DXY is still falling. EUR is not exactly soaring post-German election.

The AUD rocket is in danger of a crash landing.

Lead boots is stable.

Gold and oil got puked.

Another dirt bubble goes pop.

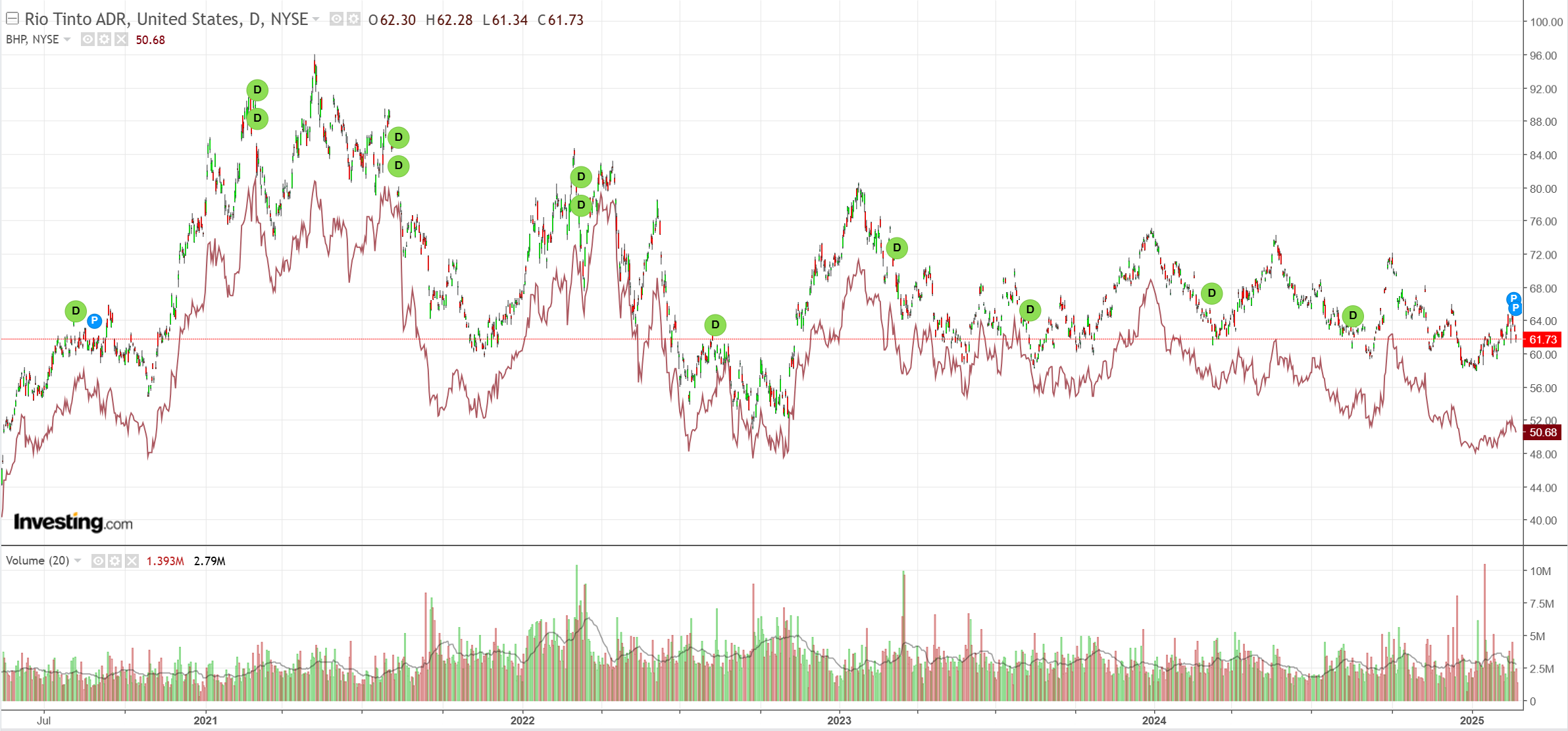

Woe is miners.

EM deepsuckered.

Junk nailed to the floor.

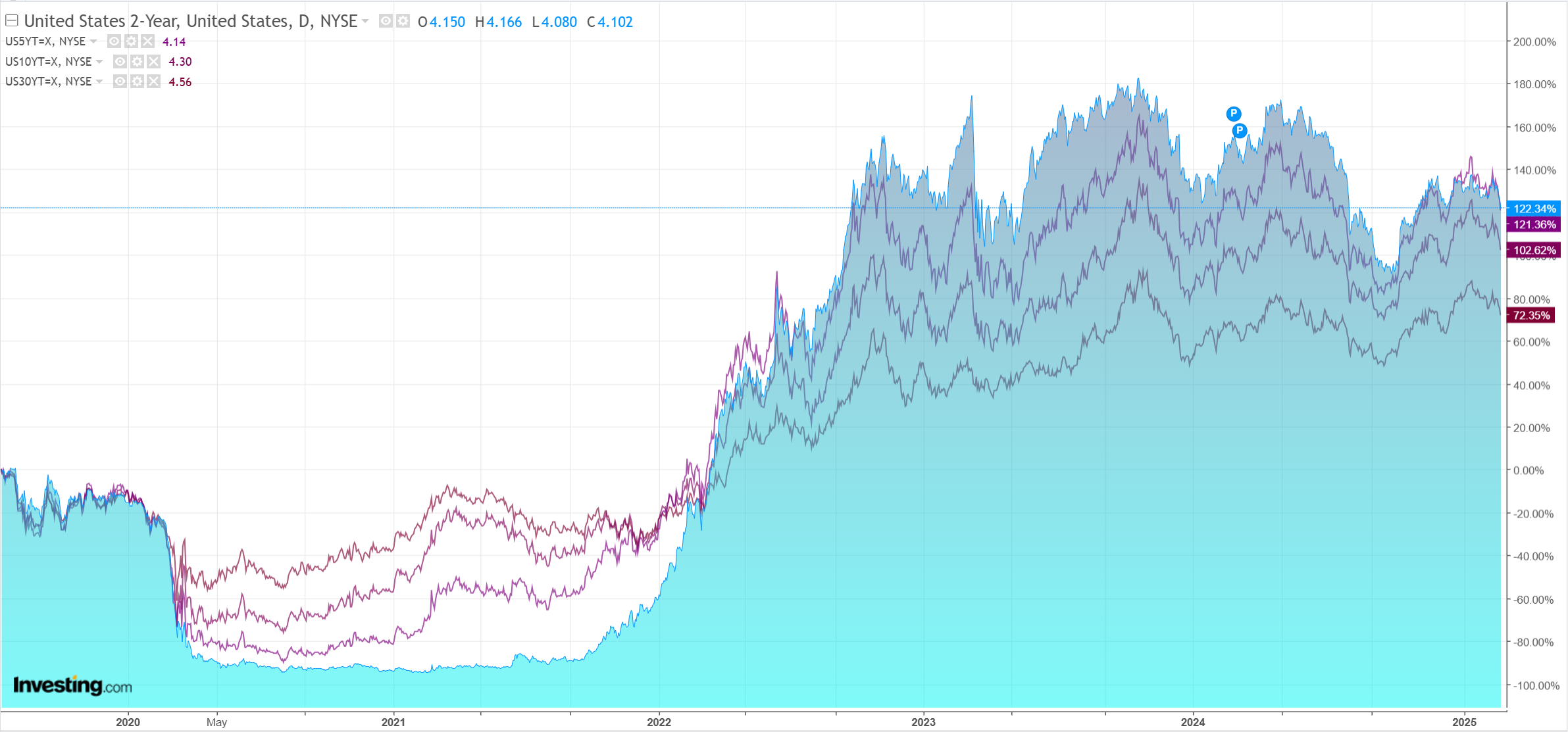

The bond bid is back.

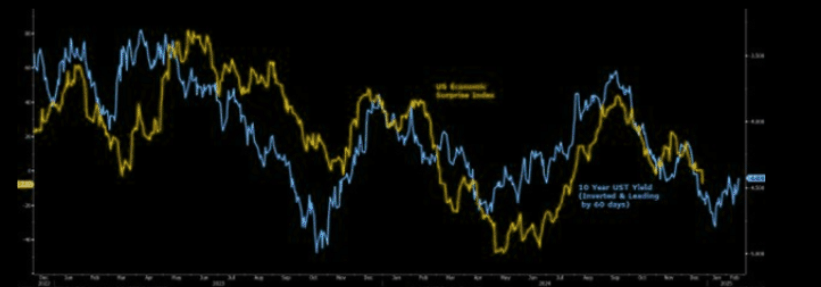

As stocks freak about growth.

Trump euphoria is suddenly Trump fear as policies bite.

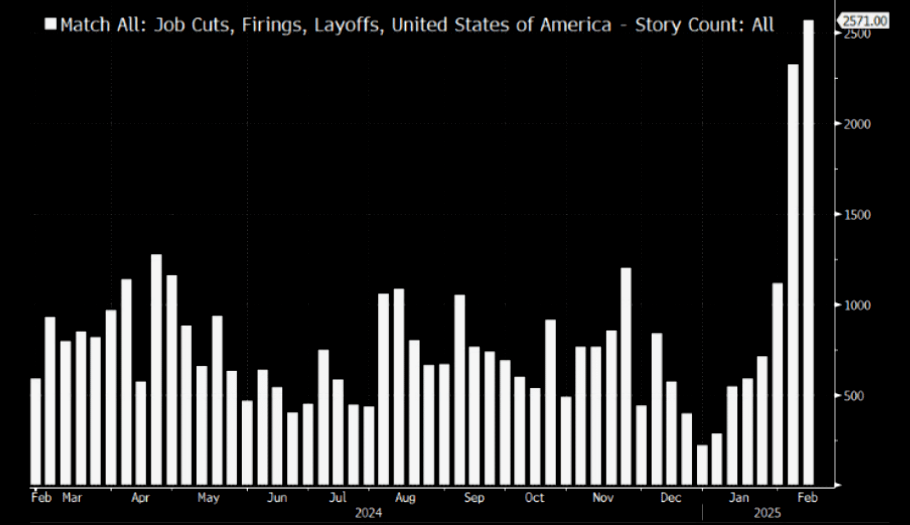

Growth is fading.

Elon’s sword is making it worse.

And the previous spike in rates has yet to fully hit.

Germany is moving fast to establish fiscal for Ukraine and more may follow, but it is still less likely than a month ago that we will see broad stimulus weapons suck up the dough.

China is also moving to stimulate further, but that is just more yawnulus as the property super massive black hole swirls endlessly.

Without the US fiscal growth engine, the profit outlook dims until the growth scare lowers rates enough to restore it.

Yields have got to fall a lot further yet for that.

The AUD rocket has flamed out until we get there.