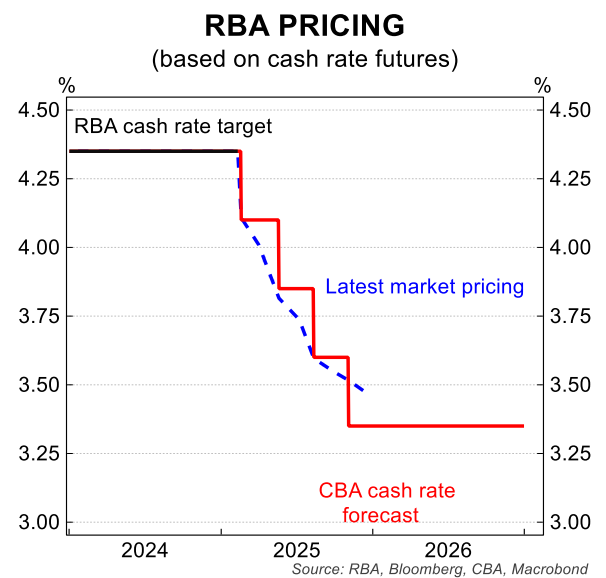

Financial markets and most economists believe that the Reserve Bank of Australia (RBA) will lower the official cash rate by 0.25% on Tuesday, followed by three additional cuts this year.

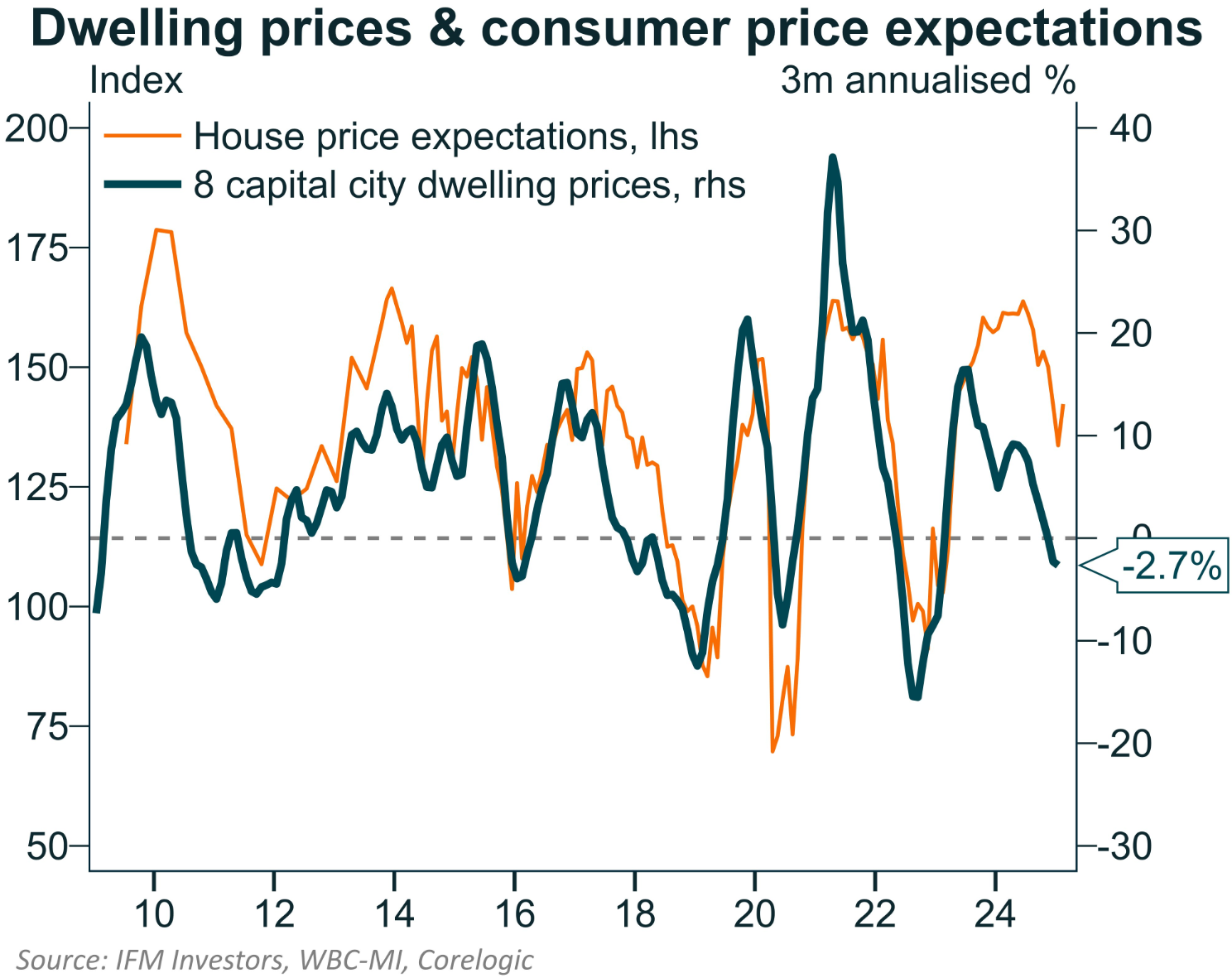

The latest Westpac monthly consumer confidence survey noted that “consumers have become much more confident about the prospect of interest rate cuts”.

As a result, “house price expectations rose by 6.5% to 142.3 in February, a solid lift, and the first rise since October”.

Australian consumers also believe rate cuts will positively impact house prices, as illustrated by Alex Joiner from IFM Investors below.

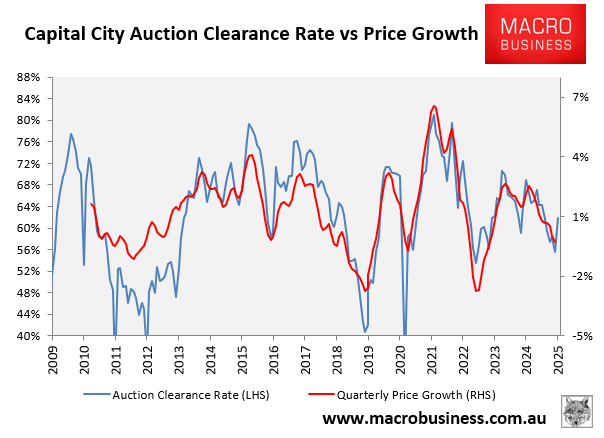

The auction market suggests that Australians are becoming more bullish on property.

Final auction clearance rates have strengthened this year, as illustrated below, which is typically followed by rising prices.

Last week’s final auction clearance rate was 64.2%, the highest since the first week of September 2024.

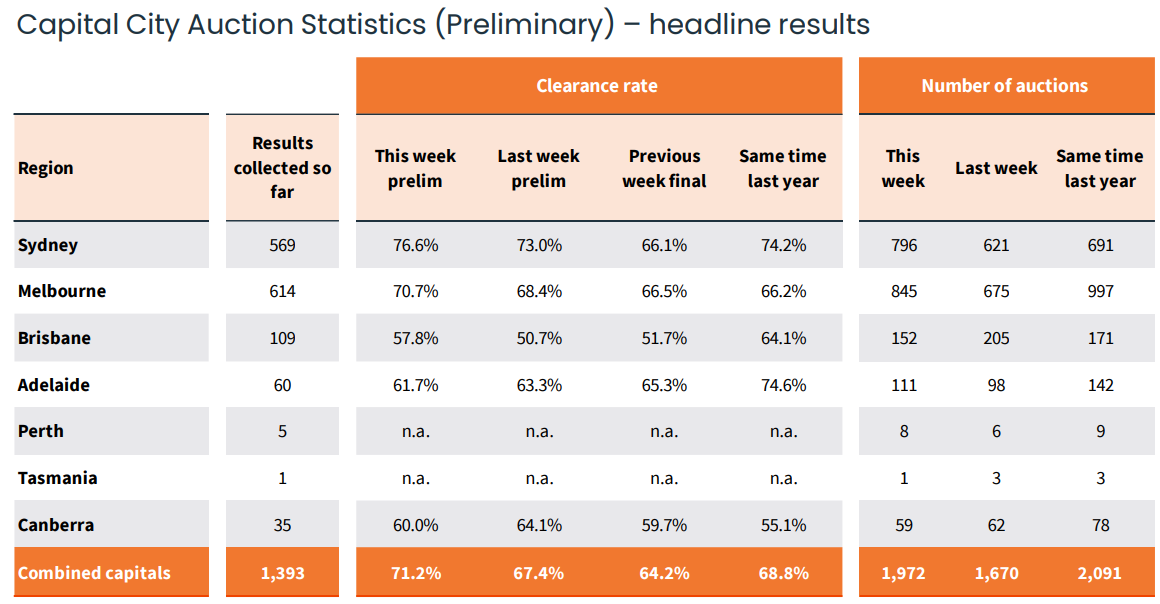

This weekend’s preliminary auction results from CoreLogic strengthened further, with the preliminary capital city clearance rate at 71.2%.

This was the first result above the 70% mark since the week ending 8 September last year (71.7%).

Melbourne’s preliminary clearance rate nudged over the 70% mark (70.7%) for the first time since the week ended 8 September 2024.

Sydney’s preliminary clearance rate bounced to 76.6%, the highest result since the first week of July last year (76.7%).

Sentiment would likely have been boosted by Treasurer Jim Chalmers’ announcement last week that Australia’s financial regulators have been instructed to relax home-lending rules for millions of Australians with university debts.

Under these changes, a borrower’s student debt will be excluded from mortgage serviceability tests where a bank expects the borrower to pay off the debt in “the near term”.

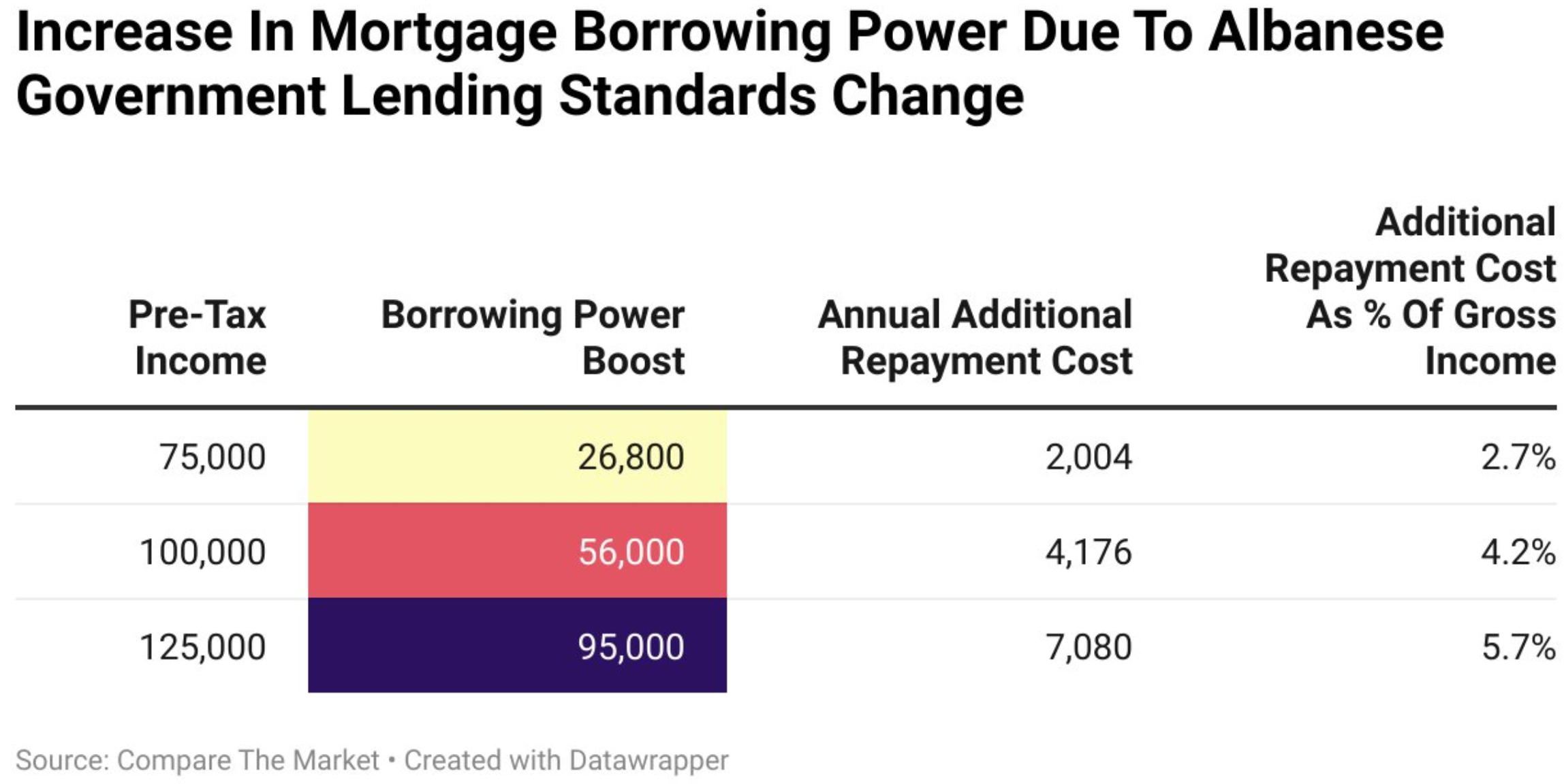

Analysis from Compare the Market estimates that a tertiary-educated single professional earning $125,000 could borrow an extra $95,900 based on the announced changes.

The extra borrowing power for some earning $100,000 would be more than $56,000, whereas a person earning $75,000 can borrow an additional $26,800.

The changes will intensify FOMO (fear of missing out) and put upward pressure on Australian home values.