Late last year, Charter Keck Cramer debunked the notion that rezoning Australian suburbs into high density will result in more affordable housing.

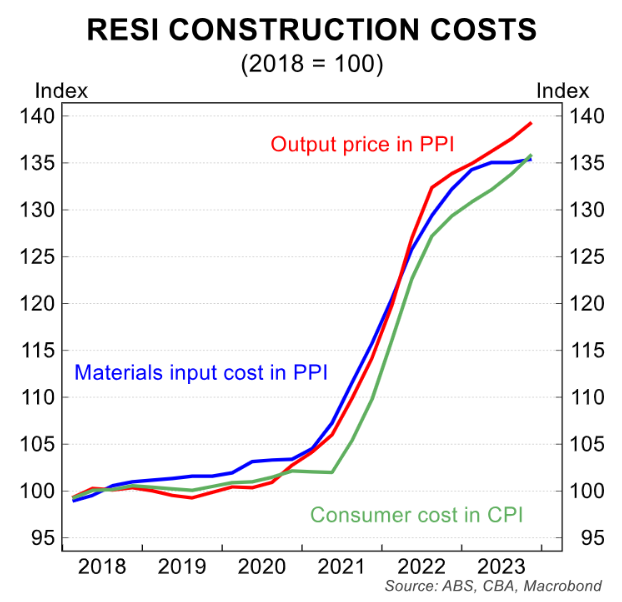

Charter Keck Cramer noted that the rise in construction costs meant that established apartment prices needed to rise by 15% to make it financially viable for developers to build apartments.

“Because building costs have jumped by 30% to 40%, prices have to basically go up to be about 30% higher compared to pre-pandemic levels”, Charter Keck Cramer national executive director of research Richard Temlett said.

“And what that means is that even with these incentives in place, there’s certain projects that will still not be financially viable”.

“The prices of established units need to recalibrate upwards by around 15% for new stock to be accepted by the market at current price points”, said the report, describing the price discrepancy between new and established apartments as a “major handbrake” for delivering new homes.

However, Charter Keck Cramer warned that a 15% rise in apartment prices would price them above what many buyers could afford.

Deloitte Access Economics also warned that apartment prices would need to rise to make construction profitable. However, this would make housing even less affordable.

“With permanently higher construction costs, the sector will be both unwilling and unable to lift supply unless property prices also lift”, Stephen Smith from Deloitte said.

“That is, housing affordability will get worse before it has a hope of getting better”.

The reality is that most Australians cannot afford to purchase a high-rise apartment.

In addition to the high up-front cost, owners face exorbitant body corporate fees.

According to a recent Four Corners report, “The Strata Trap”:

“After thousands of Australians wrote to the ABC with shocking stories of financial abuse, The Strata Trap uncovers the unethical practices that have drained untold sums of money from apartment owners’ pockets”, Four Corners reported.

“It’s almost as if the whole business model has been designed to frankly screw Australian apartment owners”, one Sydney apartment owner told Four Corners.

This week, A Current Affair (ACA) reported on how Strata fees are crippling apartment owners.

The segment cited property experts, who fear that soaring strata and owner’s corporation fees could threaten the future of the apartment market.

“There are 2.5 million Australians currently calling an apartment home. While they may be cheaper than houses, they’re leaving many financially crippled by the increases in strata fees”, ACA reported.

On top of the above, there are also costs associated with fixing the large number of defects endemic to Australian high-rise developments.

According to a November 2023 NSW government strata study, more than half of newly registered structures since 2016 had at least one significant problem, with repair costs averaging $331,829 per building.

The Strata Community Association NSW found that waterproofing was the most common major issue, followed by fire safety.

A separate Four Corners Report, “Cracking Up”, revealed a systemic failure to regulate and safeguard consumers despite repeated warnings.

Bronwyn Weir, a construction lawyer, cautioned that speeding up the development of high-rise housing complexes will inevitably result in shortcuts and more construction defects.

Weir said that “thousands and thousands of apartments have serious defects in their buildings”, labelling the problem “enormous”.

“We have what is now, you know, a systemic failure that is quite difficult to unravel”.

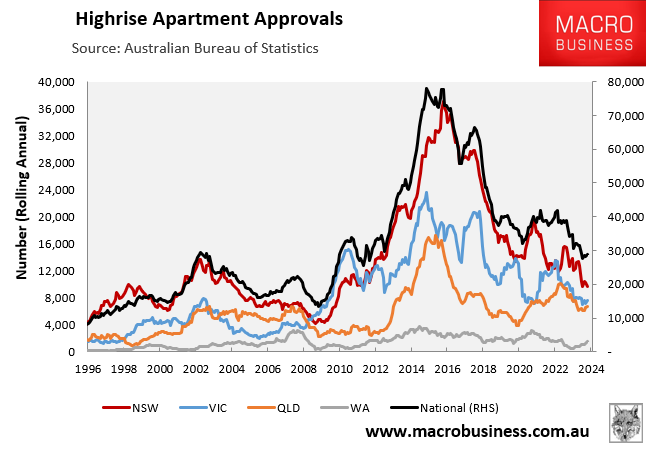

The last decade’s high-rise apartment boom was a fiasco, costing buyers and taxpayers dearly.

Australia’s policymakers are now attempting to double down by rezoning more of our cities for high-rise in a bid to entice an even more enormous construction boom. The inevitable result will be degraded quality and more defects.

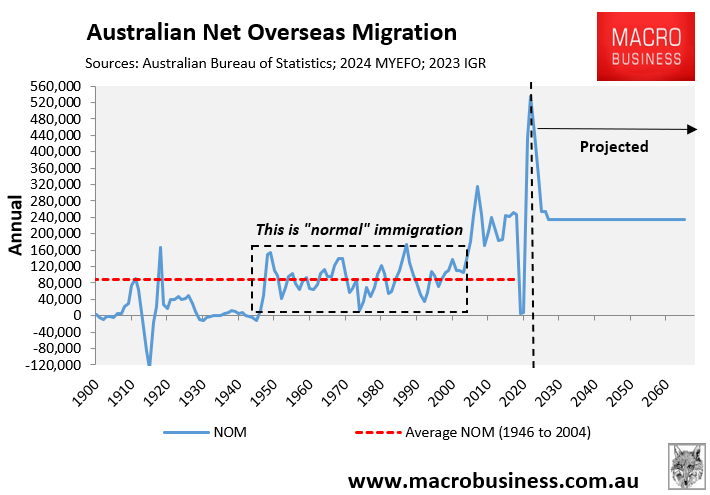

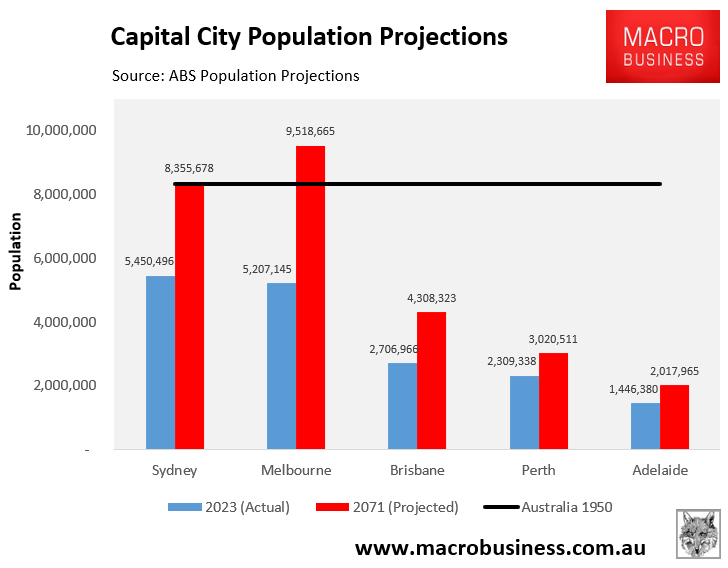

High-rise shoebox apartments would not be necessary if the federal government did not rapidly grow our cities via endless mass immigration.

Regrettably, federal and state politicians have abandoned governing for the good of the Australian people. We are essentially business inputs to fuel the Ponzi economy.