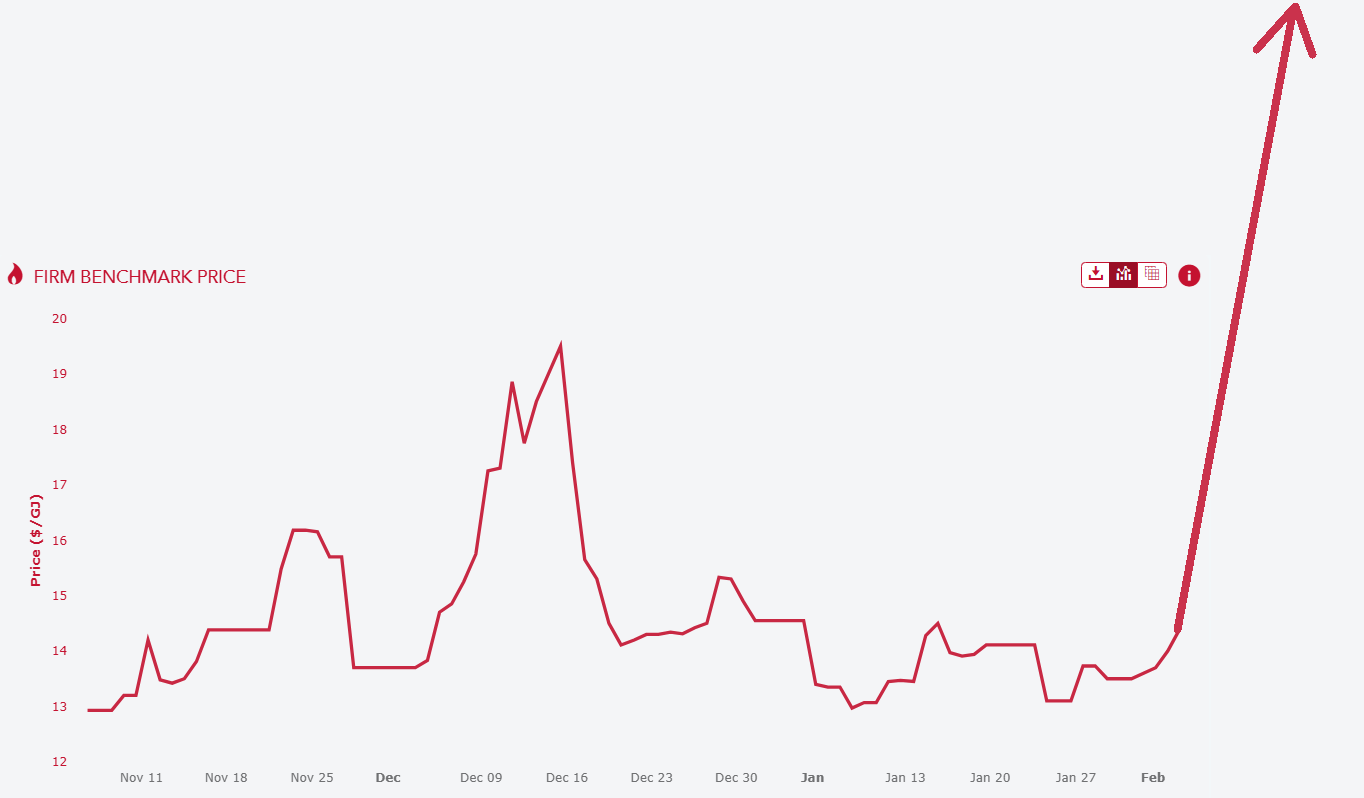

Typically, Asian LNG market prices come off after the new year as Asia exits winter.

Instead, there is a steady grind higher this year with no end in sight.

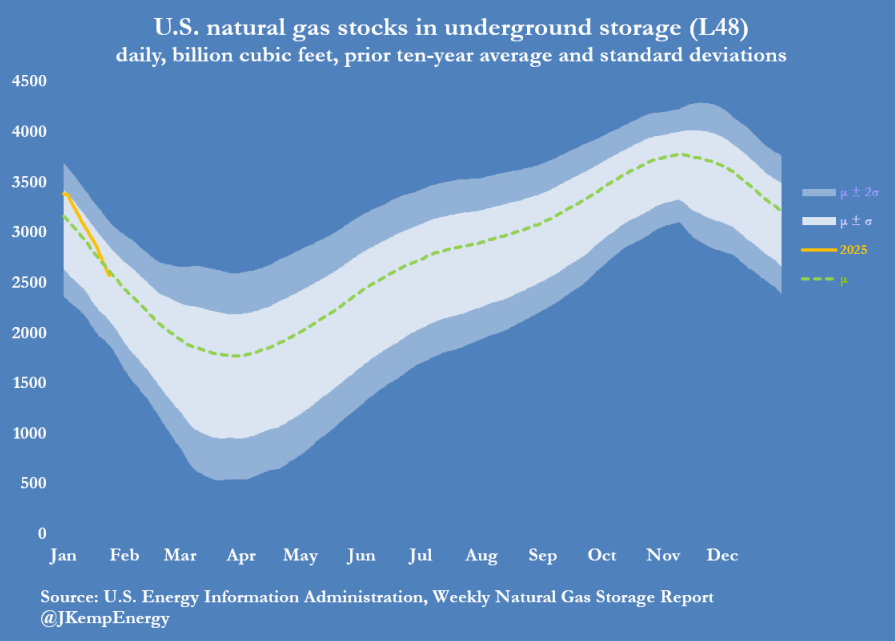

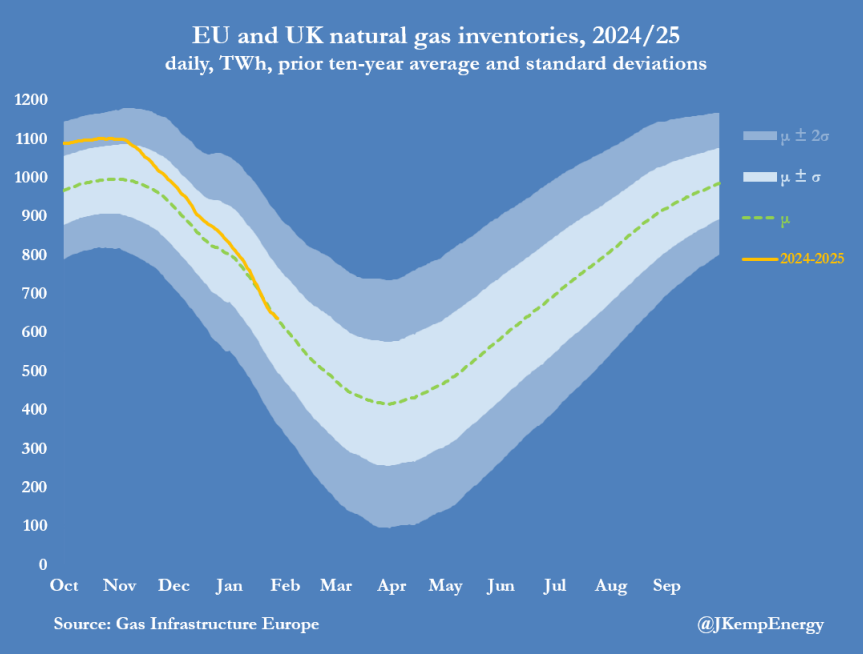

This is because there is less inventory in both the US and Europe this year.

Adding salt to the wound, one of China’s few tariff responses to King Trump was a 10% LNG tariff, meaning more draw on Australian gas.

In any normal economy, this would be great news. But in the failed East Coast gas market, it is catastrophic.

“In an increasingly protectionist global trade environment, Chinese tariffs on US LNG are likely to put more pressure on Australia’s domestic gas market, worsening an already urgent supply crisis,” said Steve Davies, head of the Australian Pipelines and Gas Association, whose members include pipeliner APA Group, producer Esso and gas services companies.

…After the announcement of China’s tariffs on US LNG, sources said they feared the impact would be fewer spot cargoes available from Queensland for the domestic market, increasing the volatility of local electricity and gas prices.

One said wholesale gas prices on the east coast could rise 10-15 per cent as a result, with the impact being felt in about six months in the higher-demand winter period and flowing through to electricity prices.

No? Really!

It is so much worse than this.

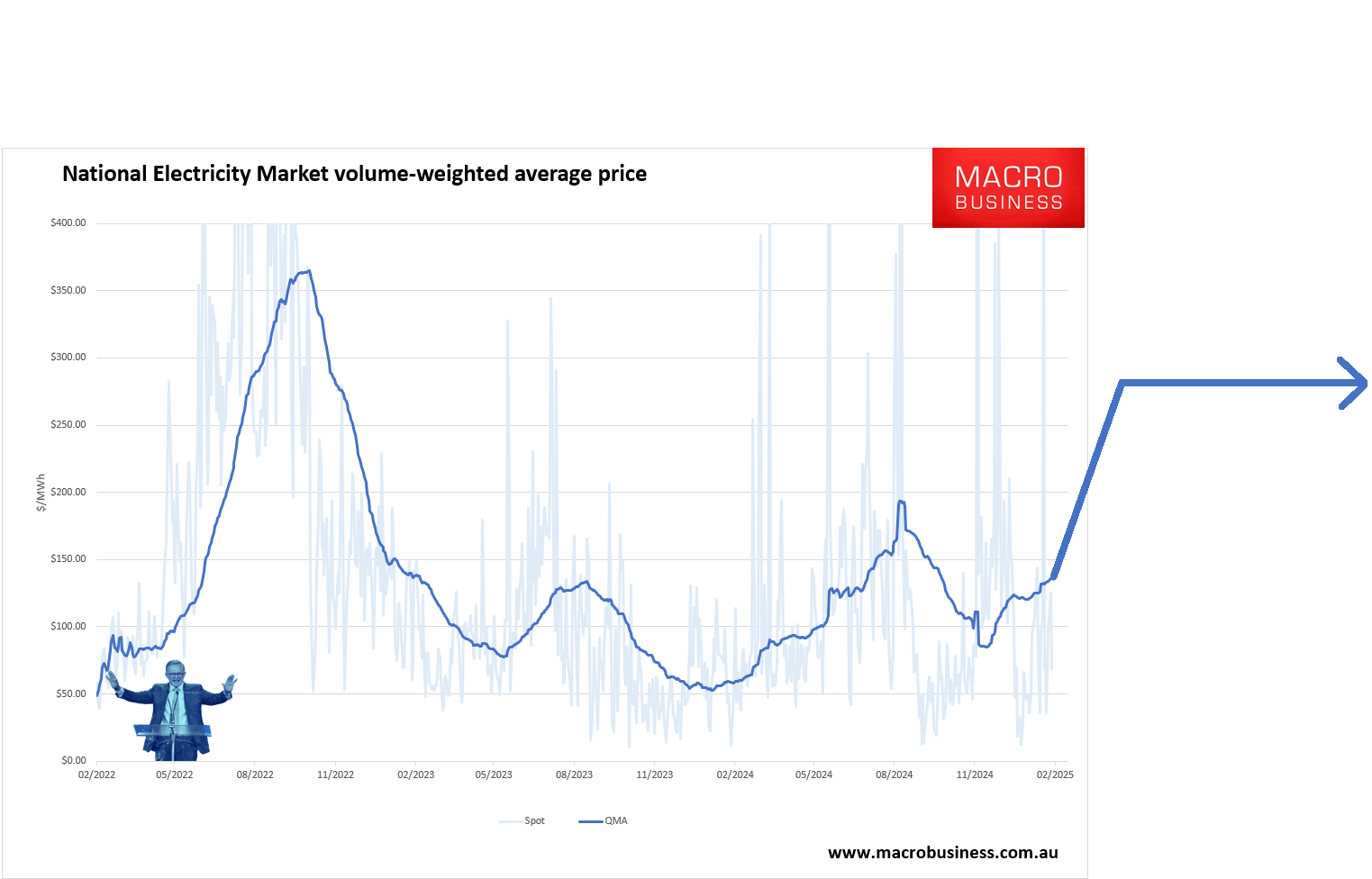

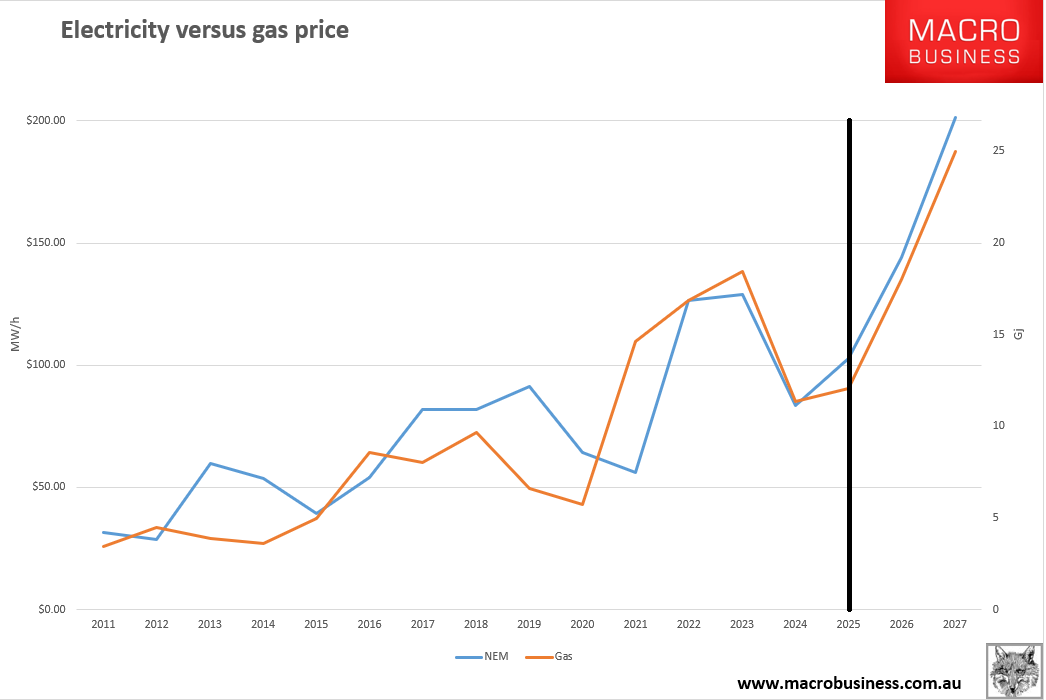

LNG imports will begin later this year, and prices for imported gas are sitting around a $25Gj minimum.

The moment they start, the East Coast gas cartel will ship out more gas and drive the local price to import parity, 74% above today’s already extortionate gas price.

Gas sets the wholesale price of electricity, so it will rise by the same amount. Unlike the Ukraine War shock, the price will never come down again.

If the LNP wins power, it intends to also remove the ADGSM and energy rebates. This will drop an energy shock on Australian households so large that all I can say is go long candles.

We are talking about adding 4% to the CPI and double that when we include spillovers.

It is absolutely bonkers.

Conversely, if Labor is in power, it will have to double its energy rebates to $7bn a year, which is pure extortionate profit subsidies for the LNG exporters. And will have to come out of your increased taxes.

But wait, there’s more!

These figures may be too conservative. The tariff war is also likely to smash steel and iron ore prices.

If, as I expect, iron ore falls into the $50s across 2026/27, the AUD will be crushed as well.

If the AUD reaches 50 cents then LNG futures predict Aussie gas import prices would rise to $27Gj.

And the budget hit from bulk commodity losses will be huge, challenging the energy rebates even under Labor.

In fact, every time the economy is hit by lower bulk commodity prices, LNG imports will build in a secondary inflation shock via the weak currency meaning every time the global economy enters a downturn, Australia will be unable to cut rates or stimulate fiscal as aggressively.

The RBA will be cornered, the budget will implode, tax hikes will rain down, households will buckle, and the great Australian housing bubble will burst.

Or, we can apply a 15% gas reservation policy to the East Coast and an export levy above $7Gj to get rich.