‘Tis rather a big release for the Trump agenda versus markets. Goldman has more.

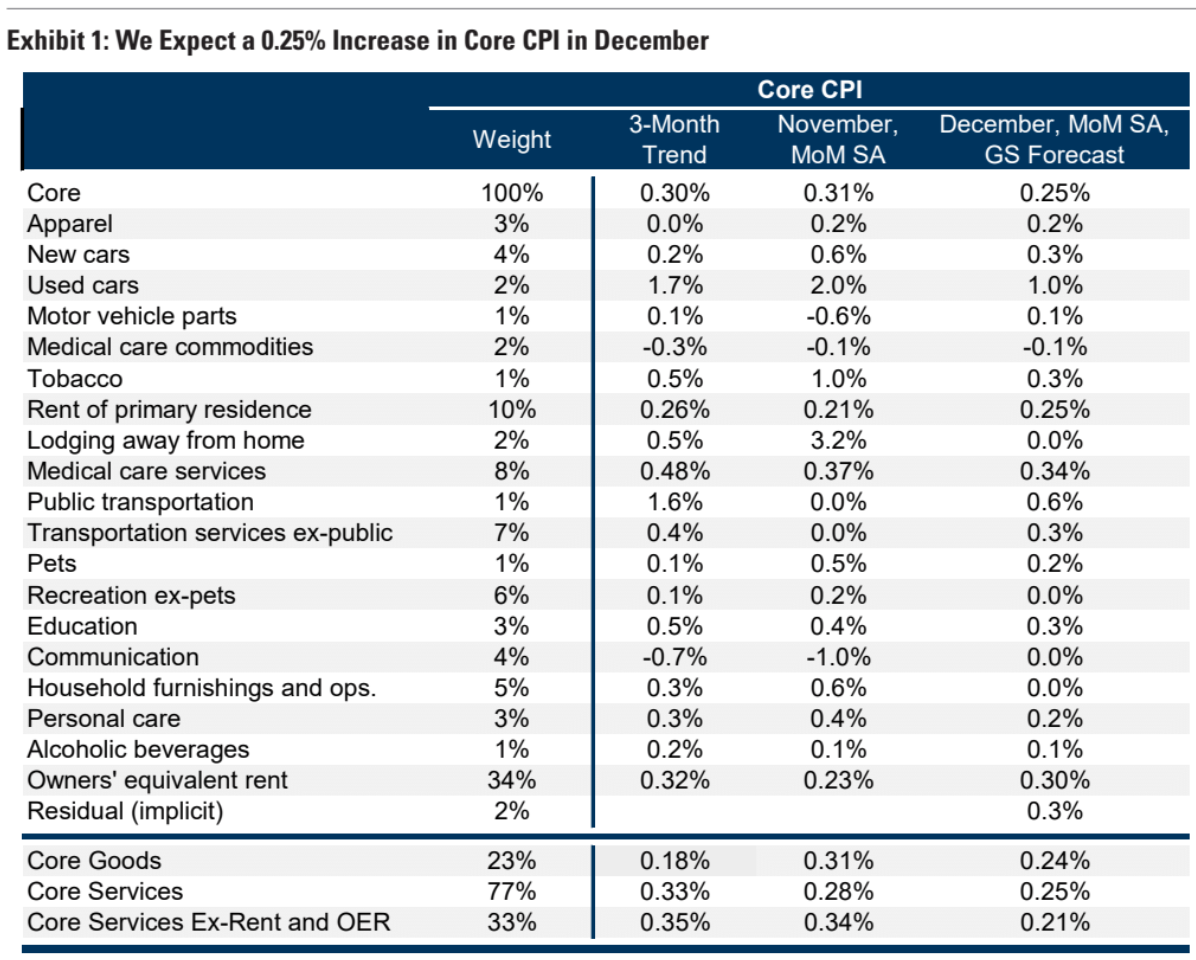

We expect a 0.25% increase in December core CPI (vs. 0.2% consensus), corresponding to a year-over-year rate of 3.27% (vs. 3.3% consensus).

We expect a 0.40% increase in December headline CPI (vs. 0.3% consensus), reflecting 0.35% higher food prices and 2.3% higher energy prices.

Our forecast is consistent with a 0.21% increase in CPI core services excluding rent and owners’ equivalent rent and with a 0.18% increase in core PCE in December.

We highlight three key component-level trends we expect to see in this month’s report.

First, we expect used car prices to increase 1.0%, reflecting an increase in auction prices.

Second, we expect another increase in airfares of 1.0%, reflecting a boost from seasonal distortions.

Third, we expect a slight acceleration in the car insurance category (+0.3%) based on continued, albeit decelerating, increases in premiums in our online dataset.

Going forward, we see further disinflation in the pipeline over the next year from rebalancing in the auto, housing rental, and labor markets, but an offset from an escalation in tariff policy.

We forecast year-over-year core CPI inflation of 2.7%and core PCE inflation of 2.4% in December 2025.

Given relatively oversold conditions, an in-line print will probably deliver a bounce.