DXY is still legging it down.

AUD was soft anyway.

Plenty of room to catch up to lead boots.

Gold is about as overbought as anything, ever. Oil not liking Ukraine peace.

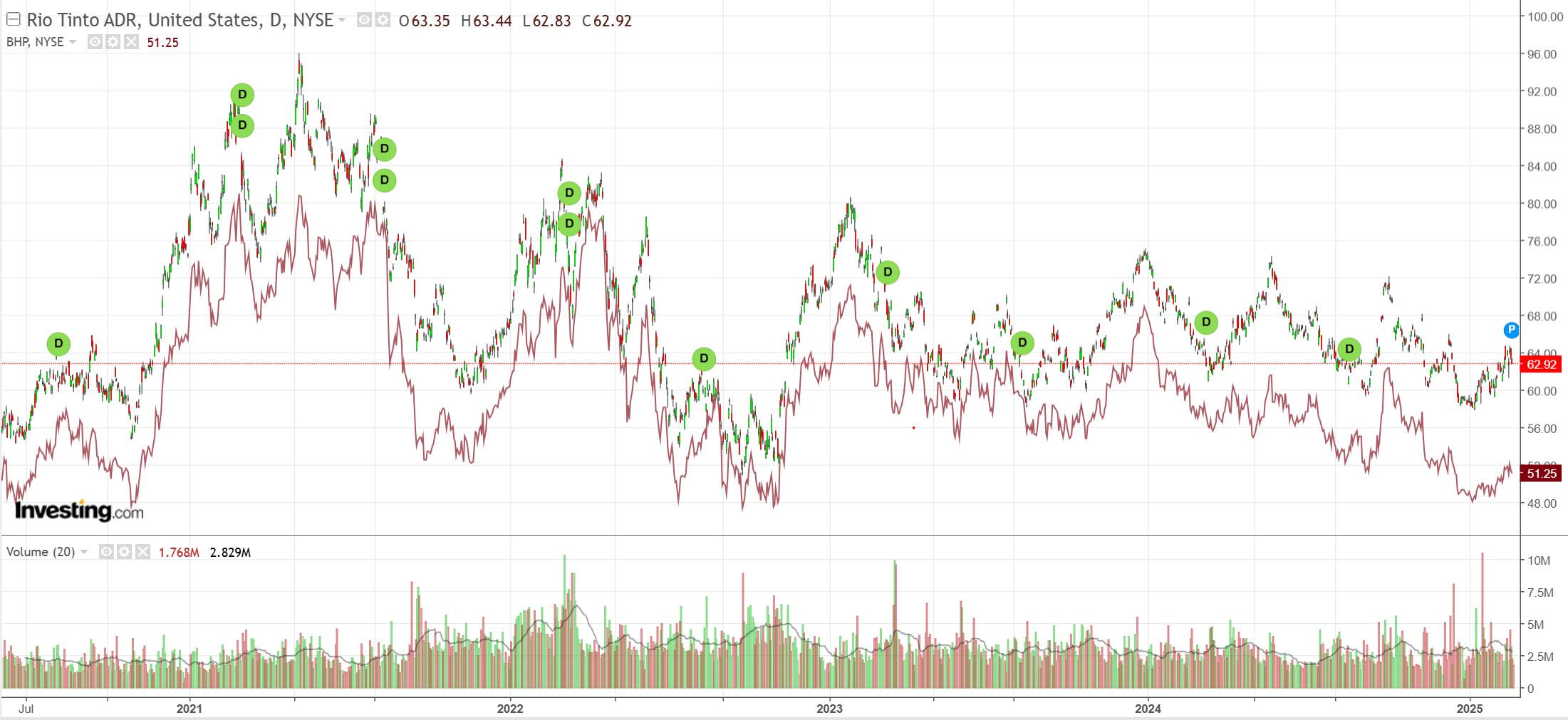

Another commods false start.

Miners rolling.

That deep suckered sound you can hear is Chinese stocks hoopla gone bust.

Junk is telling us the cycle is in danger of stalling out.

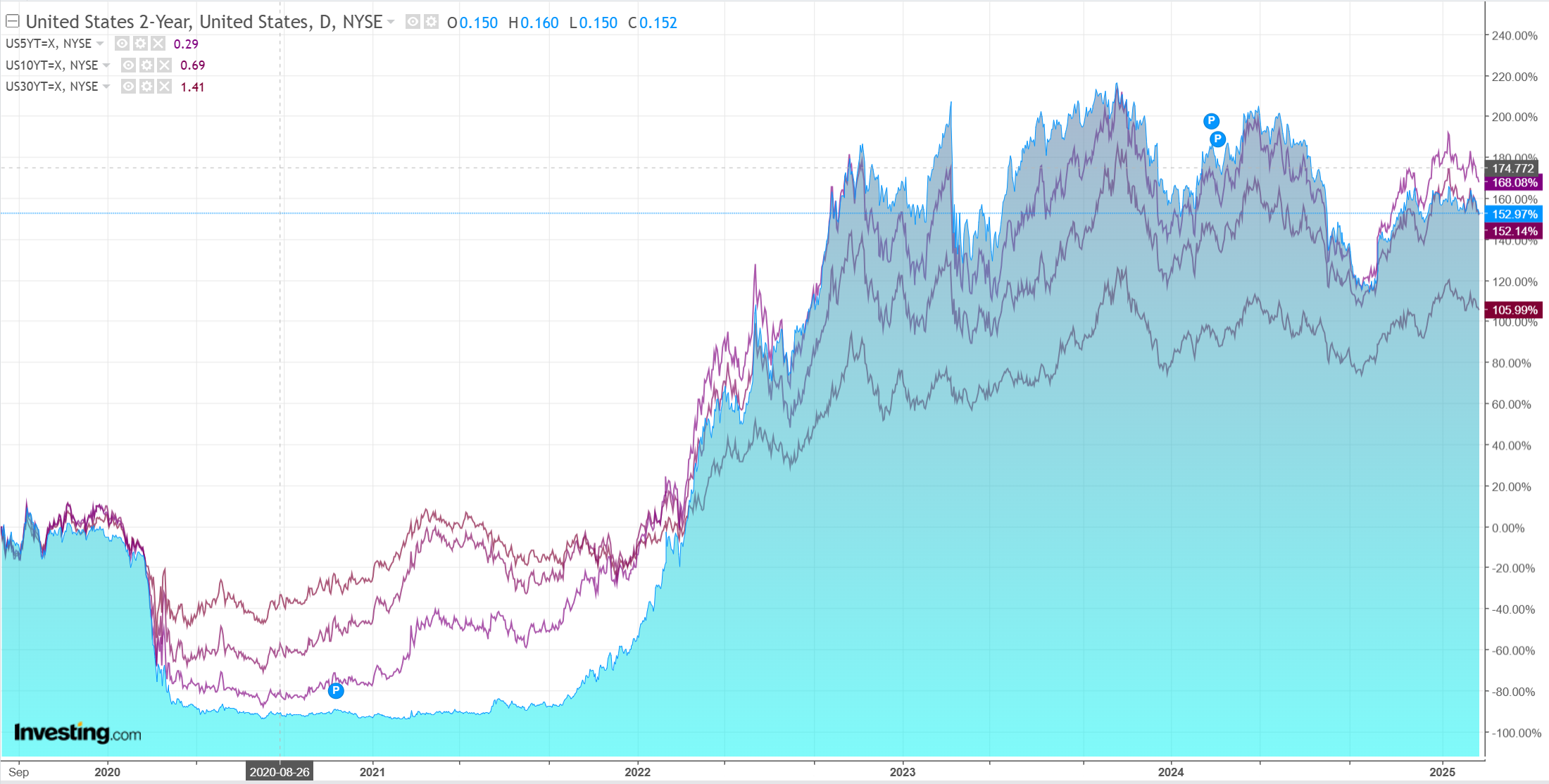

Yields coming down again.

Stocks too!

The forex market is running out of spurs. Goldman.

For the broad Dollar, the question on investors’ minds is whether we are heading for a 2017-style repeat.

That year saw relatively little change on US tax and trade policy, set against more balanced global growth that was helped by foreign fiscal expansion, and the Dollar had its largest drawdown in the post-GFC era.

The parallels to today are clear, and the risk of a repeat is rising.

However, there are also clear parallels between today and early 2018—when the US announced new steel and aluminum tariffs, was engaged in testy trade negotiations with Canada and Mexico and preparing to raise tariffs on China.

And, there are also important differences.

Most prominently, better global growth in 2017 was likely supported by China’s earlier stimulus measures that boosted growth around the region and in Europe.

Today, China’s fiscal support is more targeted and less global, and we think the potential for European fiscal stimulus looks more modest.

Ultimately, our baseline forecasts are more aligned with the 2018 parallels than 2017.

Actually, it is 2025, and it is all worse than that. Global growth has been lifting but not very swiftly and, I would argue, not very far, with a stall possible.

In 2017, the Chinese property bubble was in full rampage, and Europe was leveraging cheap Russian gas into exports there.

Now, China is in a depression. European stimulus is going to be siphoned off into defence forces. Neither is a spur to global growth.

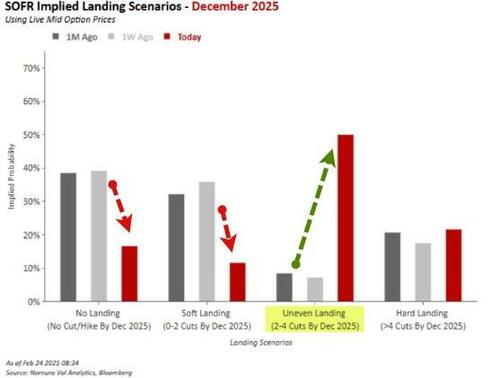

This brings us back to the US, where a fiscal recession is building in scope and the uncertainty around other Trump policies (tariffs, immigration etc) is weighing on growth and boosting inflation, curtailing monetary easing.

We still have the structural drivers of AI, fatty drugs etc but the cyclical setup is for a fade in growth. SOFR is starting to panic.

The most promising new stimulus is an end to the Ukraine War and a crash in energy prices, but that is already largely priced in equities, though probably not fully in DXY or gold, both of which will need to fall further.

Stocks are hinting that animal spirits are coming off now too.

AUD is caught in the crossfire and may be approaching the peak of its rebound.

Expect it to follow risk.