DXY shrugged off hot US inflation.

AUD did too.

The lead boots jaws are closing.

Gold and oil do the opposite.

Dirt bubblet.

Mining doldrums.

EM life?!?

Nah.

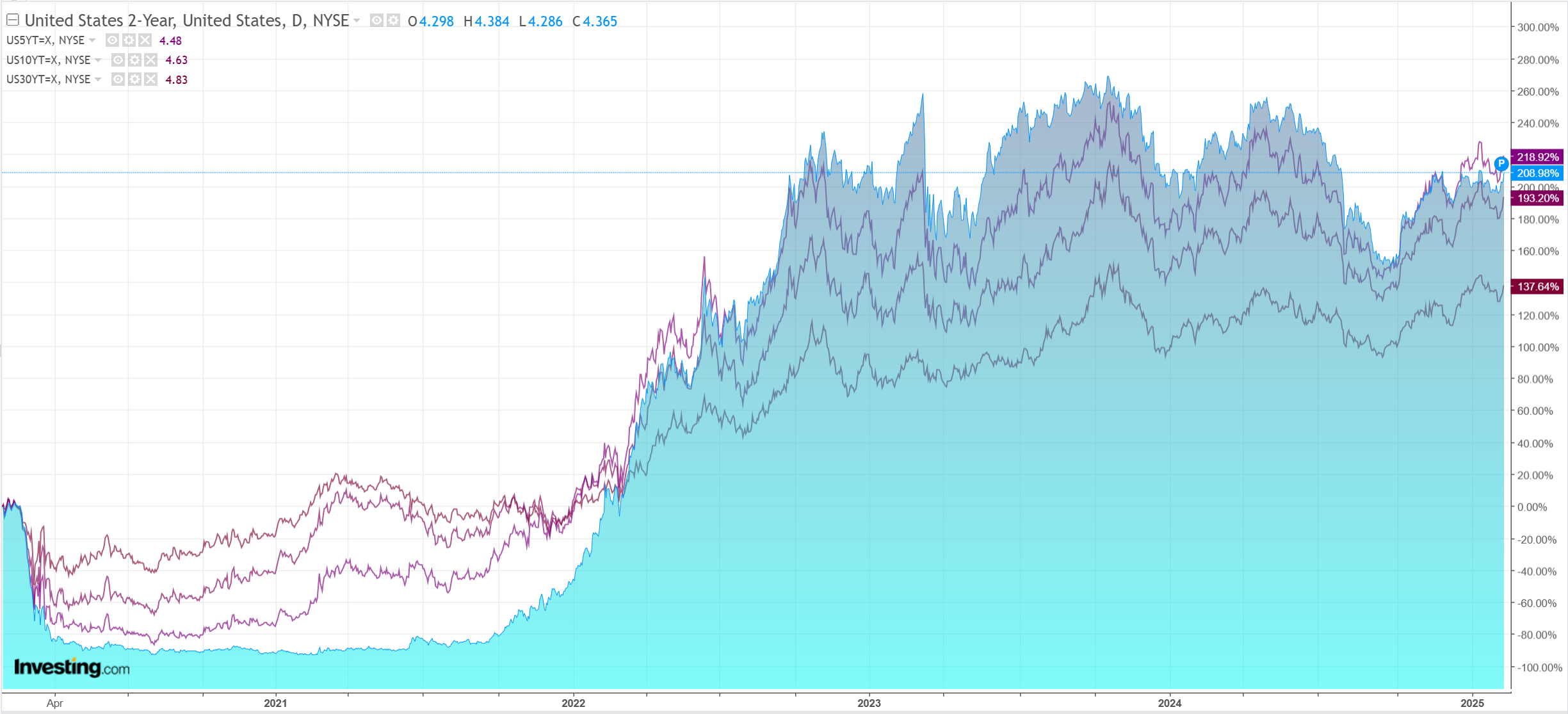

Yields up.

Stocks flat.

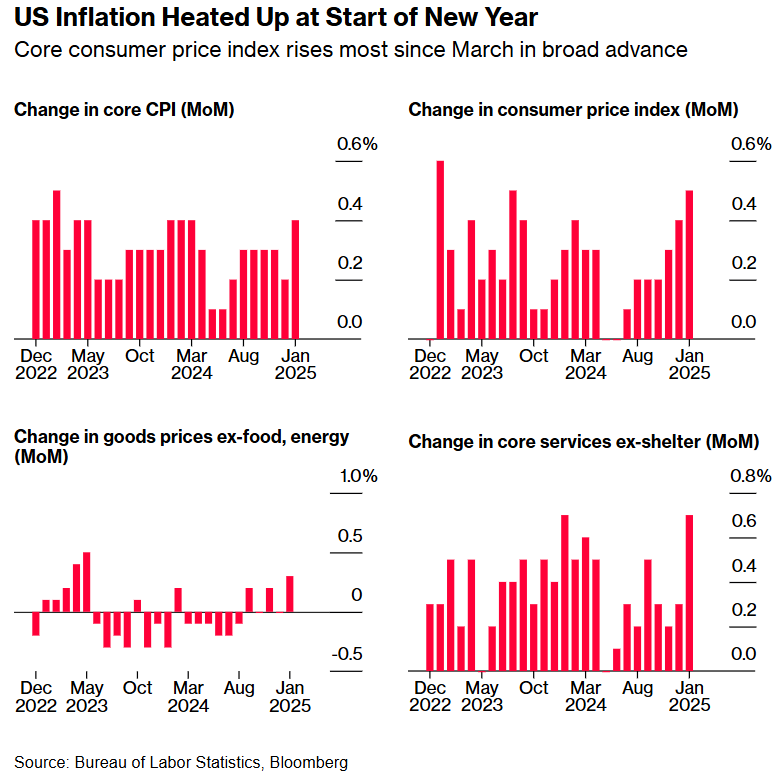

US inflation was worse than feared.

However, January is always worse than feared, and the BLS has not fully adjusted to it post-COVID.

As well, OER rose strongly and still has a long way to go.

Plus LA bushfires using hotels and bird-flu for eggs.

Lots of one-offs, which is why the market largely discounted the result, except in yields.

Goldman has it.

…there is less scope for an outsized boost from start of the year price increases (i.e.,what we have dubbed the “January effect”) because price pressures have moderated over the last year.

This form of residual seasonality is caused by the interaction of start-of-year price hikes being larger when inflation is high and seasonal factors only being calibrated to average January increases.

In short, not as scary as it looks. AUD is still buoyed off the big short.

AUD has more wood to chop before it can lower.