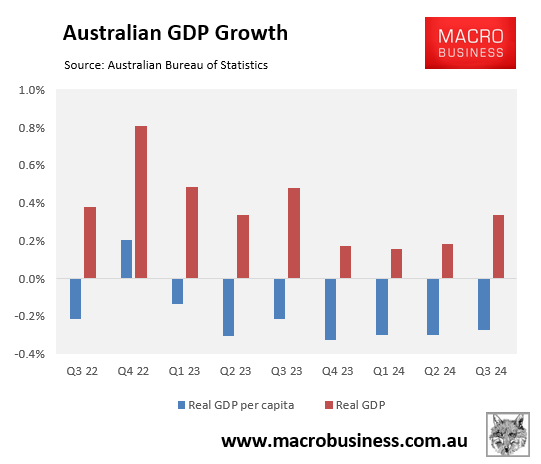

Australians are suffering their longest-running per capita recession on record at seven consecutive quarters.

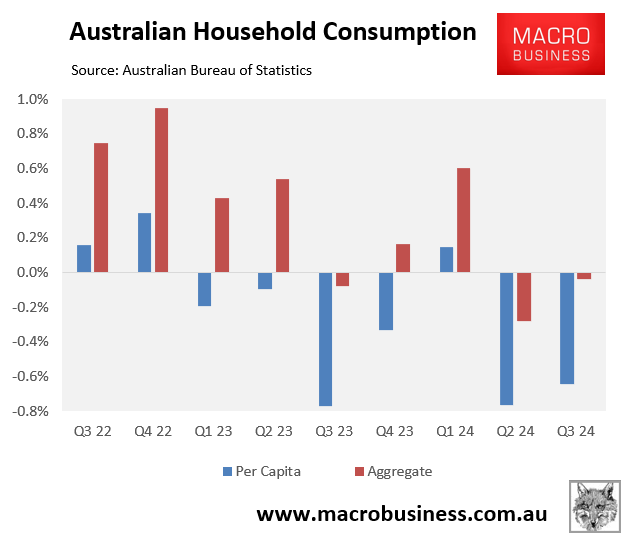

This recession is driven by the household sector, where per capita household consumption has fallen for six of the past seven quarters.

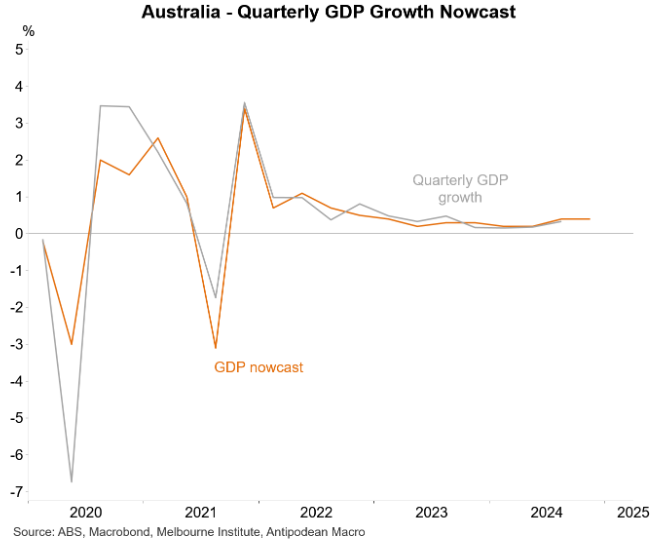

The Melbourne Institute’s latest nowcast for Australia’s Q4 GDP growth, compiled by Justin Fabo from Antipodean Macro, remained at 0.4% q/q.

Australia’s population growth was 0.6% in Q3 2024, and given slowing migration, it will likely print at 0.5% in Q4 2024.

This would mean that Australia’s per capita recession has extended to eight consecutive quarters, although the pace of decline will have slowed.

Various projections suggest that Australia’s per capita recession will likely end in the first half of 2025.

The International Monetary Fund’s (IMF) most recent World Economic Outlook report predicted that Australia’s real GDP will rise from only 1.2% in the calendar year 2024 to 2.1% in 2025.

The OECD’s most recent economic outlook predicts that Australia’s GDP will increase from 1.1% in the 2024 calendar year to 1.8% in 2025.

Deloitte is more bearish, expecting real GDP growth to rebound from 1.1% in the calendar year 2024 to 1.6% in 2025.

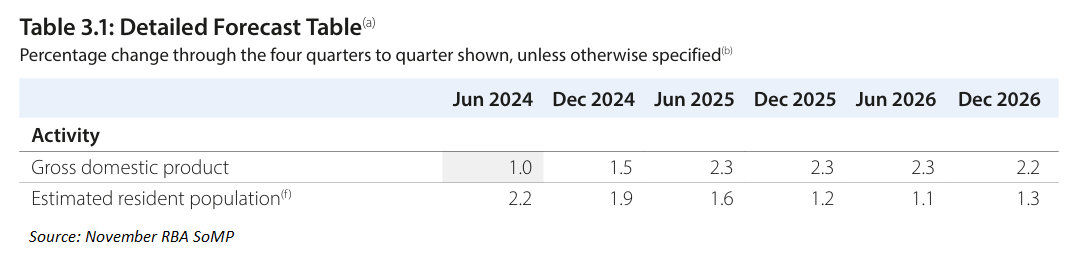

Finally, the Reserve Bank of Australia’s (RBA) November Statement of Monetary Policy (SoMP) reduced Australia’s GDP projections to 1.5% for 2024 in the year ending 2024 and 2.3% for 2024-25.

This compares to projected population growth of 1.9% for the year ending 2024 and 1.6% for 2024-25.

Therefore, according to the above projections, Australia’s per capita recession will likely end in the first half of 2025.

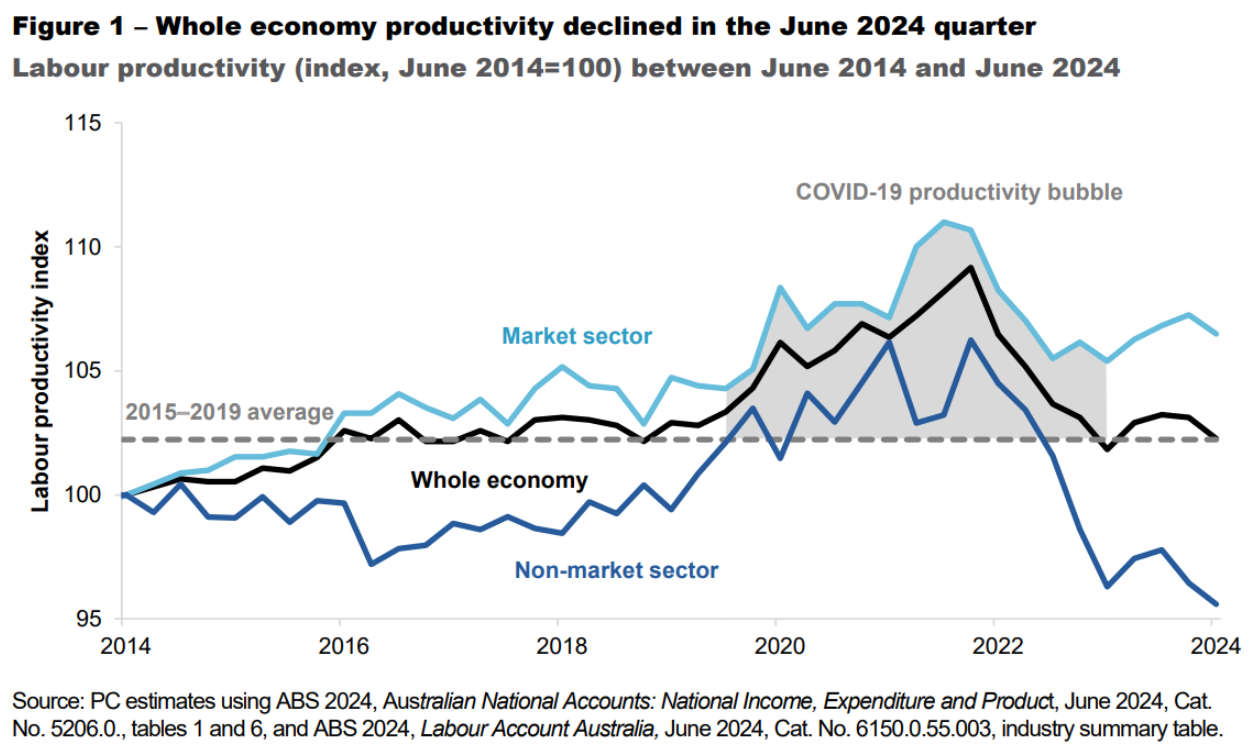

The RBA SoMP also suggests that the recovery from the recession in 2025 and 2026 will be slow. This reflects, in part, Australia’s poor productivity growth.

As illustrated above, the recent decline in Australia’s productivity has been driven by the concentration of job creation in the non-market sector (for example, the NDIS).