DXY is breaking down as Tariff Man turns into Deal Man.

AUD to the moon!

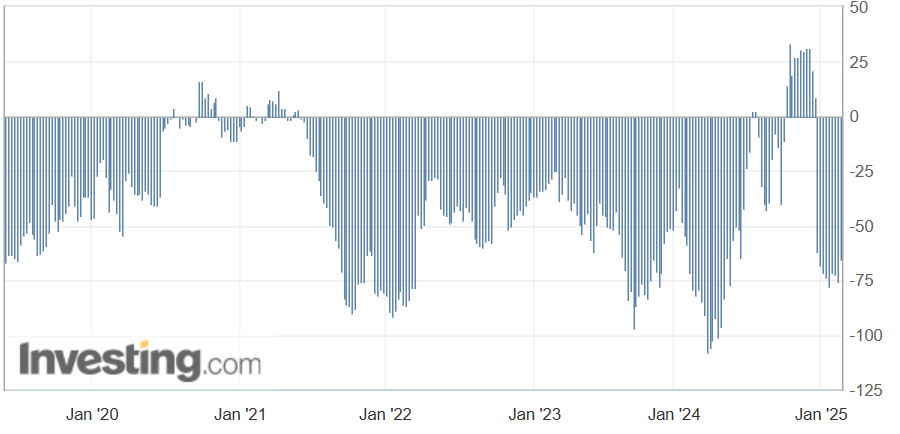

Still room to close the jaws.

And now for another one-month commodity bubble.

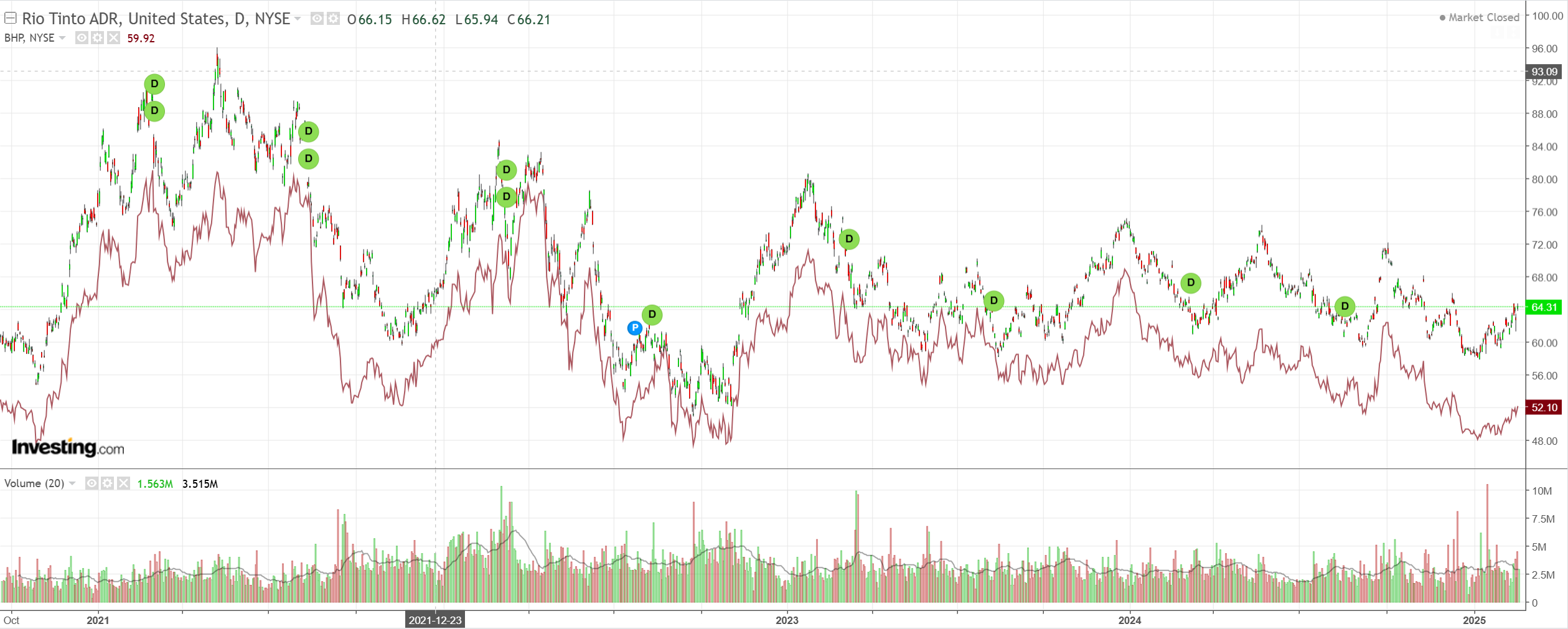

Big miners past the worst. LMAO!

EM loving DXY.

Junk fizzer.

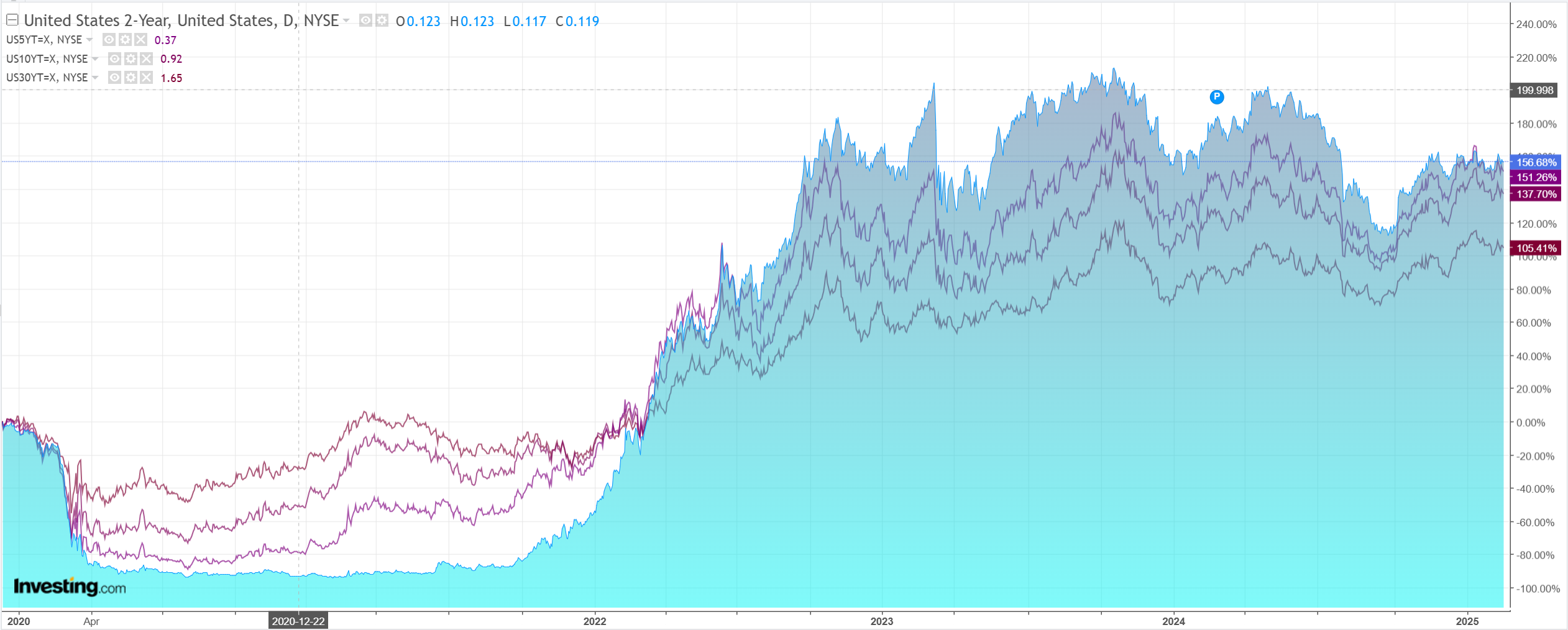

Yields eased.

Stocks struggling ATH.

This is the kind of squeezy action we need to puke the shorts in the AUD. As I have said for weeks now, when ever the market is as short a currency as it is AUD at the moment, going lower becomes high on impossible.

A few more days like this, and I would expect to see CFTC data begin to clear out.

The supposed Chinese and European recoveries, which are adding fuel to the global reflation and DXY falls, are illusions in my view.

China is in a depression with no end in sight. European fiscal is going to be hijacked by defence industries, robbing the wider economy.

I maintain that H2 will bring a return to American exceptionalism as Trump tax cuts land and the tech revolutions intensify.

It will also bring humiliation to the RBA as its inflation forecasts collapse and rate cuts resume, then rain down in 2026 as the iron ore Aussie income shock begins in earnest.

AUD up for now. AUD down later!