On Thursday, I reported how the Reserve Bank of Australia’s (RBA) latest Statement of Monetary Policy (SoMP) suggested that real per capita household disposable income may not recover back to its Q2 2022 peak until the early 2030s.

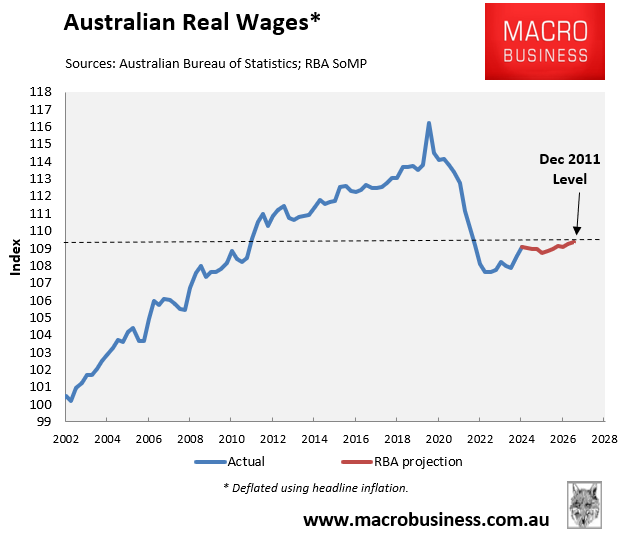

The situation is even worse for real wages. The following chart shows actual real wage growth as of Q4 2024 along with the RBA SoMP’s forecasts to Q2 2027.

By Q2 2027, Australian real wages are forecast to be 5.9% below the Q2 2020 peak, tracking at around the same level as December 2011.

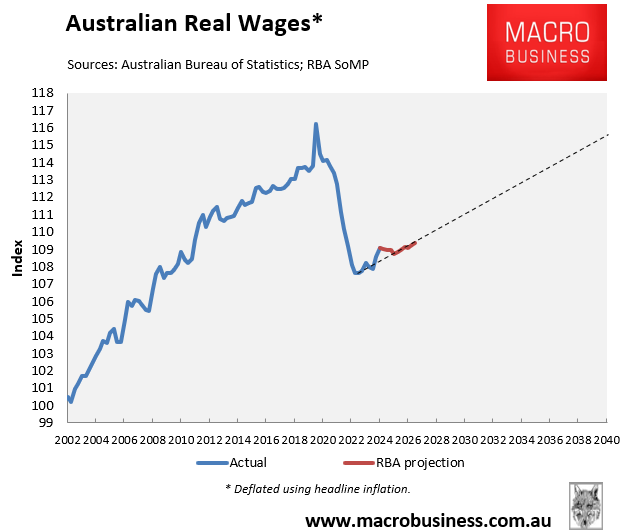

Extrapolating the RBA SoMP’s forecast suggests that real wages may not recover to the Q2 2020 peak until around 2040.

Obviously, a lot can happen between now and then and the above chart does not represent a forecast, nor does it even represent the likely outcome.

However, it does illustrate how Australian wages will take years to recover from the purchasing power lost over the past five years.

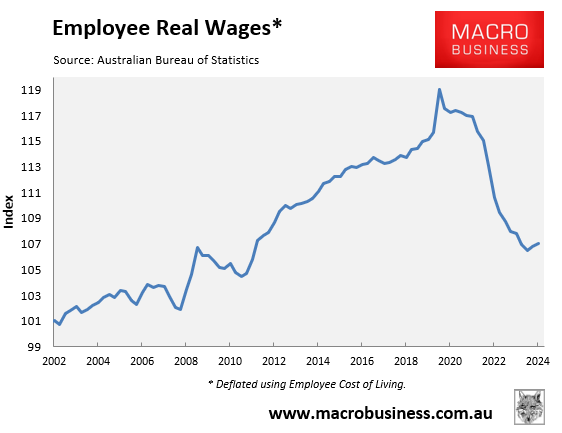

This loss of purchasing power is even worse when wages are deflated by the ABS’ employee cost of living index instead of headline CPI inflation.

The bottom line is that Australian workers have suffered a lost economic decade.