DXY is breaking down.

AUD is breaking up.

Lead boots is a standing warning.

Gold hugely overbought. Oil where it should be.

Another copper bubblet. Yawn.

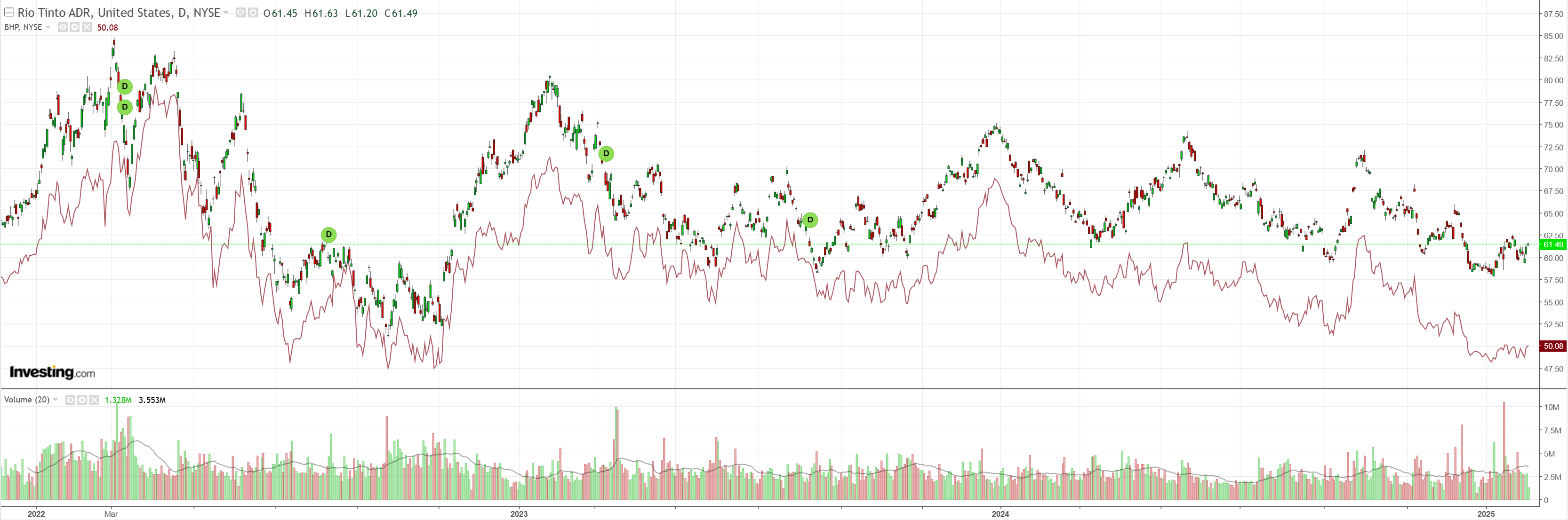

Big miners are so yesterday.

EM too.

Dude, where’s my junk?

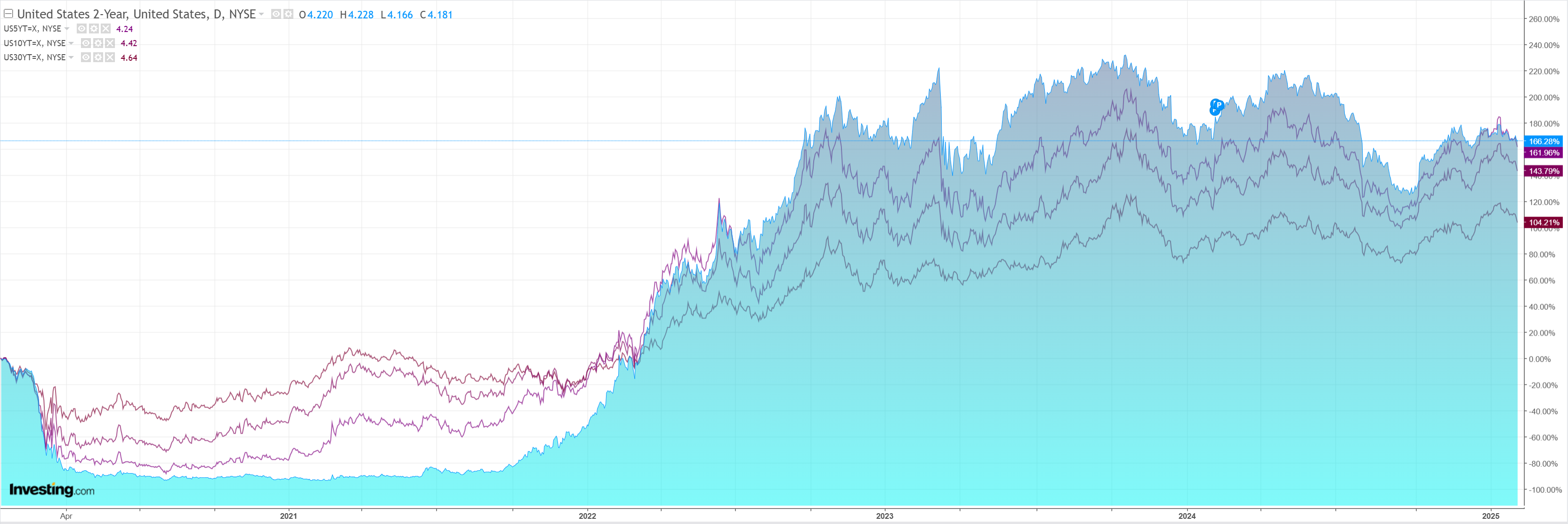

As yields break down.

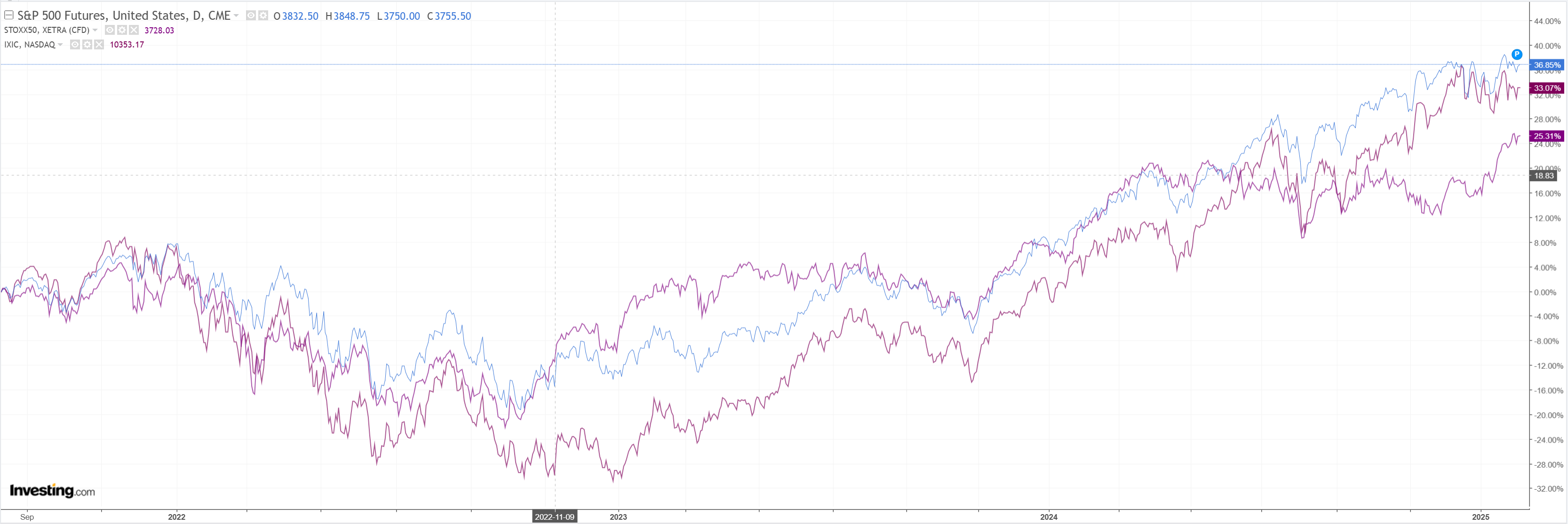

Stocks never fall.

US data was all over the place with weak JOLTS, strong ADP and ISM, but weaker services SIM.

Still, the flash-in-the-pan tariffs have convinced rate markets that Trump is more bark than bite so DXY is breaking down as well.

However, CNY is still warning that worse is ahead and it is probably right.

The 10% tariff on imports from China took effect February 4, and we continue to expect tariffs on imports from China to rise further, for a total increase of around 20pp. We also continue to expect a new tariff on auto imports from the EU.

The AUD has a couple of tailwinds for now with rising global PMIs, tariff war round one over, and a very short CFTC.

But be warned, AUD can skip away from the CNY lead boots for a while but it cannot take them off.

I will use any rebound in the AUD to get more assets offshore.