The DXY chart does not look well. If support breaks then down we go.

AUD is poised for an upside rampage.

Even lead boots is up.

Gold is entering blowoff. Oil not so much.

Another copper bubble. Yawn.

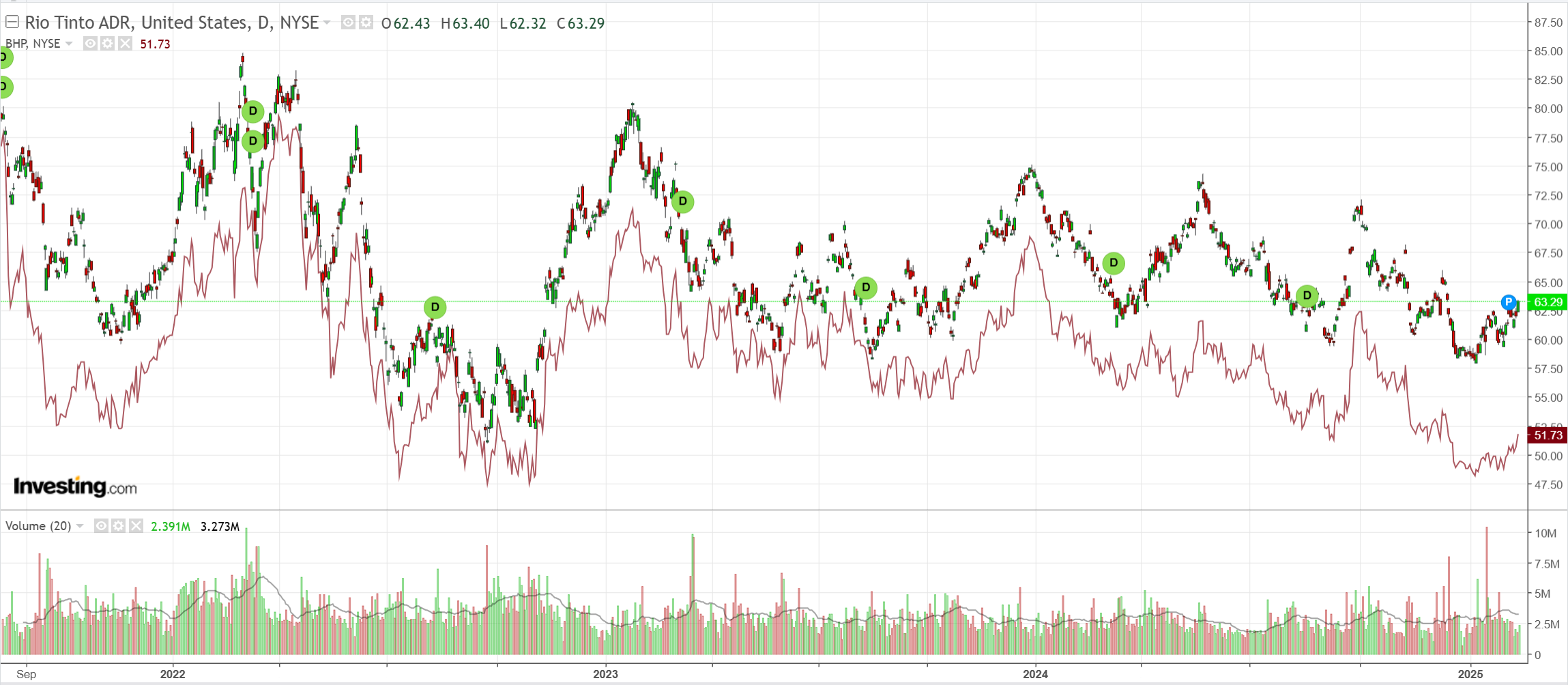

Somebody finally bought a miner.

EM up.

Junk too.

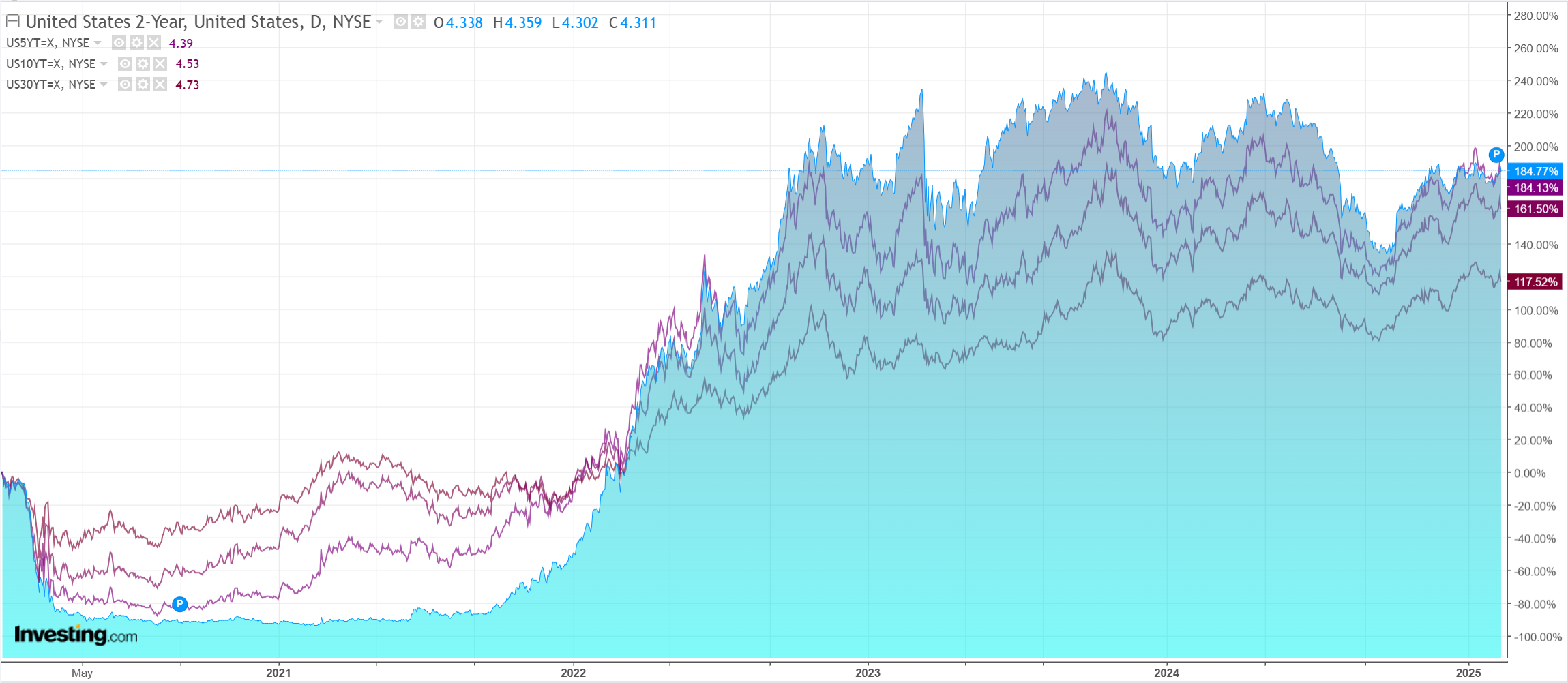

Yields down.

Stocks-a-palooza. Europe going nuts on the post-war reconstruction trade.

King Trump is fake tariff man and markets love it.

The president on Thursday signed a measure directing the US Trade Representative and Commerce secretary to propose new levies on a country-by-country basis in an effort to rebalance trade relations — a sweeping process that could take weeks or months to complete. Howard Lutnick, Trump’s nominee to lead the Commerce Department, told reporters all studies should be complete by April 1 and that Trump could act immediately afterward.

…Yet the president’s decision not to implement tariffs right away could be seen as an opening bid for negotiation — following the same strategy he’s already used to extract concessions from Mexico, Canada and Colombia — rather than a sign he’s committed to following through.

As well, although the US PPI came in hot, the elements that fed into PCE were cold, so doves got a boost.

AUD looks poised to run riot on its extended short positioning.