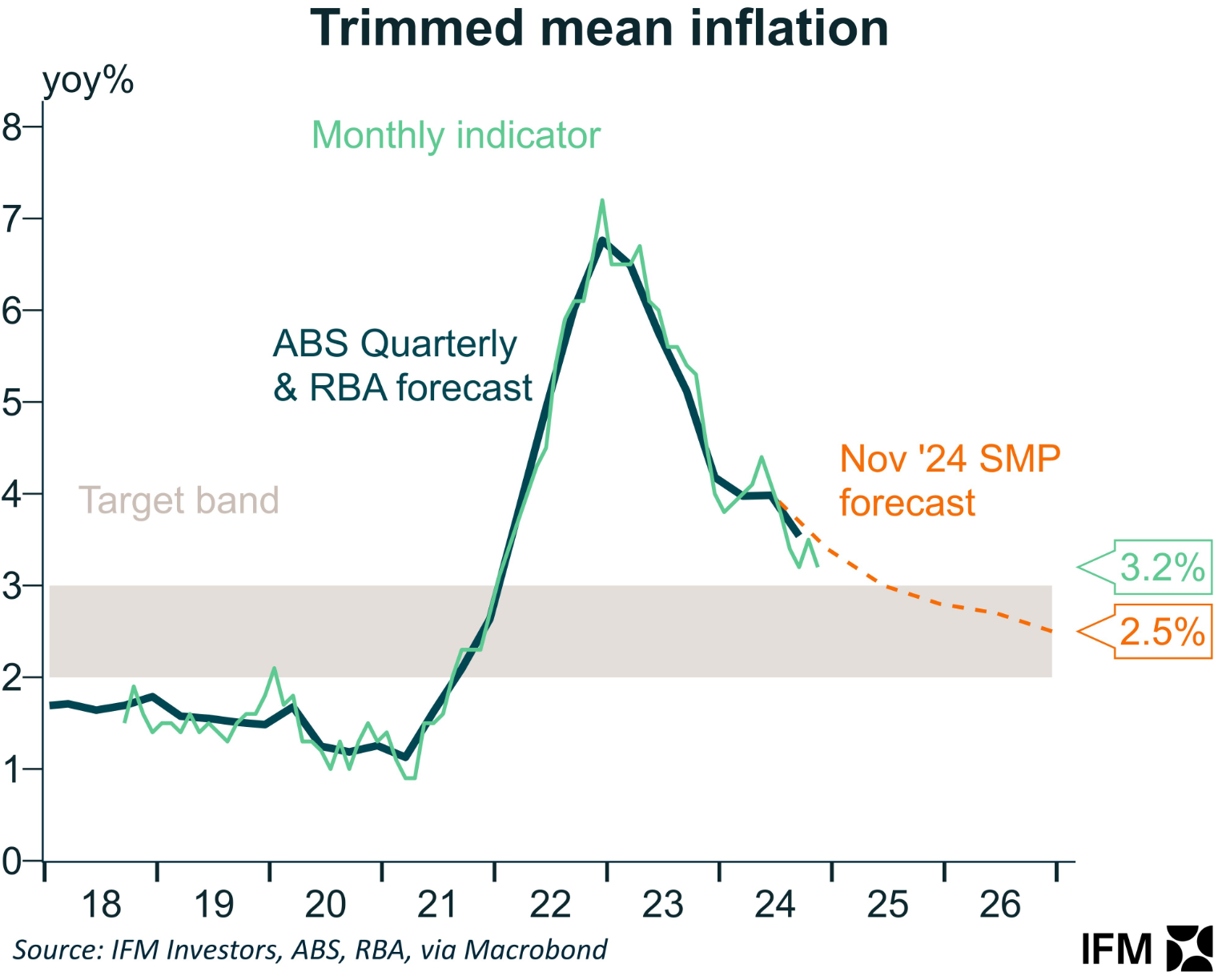

Wednesday’s monthly inflation data from the Australian Bureau of Statistics (ABS) suggested that underlying (trimmed mean) inflation is falling faster than projected by the Reserve Bank of Australia (RBA).

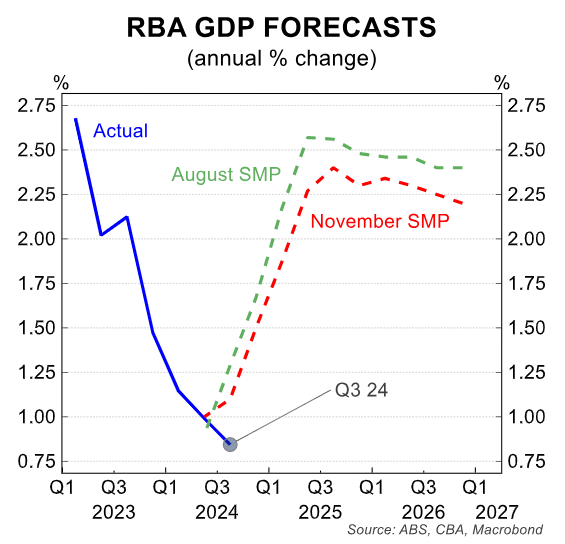

The Q3 national accounts, released last month by the ABS, reported annual GDP growth of 0.8%, also well below the RBA’s forecasts.

The Q3 wage price index from the ABS also significantly undershot the RBA’s forecasts.

Source: Alex Joiner (IFM Investors)

Viewed in isolation, the above data would lean heavily towards interest rate cuts at the next RBA monetary policy meeting in February.

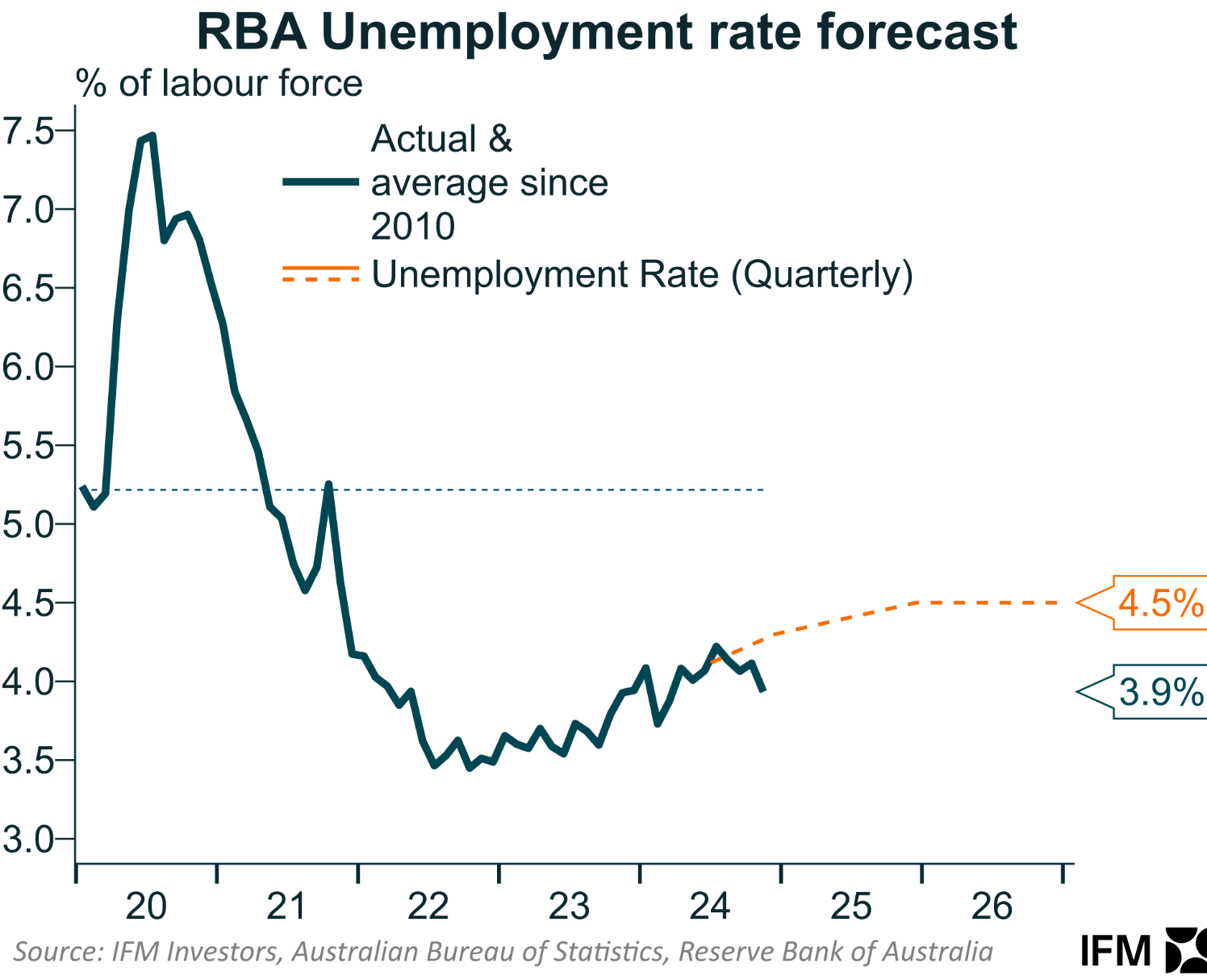

The main barrier working against rate cuts is the strength of the labour market.

Australia’s official unemployment rate was 3.9% in November, well below the RBA’s forecasts.

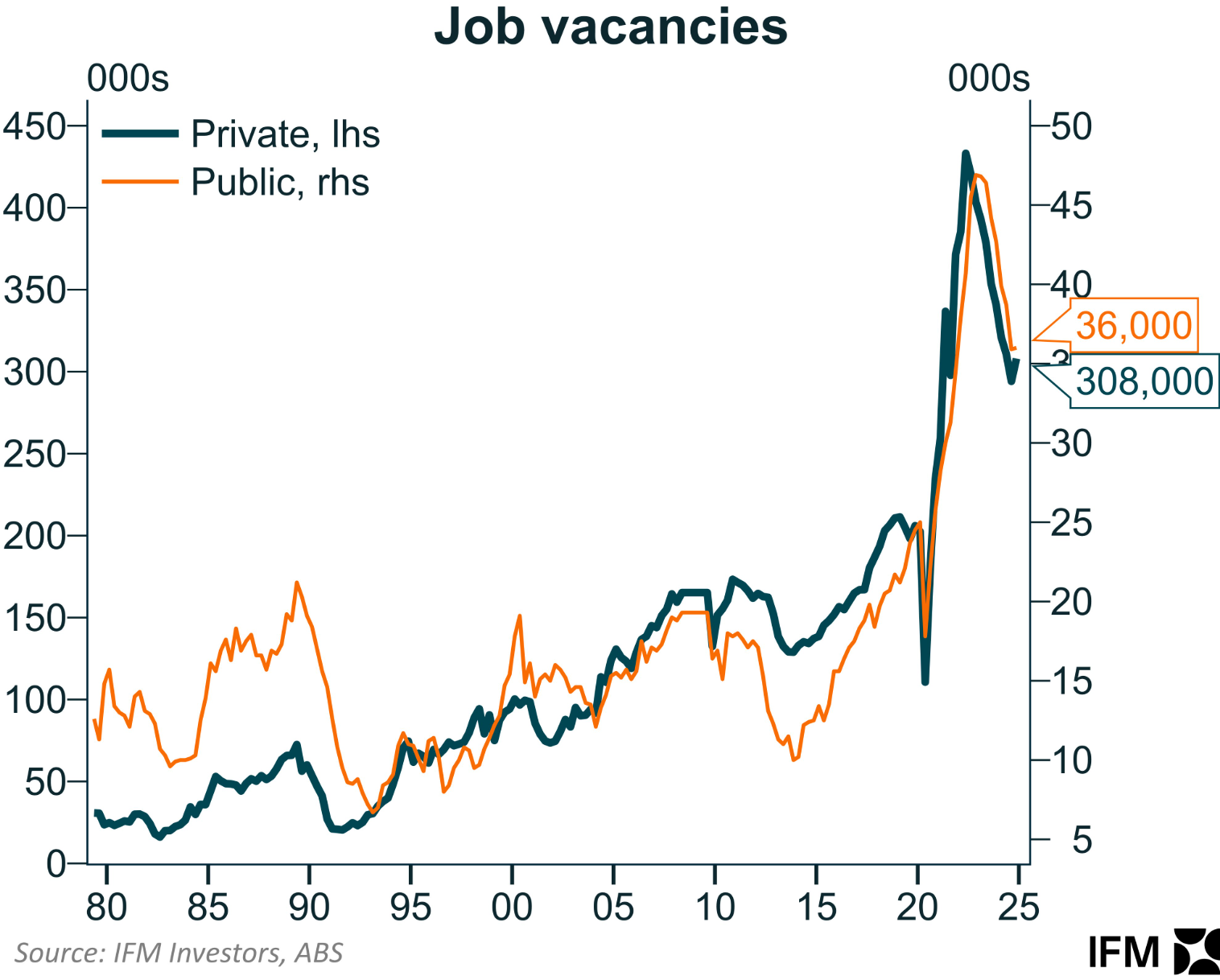

On Wednesday, the ABS also released job vacancy data, which ticked higher in the November quarter and remains historically high.

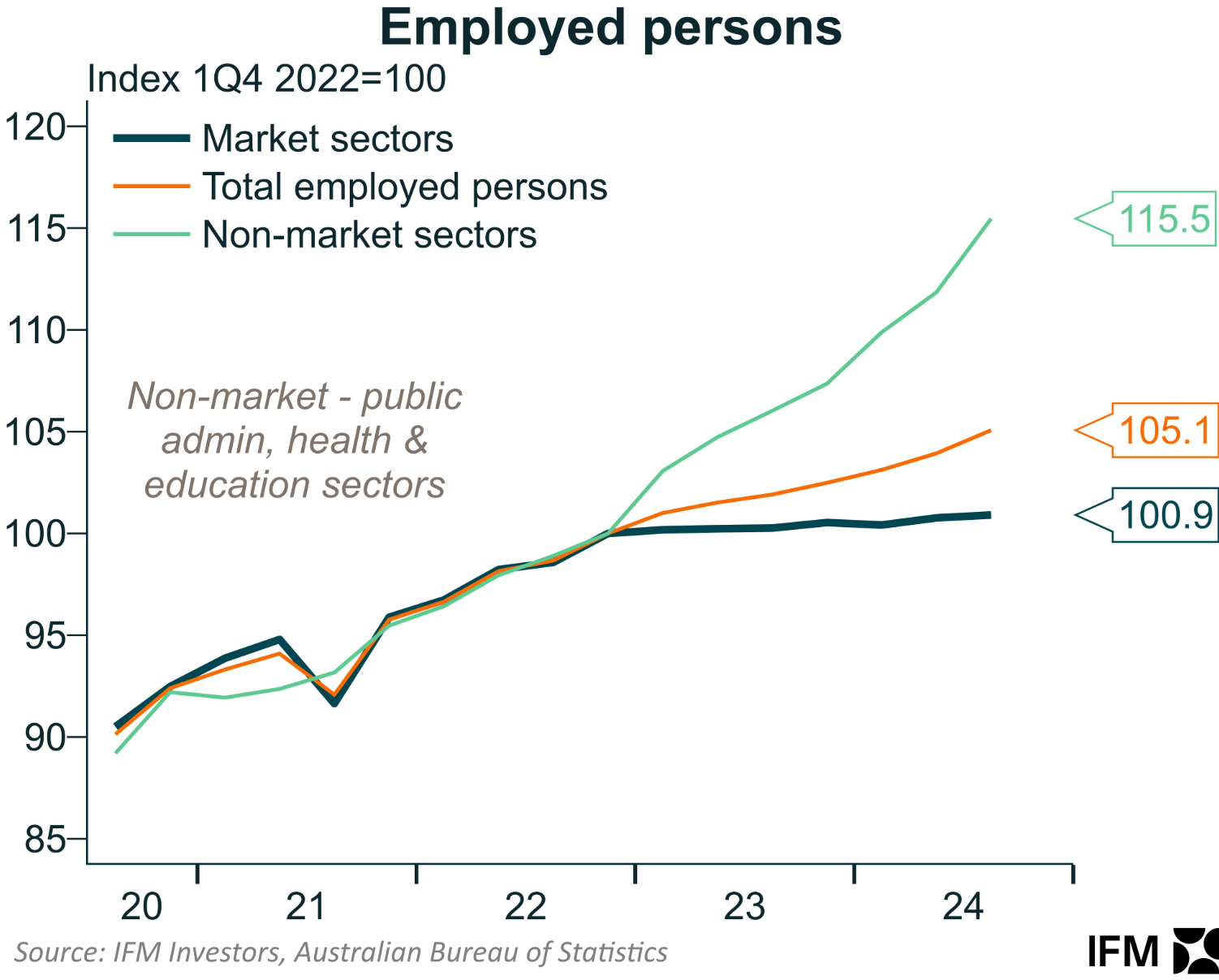

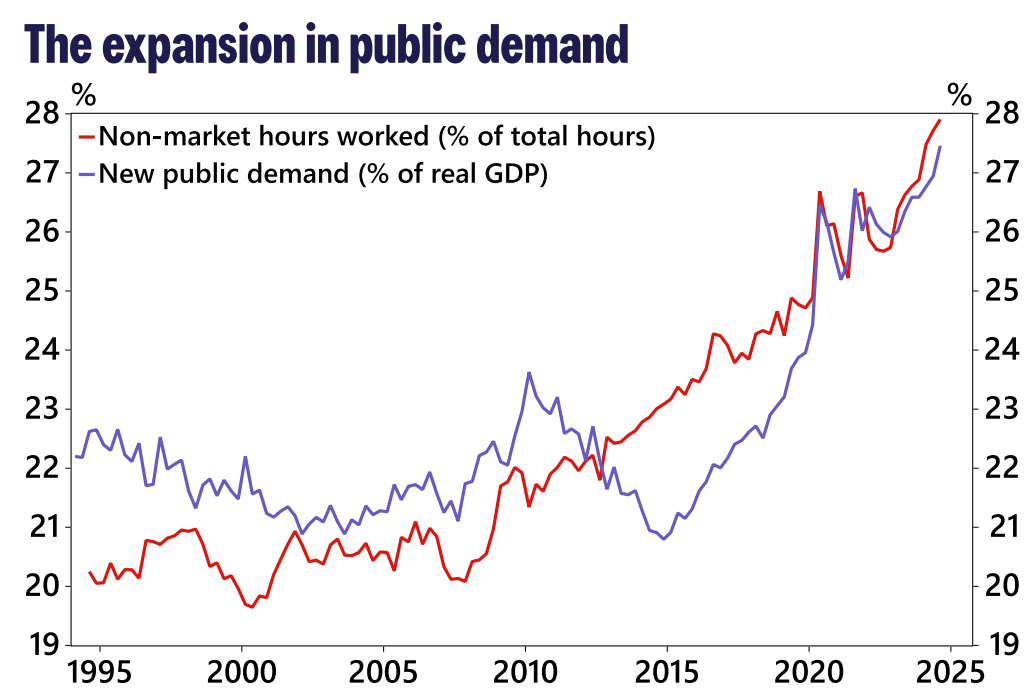

The boom in non-market (government-funded) jobs is behind the labour market’s strength.

As illustrated below by Allex Joiner at IFM Investors, non-market sector jobs expanded by 15.5% between Q4 2022 and Q3 2024, versus only 0.9% growth across the market sector.

Record public spending, therefore, is arguably the major barrier to the RBA cutting rates.

The December labour force survey (scheduled for 16 January) and the Q4 CPI release (scheduled for 29 January) are the two major data points that will determine the RBA’s interest rate decision on 18 February.

Westpac’s near-cast for the December quarter Trimmed Mean inflation was 0.6% qtr/3.4% yr.

If this came to fruition, it would see the two-quarter annualised trimmed mean inflation fall from 3.3% to 2.9%, to be within the RBA’s target range.