Last week, Labor Treasurer Jim Chalmers announced that Australia’s financial regulators would be required to loosen home lending rules for millions of Australians with student loans.

Under the changes, a borrower’s education debt will be removed from mortgage serviceability assessments if the bank believes the borrower will pay it off in the “near term”.

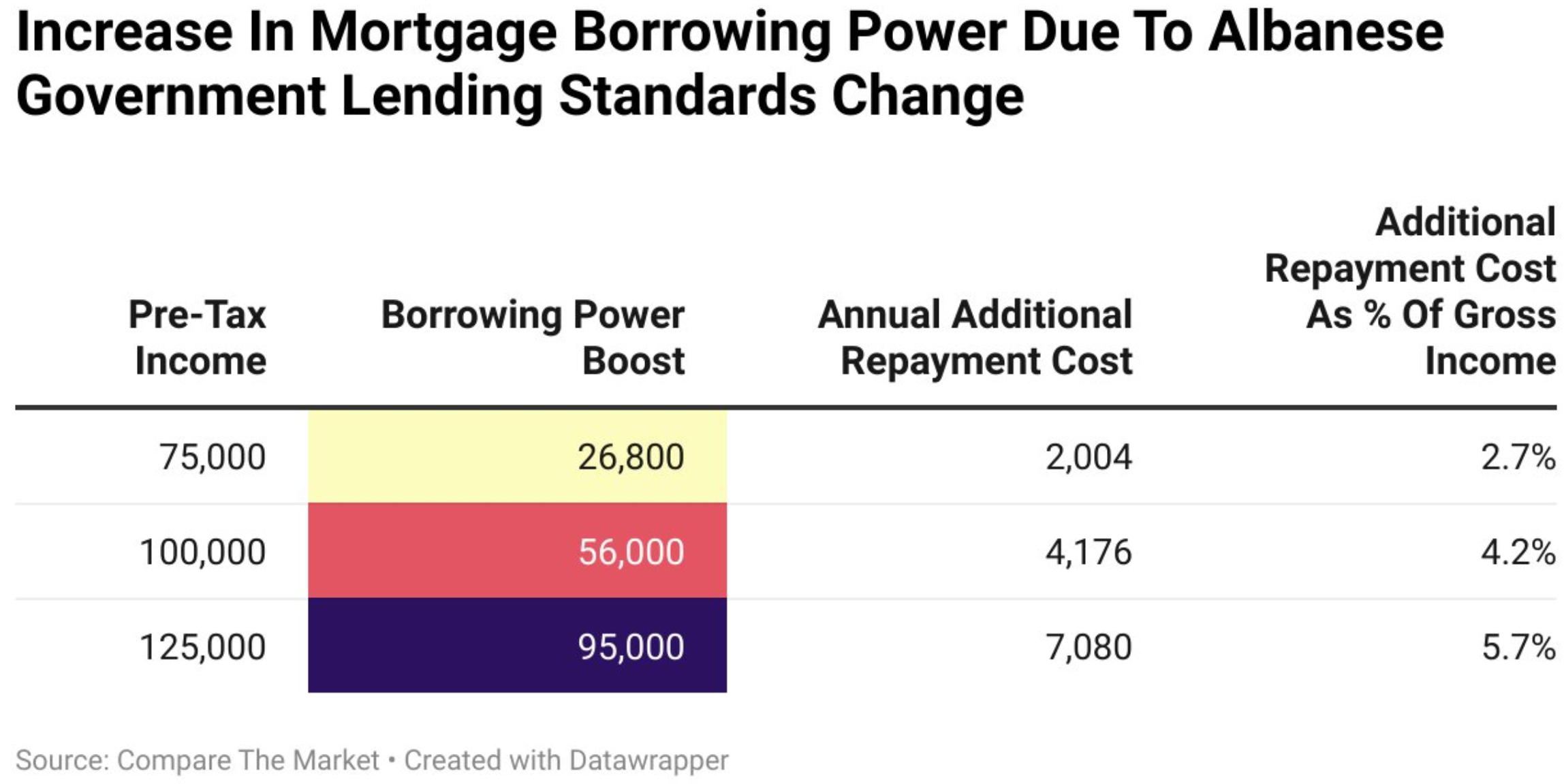

Compare the Market analysis estimates that a tertiary-educated single professional earning $125,000 would be eligible to borrow an additional $95,900 under the new policy.

Someone earning $100,000 has an extra borrowing capability of $56,000, whereas someone earning $75,000 can borrow an additional $26,800.

The lending changes will exacerbate Australia’s housing crisis by raising demand and inflating prices.

Not to be outdone, the Dutton-led Coalition has promised to allow qualifying first-time buyers instant access to $50,000 of their superannuation savings to help them buy a property if they win the election.

Modelling by the Australian Super Members Council (SMC) suggests that Australian home values could rise by an average of $75,000 (9%) in the five major capital cities if the super-for-housing policy went ahead.

“There is broad consensus among the overwhelming majority of leading economists, and policymakers, that demand-side measures such as allowing super to be used to purchase a home are poorly targeted and won’t arrest the systemic decline in home ownership for younger Australians”, the SMC report says.

According to SMC’s analysis, New Zealand, which implemented a similar policy 15 years ago via its KiwiSaver scheme, experienced a sharp increase in prices and falling home ownership.

“This data shows starkly that KiwiSaver withdrawals have failed to achieve any improvement in home ownership rates for New Zealanders and, instead, have contributed to making housing more unaffordable”, SMC said.

In 2016, the New Zealand Treasury stated that the Kiwisaver policy was inflationary and had self-defeating impacts. It also opposed an expansion of the scheme.

“The likely effect would therefore be to increase house prices, to some extent negating the goal of the proposal and negatively impacting housing affordability”, the NZ Treasury found.

The Coalition has also promised to water down responsible lending obligations to make it easier for first-time home buyers to borrow.

The upshot is that a Coalition government would likely be even more inflationary for Australia’s housing market and seems intent on blowing a bigger bubble.