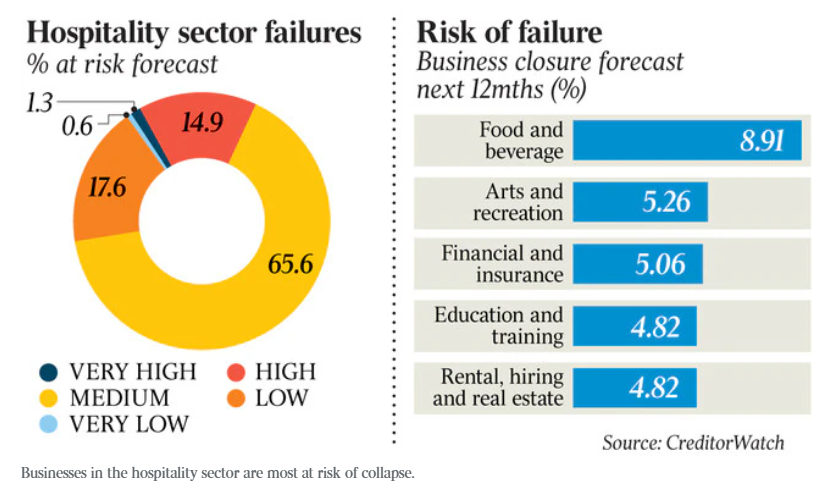

Credit reporting bureau CreditorWatch recently warned that nearly one out of every six (16.2%) hospitality businesses have a high probability of failing due to a combination of high interest rates, rising rents, high cost of living, and the pandemic hangover.

CreditorWatch forecast that 8.9% of food and beverage businesses would close over 2025.

Over the weekend, Chief Executive Patrick Coghlan noted that small business insolvencies were “as bad as it gets” in February, with the hospitality industry bearing the brunt.

However, Coghlan expects business insolvencies to peak in the middle of the year, after which conditions will improve amid interest rate cuts from the Reserve Bank of Australia (RBA).

“Insolvencies are at a record high and that will continue for the foreseeable future,” he said. “We expect that to peak at around the middle of the year”.

“If we get an interest-rate cut in February, that will provide confidence and with an industry like hospitality, it can have an almost immediate impact because all of a sudden people have a bit more money in their pockets”.

However, Dean Merlo, who runs Merlo Coffee, one of Australia’s largest independently owned coffee roasters, warned that hospitality businesses remained under intense pressure.

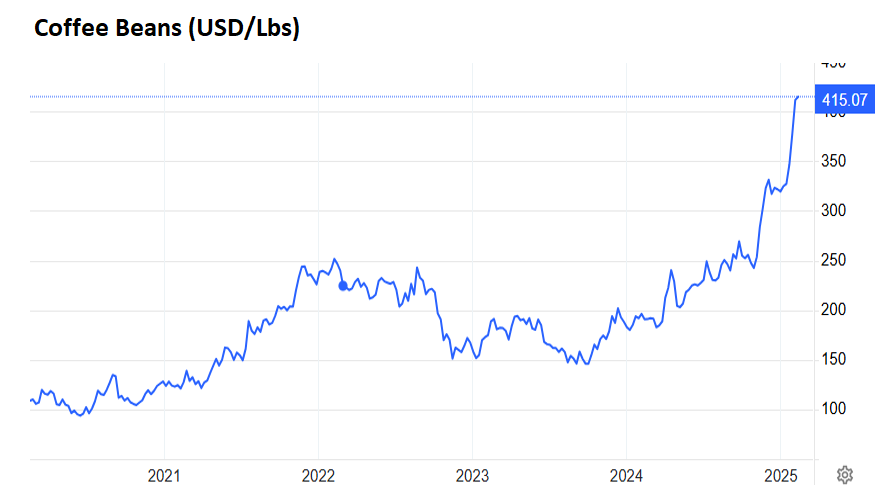

Merlo noted that the sharp rise in global coffee bean prices and other costs meant that prices needed to rise “significantly”.

“The trouble is that a lot of people have that first coffee and you ask if they want a second cup and they almost always seem to pat their pockets as they’re talking to you and say ‘I’m OK’. It’s all about money”, he said.

“The cost of goods is killing us and that’s the same for everybody – there’s no escaping it”.

“When you look at us on a global scale, we are very cheap compared to what you would pay in other countries – it’s $8, $9, $10 in other countries to buy a gourmet coffee”, he said.

Paying $5.50 for a standard coffee is normal in Melbourne. This is already beyond what many consumers can afford, as evidenced by the shrinkage of demand and the high number of cafe insolvencies.

The Chief Executive of Coffee roaster Pablo and Rusty’s, Abdullah Ramay, recently claimed that the retail price for a cup of coffee must increase to $7 to make it profitable for cafes.

“The cost of this thing should’ve been $7-plus. If you’ve been buying coffee for $4.50 … the cafe’s been subsidising”, he said.

“You should thank your cafe owner and barista; you’ve been getting the bargain of the century”.

However, if retail coffee prices rise to $7, it will crunch buyer demand even further, shrinking sales and inevitably resulting in many more cafes closing.

After all, why pay $7 when a comparable coffee from Coles Express costs only $2?

The sad reality is that the number of cafes operating across Australia boomed over the past 15 years to unsustainable levels. There was never enough consumer demand to support this number of cafes.

Soaring coffee prices, rents, and energy costs have created a perfect storm for the cafe sector that will inevitably result in significantly more closures.

Paying $7 for a coffee and $20 for basic avocado on toast is unaffordable to the vast majority of Australians.

The cafe sector, therefore, must shrink to bring supply back into line with consumer demand.