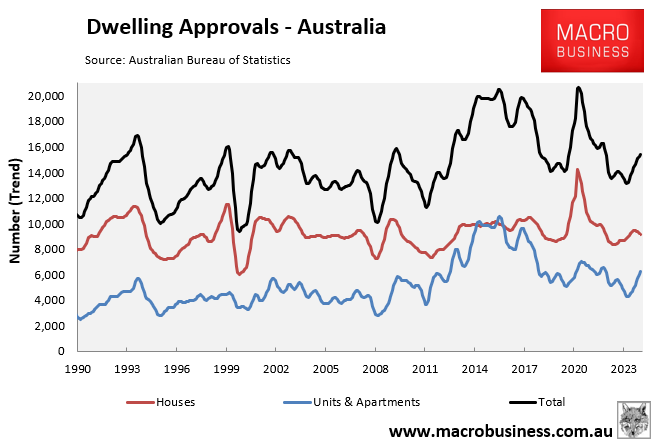

The Australian Bureau of Statistics (ABS) on Monday released dwelling approvals data for the month of December, which recorded total approvals of 15,378 in trend terms.

As illustrated in the next chart, approvals have rebounded recently, driven by units & apartments.

Even so, the 15,378 monthly approvals were 23% below the 20,000 monthly run rate to meet the Albanese government’s target of building 1.2 million homes over five years.

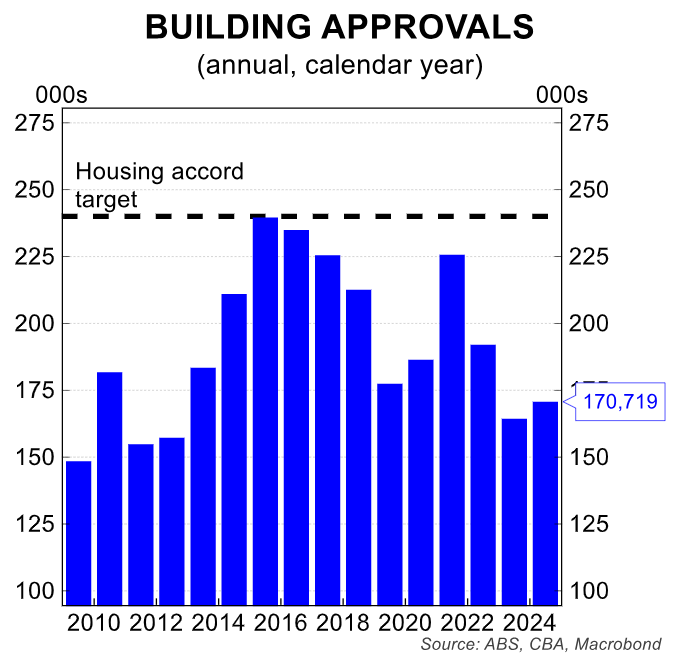

In the 2024 calendar year, 170,721 homes were approved for construction. While this was 3.9% higher than the 164,330 homes approved in 2023, it was 29% below the Albanese government’s housing target, which requires 240,000 homes to be constructed annually.

“Residential building approvals in 2024 increased from the decade low seen in 2023 but were nowhere near the levels needed to meet underlying demand for housing”, noted HIA Economist, Maurice Tapang.

“This brought the volume of approvals in the 2024 calendar year to 170,720, up by 3.9 per cent compared to the decade-low levels of 2023 but well below anything seen in the preceding ten years”.

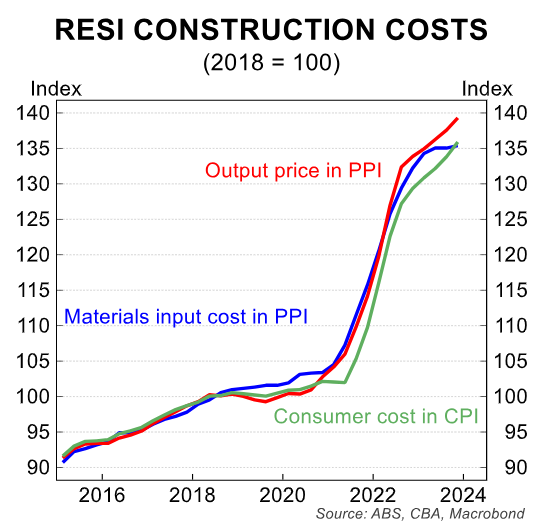

“It remains a challenging environment given the higher cost of borrowing, land and building a new home. The cost of delivering new land to market also remains high, with land prices continuing to increase”, Tapang said.

The following chart from Harry Ottley shows the wide gap between dwelling approvals and the Albanese government’s housing target.

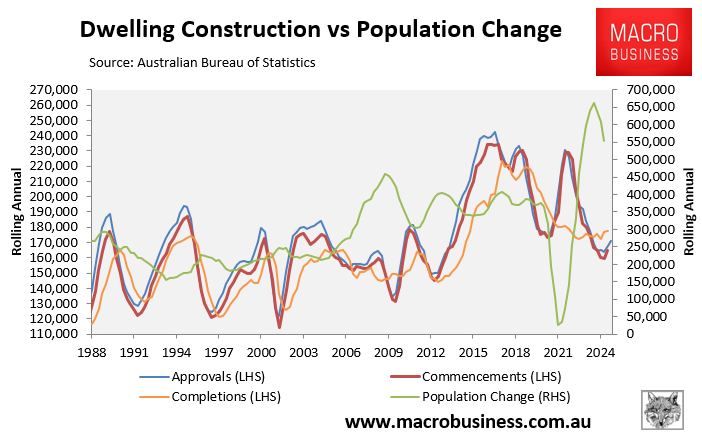

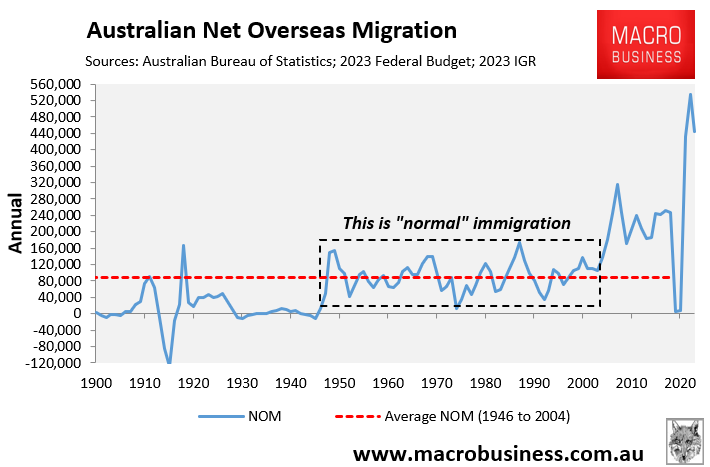

The gap between housing supply and demand also remains vast, as illustrated in the following chart.

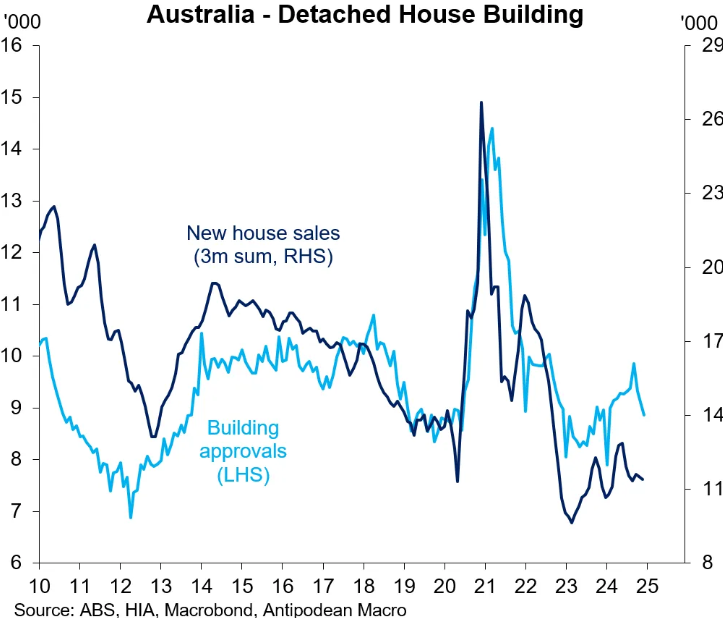

The decline in detached house approvals has also been matched by the HIA’s new home sales figures, which have stalled.

“The number of dwellings being approved remains well below what is required to ease the housing shortage and meet government targets”, noted CBA economist Harry Ottley. “But recent progress has been encouraging, albeit slow”.

“We expect lower interest rates in 2025 to stimulate more building activityin coming years”.

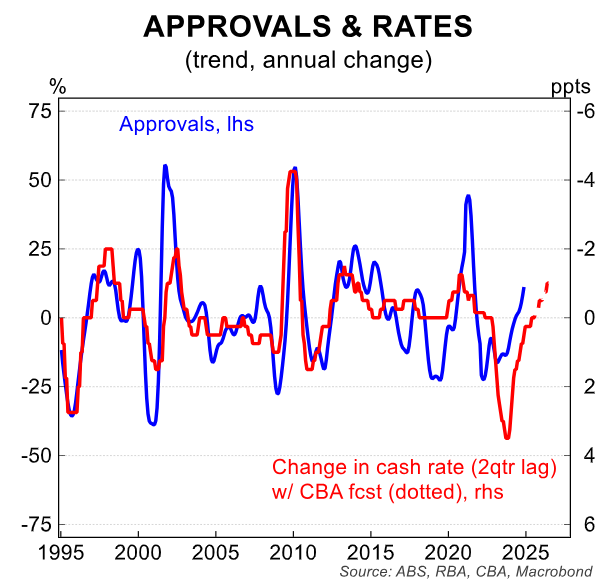

Indeed, the next chart from Ottley suggests that interest rate cuts are a necessary precondition for a rise in housing construction.

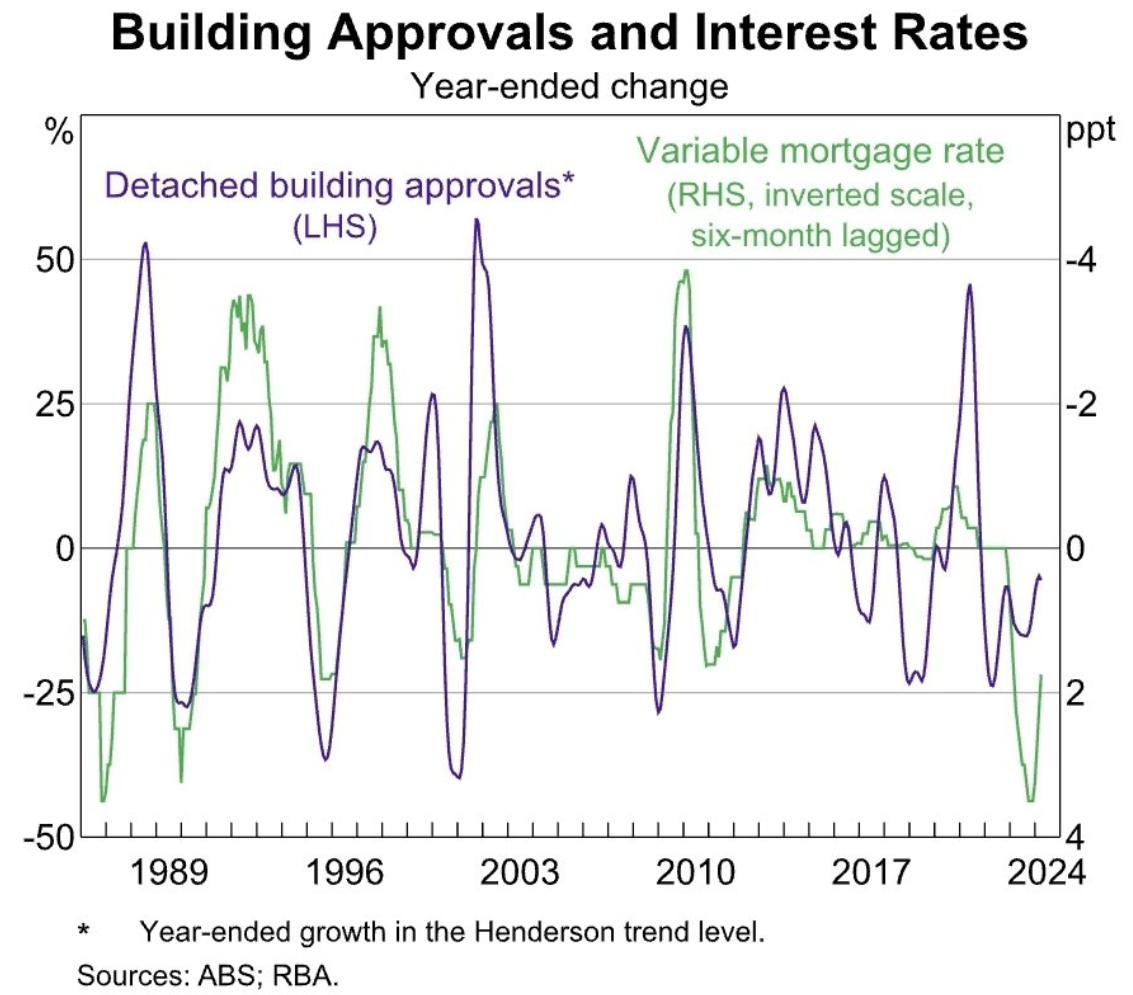

The following chart from the RBA also shows the historical relationship between mortgage rates and dwelling approvals.

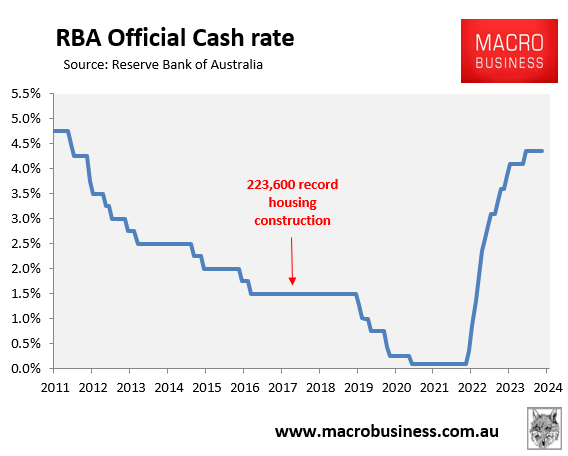

Even if the RBA cuts interest rates this year, they are likely to remain structurally higher than they were pre-pandemic.

Combined with the structural increase in construction costs, this suggests that Australia’s construction rebound will be stunted.

The logical policy response from the government should be to reduce demand commensurably by lowering net overseas migration to a level compatible with the supply side.

Unfortunately, Australian policymakers and housing “experts” refuse to acknowledge this basic fact and continue to present the housing shortage as a supply problem.