Via Goldman’s useful Scott Rubner who sees risk on.

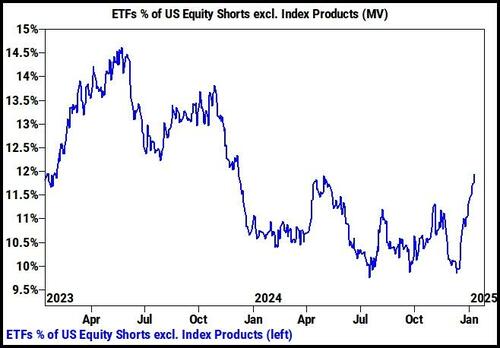

1. Largest macro ETF shorting since 2021 at GS PB

Current macro discretionary equity short position is elevated at GS PB. ETF shorts are up +24% in the past month (the fastest pace since February 2021, i.e. the meme stock). ETFs as a percentage of GS Prime US short book is the highest level since December 2023.

Source: Goldman Sachs

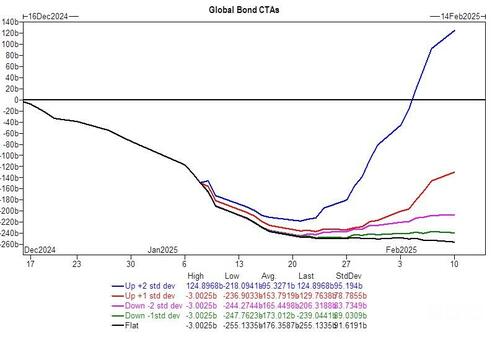

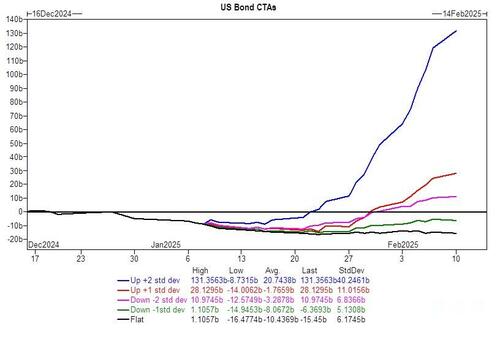

2. Systematic short in Global Fixed Income

Systematic short positioning in global fixed income is elevated and equity investors have been glued to the bond market.

Over the next 1 week…DV01

a. Flat tape: Sellers $20.16mm ($0.90mm out the US)b. Up tape: Sellers $15.67mm ($1.53mm into the US)c. Down tape: Sellers $23.65mm ($2.24mm out the US)

Over the next 1 month…DV01

d. Flat tape: Sellers $25.40mm ($0.74mm out the US)e. Up tape: Buyers $93.56mm ($34.05mm into the US)f. Down tape: Sellers $7.91mm ($5.52mm into the US)

Source: Goldman Sachs

Source: Goldman Sachs

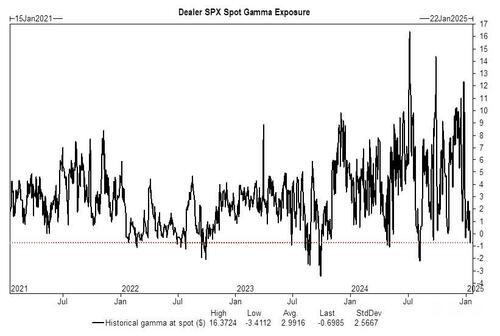

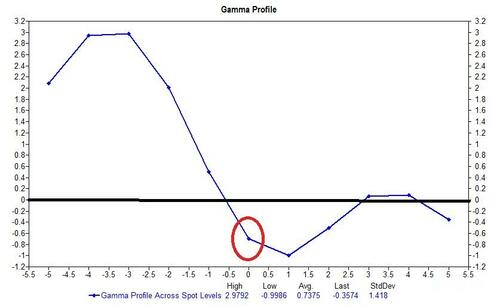

3. Short index gamma today and will unclench gamma heading into OpEx on Friday.

Index gamma is now short (-$700m) for the first time in 2025, is and highest short since 30Dec24 and 18Sep24. Our model has gamma positioning increasing on moves lower and getting shorter on rallies.

Source: Goldman Sachs

Source: Goldman Sachs

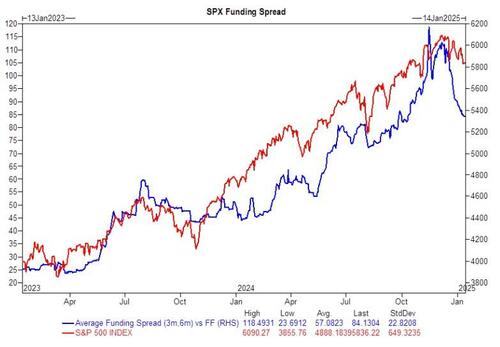

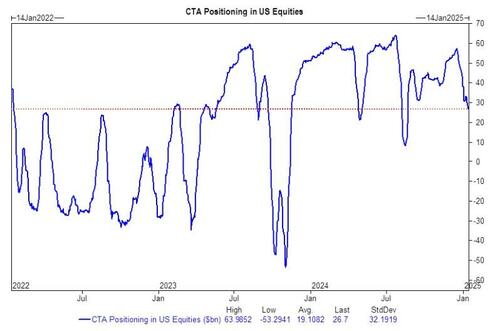

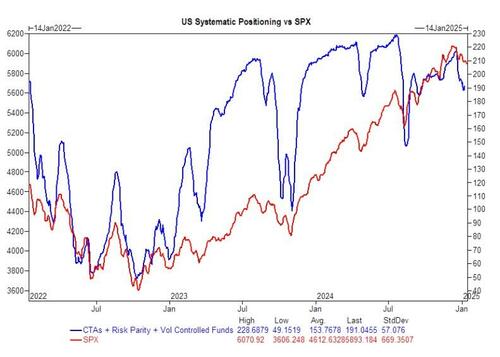

4. De-gross in marketwide leverage

Decline in leverage across professional and systematic investors.

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

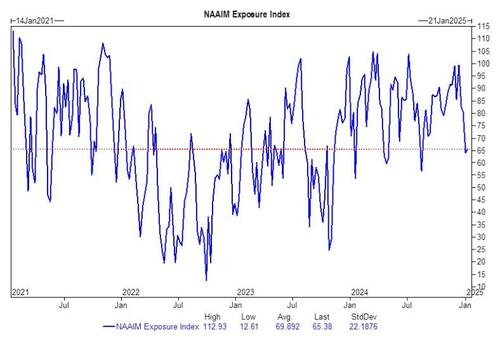

5. Sentiment Un-Streched and pretty normal during Trump 1.0.

Sentiment is no longer elevated and resembles post-election sentiment during Trump 1.0.

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

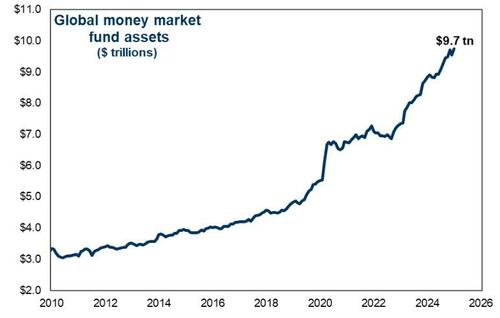

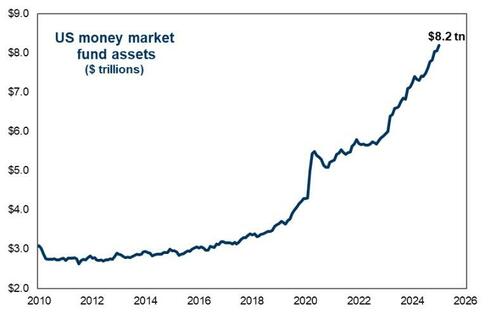

6. Money Markets

Global money market funds saw +$143.3 Billion worth of inflows last week. This was the largest weekly inflow since March 25, 2020 (i.e. covid).

That is straight cash homie.

The point here is that the money is moving and ready to buy equities once the headlines (and prices) start to settle down.

Source: Goldman Sachs

Source: Goldman Sachs

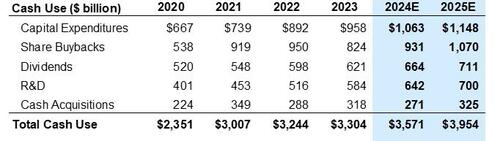

7. Peak Corporate Blackout right now

As a reminder, GS US portfolio strategy has $1 Trillion worth of demand in 2025. This starts next week.

Corporate repurchase window opens on January 24th with 45% of the S&P marketcap to return to the market. We are in the middle of the peak blackout window right now.

Source: Goldman Sachs

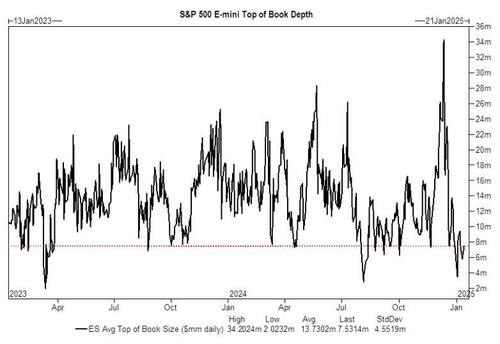

8. Liquidity remains low…

…and challenged (and works in both directions).

Source: Goldman Sachs

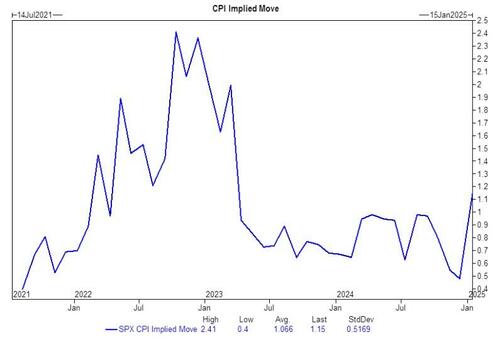

9. The options market – CPI straddle was elevated.

The straddle on S&P that catches today’s CPI report implies a market move of 1.15%.

This is the highest CPI straddle that we’ve seen since March of 2023. We think there is more upside than downside for stocks.

Source: Goldman Sachs

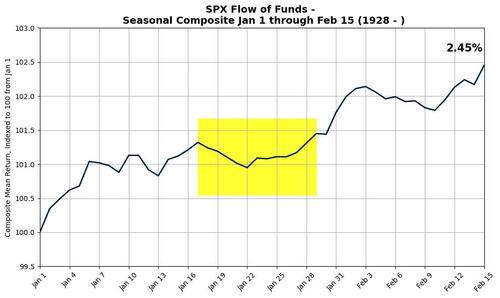

10. Seasonals

S&P 500 is entering a period of seasonal consolidation, hitting a low locally around January 22nd, before moving higher into mid – February.

0

0Source: Goldman Sachs