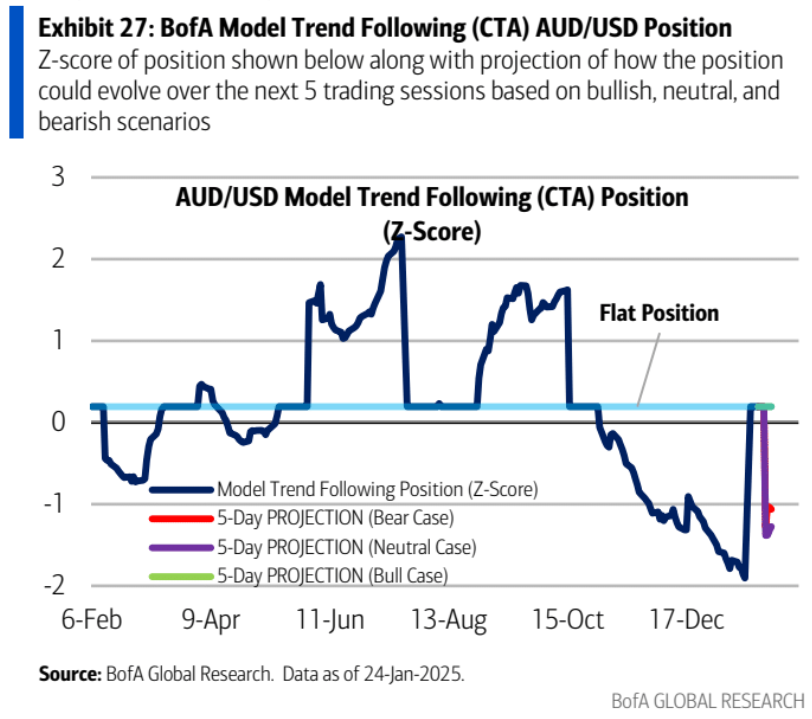

CTAs and systemics aggressively bought Australian dollars last week, undoing some of the recent bearish imbalance.

BofA has more.

With trend followers stretched long USD and only moderately long US equities, the SG CTA benchmark posted declines on the week.

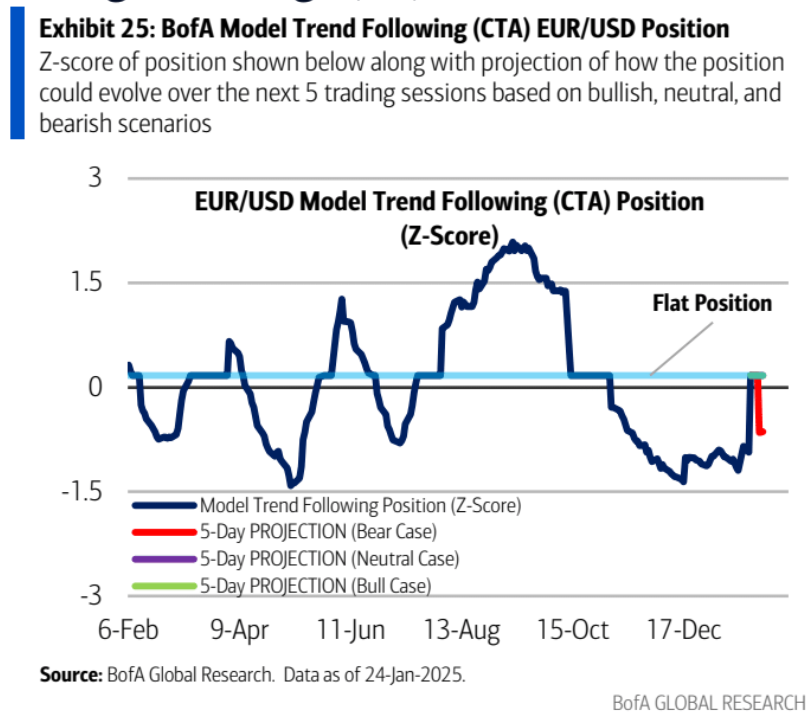

In FX, our model covered short EUR, GBP, and AUD positions this week and is still short CAD and MXN.

We note that trigger levels vary among actual CTAs and that trend followers still short EUR, GBP, and AUD could reduce the size of their positions in the coming days especially if USD continues its decline.

EUR/USD has come in some which is less DXY bearish.

The/AUD squeeze has been more violent.

I am surprised the AUD has not climbed more on this kind of move. That might suggest there are still significant outflows underway.

Anyway, there is scope for robots to go either way here now.