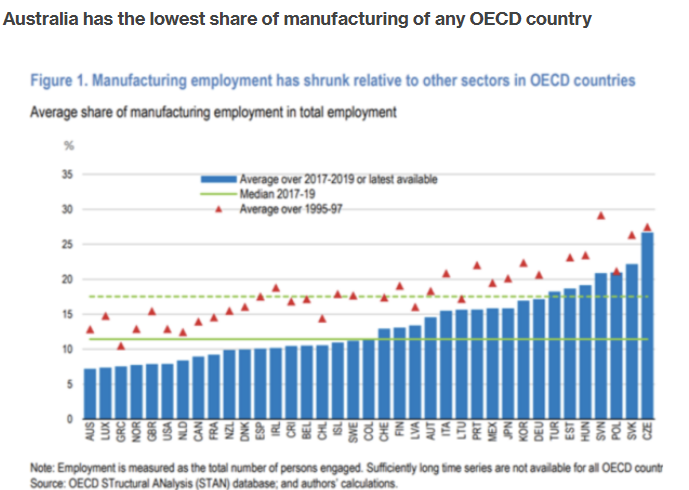

Australia’s manufacturing sector has shrunk to just over 5% of GDP, the lowest share in the OECD.

Late last month, federal Minister for Industry and Science Ed Husic spruiked Labor’s Future Made In Australia policy to boost local manufacturing.

“In Labor’s first term in office, the policies have come thick and fast: the $15 billion reconstruction fund; the $20 billion Rewiring the Nation Fund; $13.4 billion in hydrogen and critical minerals production tax credits; $1.5 billion for businesses solar and battery manufacturing supply chains; and $2 billion for green aluminium production credits”, The AFR reported.

“And that’s just the policies in Labor’s plan to “Build Australia’s Future” that come with price tags starting with a ‘b’.”

“There will be billions more to kickstart local green iron and steel making”.

The reality is that Australia’s manufacturing sector can only remain competitive with affordable and reliable energy. And Australia has no energy future if gas and electricity prices rise.

In 2022, fertiliser manufacturer Incitec Pivot shut its Australian plants due to high energy costs.

In 2024, Australia’s last significant plastics manufacturer, Qenos, closed due to high energy costs, making Australia wholly reliant on imported plastics from China.

Last month, Orica, the world’s largest provider of explosives and chemicals for mining and fertilisers for farming, threatened to wind down operations in Australia and invest in the US instead.

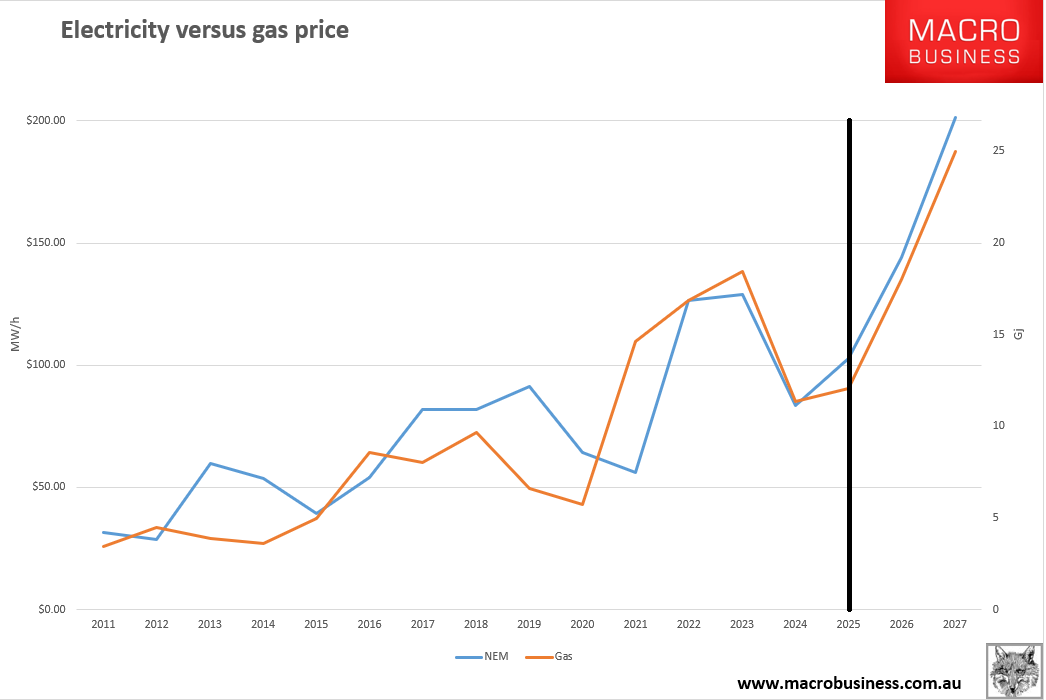

Orica’s managing director, Sanjeev Gandhi, complained that electricity prices have gone up threefold in the past 10 years, gas prices have gone up fourfold, and the cost of renewable energy is not cheap.

“The US is pro-manufacturing, they’ve got cheap energy, they’ve got good gas supply and reserves”, he said.

This month, Australia’s only architectural glass manufacturer, Oceania Glass, collapsed after 169 years of operation due to high energy costs and Chinese dumping.

Last week, Moody’s released a detailed analysis of Australia’s green energy transition, which it warned could raise real wholesale power prices (i.e., excluding transmission costs) by 5%-15% by 2035 and retail energy costs by 20% to 35%.

Moody’s projected that Australia would need to spend between $150 billion and $190 billion in today’s dollars on new infrastructure and transmission over the next decade to meet the renewables rollout. These costs will be capitalised into residential power bills.

Moody’s said that because renewables are intermittent and unreliable (because they depend on the weather), substantively more renewable energy capacity (around 3 times) must be built to cover the equivalent amount of dispatchable fossil fuel power (i.e., coal and gas).

Moody’s noted that gas-fired electricity generation will become increasingly important as a bridging fuel to cover the gap between demand and intermittent renewable supply.

As a result, energy costs will likely increase much further than Moody’s projected because East Coast gas prices will continue to rise, making firming power far more expensive.

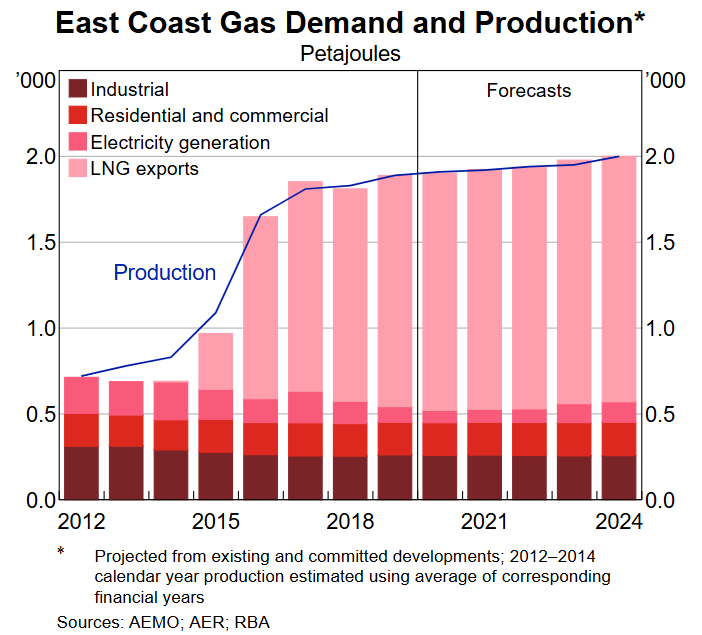

The lack of domestic reservation on the East Coast has seen nearly three-quarters of our gas exported, mainly to China, causing shortages and soaring costs at home.

The gas price situation will only worsen once import terminals come online in New South Wales, Victoria, and possibly South Australia, locking in even higher gas and electricity prices.

Instead of wasting billions of taxpayer dollars picking winners as part of its Future Made In Australia policy, the federal government should dramatically slow the renewables rollout and force East Coast gas reservation, in concert with old-fashioned cost-plus pricing regulation and gas export levies.

Australia has an abundance of energy, so its energy costs should be among the lowest in the world.

Policy failure and the pigheaded pursuit of ‘net zero’ are denying Australians cheap energy.

Do we want a situation in which the only viable manufacturing in Australia is that which survives on government subsidies?