DXY took a breather.

AUD is poised for more.

Plenty of room in the Chinese jaws.

Oil and gold firm.

Copper bubblet bursts. Yawn.

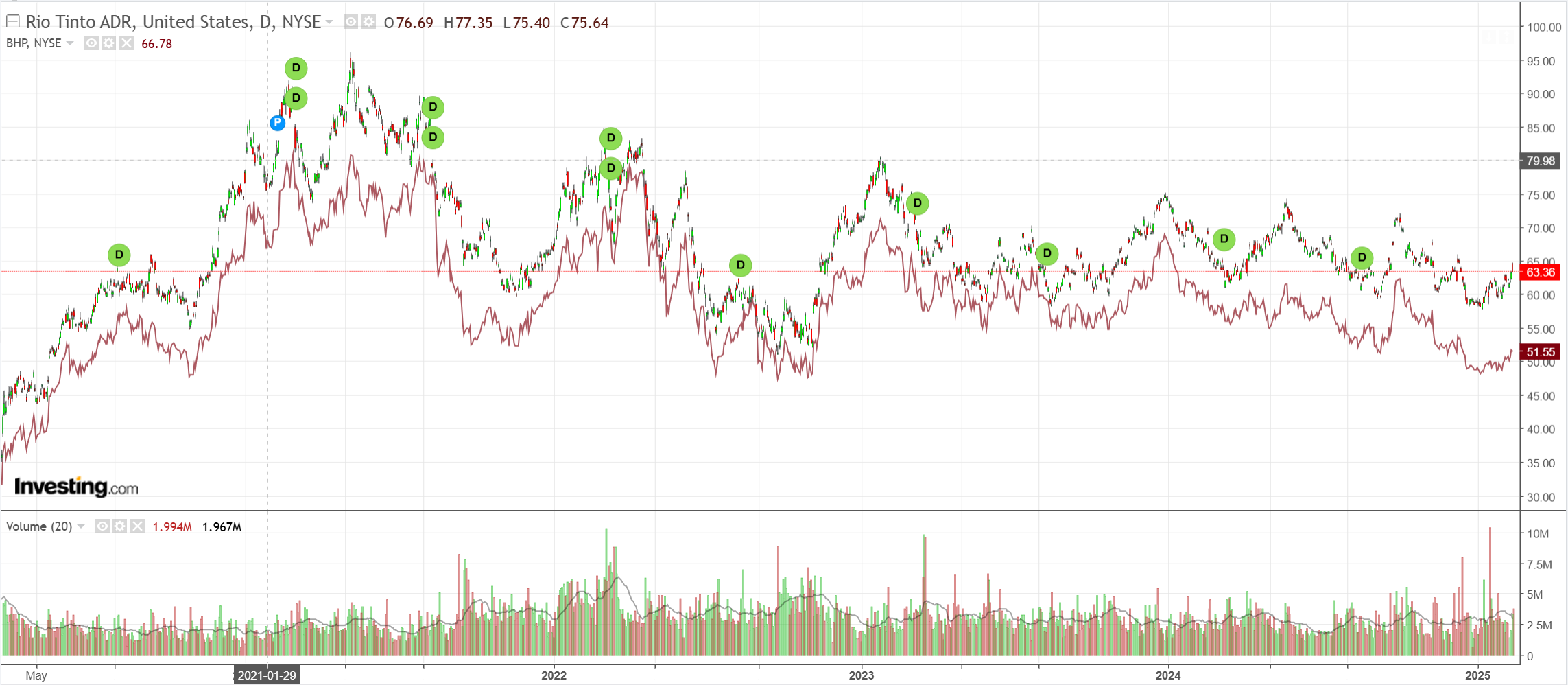

Miners stuffed.

EM deepsucking.

Junk breaking out?

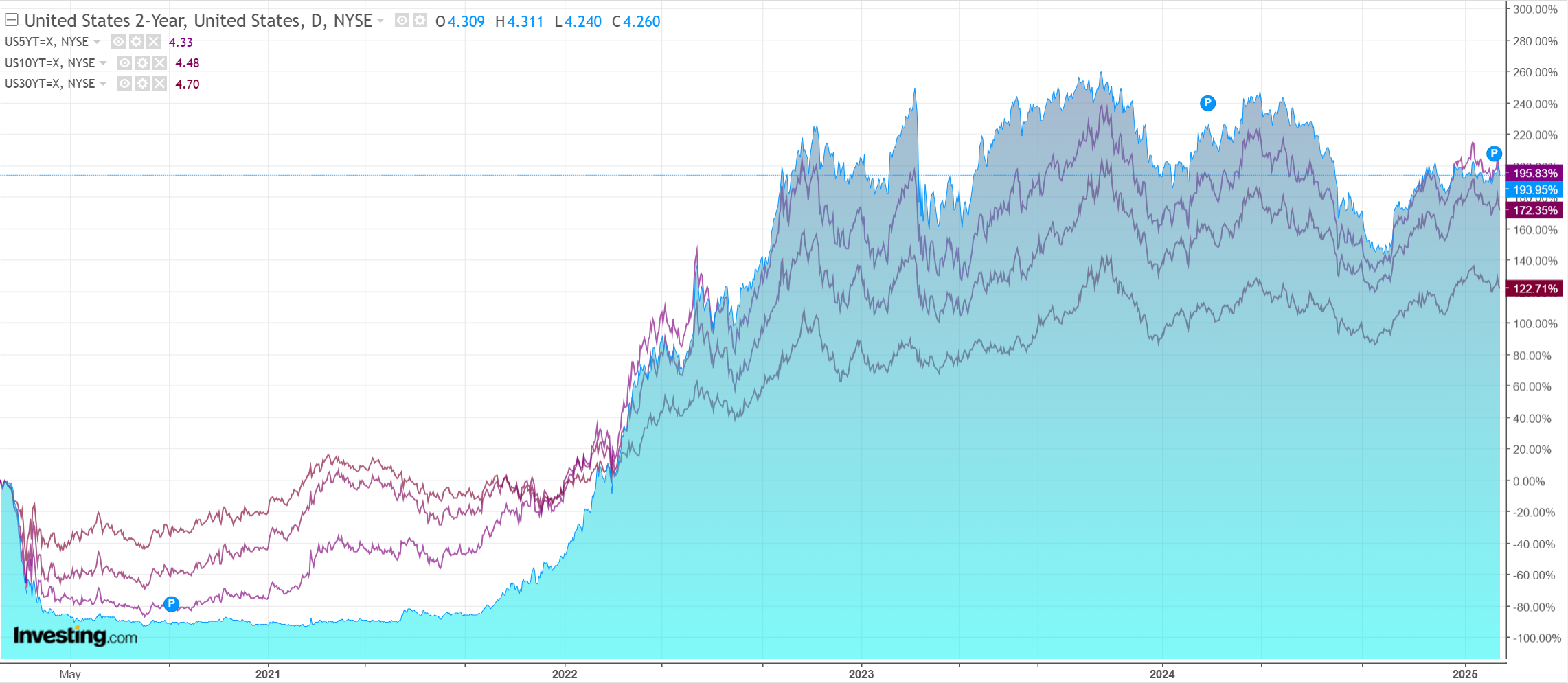

Yields down.

Stocks up.

I can’t remember an RBA pile-on of such intensity. Both hawks and bulls are so politicised that the central bank can’t win.

On the one hand, the mortgage complex and ALP media is demanding cuts. On the other is the LNP media is demanding a hold. Both accuse the other of bias.

Warwick McKibbin is demanding a hold, so that is a contrary indicator for cuts. He is usually wrong.

The bank should cut. Inflation is crashing, the consumer recovery is a joke, and falling wages trump falling unemployment for the future.

Almost nobody mentions wildly out-of-control immigration as the reason for the disparity, so how can any be taken seriously?

The history of the bank says it will cut. When it has been wrong in the past, it has backflipped without fuss. It has been too hawkish again this time.

For the AUD, this is priced. Hawkish commentary may give it more of a lift, given that is its trend.

Even so, I expect back-to-back cuts as data keeps souring, and eventually, this will stall the currency.