DXY is trending down. EUR up.

AUD has flamed out.

Lead boots are going nowhere.

Oil has priced the end of the war, gold has not.

Copper has caught Goldman disease.

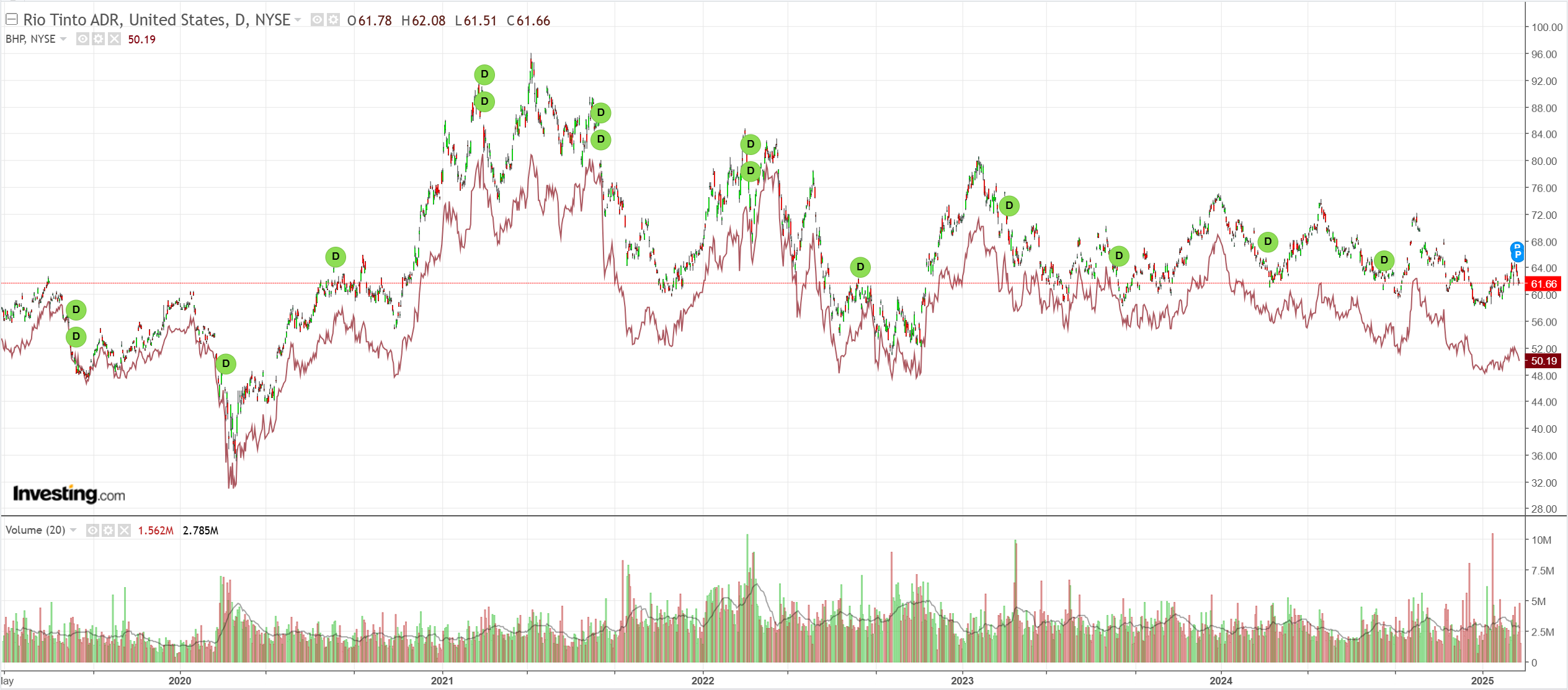

Big miners are the dogs of dogs.

Or maybe that is EM.

Or junk!

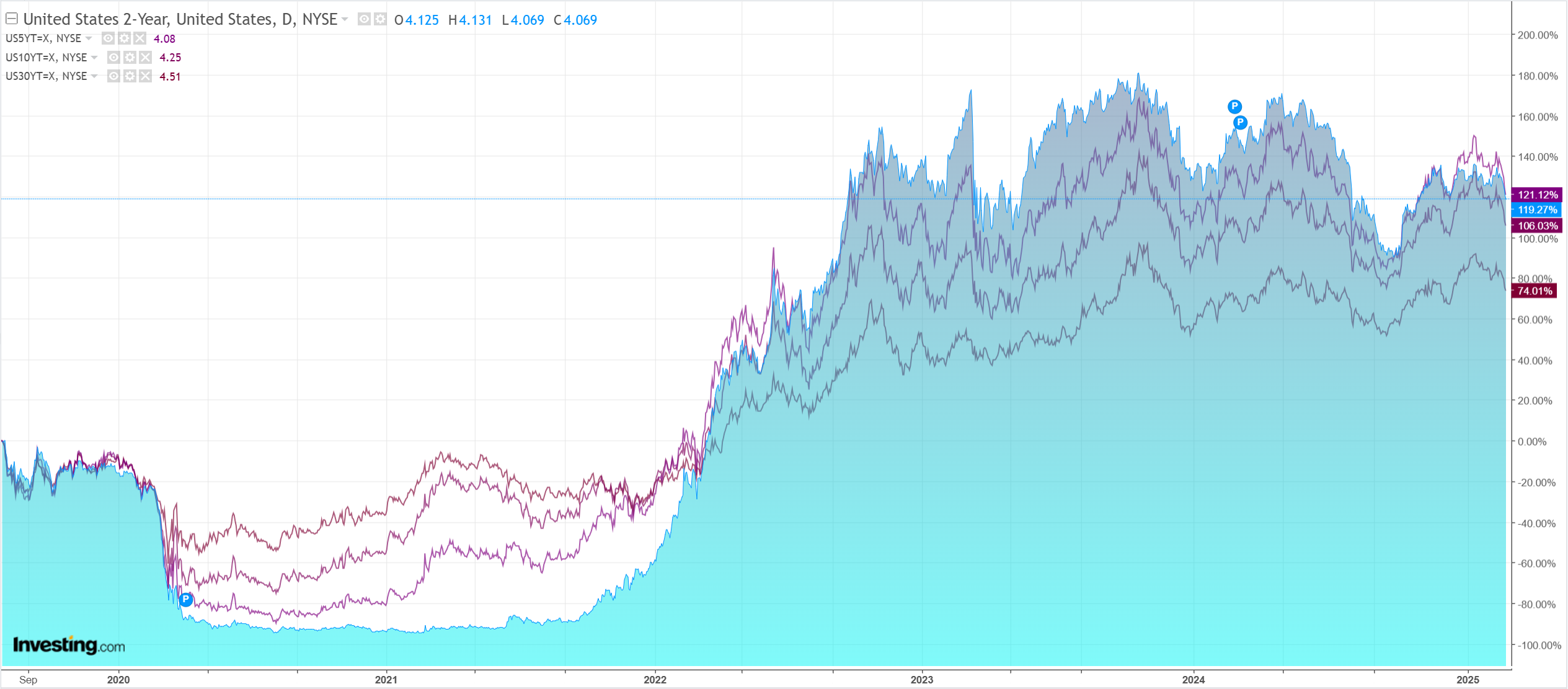

The growth scare is working on yields.

Still not enough to save stocks.

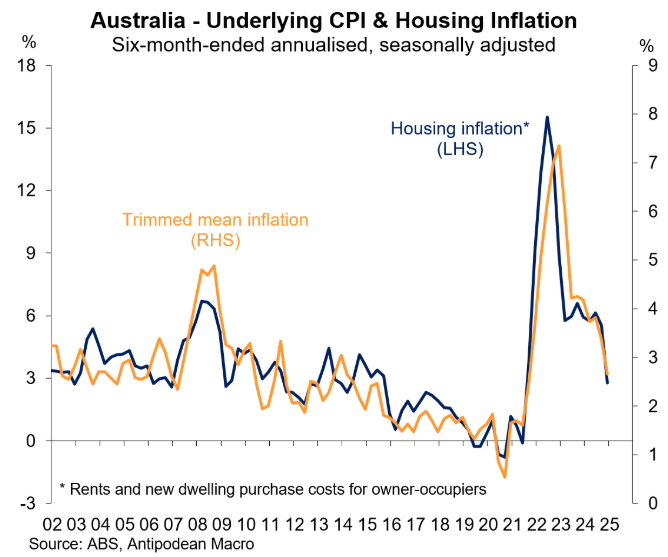

It’s not hard to read the crushed AUD today. From the moment of release of monthly inflation yesterday, the currency fell.

Why? Put a fork in inflation, it’s done.

Both rents and housing costs have materially further to fall in the CPI. Wages are caput dragging down services. Goods prices going nowhere. Regulated prices will follow.

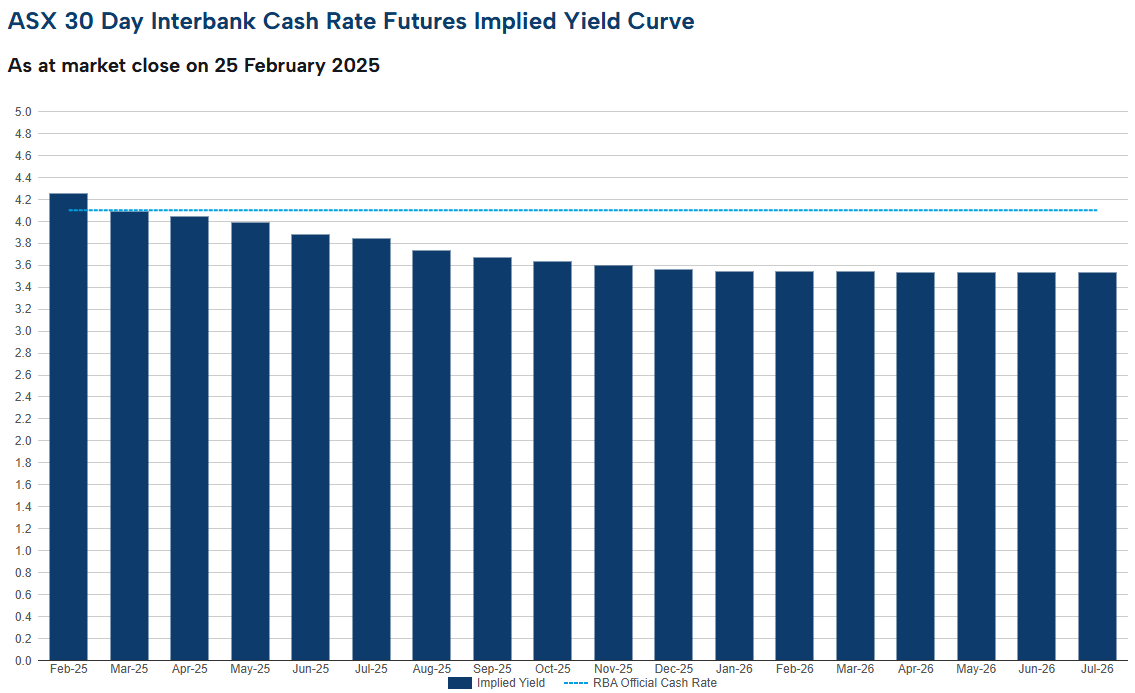

Markets are pricing another 2.5 cuts this year and none next year.

As the bulk commodity income shock arrives in 2026, it will be another four cuts.

Madman chaos also hit the AUD as King Trump extended deadlines for Canada and Mexico but announced 25% tariffs for the EU.

With global growth under pressure, too, it looks like much of the AUD’s dead cat bounce is done.

However, it probably still needs to chop through the positioning short to get much lower.