Australian housing affordability has never been worse.

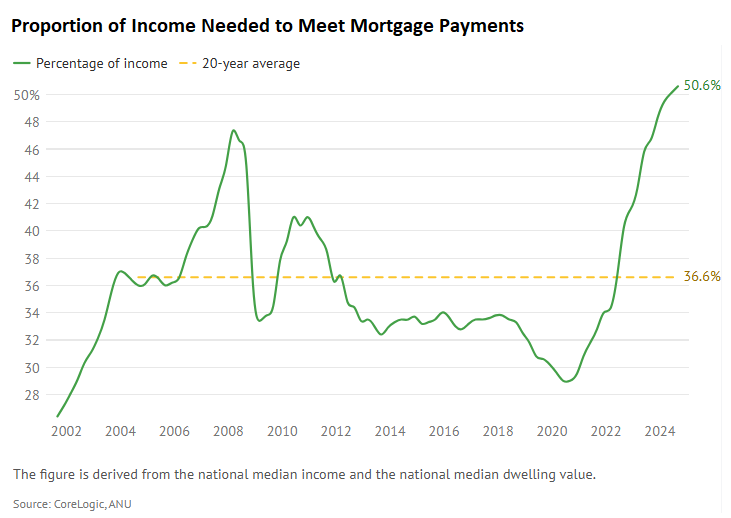

The percentage of income required to meet repayments on the median-sized mortgage hit a record high of 50.6% at the end of 2024.

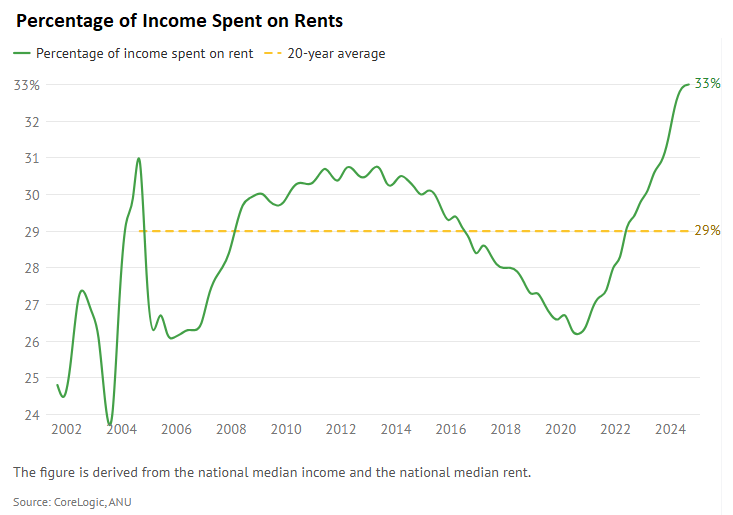

Rental affordability also reached a new low, making it difficult for first-time buyers to save a deposit.

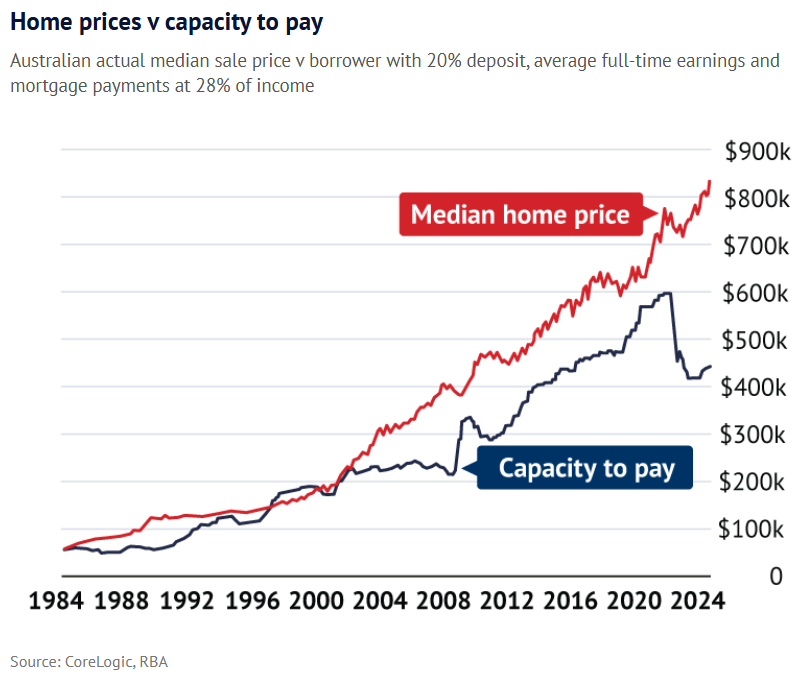

Prior to last week’s 0.25% interest rate cut from the Reserve Bank of Australia (RBA), a record gap had developed between borrowing capacity and home prices.

While additional rate cuts from the RBA should close the affordability gap somewhat, a new survey from Finder revealed that nearly one-third of Australian adults polled would take out a 40-year mortgage if it reduced their monthly repayments to a more affordable level.

Finder’s analysis showed that only three lenders currently offer 40-year mortgages in Australia—two exclusively to first-home buyers.

The major banks are expected to begin offering 40-year mortgages once the notion of a mass market takes hold.

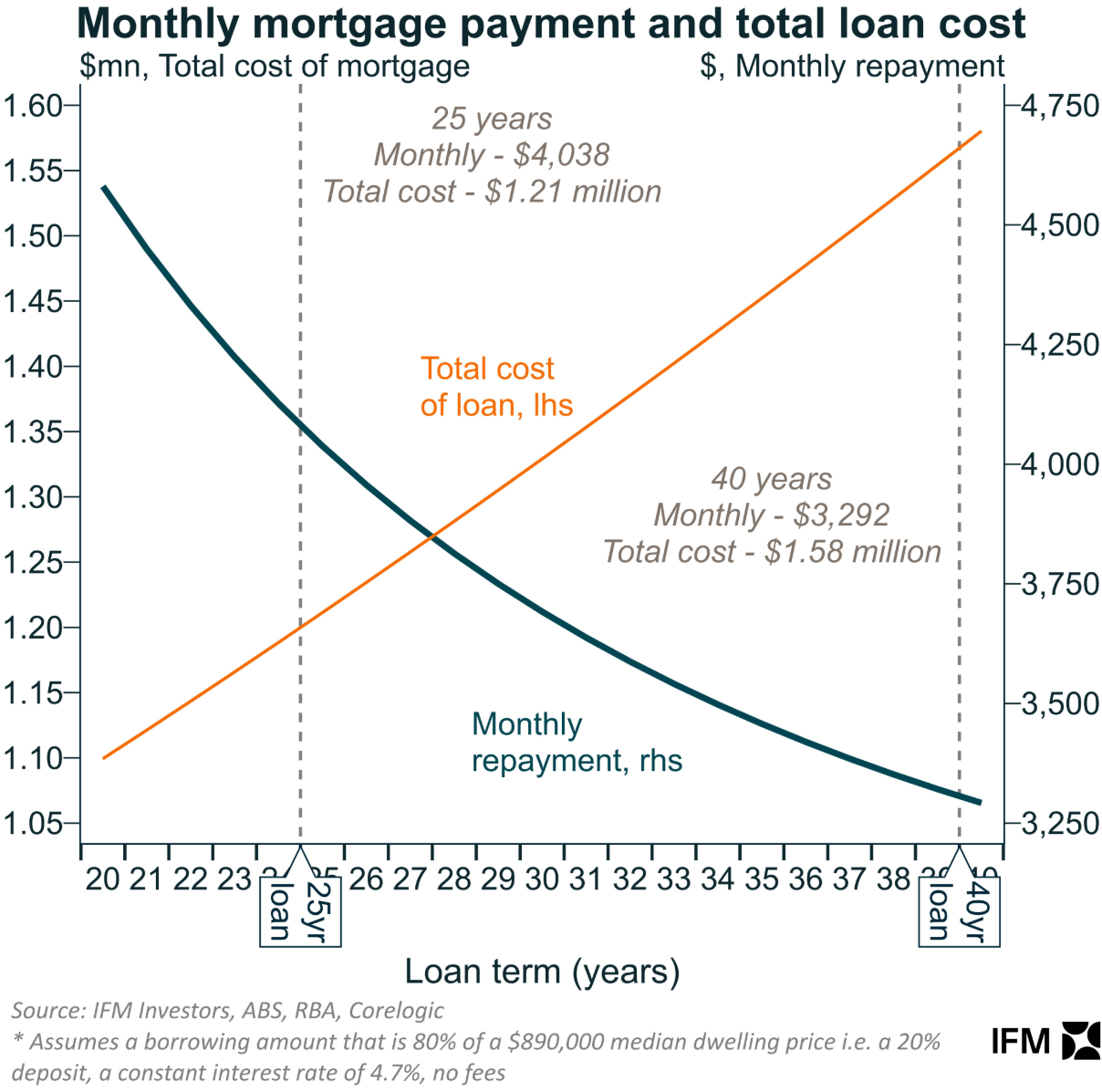

The following chart from Alex Joiner from IFM Investors illustrates the extra borrowing capacity from a longer 40-year mortgage term.

While monthly repayments are reduced from longer loan terms, the total repayment cost increases, and more Australians will carry mortgage debt deep into retirement.

Extending mortgage terms is another blatant attempt to boost housing demand and spark a fresh price boom.

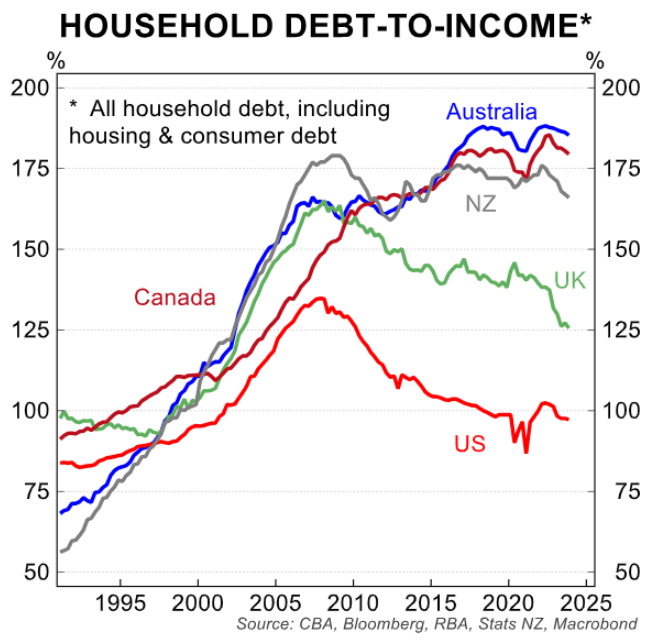

Allowing individuals to borrow more for home will accomplish the same thing it always does: raise debt levels and increase long-term housing costs.

This century has provided ample empirical evidence of how the story will end.

Neither politicians nor banks, nor the property industry desire more affordable housing because it would necessitate lower prices.

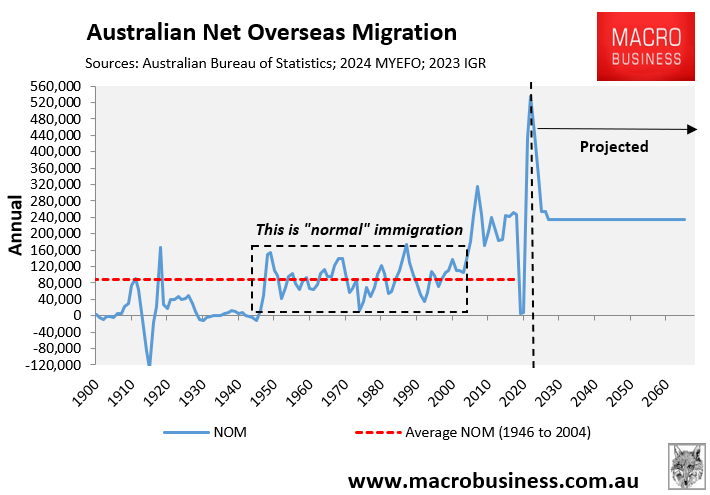

They will never recommend limiting immigration to moderate, sustainable levels of less than 120,000 per year so that housing supply can keep up with demand.

Nor will our politicians implement broad-based tax reforms to shift economic activity away from housing speculation and towards productive activities.

Instead, politicians and the property industry pretend to care by implementing bogus solutions for prospective first-time home buyers while deliberately raising housing prices through self-defeating demand-side stimulatory policies.