The Reserve Bank of Australia (RBA) begins 2025 with a confusing economic picture that complicates monetary policy settings.

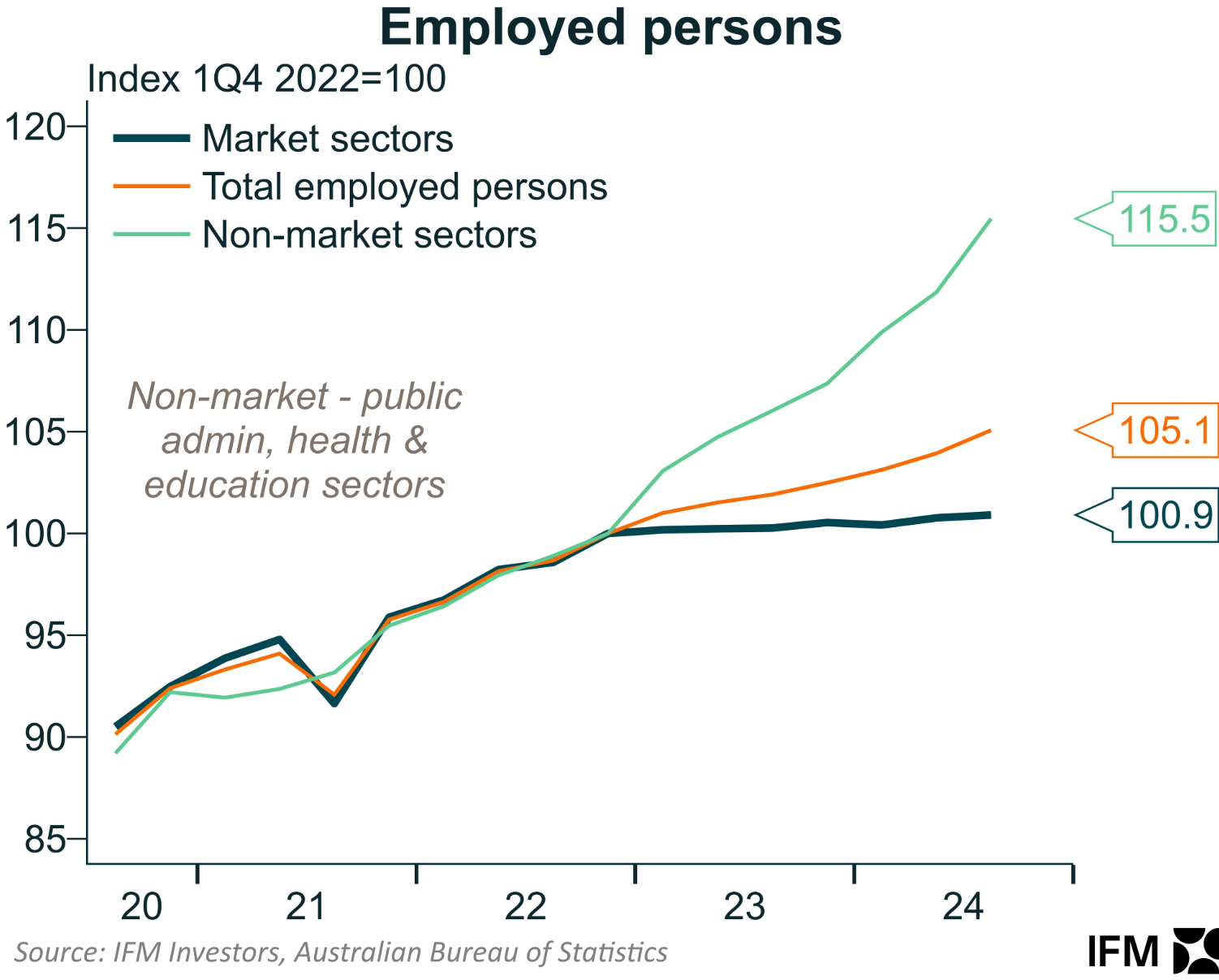

The key factor preventing the RBA from cutting rates is the stronger than expected labour market, driven by the boom in non-market (government-funded) jobs.

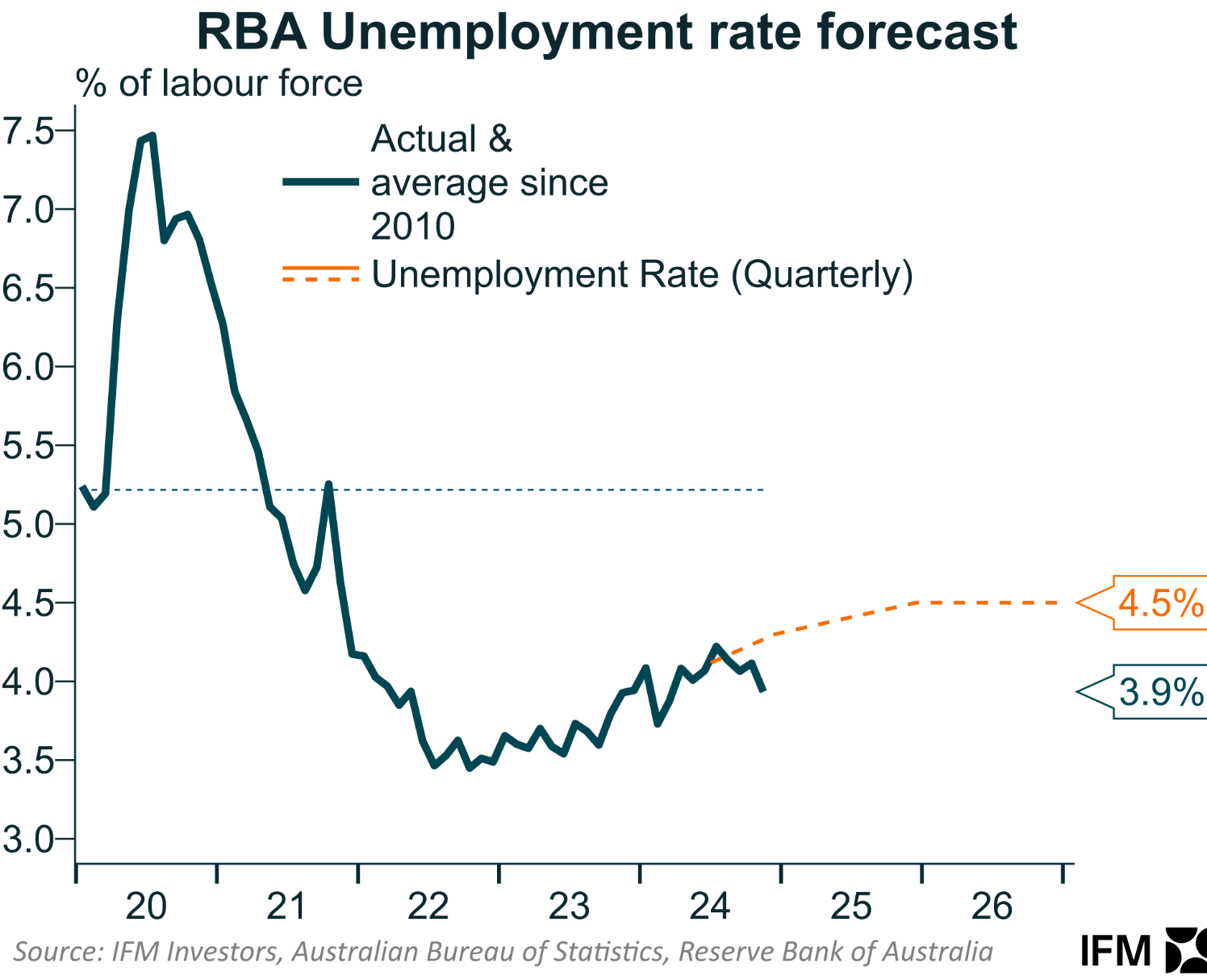

As a result, Australia’s official unemployment rate (3.9%) is tracking well below the RBA’s forecast from the November Statement of Monetary Policy (SoMP).

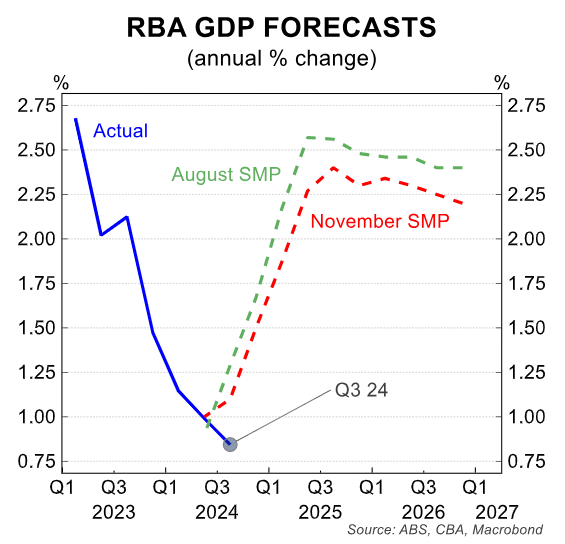

On the other hand, Australia’s economy is growing at its slowest pace since the early 1990s recession outside of the pandemic, recording annual growth of only 0.8% in the year to Q3 2024.

As a result, the Australian economy is growing at a far slower rate than forecast by the RBA in its November Statement of Monetary Policy (SoMP).

The same can be said for Australian wage growth, which has also significantly undershot the RBA’s expectations.

Source: Alex Joiner (IFM Investors)

Indeed, the minutes from the RBA’s most recent meeting explicitly stated that wage growth has softened more than expected, suggesting that Australia’s labour market is not nearly as strong as suggested by the low unemployment rate.

“The information received since the previous meeting confirmed that wages growth had slowed and that this had occurred faster than expected”, the RBA minutes read.

“A number of indicators of labour market conditions had strengthened or stabilised over preceding months”.

“However, employment growth in the market sector had been weak and hiring intentions in the private sector were below average”, the minutes said.

Indeed, the RBA minutes left the door ajar for an earlier commencement of rate cuts should the economic data evolve as expected.

While underlying inflation of 3.5% remains above the RBA’s target of 2% to 3%, the minutes noted that “the risk inflation returns to target more slowly than forecast had diminished since the previous meeting and the downside risks to activity had strengthened”.

“If the future flow of data continued to evolve in line with, or weaker than, their expectations, it would further increase their confidence that inflation was declining sustainably towards target”.

“If that were to occur, members concluded that it would, in due course, be appropriate to begin relaxing the degree of monetary policy tightness”, the minutes said.

The December labour force survey (out on 16 January) and the Q4 CPI release (out on 29 January) are the two major economic releases that will inform the RBA’s next rate decision on 18 February.

Westpac’s near-cast for the December quarter Trimmed Mean inflation is 0.6% qtr/3.4% yr. Such a result would see the two-quarter annualised trimmed mean inflation fall from 3.3% yr to 2.9% yr, moving it within the RBA’s target range.

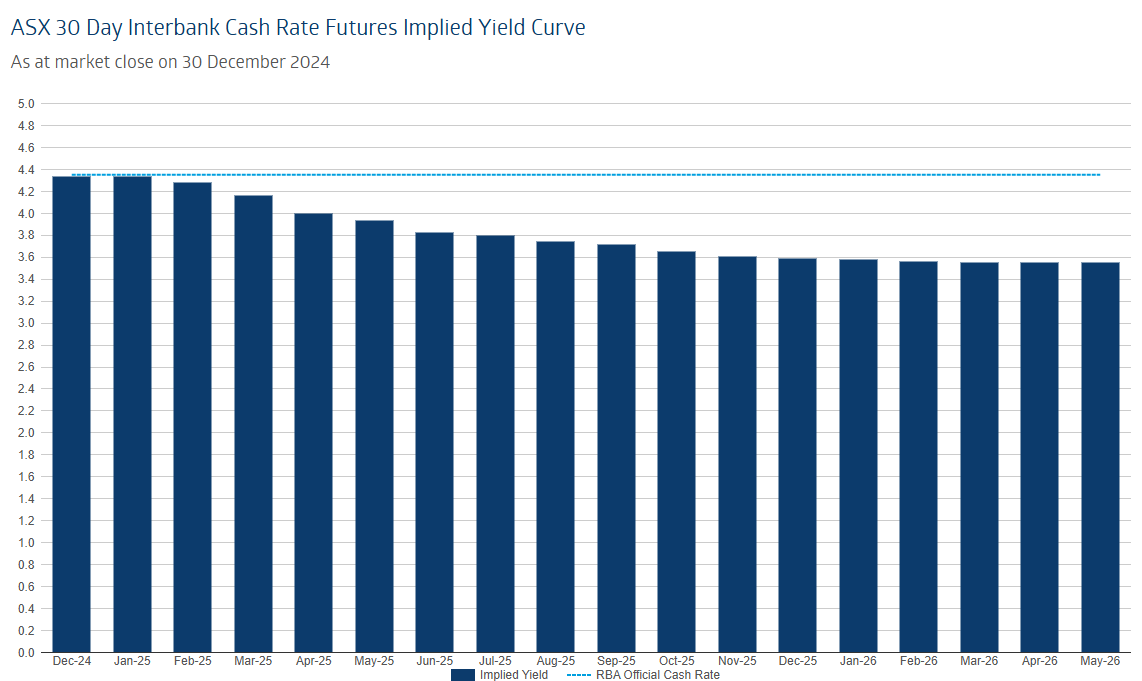

For what it is worth, financial markets tip that the first rate cut will likely arrive at the 1 April meeting (see below).