DXY is back on more tariff talk.

AUD was soft.

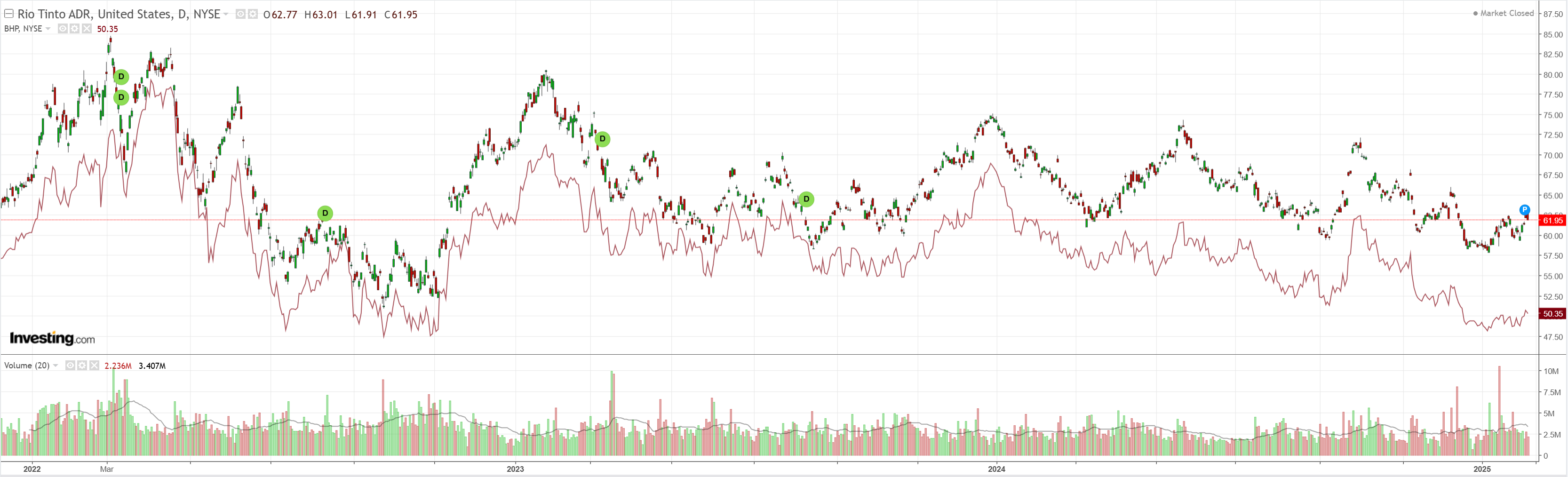

Lead boots are weighing.

Gold is a machine.

Copper bubble!

Miners lagging.

EM maybe.

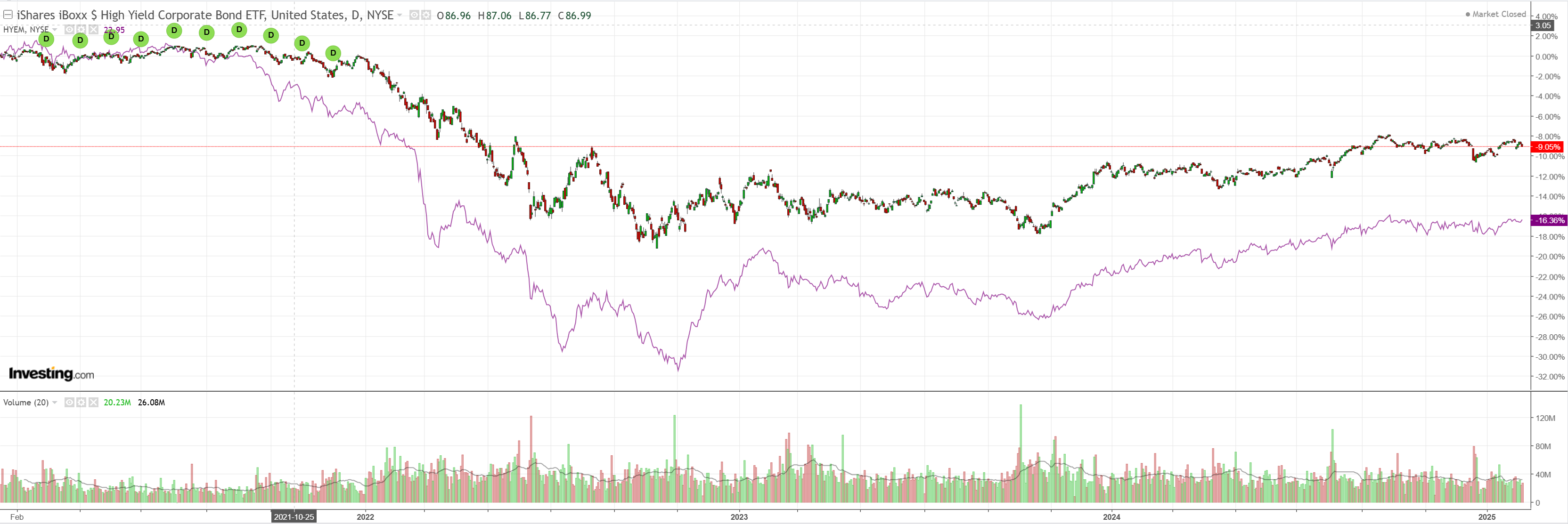

Junk in the trunk.

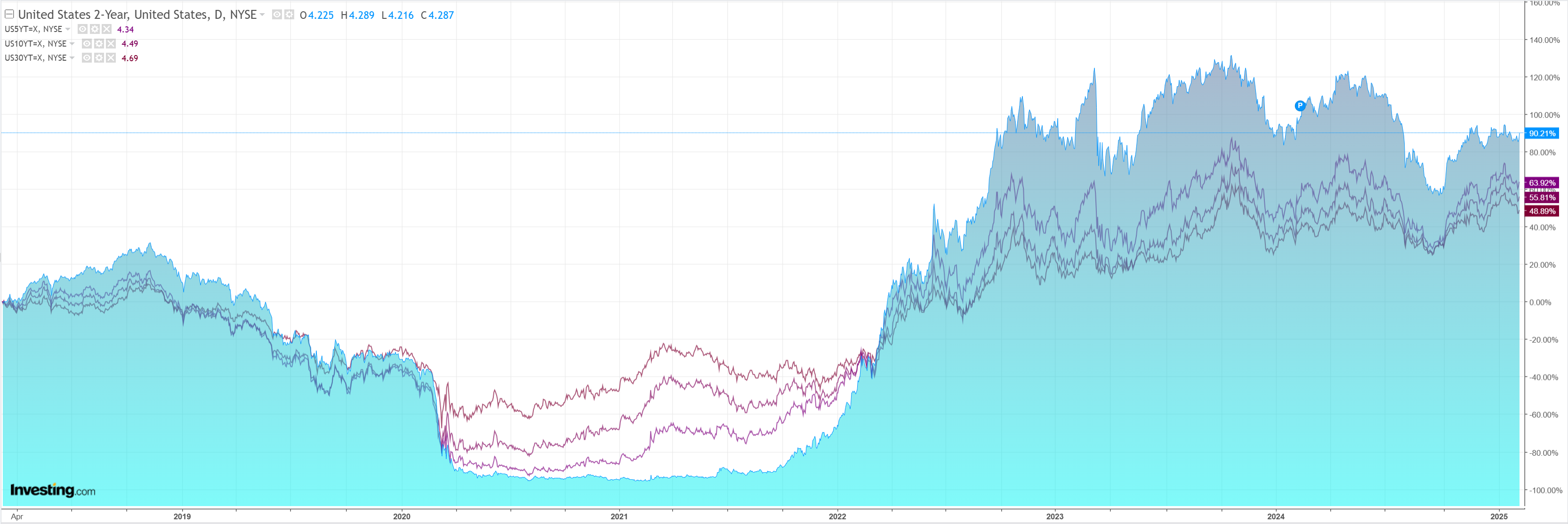

Yields up.

Stocks down.

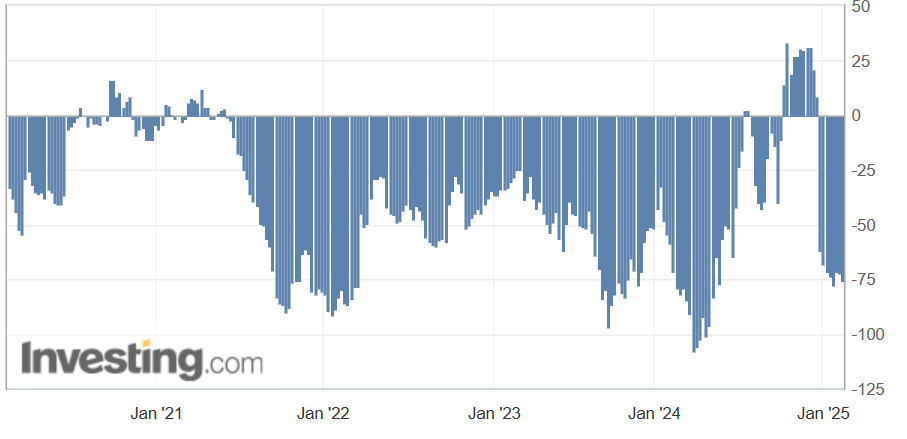

AUD CFTC still very short in futures but long in options. Futures rule.

US jobs were reasonable enough—142k and 4% UE. Wages are still firm.

BofA says it’s too early to buy AUD.

AUDFX has been highly sensitive to tariff noise, especially China-related, briefly reaching post-Covid lows vs. both USD and its trade-weighted basket. While consistent with our bearish 1Q outlook, the current level is close to our forecast trough at 0.62.

While we remain comfortable with this forecast, it is too early to fade the tariff risk premium just yet.

US tariff actions have so far skewed a little more to countries other than China, in turn keeping CNY depreciation in check, but risks are skewed to the downside with associated spillover to AUD.

Meanwhile, sustained disinflation has brought forward our economists’ forecast for RBA rate cuts so rate differentials are no longer an obvious tailwind for AUD.

However, we continue to see a gradual recovery in AUD from 2Q onward, propelled first by USD depreciation followed by the lagged impact of China stimulus in the second half of ‘25.

Our new forecast for a higher RBA terminal policy rate of 3.6% premised on sticky inflation supports a medium-term trough in AUD as well.

Meh. I’m still bullish AUD short-term on Trump’s weak tariffs to date, bearish market positioning, and misjudgments about high RBA terminal rates.

I am still more bearish later as Trump versus China deteriorates and CNY falls, iron ore is clubbed with Simandou, and the RBA is forced lower most think in 2026.

For now, bear hunting season is intact.