Australians are drowning in mortgage debt.

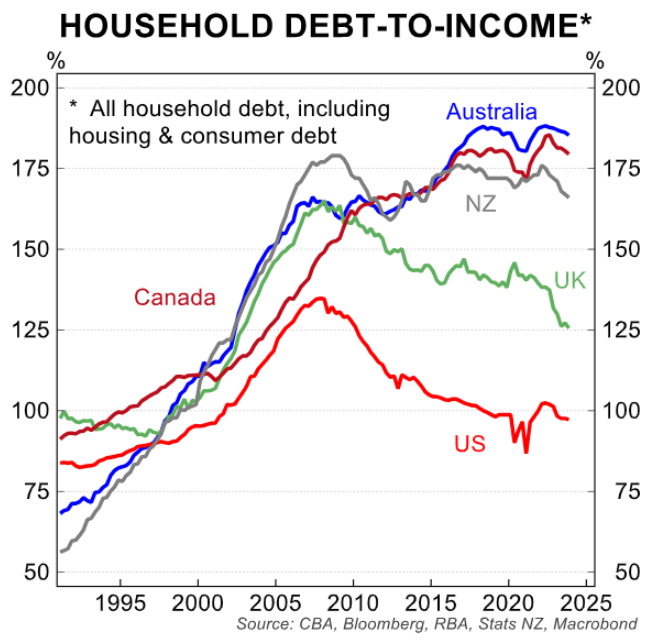

We have among the most indebted households in the world.

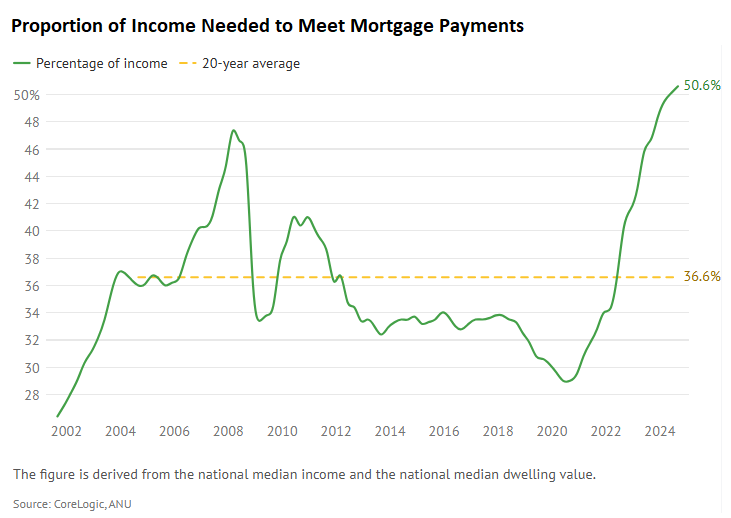

Mortgage payments also take up a record share of Australian household disposable income.

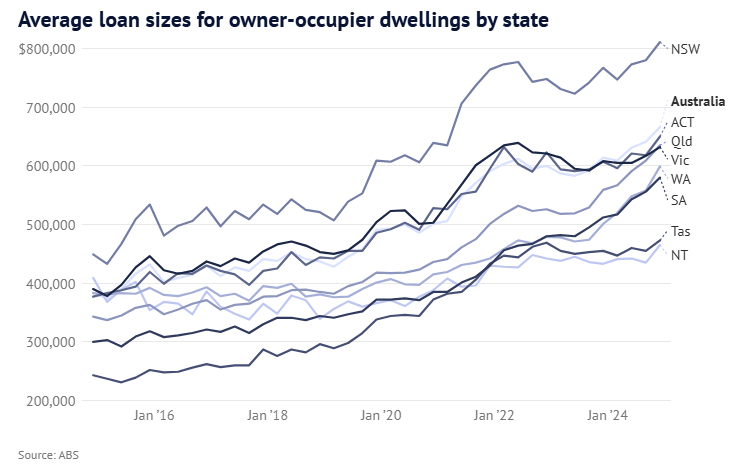

On Wednesday, the Australian Bureau of Statistics (ABS) released housing finance data for Q4 2024. It revealed that the average Australian home loan has jumped to an all-time high of $666,000, up $25,000 over the quarter.

The average home loan in New South Wales also hit $800,000 for the first time.

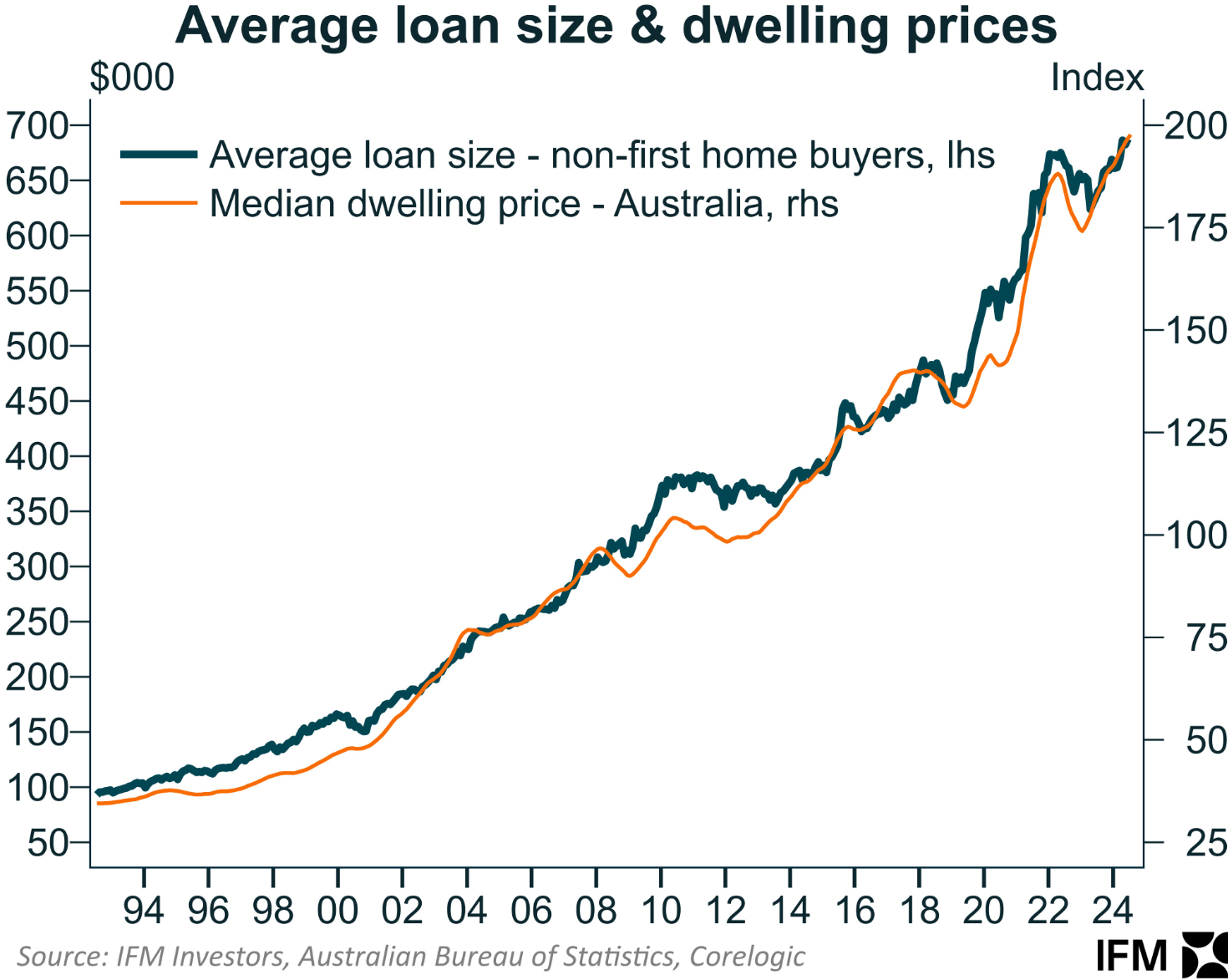

The surge in average loan sizes is behind the inexorable growth in Australian home prices.

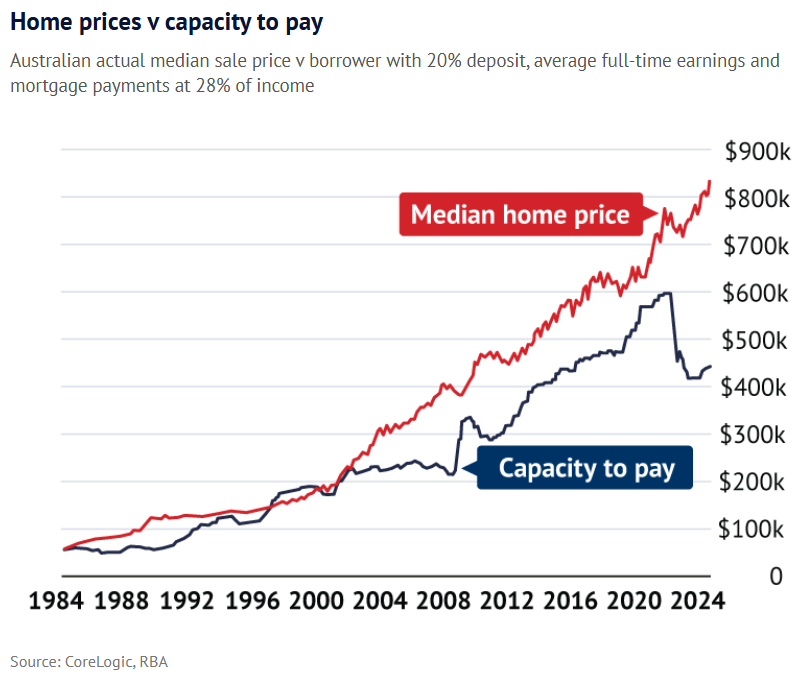

Australian housing affordability is severely stretched, evidenced by a record gap between borrowing capacity and median home prices.

As a result, the housing market requires three key things to continue appreciating.

- Interest rates need to fall to improve borrowing capacity.

- Incomes need to rise.

- Rules around lending need to ease to allow buyers to take on larger mortgages.

The first criterion will likely get ticked off next week, with the Reserve Bank of Australia expected to commence an interest rate easing cycle.

Nominal incomes always rise, but the rate of growth is slowing.

Both sides of politics have committed to easing lending standards, allowing borrowers to take on bigger mortgages.

Treasurer Jim Chalmers this week ordered financial regulators to soften home-lending rules for millions of Australians with university debts.

Under the changes, a borrower’s student debt will be discounted from mortgage serviceability tests where a bank expects the borrower to pay off the debt in “the near term”.

Compare the Market analysis shows a tertiary-educated single professional earning $125,000 would be able to borrow an extra $95,900 based on the announced changes.

The extra borrowing power for some earning $100,000 would be more than $56,000, whereas a person earning $75,000 can borrow an additional $26,800.

The Coalition opposition has also promised to allow home buyers to raid their superannuation savings for a deposit, and it has committed to watering down responsible lending obligations.

These policies would boost housing demand and increase mortgage debt, driving prices higher. As a result, they would make the affordability situation worse.

Australia is already the land of the mega-mortgage. It is about to get much worse.