DXY reversed.

AUD is printing multiple hammer candles.

CNY reopens today after the LNY break.

Gold is massively overbought.

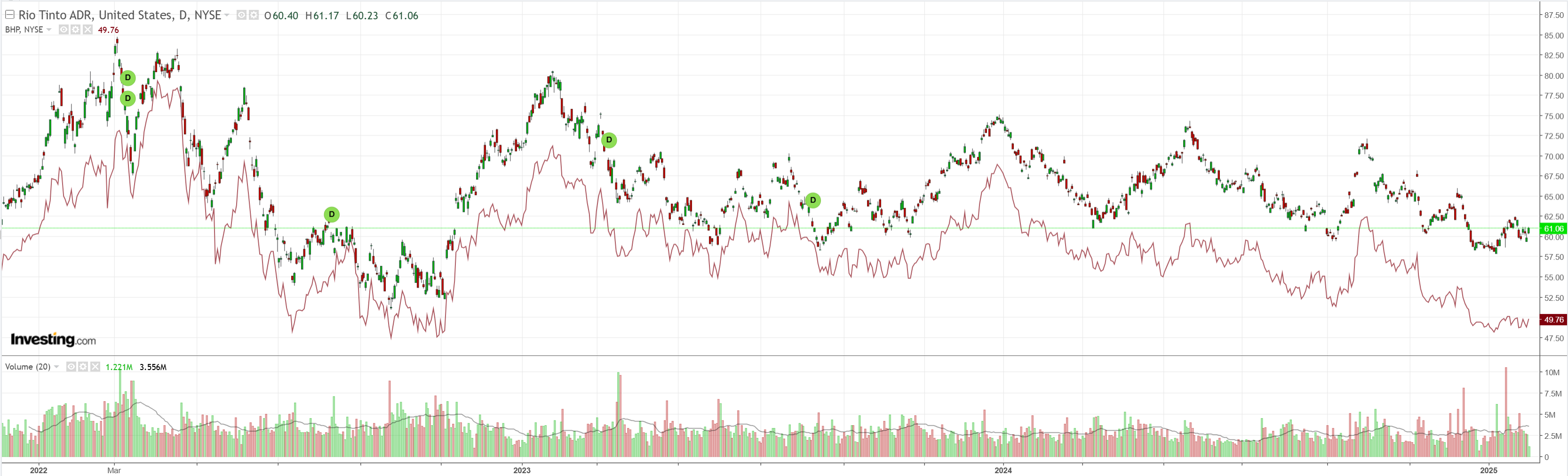

Dirt having another crack.

Miners meh.

EM meh.

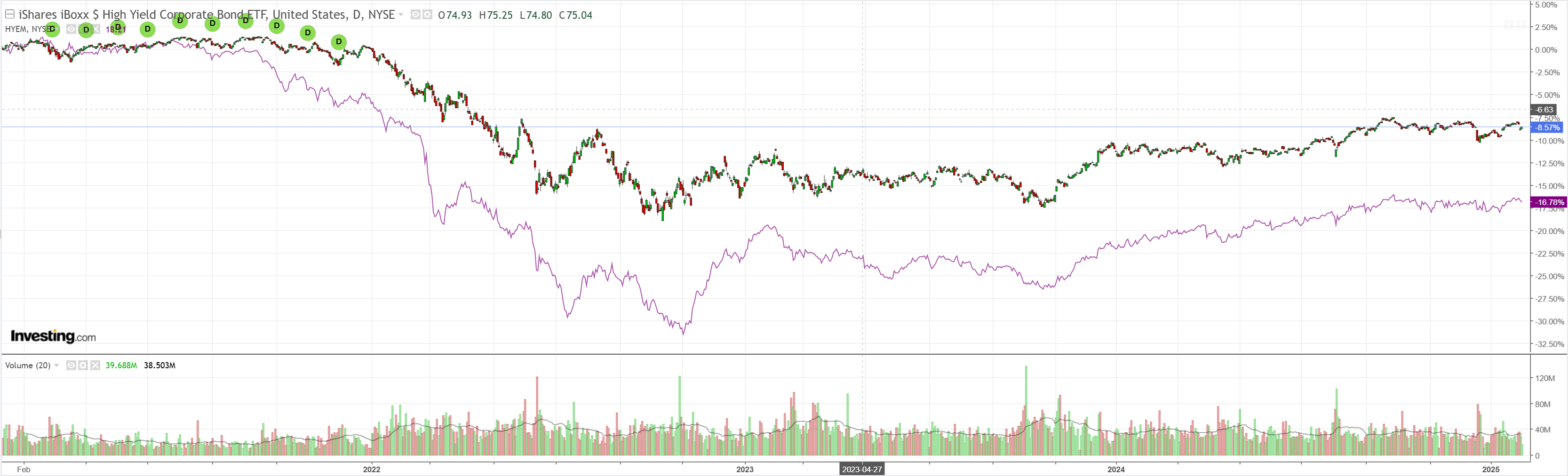

Junk meh.

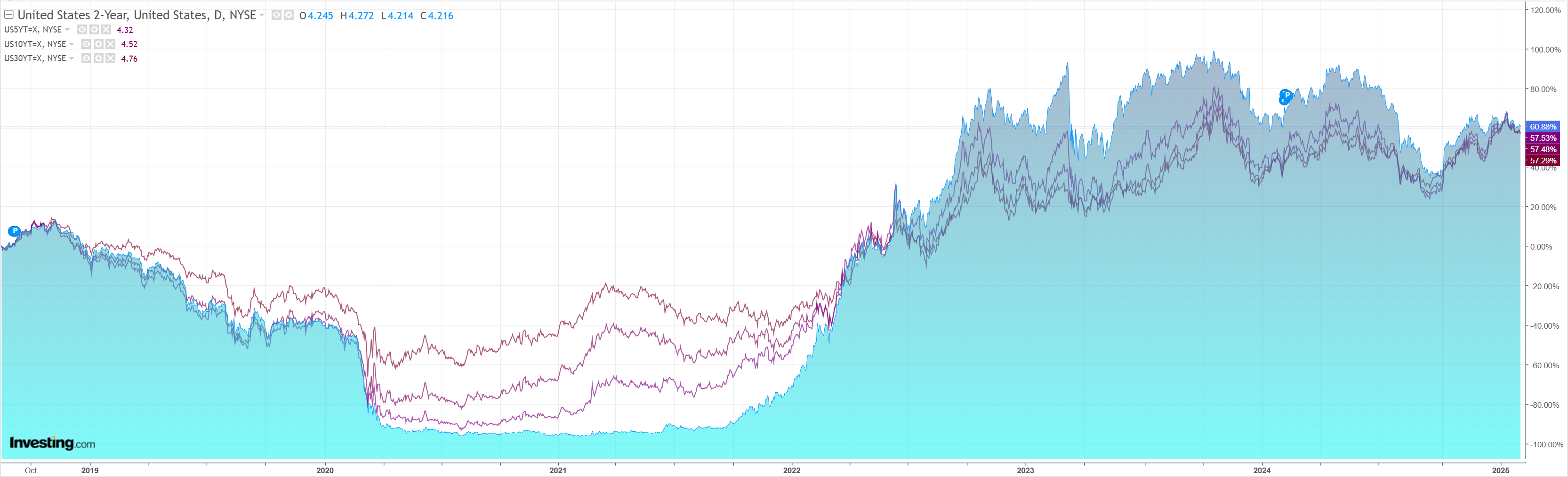

Yields meh.

Stocks only go up.

If the last few days are an example of Trump tariff objectives, then what has the market to be afraid of?

More importantly, the world appears prepared to give Trump his symbolic wins and then get back to business as usual.

The key is China, of course. But even it is treading softly.

After the US leader gave a last-minute reprieve to both Canada and Mexico, his 10% tariffs on China took effect after midnight Washington time on Tuesday. Within seconds, Beijing announced additional tariffs on roughly 80 products to take effect on Feb. 10, launched an antitrust investigation into Google, tightened export controls on critical minerals, and added two US companies to its blacklist of unreliable entities.

The swift but calculated retaliation signaled that Beijing had learned a lesson from its first trade fight with Trump, when China retaliated with tariffs on par or close to what the US imposed. This time Xi only put tariffs on $14 billion worth of American products, a sliver of what Trump targeted, while taking other measures that showed off China’s ability to inflict further pain on US companies if needed.

Goldman sees CNY falling from here.

…we think the broad USD should strengthen (driven by larger-than-expected tariffs on Canada/Mexico) alongside the idiosyncratic weakening pressure on the CNY (from China-targeted tariffs).

Moreover, we think the market will price in some uncertainty or risk premium of additional tariffs from here – sustaining upside pressure on USD/CNY.

Taken together, we think the authorities will allow a gradual drift higher in the USD/CNY fixing towards 7.30, which should allow spot to move towards 7.40-7.50.

On monetary policy, although we have been expecting a 50bp RRR cut in Q1 given the weak domestic economy and the need for continued monetary policy easing, there is a risk that the PBOC manages interbank liquidity using low-profile instruments like repo operations and skips high-profile easing measures like RRR cuts.

That would be a 3% move. If AUD matched it, we would see a return to the tariff bottom of a few days ago in thehigh .60s.

For now, it appears the AUD rout is over.