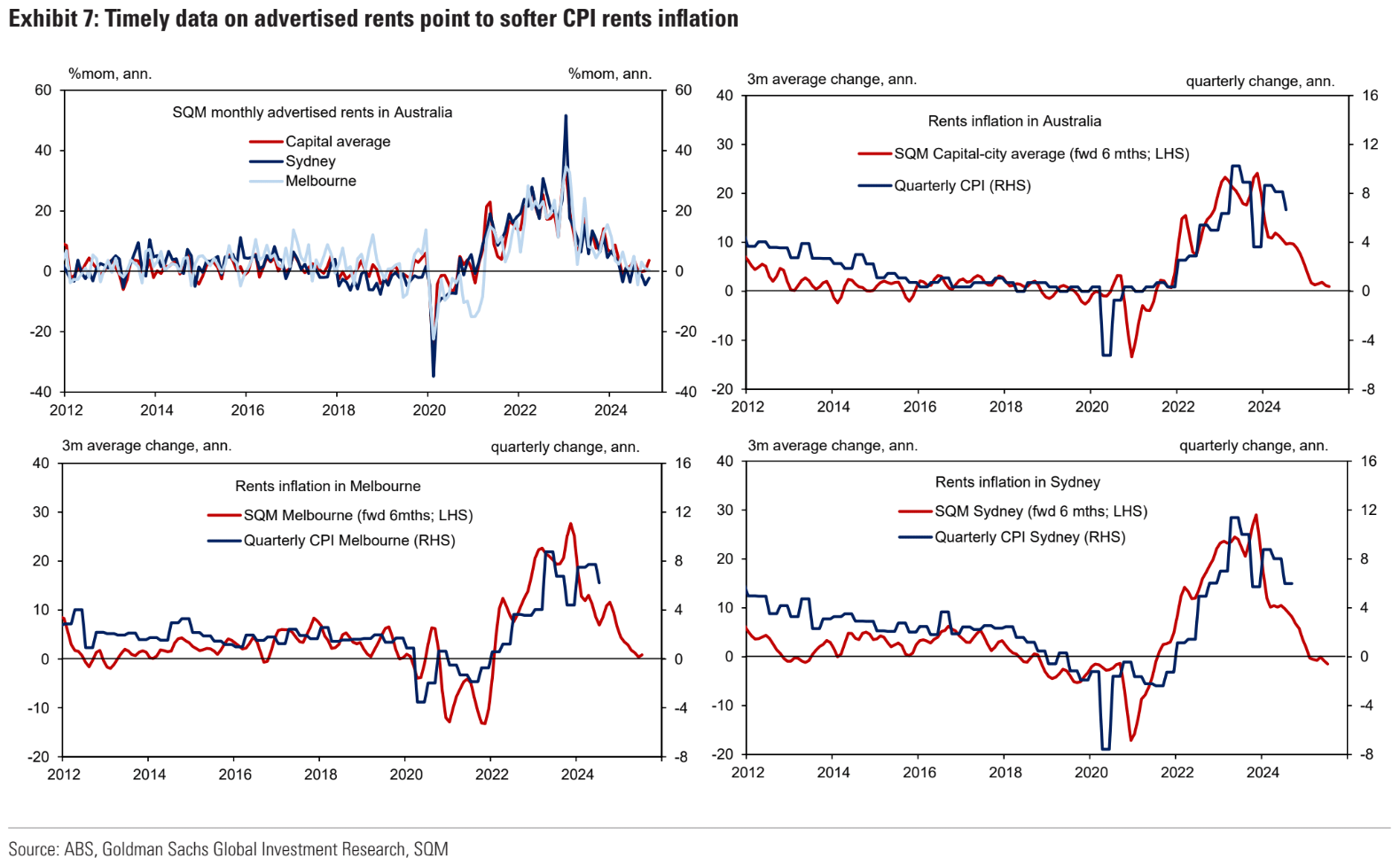

Weekly data from SQM suggest sequential growth in advertised rents continues toslow, with advertised rents in Sydney falling again in January (Exhibit 7).

The SQM data tends to lead CPI rents inflation, given SQM measures average rents across the flow of newly advertised properties, whereas the ABS measures rents across the entire stock of rental properties.

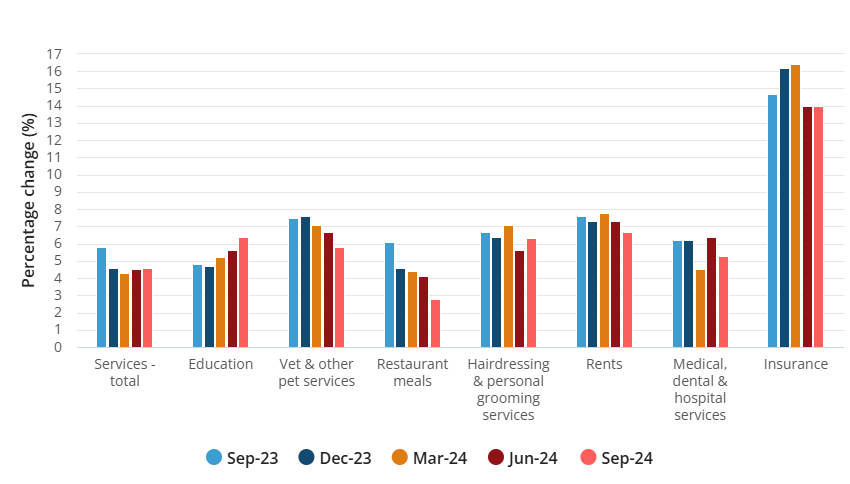

Rents make up 6% of the CPI, the largest single item, and there is lots of room for them to fall ahead.

With wage growth crashing into Also’s Indian inundation, rents are suddenly going nowhere fast.