The Market Ear with more on the equity selloff.

Breaking bad

SPX broke below the first trend line on Friday, and closed below the 100 day. The move lower is extending, and the index is approaching the big trend line (although this one only has 2 bottoms so far). 200 day comes in just above the big support around the 5700 area. Note we are much closer to the 200 day than to the 50 day.

Refinitiv

NASDAQ blues

NASDAQ broke below the short term trend on Friday. Note NASDAQ futures are trading below the 100 day as of writing, something not seen since the September rout. First bigger supports around the 20400 level, where the big trend and the 200 day come in.

Refinitiv

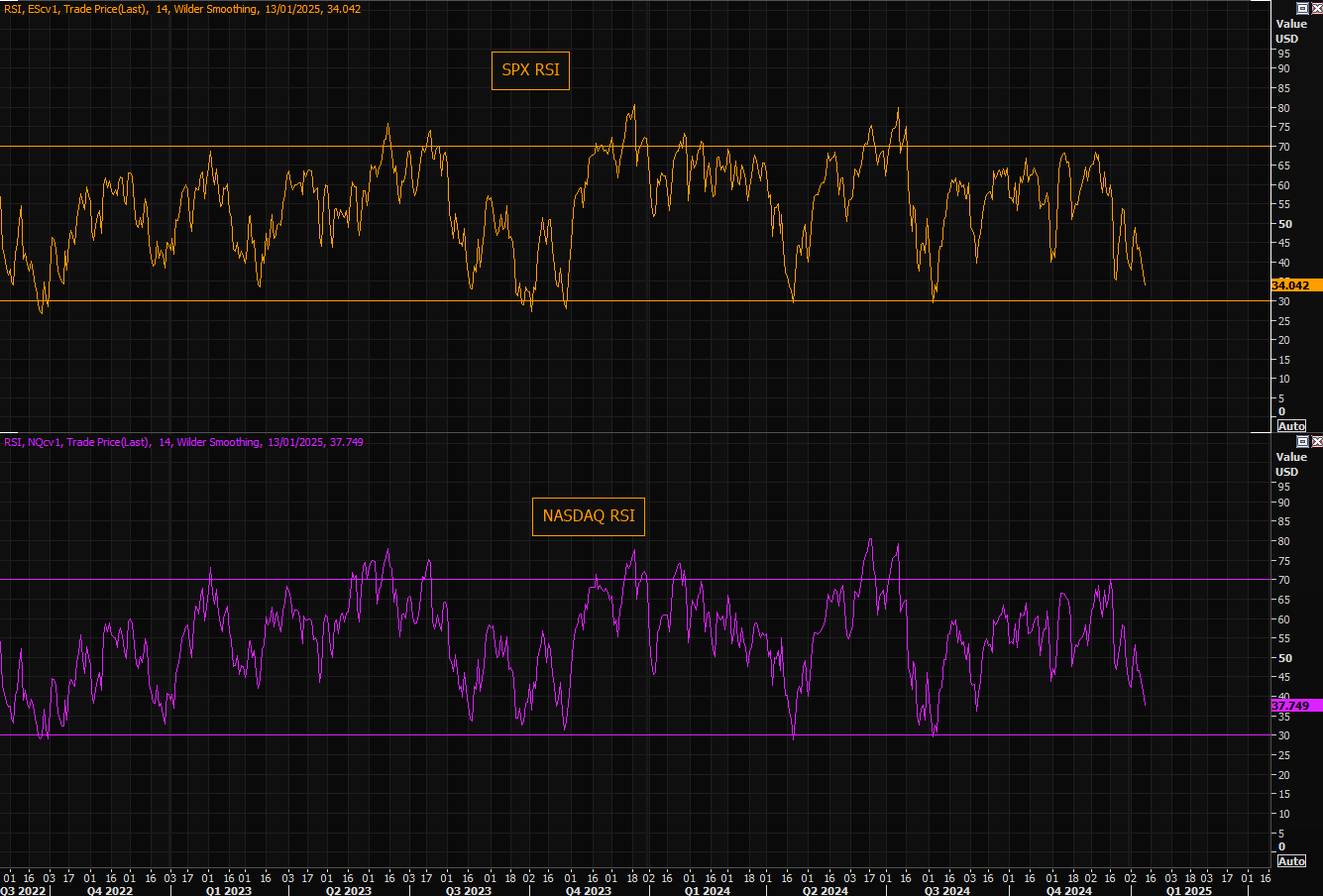

Oversold

SPX and NASDAQ futures RSI at the most oversold levels in several months.

Refinitiv

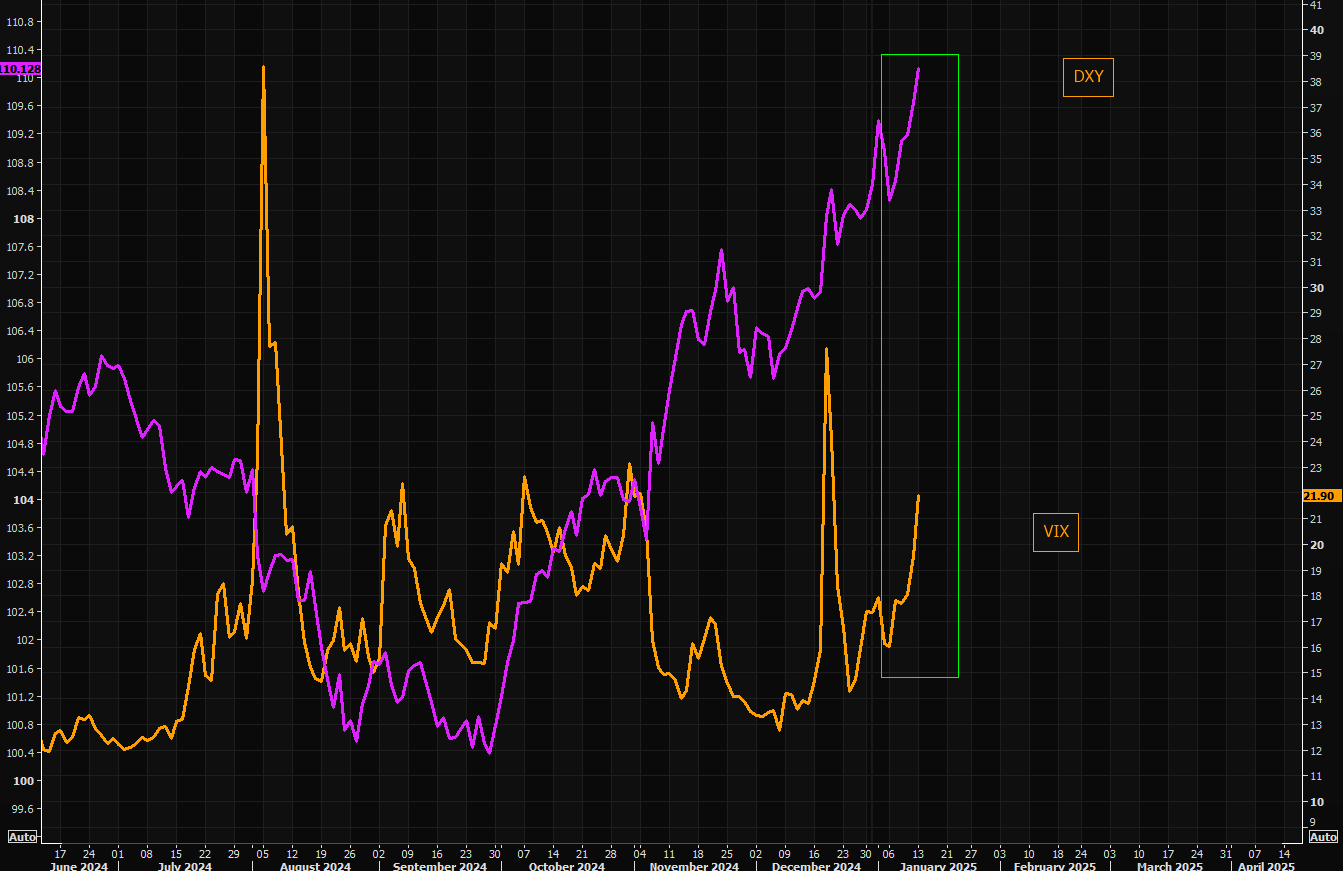

Watch closely…

…when VIX and the dollar move sharply higher.

Refinitiv

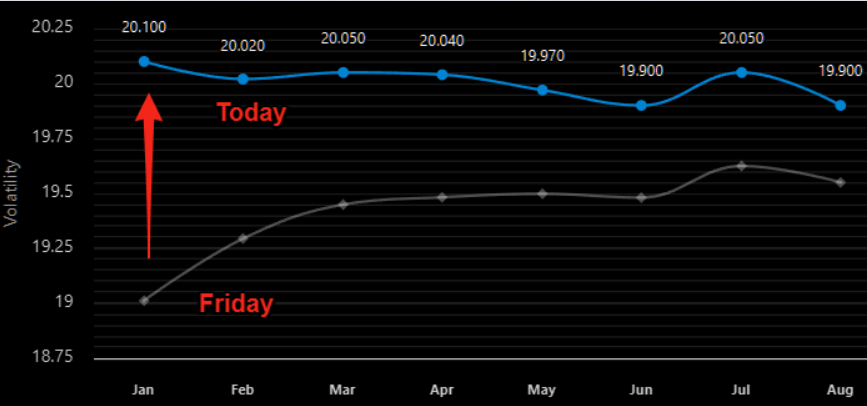

Green shoots of “panic”

VIX term structure shifting big time. Yes we have the weekend effect kicking in, but note how the short end of the curve has shifted dramatically higher. The crowd always chases protection in the shorter term maturities first.

Vixcentral

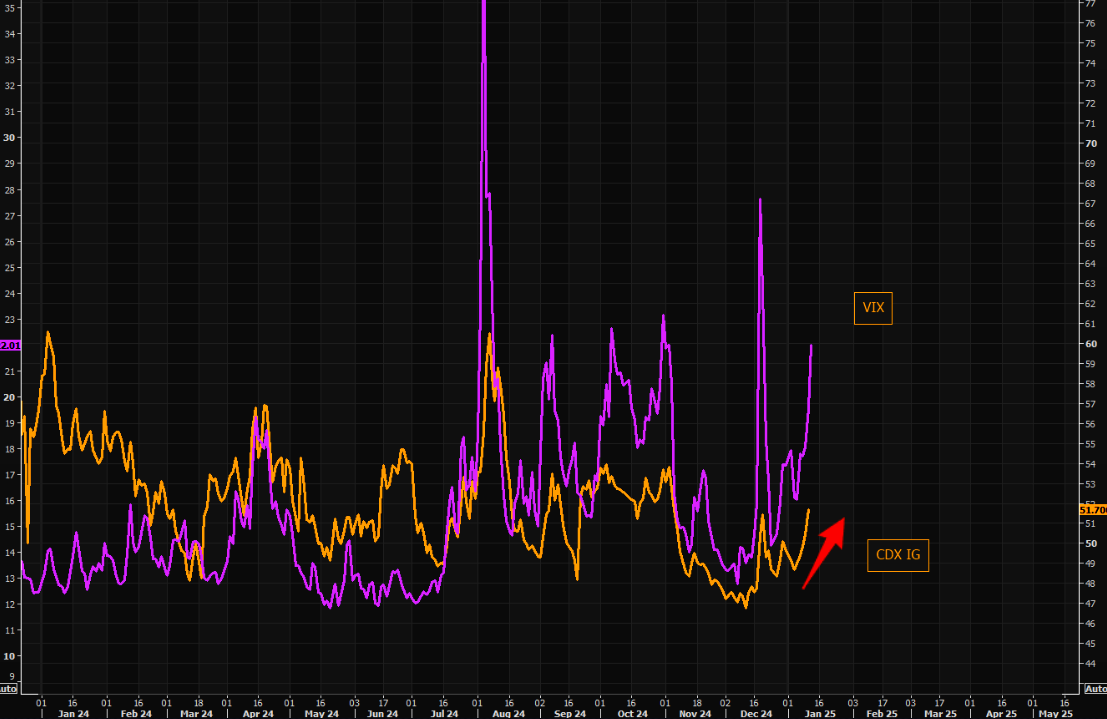

Credit protection

Noteworthy is that credit protection, CDX IG, has woken up as well during the latest pick up in VIX.

Refinitiv

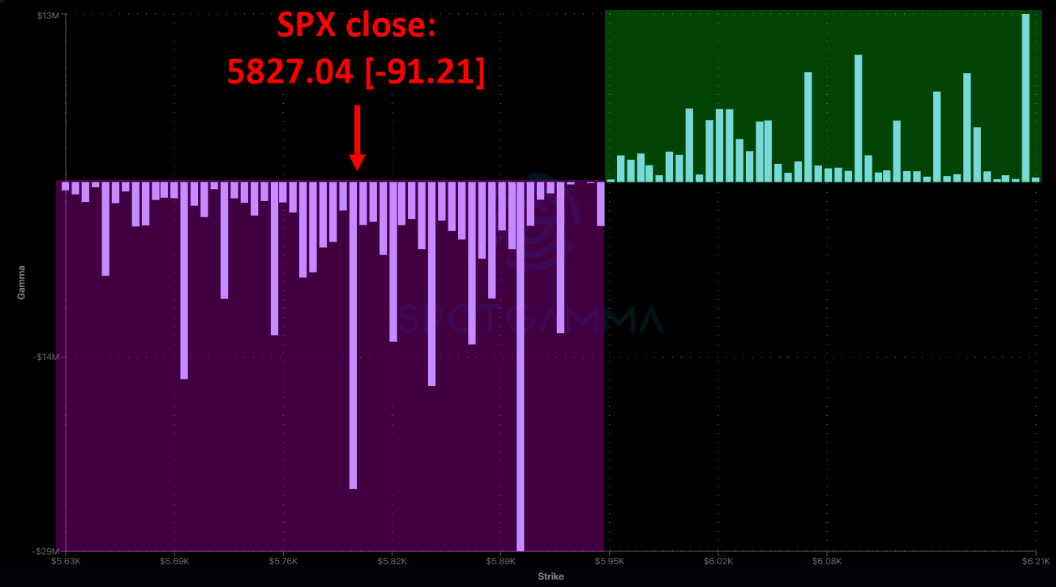

Destabilizer in full force

Dealers are in short gamma land. The entire move lower has forced them to sell deltas, with new selling as futures have moved sharply lower again. Do not forget that negative gamma works both ways, so any bounce risks becoming violent as well. Chart per Friday close.

Spotgamma

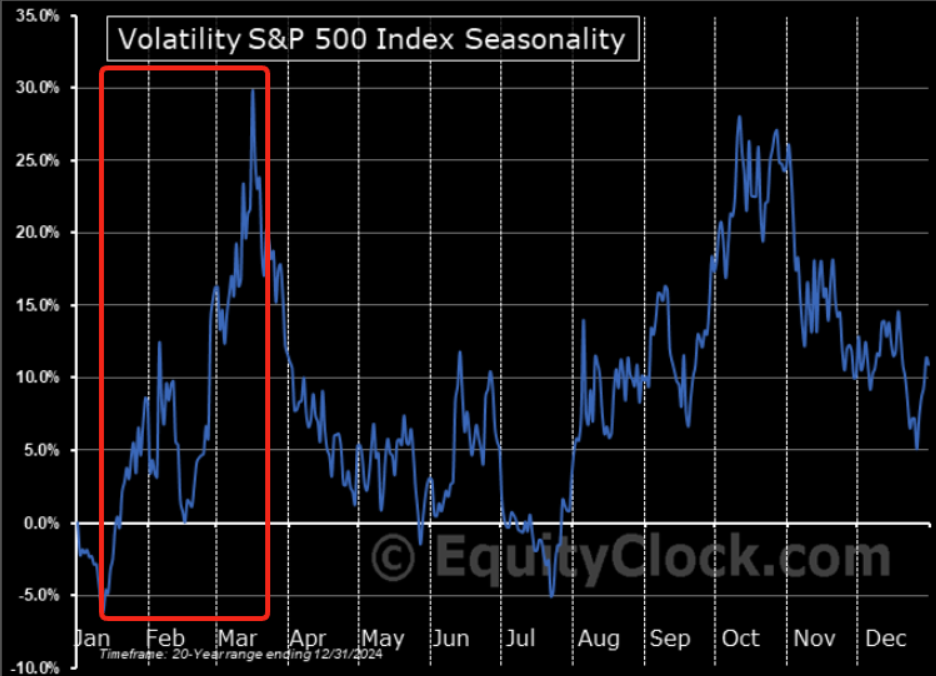

Don’t be surprised

Less than a week ago, in our post “VIX: The Calm Before The Seasonal Surge”, we outlined our long VIX logic. VIX has gone from 16 to 22 in 5 sessions. Chasing protection here is not cheap, but markets surely feel “fluid”. The question is whether we have already front-run VIX seasonality, or if things are about to get really nasty?

Equity Clock

Inflated markets and Trumpian policies cannot coexist.