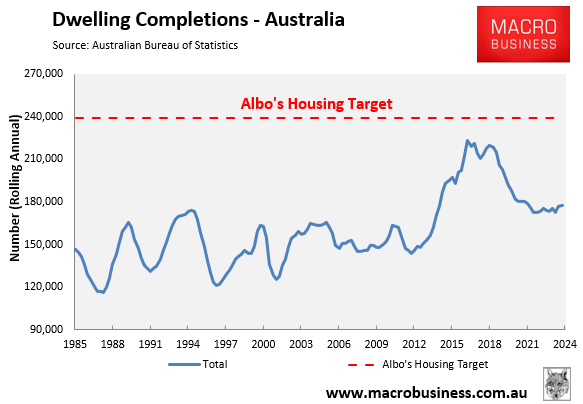

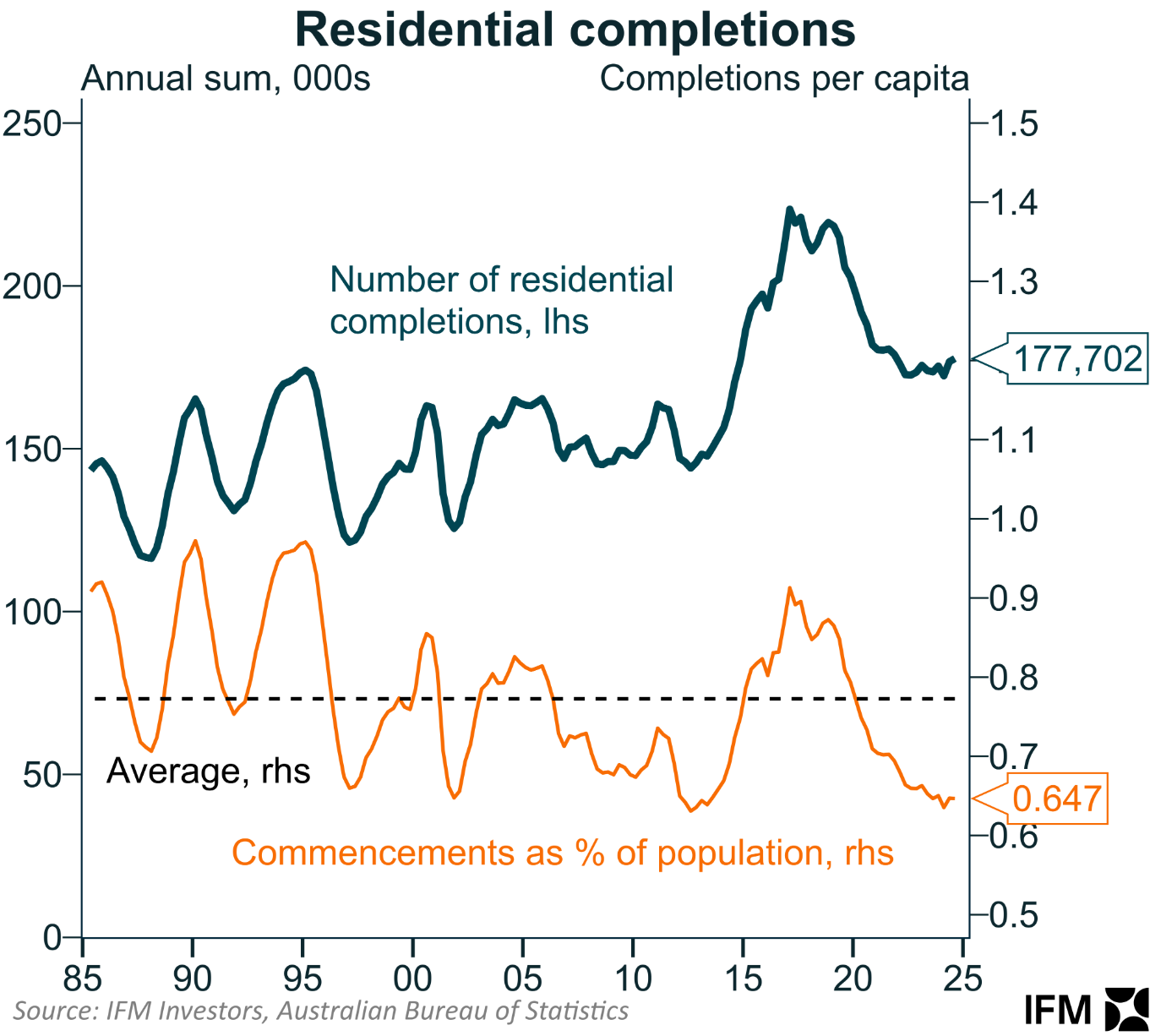

I noted on Thursday how Australia’s rate of dwelling construction has fallen way behind the Albanese government’s target of building 1.2 million homes over five years.

Only 177,700 homes completed construction in the year ended Q3 2024, 62,300 below the required annual run rate of 240,000 homes.

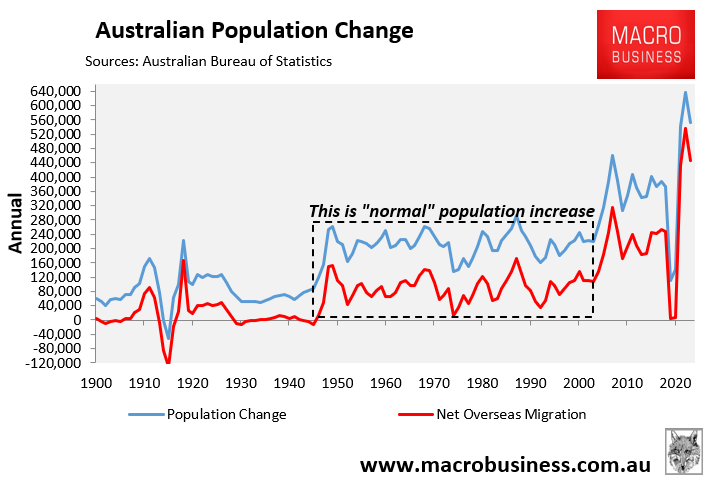

The slump in construction comes at the same time as Australia’s population expanded by 552,000 in the year ended Q2 2024, driven by net overseas migration of 445,700.

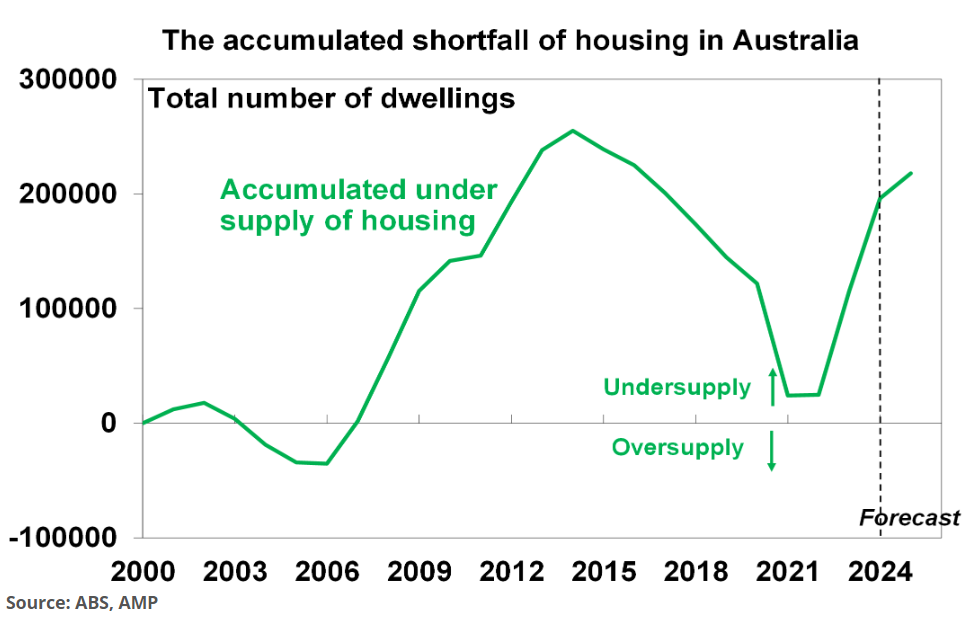

Despite the worsening housing shortage, which AMP chief economist Shane Oliver estimates at more than 200,000 dwellings nationally, Prime Minister Anthony Albanese took to Twitter to boast that Labor is expanding housing supply in NSW.

Albanese claimed that Labor is “building more homes in every part of the country… Because whether you live in the cities or the regions, everyone deserves the security of a roof over their head”.

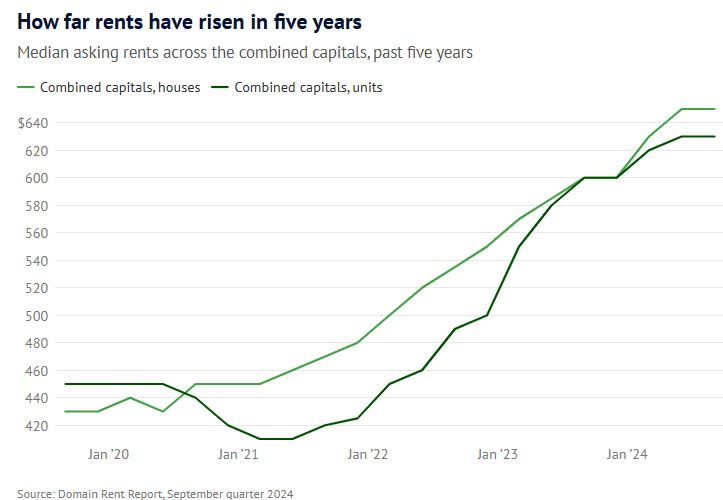

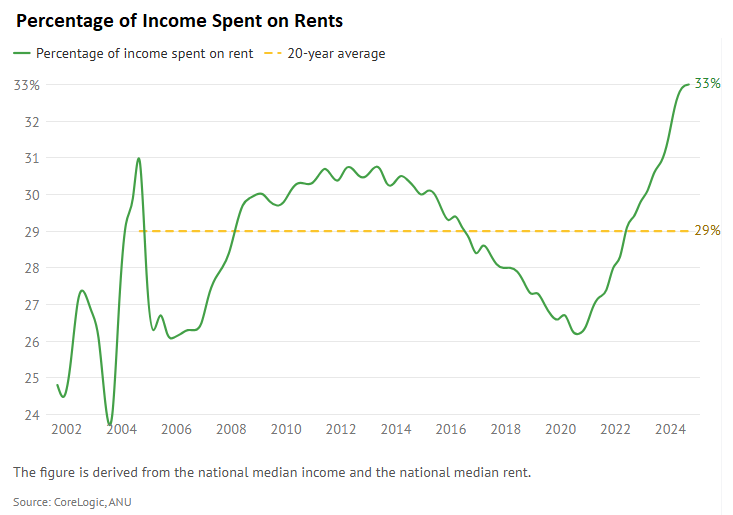

Try telling that to Australia’s suffering renters, who have seen rental vacancy rates collapse and rents soar under Labor’s record immigration deluge.

This rental surge has seen tenants dedicate a record share of their incomes toward putting a roof over their heads.

Prime Minister Anthony Albanese conveniently failed to mention that Labor irresponsibly let in nearly one million net overseas migrants in its first two years in office.

The fundamental problem facing the housing market is summarised in the following chart from Alex Joiner at IFM Investors.

While the number of dwelling completions remains higher than average, this is being dwarfed by historically high net overseas migration.

As a result, the dwelling construction rate as a share of the population is tracking at a record low.

The primary solution to the housing crisis, therefore, must be to lower population growth via immigration to a level that is compatible with housing supply.

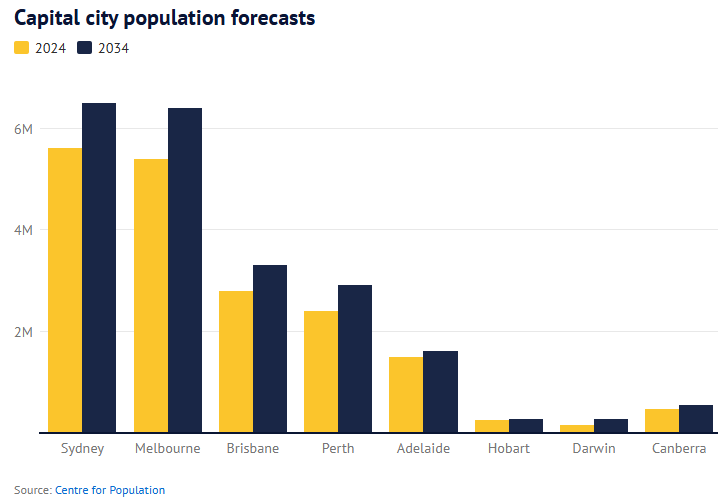

Sadly, the Centre for Population’s latest projections forecast that the nation’s population will balloon by 4.1 million residents over the next 10 years—most of whom will live in Sydney, Melbourne, Brisbane, and Perth.

Melbourne is projected to add one million residents over the coming decade; Sydney will add 900,000; and Brisbane and Perth will each add 500,000 residents.

Such a rapid population expansion, driven by net overseas migration, will inevitably worsen housing and infrastructure shortages across Australia.

The projected 410,000 annual population growth—almost equivalent to the population of Canberra annually—will guarantee that population demand forever overruns supply, putting upward pressure home prices and rents.

Excessive population demand via immigration is the fundamental problem facing Australia’s housing market.