DXY is breaking down as EUR rises on a peace premium. Premature is what FX does best!

AUD to the moon!

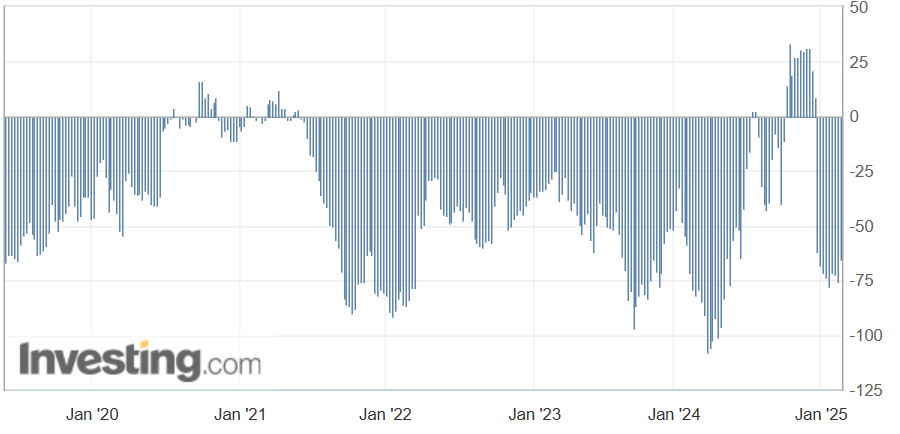

The AUD short has been squeezed a little. Not enough.

Auld lead boots helping out.

Gold is shellacked. This is a positioning unwind but also a fear of an outbreak of peace. Imagine if Russian assets were unfrozen?!

Copper bubblet yawnathon.

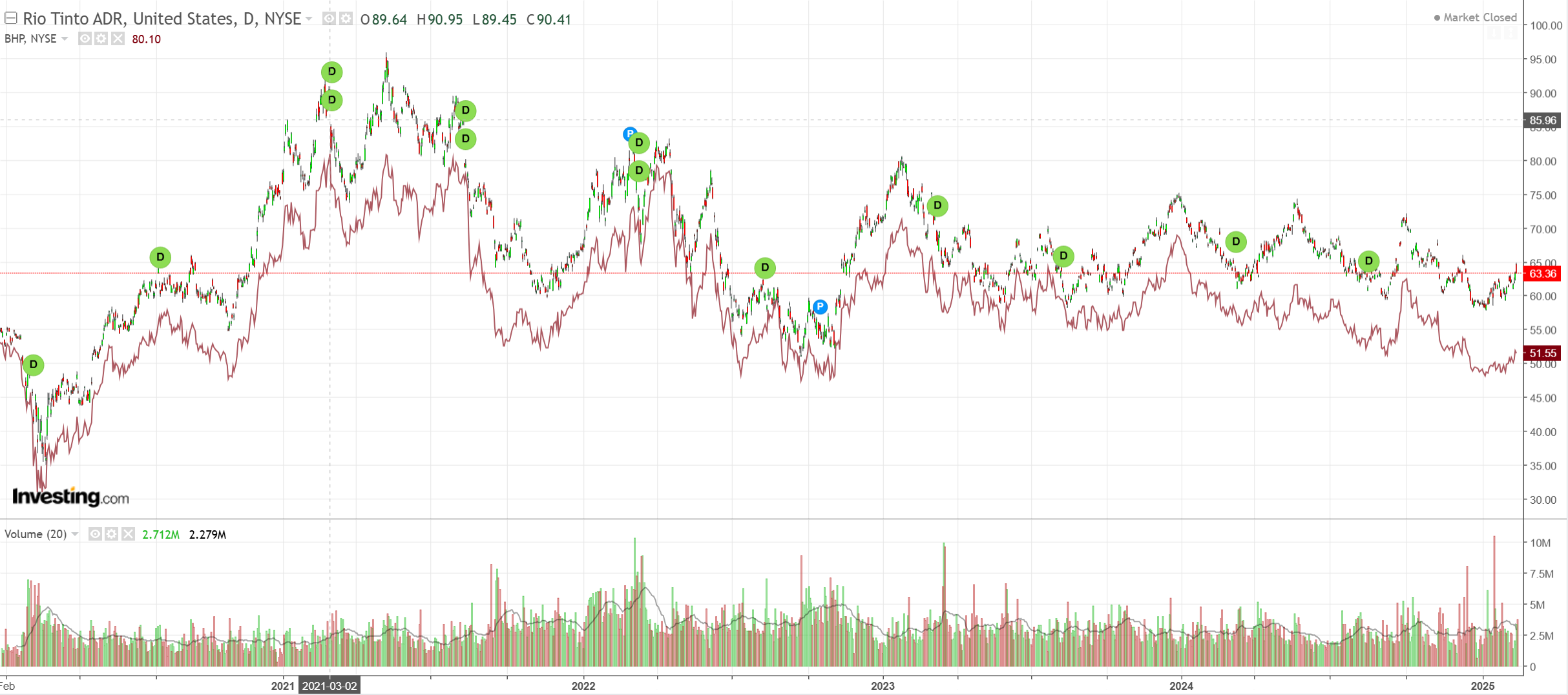

Nasty shooting star for beleaguered miners.

EM deepsuckered.

Is that a junk breakout I see before me?

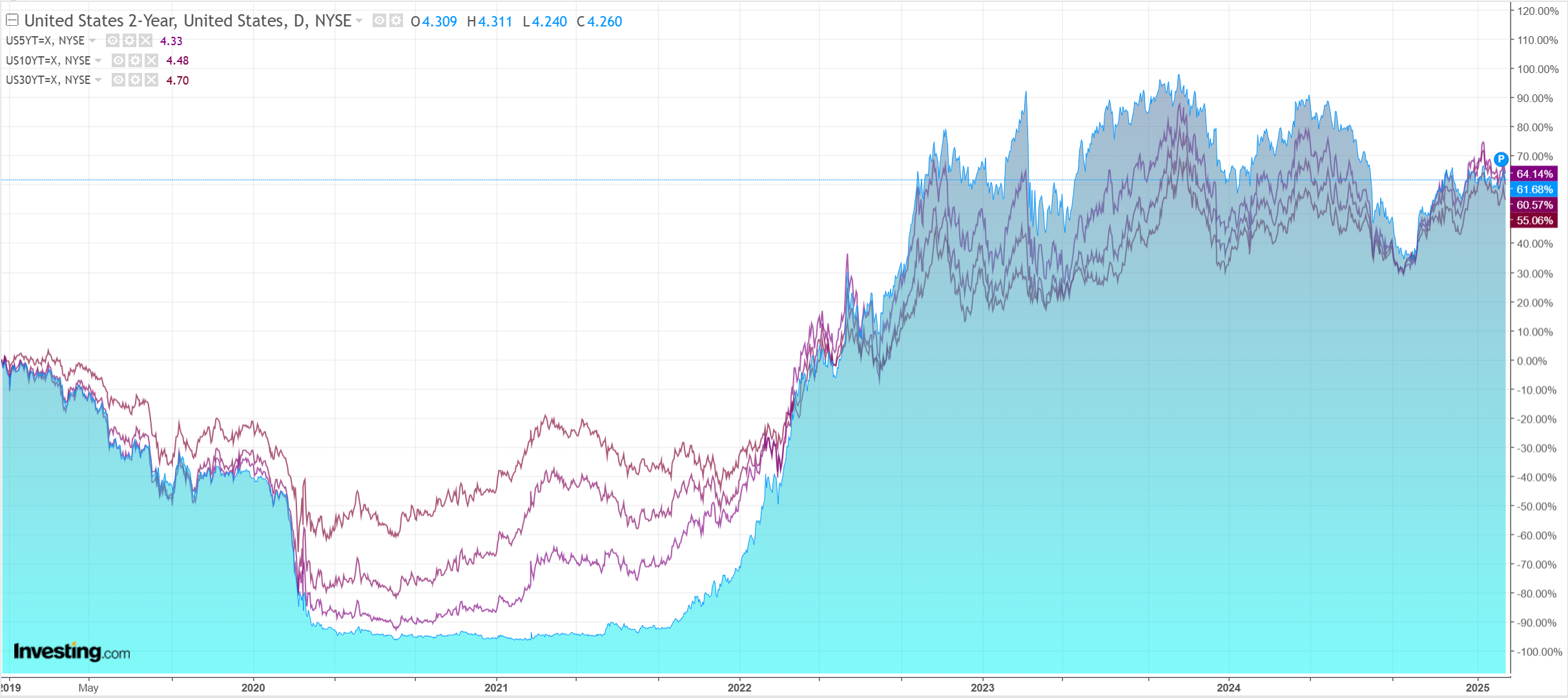

If yields keep falling.

Stocks at a glass ceiling.

Is there going to be peace in Europe? Goldman.

The Euro’s recent rise against the Dollar is in line with rising optimism for a peace deal that would likely bring an improvement to the Euro area’s terms of trade.

It is also true that at least so far, mere policy uncertainty has not been enough to weigh substantially on business sentiment and sustain post-election market trends.

And there are some signs that political negotiations could loosen the fiscal purse strings a little.

…Instead, we see some room for disappointment in the near term if peace negotiations fall short of expectations, and over the medium term we still think that policy uncertainty will weigh on capital flows even if tariff implementation is slightly later and business sentiment more buoyant than we expect, which is more important for the currency.

We remain confident that EUR/USD can fall back to parity in 3 months.

That is pretty aggressive. It would probably push AUD back to 60 cents. Things in Europe are moving fast.

European leaders are clinging to the limited reassurances they’ve received in private meetings with US officials. Vance, in bilateral meetings in Munich, left open the possibility of US involvement in security guarantees if Europe significantly stepped up its support, people familiar with the matter said.

“The conversation with Vance behind closed doors was very different from what he said on the public stage,” German Foreign Minister Annalena Baerbock said in an interview.

One European minister noted that everything is moving fast and Europe is not good at moving fast. To emphasize that point, another official insisted that nothing can happen until after next week’s German election, even though it may take weeks to form a new government.

In the meantime, hope can perhaps prevail and EUR keep rallying. It is an ideal way to shake out overheated DXY longs and AUD shorts.

I still say we’re biased upwards before we roll over again.